Unconventional gas development in North America facing major hurdles

Don Warlick

Warlick International

Houston

There is no question this is a time of dynamic change for natural gas in North America with the ongoing economic recession reducing demand for natural gas. At the same, thanks to the tremendous improvements in technologies for subsurface evaluation, drilling, and completion we have ramped up gas production, largely through increases in gas shale and tight gas resources. As a result, gas storage could be brimming by late summer.

Haynesville operations,Photo courtesy of Chesapeake Energy

It’s also worrisome to know that more LNG tankers are about to appear over the horizon. Natural gas supplies in North America will be impacted indirectly by the global recession with other countries taking smaller LNG volumes – at a time with more liquefaction capacity coming on line. Unless international economies improve we can probably expect a growing global surplus of LNG surplus with future cargos coming to North American shores.

But there are positives, too. Remember that natural gas is critical to our energy supplies. About half of natural gas consumed today now comes from wells drilled in the last 3-1/2 years. Factor in the significant fall-off in gas rigs working US and Canadian fields with consequent reductions in natural gas production that will begin showing up by late 2009. Then there is the bigger picture related to green energy and the clean-burning nature of natural gas, reducing overall emissions in the future.

What then is the best path forward for E&P and oilfield services in the balance of 2009 and 2010? This condensed report summarizes the current situation with a focus on unconventional gas, what may lie ahead, and updates about how the E&P sector is handling this huge step-change in the natural gas space.

Years of evolution into unconventional gas

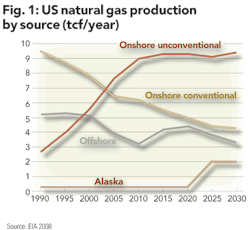

The US is supplied gas through several sources: onshore conventional, offshore, Alaska, and onshore unconventional gas production. Figure 1 shows the growing contribution from onshore unconventional resources, which includes gas shale, coal bed methane, and tight gas.

Although coalbed methane and tight gas development has been taking place for years, significant growth in total unconventional gas production began to show up ~ 1990, then taking off on a breathtaking ride through 2008, growing about 7% CAGR.

Figure 1 shows declines in onshore conventional and offshore production are obvious, with minimal contribution from Alaskan gas until the year 2020. The EIA anticipates an increase in offshore gas production beginning around 2010 and peaking by 2020. But the message is clear: Unconventional drilling and development are making a big difference in supply.

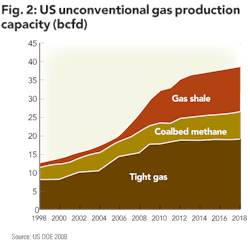

In Figure 2, we see how unconventional gas production capacity has lifted off since 1998, plus a look ahead through 2018.

As Figure 2 indicates, there is tremendous production from tight gas basins such as the Piceance, Pinedale, Anadarko, and others that came prior to 1998 and continue to grow in the years beyond. Similarly, coalbed methane (CBM) production in the Powder River, San Juan, and Black Warrior basins provided ample gas production prior to 1998 with some increase thereafter.

But the big news is significant growth in gas shale capacity beginning after 2005 and which continued to climb through 2008-2009 with a trajectory of about 25% CAGR. It was during that time that technology, Barnett science well drilling/completion, infusion of capital, and market frenzy kicked in.

As a result we have an active pipeline of new shales coming forward sequentially. This growth was largely created by success in the Barnett (which by itself now supplies 6% of all natural gas in the Lower 48 States) with thanks to companies like Devon, EOG, XTO, and others with their application of technologies, talent, and dollars.

Next in this line of newly-economic shales came the Fayetteville shale pioneered by Southwestern Energy, and which continues to expand today. Third in sequence is the Arkoma-Woodford led by Newfield Exploration, which is utilizing ever-extending laterals in their horizontal completions.

And there’s more: The new gas shale developments have great promise also – both the Haynesville and Marcellus are proving exceptional additions to this pipeline of new unconventional gas development. The next candidate in succession will probably be the Eagle Ford Shale in South Texas, now too early-stage to define clearly, but typifying the sequential surprises we are observing as shale development moves forward.

Two high-growth gas shales

It is instructive to review the two latest shales that exemplify the future of unconventional gas. Even with an overhang in gas supply (some report as much as 5bcf/d), conventional and offshore gas production continue to decline steadily and must be replaced by unconventional production. Certainly we can turn off drilling for a time but must pick up in the near future to return to the supply “treadmill.”

The E&P sector is undergoing an evolutionary process in gas shale development. And it’s really the issue of managing economics in the future that will enable the leading operators of unconventional plays to survive in times of a supply/demand mismatch with consequent low prices – just like today. So the key to gas shale successes will be in pushing down the costs of locating, leasing, drilling, completing, and operating these fields on smart, strategic bases.

Two great shales in early stages of development, much like the Barnett was in the 1999-2002 era, are the Haynesville and Marcellus, shown in Table 1 in comparison to the Barnett.

But there’s a big difference today. Operators and service companies now have toolboxes loaded with technology that multiply their capabilities and enable them to compress in time their evaluative-drilling-completion cycle. With reference to Table 1, there are differences in these shales, but when all factors are taken into account each shale can have results that can be stupendous in some cases.

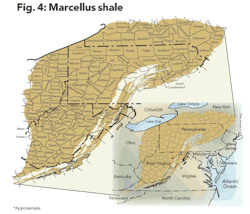

Take note, also of the huge ariel extent of the Marcellus as we know it now. But the real action is taking place in the Central Marcellus, which comprises about 28,000 square miles.

Ultimately the most telling metric is F&D cost. It appears that the Haynesville is somewhat lower than that of the Barnett but the Marcellus is lower still. This will prove to be very critical for both shales and future E&P plans since lower costs are now the watchword for all unconventional gas development.

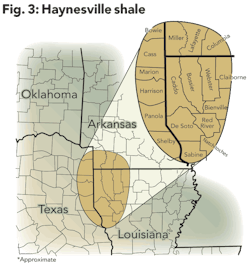

The genesis of the Haynesville began in late 2007 when Dallas-based Cubic Energy revealed the superior performance of two wells in Caddo Parish, Louisiana.

Then came an announcement by Chesapeake Energy indicating its belief in the potential of the play. Those announcements plus others set off a land rush in leasing followed soon after by vertical test wells and now, expanding horizontal drilling programs. Helping to speed development is widespread infrastructure thanks to the significant history of oil and gas development in this area.

A big plus in developing Haynesville plays is the option to pursue gas in companion formations like the James Lime, Travis Peak, Cotton Valley Sand, Cotton Valley Lime, and also the Smackover.

This basin has drawn aggressive players like Chesapeake (in a joint venture with Plains Exploration), EnCana, Petrohawk, Andarko, Goodrich, and others. There’s a good chance that drilling will triple this year compared to 2008 and that kind of growth will continue in 2010.

The latest among big-play shales that has ignited the interests of many E&P players is the Marcellus.

Early lease payments were cheap: $150-$200 an acre in Pennsylvania, and by late 2008 in the $3,000 range with offered royalty levels from 12.5% to 18.75%.

The Marcellus has an important advantage in its proximity to large East Coast US gas markets, but it’s early in the game in determining reliable estimates of recoverable reserves.

The leading operators/leaseholders in the Marcellus include Range Resources, the Chesapeake/StatoilHydro JV, Cabot, EQT and others.

This basin should increase drilling activity by more than a third this year and continue upward in 2010.

A challenging gas environment

It’s obvious that natural gas pricing is low due to the current imbalance in supply and demand. Spot natural gas prices are way down and there’s a good chance they will continue to be quite low the rest of 2009.

Other factors that affect price and the future of natural gas in North America:

- The future prospect of more LNG coming from an expanding base of LNG capacity. Remember, too, that once those new foreign liquefaction plants crank up they do not stop. It will be important that international economies recover soon to absorb some of these growing LNG volumes.

- On the demand side North American gas consumption has been hurt largely due to declines in new housing starts and the auto manufacturing sector. Recovery in both will be painfully slow.

- US gas storage is jamming up with what could be record volumes of natural gas perhaps by the end of this summer. A cold winter heating season would be a blessing but is totally unpredictable.

With the huge mismatch of supply and demand in North America, solutions include reducing rig count (we’ve done that in a big way), allowing the natural decline of producing gas wells to drop supply (that’s underway), and enhancing gas demand (we may be seeing a glimmer of economic recovery at this point). In any case E&P and service companies must face the prospects of oversupply and potentially low gas prices for months to come.

Taking action in a difficult market

How then will the quick, adept (and big) take action in this difficult gas market environment? We are in a step-change era that follows a multi-year run of borrowing to buy acreage, funding drilling programs and ramping up production (which helps one to borrow even more to drill more). It worked in the 2002-2008 era but like the US economy, all that has changed.

E&P companies are taking a variety of routes in order to adapt, survive, and even prosper in the long term. A characterization of options follows:

Joint ventures for drilling/development

Chesapeake mastered JVs years ago and has done so in grand fashion as it sprinted ahead of others in broad land leasing programs then sought joint venture partners to fund drilling programs. Three examples:

- A Chesapeake/StatoilHydro JV was formed in November 2008 with plans to spend $3.4 billion in developing Chesapeake’s Appalachian holdings with principal focus on the Marcellus; this could play out over 20 years with more than 13,000 horizontal wells.

- A similar JV between Chesapeake and Plains Exploration & Production Co. in the Haynesville; established in 2008 appears to be on schedule with the partnership reportedly running 24 rigs by early May with plans for up to 36 rigs in 2010.

- BP joined Chesapeake in a joint venture relationship in 2008 with plans to develop Chesapeake holdings in the Arkoma-Woodford and Fayetteville shales for $3.6 billion.

- MarkWest Energy Partners and NGP Midstream Resources formed a joint venture in early 2009 focused on construction and operation of midstream facilities in the Marcellus.

Euro-partnering

There is interest among European E&P players to secure Western Hemisphere gas and also pick up on expertise and partnering relationships to exploit global unconventional resources. Several examples:

- BG Group plc announced its entry into the Haynesville in late June by spending around $1 billion for Haynesville shale gas properties from Dallas-based EXCO Resources, an aggressive but overcommitted E&P driller. BG secures gas supply to deliver on commitments to US customers plus gas shale know-how while EXCO gets much-needed operating capital.

- Eni SpA joined Quicksilver Resources in the Barnett Shale, committing $280 million to help develop its Alliance field. Eni has rights to certain production plus exchange of technical knowledge; Quicksilver secures capital to move forward in Alliance development.

- Italy’s Euramerica Energy Inc. announced a farm-in with Admiral Bay in the Cherokee basin to drill 25 CBM wells this year and 25 wells in 2010, funding all drilling and completion costs.

Specialized partnering

There are always unique partnering possibilities in the energy space, but perhaps it could be even more applicable and timely for unconventional opportunities:

- Williams recently executed in agreement with Rex Energy Corp. in the Marcellus, securing half interest in about 44,000 net acres in a “drill to earn” arrangement.

- Williams also created Laurel Mountain Midstream LLC with Atlas Pipeline Partners, which will own 1,800 miles of intrastate gathering lines that serve 6,900 wells in the Appalachian basin.

- In the Haynesville, Shell and EnCana are reportedly looking for someone to help develop 119,000 acres, ideally an active partner to expedite evaluation of the partnership’s Haynesville portfolio.

Entry by majors

Size and scale plus interest in unconventional opportunities come together in some instances. We would not be surprised to see more of the following take place this year and next:

- Talisman is looking for opportunities to enhance its unconventional growth plans with the Haynesville as an important target. The Canadian producer currently has positions in the Marcellus (via its Fortuna subsidiary), the Montney in British Columbia, and the Utica in Québec.

- ConocoPhillips is building position in the Haynesville and Eagle Ford shales, reportedly with 300,000 net acres in the Eagle Ford. The Houston-based major is an experienced unconventional player and is the leading coalbed methane producer in the San Juan basin.

Asset monetization/property sales

There are a number of ways to raise capital in for reinvestment, high-grading, redirecting focus, or by doing a deal to monetize certain assets. Two examples:

- EXCO Resources extended itself via large bets on gas and unconventional resources but was able to pull off a double play, doing a deal in the Haynesville with BG Group (cited earlier) and at the same time selling off its non-shale assets to Encore.

- Chesapeake has raised about $13 billion in a continuing asset-monetization program that began in 2007. Some transactions are for cash, others joint ventures, with some arranged through VPPs, or volumetric production payments – all focused on feeding unconventional growth.

Private equity investment

Private equity capital is still flowing, albeit at a trickle but there is life for private investments in selected energy situations with unique/attractive conditions:

- Morgan Stanley Private Equity directed a majority investment into a strategic partnership with Triana Energy Investments, an E&P company focused on the Marcellus.

- Kolbert Kravis Roberts & Co. invested $350 million into a privately-held E&P company, East Resources Inc., which operates in the Marcellus.

- In late 2008, Avista Capital Partners announced it would contribute up to $150 million with Carrizo Oil & Gas for development in the Marcellus Shale.

Conclusion

Regardless of the difficult environment, there are opportunities among gas holdings scattered across unconventional plays in North America. Those companies with relatively strong balance sheets and credit access could take advantage through 2010 to supplement existing unconventional core areas or secure new properties to grow or enhance their inventory at reasonable F&D costs.

They can load up with or expand unconventional assets via acquisition, partnering, joint venture, or other unique approaches to leveraging. Considering such opportunity, we’re reminded of the old business axiom: Where there’s confusion, there’s money.

About the author

Warlick releases UG report Warlick International recently published its fourth annual “North American Unconventional Gas Market Report,” a 558-page compendium of details on the top 21 unconventional gas basins in the US and Canada. For more information, email [email protected] or visit the PennEnergy website at www.pennenergy.com. Click on “Natural Gas / ENG,” then scroll down to North American Unconventional Gas Market Report. Don Warlick will be speaking soon at PennWell’s Unconventional Gas International Conference in Fort Worth, Tex., Sept. 29-Oct. 1. For details, visit www.unconventionalgas.net. |