Civitas board bumps CEO Doyle, agrees to $435 million of asset sales

Key Highlights

- Wouter van Kempen has been appointed interim board chair to lead Civitas during the CEO transition, with an expected tenure of about six months.

- Civitas is divesting non-core assets in the Denver-Julesburg basin for $435 million to reduce debt and focus on core operations.

The directors of Civitas Resources Inc., Denver, have thanked chief executive officer Chris Doyle for his services and installed board chair Wouter van Kempen on an interim basis. The company’s leaders also have signed two agreements, worth a combined $435 million, to sell some assets in the Denver-Julesburg basin.

Doyle had led Civitas since May 2022 and oversaw the company’s 2023-24 move into the Permian basin via three acquisitions worth about $7 billion in all. (OGJ Online, Oct. 4, 2023) But the company’s stock has lost about half of its value over the past year even as Doyle had launched a $100 million cost-savings plan (OGJ Online, May 9, 2025), two topics van Kempen noted in the statement announcing his interim appointment.

“Every day, we navigate a fiercely competitive market for a limited pool of investor capital,” said van Kempen, who along with the rest of Civitas’ board also has voted to ramp up share repurchases. “I am committed to continue transforming Civitas into a world-class energy company by strengthening our performance-driven culture, executing with relentless discipline, and driving industry-leading cost efficiency, in order to maximize value for our shareholders.”

Van Kempen has a broad background in the energy space. Most recently, he led DCP Midstream GP LLC for a decade through December 2022 and before that was president of Duke Energy Generation Services. He is today the lead director of the board of Engine No. 1, the activist investment firm that made waves in 2021 by getting three climate-change-focused candidates elected to the board of ExxonMobil Corp.

Speaking to analysts and investors on an Aug. 7 conference call, van Kempen said he expects to be in his interim role for about 6 months as the board searches for Doyle’s full-time successor.

“[We’re] very appreciative of what Chris has done to get the company to where we are today,” he said. “But we think there is a shift needed on what we’re going to do here forward. And again, that’s not a strategic shift. It is really focused on how do we execute better, how do we get better performance, how do we get more cost leadership.”

Civitas’ cost-cutting plan is on track so far and should generate about $40 million in savings this year before growing to $100 million in 2026. Helping drive those numbers are operations in the field that are trimming drilling, completion, and equipping costs across the company’s holdings in the Delaware, Midland, and DJ basins. Clay Carrell, the company’s president and chief operating officer, said on the conference call that a range of future gains are in the works.

“We’ve got things on the capex side around both drilling and completions, design changes. There’s a component of service cost reduction in there, local sands, bringing more proppant providers into the mix, which is creating competition,” Carrell said. “On the [lease operating expenses] side, things around compression optimization, getting more power to our locations and reducing generator costs.”

Shedding DJ assets and targeting Q3 volume growth

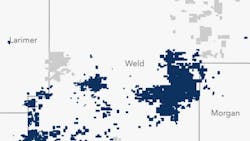

Civitas executives are trimming their DJ footprint via two agreements (with unidentified buyers) to sell non-core assets for a total of $435 million. The assets are expected to produce about 12,000 boe/d during the fourth quarter and about 10,000 boe/d next year and chief financial officer Marianella Foschi said they are “further down the development plan for us so there’s really minimal-to-no near-term impact” on Civitas’ output.

The sales of the assets, which are in the northern portion of Civitas’ DJ acreage position, are expected to be completed by the end of September. Proceeds will be used to pay down Civitas’ debt.

Word of Doyle’s exit and the planned DJ divestitures came after a second quarter in which Civitas averaged 149,000 b/d of oil production and 317,000 boe/d of total production. Total revenues were nearly $1.1 billion versus $1.3 billion in the same period of last year and net income slid to $124 million from $216 million even though the company booked a $104 million gain on derivatives. Output in the third quarter is expected to average 154,000 to 160,000 b/d of oil and 327,000 to 338,000 boe/d in total.

Investors cheered Civitas’ news Aug. 7: Shares of the company (Ticker: CIVI) were up about 8% to $30.09 in midday trading. They are, however, still down more than 35% over the past six months, a slide that has cut the company’s market capitalization to about $2.8 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.