Rystad Energy: Oil glut months away from topping global storage

With a forecasted oil surplus of 10 million b/d from April, global storage infrastructure will be unable to take more crude and products in just a few months, according to Rystad Energy analysis.

“Our current liquid balances show supply surpassing oil demand by an average of nearly 6 million b/d in 2020, resulting in an accumulated implied storage build of 2.0 billion bbl this year.”

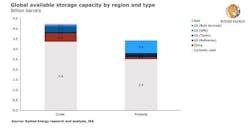

The world currently has around 7.2 billion bbl crude and products in storage, including 1.3 billion to 1.4 billion bbl currently onboard oil tankers at sea, according to the analysis. On average, 76% of the world’s oil storage capacity is already full, Rystad estimates.

“There is essentially no idle storage capacity available on tankers, as Saudi Arabia and other producers might have already wiped out the available population of Very Large Crude Carriers (VLCC) for March and April 2020. Our data shows that the theoretical available storage capacity at present is just 1.7 billion bbl onshore for crude and products combined. Using our estimate of an average of 6.0 million b/d of implied oil stock builds for 2020, in theory, it would take nine months to fill all onshore tanks. However, in practice we will hit the ceiling within a few months due to operational constraints.”

“The current average filling rates indicated by our balances are unsustainable. At the current storage filling rate, prices are destined to follow the same fate as they did in 1998, when Brent fell to an all-time low of less than $10/bbl,” said Paola Rodriguez-Masiu, senior oil markets analyst, Rystad Energy.

Floating storage normally uses VLCCs, which can carry about 2.0 million bbl. There are about 802 VLCCs active globally with a combined capacity of 250 million deadweight tonnage (dwt), capable of collectively storing 1.8 billion bbl, by Rystad Energy’s estimates. The entire global fleet, including smaller Suezmax and Aframax vessels, is estimated to have a combined capacity of 630 million dwt or 4.6 billion bbl.

However, to keep oil flowing between regions, a ballast of around 50% is necessary, as cargos often need to travel with no cargo to the destinations where they pick up oil, meaning that at any given time around half of the world's fleet is booked traveling to consumer destinations, while the other half is empty on their way to pick up oil. This reduces the number of available vessels to about 57.

In addition, the workable available capacity is significantly lower as many of these vessels are under long-term charter deals or locked in ownership agreements, such as COSCO vessels with PetroChina. Waiting time at ports and repairs further shrinks the workable available capacity.

Due to these factors, using supertankers to float oil offshore might not be a viable option this time, as the planned OPEC+ output hike has not only limited the workable available vessels but also caused a surge in tanker freight rates. The cost of renting a VLCC on the spot market has risen from about $20,000/day last month to $200,000-300,000, depending on destination.

“We find that liquid supply will have to be reduced by around 3-4 million b/d compared to the current production planning to bring the implied stocks builds closer to 2-3 million b/d for 2020, which is the level of implied stocks build that we find sustainable in the short to medium term,” Rodriguez-Masiu concluded.