US oil and gas M&A activity maintains momentum in third quarter

US oil and gas mergers and acquisitions activity surpassed $17 billion in this year’s third quarter, maintaining the momentum established in the second quarter, according to a recent report from Austin-based oil and gas data analytics company Enverus. This quarterly total approaches the 2016-18 historical quarterly average of $19 billion and puts year-to-date M&A at more than $85 billion.

“Most public [exploration and production companies] are highly limited in access to external capital right now,” said Andrew Dittmar, Enverus senior M&A analyst. “Shale companies are turning to deals as another option in the toolbox to bridge the gap to free cash flow and hopefully shift market sentiment back in their favor. In contrast to prior years, where Permian asset deals dominated, we are seeing broad geographic diversity in the current market and a variety of deal types including joint ventures and royalties.”

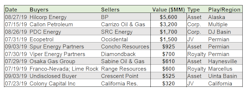

Top US upstream M&As

Enverus’ report also published a list of the top 10 US upstream M&A transactions during the most recent quarter.

Reaching into a region that has not often been at the forefront of deals, Hilcorp purchased BP PLC’s Alaska business, including its Prudhoe Bay and Trans Alaska Pipeline System interests, for $5.6 billion in the largest deal in the third quarter. Since exiting an early investment in the Eagle Ford, privately held Hilcorp has been a countercyclical buyer of conventional assets. Meanwhile BP, a pioneer and major player in Alaska, is exiting the state to refocus US operations on shale assets purchased from BHP.

The next largest transactions in the third quarter were a pair of corporate mergers. Early in the quarter, Callon Petroleum Co. purchased Permian and Eagle Ford producer Carrizo Oil & Gas Inc. for $3.2 billion in an all equity and debt transaction. The deal has run into some investor opposition spearheaded by hedge fund Paulson & Co., who specifically cites the deal premium of 25% and the addition of Eagle Ford assets to Callon’s Permian portfolio, as points of contention.

Dodging those issues and potentially setting the template for corporate consolidation, PDC Energy Inc. acquired fellow DJ basin producer SRC Energy Inc. in a zero-premium stock and debt deal for $1.7 billion. In a rarity for E&P deals in this market, both companies’ stock value moved up on the announcement as investors applauded the price and commitment to core DJ basin operations.

“There is a broad consensus that corporate consolidation is positive for the industry,” added Dittmar. “While the benefits are there, getting the right deal in place is challenging. Companies that match up on asset fit are needed, as well as a low premium to avoid a buyer selloff. Conversely, targets have to be convinced on the long-term upside since an immediate payoff isn’t evident.”

Outside of corporate-level deals, there is very little buying from public companies. Private capital has partially stepped up, most significantly KKR & Co. Inc.-sponsored Spur Energy Partners LLC, which has deployed more than $1 billion including a $925-million acquisition from Concho Resources Inc. targeting the New Mexico shelf.

“Private equity looks to be largely sticking to their script from prior quarters and cautiously deploying capital on deals secured with significant cash flow,” commented John Spears, Enverus market research director. “There are ample opportunities. In a quick start to the fourth quarter, Oklahoma producer Roan Resources is being taken private by Citizen Energy, an affiliate of Warburg Pincus, for more than $1 billion consisting of around 77% debt assumption and 23% cash to shareholders. We could see other small-cap E&Ps with high debt and low share prices take similar buyout offers.”

While some public companies could announce all-stock acquisitions like Callon and PDC did in the third quarter, cash offers will likely need to come from the private market or the largest public companies, which still have substantial internally generated funds and high investment grade credit ratings.

Low company and asset prices in the US are also starting to draw interest from abroad. Japanese LNG importer Osaka Gas purchased East Texas gas producer Sabine Oil & Gas Corp. for a reported $610 million. A few days later, Colombia-based Ecopetrol signed a $1.5-billion joint development deal with Occidental Petroleum Corp. targeting undeveloped acreage in the Midland basin. While the Osaka deal was more narrowly tailored to source gas for LNG, the Ecopetrol JV shows that international companies view US shale assets as competitive on a global basis. On a dollar-per-acre basis, the deal looks to have priced relatively in line with past Permian deal activity.

There were also a handful of Chapter 11 filings during this year’s third quarter including Halcon Resources Corp., Sanchez Energy Corp., and Alta Mesa Resources Inc. Thus far, most Chapter 11 filings have ended in a recapitalization with creditors taking control of the company, but there could be a shift to more liquidations via bankruptcy sales processes as some lose patience and see companies going through multiple reorganizations.

Moving into this year’s final quarter, public companies are likely to remain highly focused on keeping capital spending in check while maintaining moderate production growth to deliver on promised free cash flow. Investors will likely closely watch as 2020 capex guidance is rolled out to look for any inflation. Current company valuations show a strong investor preference for E&Ps with clean balance sheets and established capital returns from dividends or buybacks versus high growth. That may translate to little appetite for making acquisitions among most independent public E&Ps.