Permian Resources adds Delaware basin assets in $608-million deal with APA

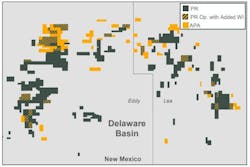

Permian Resources Corp., Midland, has agreed to acquire northern Delaware basin acreage from APA Corp. in a $608-million bolt-on deal with inventory that immediately competes for capital.

Through the agreement, the company will acquire about 13,320 net acres, 8,700 net royalty acres, and expected second-half 2025 production of 12,000 boe/d (45% oil) within its core New Mexico operating areas, Permian Resources said as part of its first-quarter 2025 earnings report.

The acquired acreage is over 65% operated, 99% held by production, and has an average 8/8ths net revenue interest of about 83%, and the majority lies within Permian Resources’ existing Parkway asset in Eddy County, among the company’s most efficient assets, the company said.

'Underappreciated' upside potential

In a call with analysts May 8 after the first-quarter report, co-chief executive officer Will Hickey touched on what he sees in the region.

The bulk of the company’s activity in recent years has been in the Second and Third Bone Spring sand and the [Wolfcamp] X-Y. Those are the best returning targets, he said. Potentially underappreciated, he said, is "there really is a lot more beyond just those zones as you move further north and they may be a little further down the stack for us, but really good targets."

Hickey noted the company has drilled "a handful of good Harkey wells" and some of the deeper targets in the Wolfcamp. "I think it's an area that has a lot to continue to give," near term and long term, he said.

As for the acquired acreage, Permian Resources said it has identified over 100 gross operated, 2-mile locations with high net revenue interests which immediately compete for capital.

Inventory scheduled for 'near-term' development "achieves an average breakeven of $30 per barrel WTI," the company said, and "the asset’s shallow base decline and high-return inventory drive a low reinvestment rate of approximately 35%."

Upside potential includes an increased working interest in over 100 existing Permian Resources-operated locations and non-operated acres adjacent to and surrounding its current position that it plans to "trade for incremental interests in existing operated units or establish new operating units."

Asked on the call about the company's ability to work trade deals, Hickey said the company has "active ongoing trade discussions with…everyone who's relevant and active in the Delaware basin," noting within its existing footprint, Permian Resources has "meaningful overlap with every operator of scale" in the basin."

The roughly 4,500 non-operated acres it has acquired "fits right into the discussions that we're already having," and should help optimize both the acquired assets as well as some legacy assets that the company has been working to trade and consolidate, he continued.

Hickey said non-operated locations are still a small part of the company portfolio, and that the goal is to operate.

The aim, he said, “is to have more pieces that we can feed our land team to go do trace and convert non-up into op in a way that makes sense," he said. The Delaware basin holds a lot of "win-wins...like this transaction on a broader scale, but on trade on the smaller scale," he said, noting the goal is to operate "because we think our cost structure and our execution product truly is differentiated."

When asked about the broader merger and acquisitions landscape in the Permian, Hickey said he envisions opportunities of this size over the long term in the Delaware basin.

There's been a lot of Permian consolidation in the last 3 years of scale, he said, "and…on the back of consolidation, historically, you've seen non-core asset sales come out of it."

And in a downturn, "there's a potential for that activity to actually pick up as you have potentially more motivated sellers."

The deal is expected to close by the end of this year’s second quarter.

2025 operational plan, target update

"As a result of the current environment," said James Walter, co-chief executive officer, Permian Resources will reduce its cash capital expenditures range by $50 million (3%) at the mid-point to $1.9-2.0 billion from $1.9-2.1 billion, but will maintain its full year 2025 average production guidance of 360,000-380,000 boe/d (OGJ Online, Feb. 26, 2025).

"Underpinned by high-return inventory and improved business fundamentals," Hickey said, the company expects to deliver "similar free cash flow at $60/bbl WTI for the remainder of 2025 as we did in 2024 at $75/bbl."

For 2025, Permian Resources plans to turn-in-line about 275 gross wells, down from the 285 forecast earlier this year, and in line with 2024 levels, while remaining flexible for the remainder of the year, depending on commodity prices and service costs.

Hickey said in this year’s first quarter, the company reduced controllable cash costs/boe by 4% quarter-over-quarter and lowered drilling and completions costs to $750/ft [an 8% reduction compared with 2024], which helped generate record quarterly adjusted free cash flow of $460 million.

At the very core, Hickey said, "[Permian Resources'] development program and capital allocation through the drill bit is a very returns-focused equation. And that hasn't changed in the new commodity price." Returns are compressed, but the company is "still generating great returns to the drill bit."

He said this year, given the overall macro backdrop, the company will hold the line on production and accrue to less capex for the year.

"We can thread the needle…doing this in a way where we maintain maximum flexibility with the ability to hit the gas pedal anytime between now and next year, early next year if we see things turn around."

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.