Permian consolidation continues with Diamondback’s $4-billion Double Eagle deal

Diamondback Energy Inc., Midland, Tex., has agreed to acquire certain subsidiaries of Double Eagle IV Midco LLC, Fort Worth, Tex., in a cash and stock deal valued at about $4.08 billion (6.9 million shares, $3 billion cash).

With this, "the first big Permian deal of 2025," Diamondback Energy is set to become the "second largest producer in the Midland basin behind ExxonMobil based on gross operated oil volumes," according to Andrew Dittmar, principal analyst at Enverus Intelligence Research (EIR).

"With Pioneer Natural Resources sold to Exxon in 2023, Diamondback has taken over the mantel of being the premier large Permian pure play with broadly comparable scale to Pioneer at the time of its sale," Dittmar said in a note to media Feb. 18.

The scale and seller are of note.

The core locations acquired immediately compete for capital and the deal “bolts on to core inventory and takes one of the last premier private packages off the board,” TD Cowen analysts said in a note Feb. 18.

EIR analyst Dittmar called the deal a priority for Diamondback, which has been focused on acquisitions in Midland basin, “because it represents one of the last current opportunities to get a large, high-quality asset from a private seller.”

Diamondback, Double Eagle deal details

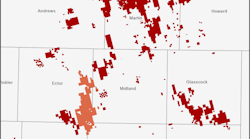

The agreement calls for Diamondback to acquire Double Eagle IV's core Midland basin assets including 407 horizontal locations (342 net) across 40,000 net acres of largely undeveloped acreage, with acreage contiguity allowing for more extended laterals, TD Cowen analyst said.

In its release Feb. 18, Diamondback noted estimated run-rate production from the assets of about 27,000 b/d (69% oil) and that inventory additions lie predominantly within well-delineated Middle Spraberry through Wolfcamp B zones.

Adding to the deal details, TD Cowen analysts said the transaction “appears to exclude developed acreage in Reagan County based off of production figures and shared acreage maps."

As part of the acquisition agreement, Diamondback said it also agreed with Double Eagle to accelerate development on a portion of Diamondback’s non-core southern Midland basin acreage.

Going forward, Diamondback noted an anticipated $200 million capital expenditure in 2025 at current Midland basin well costs of $555-605/ft with the addition of one additional rig running versus Diamondback base case.

To accelerate debt reduction following the deal, Diamondback said it plans to divest at least $1.5 billion of non-core assets with a plan to reduce net debt to $10 billion, and long term, maintain leverage of $6-8 billion.

EIR’s Dittmar said the operator “would likely look to its Delaware basin assets for sales opportunities, further concentrating its focus on the Midland basin.”

The deal is expected to close on Apr. 1, 2025, subject to customary closing conditions and regulatory approval.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.