Matador Resources adds to Delaware basin assets in $1.9-billion deal

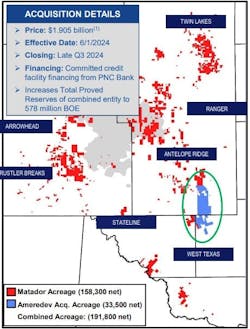

Matador Resources Co., Dallas, is expanding its Delaware basin position in the Permian basin in Texas and New Mexico through a $1.905-billion cash deal to acquire oil and natural gas producing properties and undeveloped acreage as well as a stake in certain midstream assets.

A subsidiary of Matador agreed to acquire a subsidiary of Ameredev II Parent LLC, an EnCap Investments LP portfolio company.

Matador is set to acquire acreage in Lea County, NM, and Loving and Winkler Counties, Tex., and an approximate 19% stake in Piñon Midstream LLC, which has midstream assets in southern Lea County (OGJ Online, June 4, 2024).

Matador “continues to build scale as one of the two principal public companies with the lion’s share of their operations in the Delaware basin,” said Andrew Dittmar, principal analyst at Enverus Intelligence Research.

The operator “appears set on maintaining its status as an independent company and has sought private opportunities to bolster its position that will be a close operational fit with their existing footprint. Building a position of scale is key for achieving operational synergies including longer lateral development and optimizing midstream infrastructure. Matador should be able to optimize development of the position and coordinate with its existing midstream footprint including handling any issues from sour gas issues on the asset,” Dittmar said.

Ameredev assets

Ameredev had estimated production in this year’s third quarter of 25,000-26,000 boe/d (65% oil). The assets include about 33,500 contiguous net acres (82% held by production; over 99% operated) in the northern Delaware basin, most of which lies in Matador’s Antelope Ridge asset area in southern Lea County, NM, and Matador’s West Texas asset area in Loving and Winkler Counties, Tex.

The deal adds 431 gross (371 net) operated locations (86% working interest) identified for future drilling, including prospective targets throughout the Wolfcamp and Bone Spring formations, consistent with Matador’s methodology for estimating inventory with typically 3-4 (or fewer) locations per section, or the equivalent of 160-acre (or greater) spacing, in all prospective completion intervals.

Drilling, operations

Prior to transaction closing, Matador expects Ameredev to operate one drilling rig and to continue operations on 13 drilled but uncompleted (DUC) wells with one completion crew.

Going forward, Matador said the prospectivity of the Ameredev acreage immediately competes for development capital with Matador’s existing acreage. Matador expects to continue operating a total of nine drilling rigs for the immediate future on the combined 192,000 net acres of the Matador-Ameredev properties.

The additional ninth drilling rig and the associated Ameredev activities are not expected to increase the range of Matador’s estimated drilling, completing, and equipping capital expenditures of $1.10-1.30 billion for 2024.

On a pro forma basis following closing of the deal, Matador expects to have over 190,000 net acres in the Delaware basin, about 2,000 net locations, production of over 180,000 boe/d, proved oil and natural gas reserves of 580 MMboe, and an enterprise value over $10 billion.

The deal, subject to customary closing conditions, is expected to close late in third-quarter 2024.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.