1Q09 revenues decline 22%, net income drops by $50 billion

Don Stowers and Laura Bell

Financial results for the 146 publicly-traded US companies tracked in the OGJ200 report were down as expected in the first quarter of 2009. For the second consecutive quarter, revenue declined and net income again fell into negative numbers.

For the collective companies tracked by PennWell, total revenue fell 8.1% to $178.4 billion compared to $194.2 billion in the first quarter of 2008. However, net income crashed – a net loss of $10.7 billion, down a whopping 156.5% from 1Q08. Nevertheless, this was a slight improvement over the 4Q08 in which the group showed a $42 billion loss in net income.

Total asset value continued to fall as well. For 1Q09, assets totaled $1.03 trillion, down 6.7% from the same period in 2008 and down from the $1.07 trillion reported for the previous quarter. Revenues fell even more to $178.4 billion, down 8.1% from the first quarter of 2008 ($194.2 billion) and down 22% from the prior quarter ($228.8 billion).

Stockholder equity fell a modest 2.1% for the quarter to $488 billion, down about $10 billion from the comparable quarter in 2008 and up almost $7 billion from the fourth quarter of last year. This reflects an upswing in stock values for oil and gas producers.

Capital and exploration expenses increased 7.6% to $32.9 billion, up from $30.6 billion in the 1Q08.

IHS Herold reported on July 20 that economic indicators were up for energy companies in the second quarter, spurred by a resurgence in oil prices and a thaw in equity and credit markets. Herold, a specialized research and consulting firm that focuses on valuation, strategy, and performance measurement of the world’s leading oil and gas companies, cautions that the market is still extremely volatile and uncertainty is the rule.

Looking at the top 20 companies (as ranked by assets), net income dropped 41.5% compared to the previous quarter. The first quarter showed net income of $9.7 billion among these companies in contrast to the $16.5 billion in net income for 4Q08.

For the top 20, revenues fell from $220.2 billion to $171.6 billion, a decline of about 22%, in the first quarter compared to the prior quarter. Total assets (market capitalization) fell from $890.2 billion in the fourth quarter to roughly $765.1 billion in the 1Q09 – about a 14% drop in value. Stockholder equity among this group remained relatively constant showing a slight increase (1.9%) in the first quarter compared to 4Q08.

Capital and exploration expenses for the elite 20 fell nearly 35%, down from $43 billion in the fourth quarter, to slightly more than $28 billion in the first quarter of this year.

Top 20 getting more bang for buck

For the last two quarters, OGFJ has reported on the stark differences between the Top 20 producers on the one hand and the remaining 136 companies whose financials we track. The differences are marked and clearly show the dominance of the 20 largest companies in all categories over their smaller counterparts.

For instance, in 1Q09, the Top 20 producers control 74.2% of total assets, while the remaining 136 companies control just 25.8%. In stockholder equity, the difference is even more pronounced – 92.6% of stockholder equity is in the Top 20 companies with just 7.4% in the remaining companies.

The 20 largest companies accounted for 96.2% of all revenue from the total group, while their 136 smaller counterparts had just 3.8% of all revenue. In net income, the group as a whole had a net loss of $10.7 billion in the first quarter. However, the Top 20 had net income of $9.7 billion – a stark difference between the majors and super independents on the one hand and smaller oil and gas producers on the other.

The Top 20 had $28.1 billion in capital and exploratory spending in the first quarter versus $32.9 billion for the group as a whole. In other words, the Top 20 accounted for 85.4% of total spending, while the remaining companies spent $4.8 billion, or 14.6% of the total. So the conclusion we can draw is that the larger companies are getting the most bang for their buck, judging from net income versus capex spending.

The OGJ200 group of companies consists of publicly-traded, US-based producers. The group appears in the Oil & Gas Journal’s annual special report, which ranks the firms by year-end total assets. To qualify for this list, a company must have operations in the United States.

Firms not reporting

For the 1Q09, the group includes 146 firms, the same number of companies listed in the previous edition of the OGFJ200 Quarterly Report, published in the May 2009 issue of Oil & Gas Financial Journal. The financial results of 14 of these companies were not available for this issue of the report, as these companies had not filed their first-quarter results with the US Securities & Exchange Commission by press time.

Largest producers

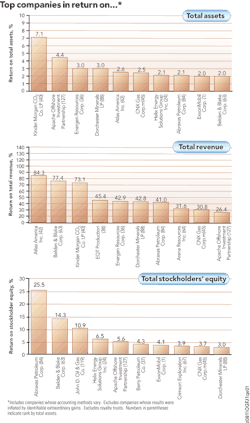

The Top 20 showed a 22% decline in revenue ($48.6 billion) for the first quarter compared to the prior quarter. Exxon Mobil – the leader in four of the five categories – assets, revenue, income, and stockholder equity – saw a $16.5 billion revenue decline over the 4Q08, but in all 13 of the Top 20 showed declines. Fort Worth-based XTO Energy, which showed a 9.3% revenue gain ($200 million), was the biggest gainer of the group and moved from 11th place to 8th place in the revenue rankings. Other revenue gainers included El Paso Corp. (No. 13); Dominion Energy (No. 14); Questar Corp. (No. 16); Helix Energy Solutions Group (No. 17); Williams Cos. Inc. (No. 18); Southwestern Energy (No. 19); and Pioneer Natural Resources (No. 20).

Net income fell 41.5%, from $16.5 billion to $9.7 billion, for the first quarter. Exxon Mobil and Chevron were the category leaders, although both showed income declines. ConocoPhillips moved back into the No. 3 position this quarter after dropping out of the top 20 in 4Q08. Other new additions to the Top 20 include Houston-based Marathon Oil, CNX Gas, Cabot Oil & Gas, EQT Production (formerly Equitable Production), and Berry Petroleum. Dropping out of the Top 20 for this quarter in net income were Anadarko Petroleum, Noble Energy, Encore Acquisition (last quarter’s fastest-growing company), Legacy Reserves, Southwestern Energy, Hess Corp., Ultra Petroleum, and Clayton Williams Energy.

Fastest-growing companies

The five fastest-growing companies for the first quarter of 2009 (in stockholder equity compared to the preceding quarter) are Cabot Oil & Gas Corp. (4.4% growth); Bill Barrett Corp. (4.3% growth); XTO Energy (3.8% growth); Goodrich Petroleum (2.7% growth); and Murphy Oil Corp. (1.0% growth). XTO Energy (No. 7) and Murphy Oil (No. 16) both rank in the Top 20 according to total assets.