Crescent pushes into Permian with $3.1-billion Vital purchase plan

Crescent Energy Co., Houston, plans to buy Vital Energy Inc. for about $3.1 billion, a deal that will add the Permian basin to its portfolio and increase its net production by about half.

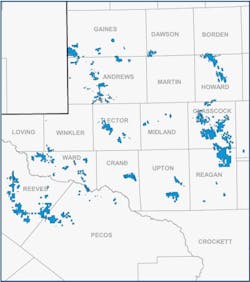

The planned acquisition of Tulsa-based Vital will add to Crescent’s operations an organization that spans about 285,000 acres across both the Midland and Delaware basins in the Permian and which is expected to produce nearly 140,000 boe/d this year.

By comparison, Crescent’s assets in the Eagle Ford and Uinta basins span about 540,000 and 145,000 net acres, respectively, and are forecast to have total 2025 production of roughly 255,000 boe/d.

Crescent chief executive officer David Rockecharlie will retain that role in the combined company. The all-stock transaction is expected to close by year’s end and create $90-100 million in cost savings.

The companies’ pro forma production will be about 64% liquids and have an inventory of about 3,100 development locations. Vital today runs four rigs but Rockecharlie said his team plans to trim that to between one and two as it slows the development pace.

“We have high conviction around the quality of the inventory available to us here,” Rockecharlie said on a conference call with analysts and investors. “But we’re just going to take it slower and we think that’s going to be better for all the shareholders.”

Additional deals

With Vital, Rockecharlie and Crescent are building on a series of acquisitions since early 2023 that have grown the company into the third-largest producer (behind ConocoPhillips and EOG Resources) in the Eagle Ford. Their most recent deal, which closed in January, was the $905 million purchase of Ridgemar Energy assets covering about 80,000 net acres (OGJ Online, Dec. 4, 2024).

Look for more deals: In both Crescent’s statement announcing the Vital buy and on the conference call, Rockecharlie pointed out that Crescent has $60 billion worth of acquisition opportunities in the Permian and Eagle Ford once Vital is brought into the fold.

At the same time, Crescent leaders will look to divest more assets they consider to be outside the company’s core. The company runs some conventional assets in Wyoming that focus on carbon capture, use, and storage.

After Crescent unloaded nearly $55 million worth of assets in 2024 and another $110 million in first-half 2025, Rockecharlie said he has lifted Crescent’s target for divestitures to $1 billion.

Shares of Crescent (Ticker: CRGY) were down nearly 5% to $9.46 in midday trading on the heels of the Vital news. Over the past 6 months, shares have lost about 30% of their value, a slide that has cut the company’s market capitalization to about $2.4 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.