Baytex exits US oil and gas through $2.3-billion sale of Eagle Ford assets

Baytex Energy Corp., Calgary, has agreed to sell its liquids-rich US Eagle Ford assets to an undisclosed buyer for US$2.305 billion in cash. The assets being divested represent all Baytex's US business, the company said in a release Nov. 12, and the deal positions Baytex as a Canadian producer refocused on its highest-return assets.

According to the company's website, Baytex holds 255,000 gross acres in the Eagle Ford, 70% operated.

As of Dec. 31, 2024, the Eagle Ford assets had proved plus probable reserves of 401 MMboe (277 MMboe proved; 124 MMboe probable). Production from the assets in this year’s third quarter averaged 82,765 boe/d (52,330 b/d light oil and condensate; 15,582 b/d NGLs; 89,115 Mcfd natural gas).

"By sharpening our focus on core Canadian assets, we have a solid foundation to drive disciplined growth, capitalize on new opportunities, and deliver long-term value for our shareholders,” said Mark Bly, chair of the board of directors.

Baytex entered the Eagle Ford in Texas in 2014 through a $2.6-billion deal with Aurora Oil and Gas Ltd.

Core Canadian focus

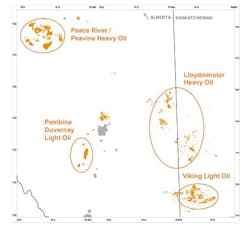

Baytex said the company will be focused on heavy oil operations at Peavine, Peace River, and Lloydminster, as well as its scalable position in the Pembina Duvernay and high netback light oil in the Viking.

For 2026, the operator has set preliminary capital spending budget of $550-625 million and expects to target yearly production growth of 3-5% at a WTI price of US$60-65/bbI.

Baytex’s heavy oil assets comprise 750,000 net acres of land and 1,100 drilling locations, which, the company said, supports about 10 years of drilling at its current development pace.

In the Pembina Duvernay, Baytex holds 91,500 net acres and has identified about 212 drilling locations. Over the next 2 years, the company expects to transition to a one-rig drilling program with 18-20 wells/year, targeting production of 20,000-25,000 boe/d by 2029-2030.

The operator’s Canadian portfolio delivered production of 65,000 boe/d (89% crude oil, NGLs) in the first 9 months of 2025, which reflects a 5% growth rate compared with 2024 (excluding non-core divestitures).

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.