Devon, Coterra joining forces to create 1.6 million boe/d shale titan

Devon Energy Corp., Oklahoma City, and Coterra Energy Inc., Houston, are uniting in a deal that values the latter at nearly $22 billion and will create a shale operator that ranks second only to ConocoPhillips in Lower 48 production.

Analysis

Following news of the deal, Andrew Dittmar, principal analyst at Enverus Intelligence Research, said that with fewer one-core-play deals left, exploration and production companies are looking to multi-basin mergers to gain scale and inventory. In this case, the envisioned synergies, plus what the deal means for Devon in the Permian basin, are key.

"Synergies are a cornerstone of the all-equity combination and longer-term success of the deal will in a large part hinge on delivering synergy capture," Dittmar said, who also noted that the "real prize of the deal" is the Delaware basin acreage "and the centerpiece of the combined company."

Once closed, the combination would move Devon to the rank of top producer in the basin from its current third-place standing based on gross operated volumes, and places it as "a top three overall Permian producer on a gross operated basis with more than 1 MMboe/d," Dittmar said.

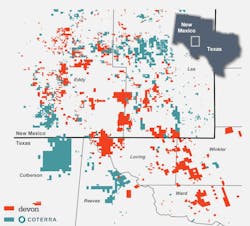

The combined enterprise, which will keep the Devon name and be led by Devon chief executive officer Clay Gaspar, will have 2026 production of more than 1.6 million boe/d (MMboe/d). More than half of that will come from the Delaware basin, where the two companies operate on a combined 746,000 acres.

“This transformative merger combines two companies with proud histories and cultures of operational excellence, creating a premier shale operator,” Gaspar said in a statement. “We’ve now built a diverse asset base of high-quality, long duration inventory to drive resilient value creation and returns for shareholders through cycles […] This will drive higher free cash flow and greater shareholder returns beyond what either company could achieve alone.”

The transaction, which has been rumored for several weeks and is expected to close by summer, will see Devon’s headquarters relocate to Houston while keeping a sizable presence in Oklahoma City. Tom Jorden, chaiman, president and chief executive officer of Coterra, will become non-executive chairman of the combined company’s board.

The companies’ executive teams expect to generate cost savings and financial synergies of $1 billion/year by end-2027. That figure will be split relatively evenly between more efficient capital spending, higher operating margins, and outright cost cuts.

In addition to its core Delaware operations, a united Devon-Coterra organization will comprise:

- About 520,000 net acres in the Anadarko basin that produce about 173,000 boe/d and which Gaspar said has “real upside” because of the companies’ neighboring assets and infrastructure and midstream investments.

- Roughly 90,000 net acres in the Eagle Ford from Devon, which average 63,000 boe/d.

- Devon’s 730,000 net acres in the Rockies, where it produces 205,000 boe/d.

- Coterra’s Marcellus natural gas holdings, which span 190,000 net acres and average 330,000 boe/d.

The last of those has been a focus of investment firm Kimmeridge, which has criticized Jorden and his team and called for Coterra—the result of the 2021 merger of Cimarex Energy and Cabot Oil & Gas—to divest its Marcellus assets and focus on the Delaware. On a conference call with analysts, Gaspar didn’t commit to any such post-merger moves but also said that the combined company’s leaders will take “an objective view of asset rationalization.

“We will be ruthless capital allocators,” Gaspar said. “These individual assets need to compete […] The game will change as we apply these synergies, apply leanings, apply some of the techniques from both sides. I think this will really rejockey some of these other opportunities.”

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.