Anadarko strikes oil at Heidelberg prospect

Oil major Anadarko Petroleum has made an oil discovery at its Heidelberg prospect in Green Canyon block 859 in the deepwater Gulf of Mexico. The discovery well encountered more than 200 feet of net oil pay in several high—quality Miocene sands.

“The Heidelberg discovery further validates our geologic understanding of the subsalt Miocene trend. The well encountered the same—age sands and reservoir characteristics similar to the previously announced Caesar/Tonga discoveries,” said Bob Daniels, senior vice president, worldwide exploration. “Since 2005, we have drilled seven successful exploration wells in this Middle—Miocene trend, each targeting resources of more than 100 million barrels.”

Heidelberg is located in roughly 5,000 feet of water and, to date has been drilled by the Noble Amos Runner semisub to a total depth of nearly 28,500 feet. Heidelberg’s proximity to Anadarko’s 100% owned Constitution spar enhances the company’s flexibility to consider a variety of development options after further appraisal, which Anadarko intends to conduct in the second half of 2009.

Anadarko operates the block with a 44.25% working interest. Partners include Mariner Energy Inc. (12.5%), ENI (12.5%), StatoilHydro (12%), ExxonMobil (9.375%), and Cobalt International Energy LP (9.375%).

Once drilling operations are complete at Heidelberg, Anadarko plans to drill the Vito prospect in Mississippi Canyon block 984, which Anadarko operates with a 20% working interest. Vito is a 30,500—foot test, targeting Miocene objectives in 4,000 feet of water.

Anadarko also is currently drilling the Shenandoah Lower—Tertiary prospect, located in Walker Ridge block 52. Anadarko operates Shenandoah with a 30% working interest.

An additional exploration well is planned to spud during the first quarter at the Samurai prospect, which is operated by Anadarko with a 33.33% working interest. Samurai is a Middle— and Lower—Miocene test located in Green Canyon block 432.

Noble Denton expands engineering office in the Middle East

Noble Denton, an offshore and marine consultancy firm, has furthered its expansion in the Middle East.

The company has increased the number of employees in the Detail Design Engineering office in Sharjah to 80 and recently relocated the office to a larger space.

The office is responsible for a complex process of taking a client’s base design (concept) and bringing it to life, customising and ensuring that the project is feasible and built to specification.

The multi—disciplined office employs a wide rage of engineers, including naval architects, structural, mechanical, piping, electrical, and instrumentation engineers. The process is taken from feasibility stage through to delivery of vessel to client.

“This expansion of the detail design department in the Middle East is a fantastic opportunity for the company, as since its founding just a year ago it has quickly become one of the biggest success stories for the company to date,” noted David Wells, managing director Middle East.

Southern Star makes 9th Cotton Valley discovery

Southern Star is celebrating its ninth successful Cotton Valley discovery well in its Sentell Field Development Project, Bossier Parish, La.

The Cotton Valley discovery, the L. Moore 20—1 well, which reached a depth of 9,904 feet on January 31, 2009, is the northwest offset to the company’s recent Cash Pointe 30—1 discovery.

Wireline logging and mud log shows indicate the L. Moore 20—1 Well encountered 104 feet of net effective gas pay in the Cotton Valley Formation. The company notes there are key intervals in the most productive intervals of the Upper Davis with 47 net feet of pay.

Southern Star has run and set 4 1/2 inch production casing to total depth. Completion operations commenced this week. Hydraulic fracturing in the Upper Davis was performed on February 13.

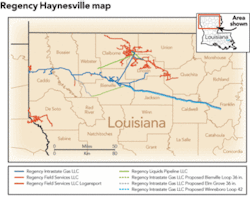

As mentioned, this is the ninth well in the field. The other eight wells encountered similar log characteristics; five wells are commercially producing, the sixth is awaiting pipeline construction and completion, and two wells were extended as successful Haynesville delineation tests.

Construction of an extension of the field gathering system to connect the Section 20 wells was completed in early February and should allow for immediate production from the Moore 20—1 well upon completion. Work continues to extend the line down to the Cash Pointe 30—1 Well.

David Gibbs, Southern Star’s president and CEO, said, “The results from the L. Moore 20—1 offer further indications of the quality of the Cotton Valley play in our acreage position. Developing the Sentell Field as a Cotton Valley producer remains a viable strategy at natural gas prices above $4.50 per Mcfe. The company’s advantage lies in our dual development strategy between Cotton Valley production and the planned Haynesville Development Program, which is based on previously—announced successful Haynesville tests in two locations within our Sentell Field.”

Mariner Energy cites three successful exploration wells

Houston—based, independent oil and gas exploration, development, and production company, Mariner Energy Inc. has discovered oil in three exploration wells in the Gulf of Mexico: Heidelberg #1 on Green Canyon Block 859, Bushwood #1 (formerly Geauxpher #3) on Garden Banks Block 463, and Smoothie #2 on South Timbalier Block 49.

The first discovery in Heidelberg was made as a 12.5% working interest partner with operator Anadarko Petroleum Corp. (see p.14).

The Bushwood deepwater well is located in water depths of roughly 2,700 feet. The third well, Smoothie #2 is part of deep shelf assets the company acquired from StatoilHydro in 2008.

Scott D. Josey, chairman, CEO, and president said, “These results underscore the substantial potential of our prospect inventory and further demonstrate Mariner’s ability to generate organic growth from our diversified portfolio. We completed our 2008 offshore drilling program with an 80% success rate, and our 2009 program is off to an excellent start.”

Bushwood #1, a Conventional Deepwater Amplitude prospect, was drilled to a total depth of nearly 25,300 feet, logging more than 260 feet TVT of net gas pay in multiple sands, with more than 150 feet TVT of net gas pay found in the deeper exploratory section. Mariner operates and holds a 30% working interest. Partners include Energy Resource Technology GoM Inc., a wholly—owned subsidiary of Helix Energy Solutions Group Inc. (35%), Apache Corp. (20%), Deep Gulf Energy II LLC (10%), and Deep Gulf Energy LP (5%).

Smoothie #2, a deep shelf prospect, was drilled to a total depth exceeding 20,100 feet, logging more than 200 feet TVT of net gas pay in multiple zones. Mariner operates the well holding a 100% working interest in the discovery.

ATP operations update

ATP Oil & Gas Corp. is forging ahead on development activities and has updated its capital expenditures estimates.

On the Gulf of Mexico shelf, two wells at High Island A—589 were drilled, completed, and placed on production during December 2008. The wells were completed in the 9,800’ and 10,000’ sands. At South Marsh Island 190, ATP is working on final pipeline connections for one new well. First production at SMI 190 is projected in the third quarter 2009.

Connection and completion of HI A—589 and SMI 190 were delayed because of third—party pipeline outages as a result of Hurricane Ike. ATP has a 100% working interest in HI A—589, a 75% working interest in SMI 190, and is operator of all three wells.

In the North Sea, ATP drilled the Wenlock #2 well to a total depth of 15,200’. The well successfully encountered the targeted reservoir sands and was completed with a 3,000’ horizontal section. Completion and connection operations are underway with initial production expected before the end of the first quarter 2009.

Following completion of the Wenlock #2 well ATP will commence drilling a well in the Bodbury prospect, an exploratory offset immediately northwest of Wenlock.

ATP has a 20% working interest and is operator of Bodbury and both Wenlock wells.

While capital expenditures for 2009 are estimated to be between $300 million and $500 million, ATP may revise its development plans and budgets during the year. One catalyst is the active pursuit of buyers of partial interests in selected assets.

– Mikaila Adams

Nighthawk Energy, Running FoxesPetroleum make gas discovery in KS

Nighthawk Energy plc, the US—focused hydrocarbon production and development company, has made what they deem a ‘significant’ gas discovery and a new reservoir at the Devon Oilfield waterflood project, located in Bourbon County, Kan.

Nighthawk holds an 80% interest in the project, which covers an area of 1,764 acres. Running Foxes Petroleum Inc. is the operator and holds the remaining 20%.

The Graham 6—36D—3 well was tested from the Lower Bartlesville formation at a depth of 430 to 438 feet resulting in a stabilized open flow test of 627 Mcfd (thousand cubic feet of gas per day) through a one inch choke.

The well has been hooked up to a local pipeline and gathering system and natural gas is now producing at a choked off rate of 160 Mcfd and being sold into the market.

The producing sandstone represents a separate reservoir from the main Bartlesville channel system presently being waterflooded at the Devon project. Eight additional locations have been staked and will be drilled to further test the new reservoir.

Noble strikes oil offshore Equatorial Guinea; increases potential of Tamar discovery

Noble Energy projects have yielded positive results as of late. The company has two offshore discoveries in the past months, and recently released flow test results from one.

Most recently, Noble discovered oil on Block “O” at the Carmen prospect, offshore Equatorial Guinea.

The Carmen well is the company’s first oil discovery on the block. It encountered roughly 26 feet of net oil pay, along with 13 feet of net gas pay. Located in 150 feet of water, the well was drilled by the Trident VIII jackup to a total depth of 11,550 feet to test a lower Miocene reservoir. The well has been temporarily abandoned pending future development considerations. There are no plans to flow test the reservoir at the current time.

Noble Energy is the technical operator of Block “O” with a 45% participating interest. Its partners on the block include GEPetrol, the national oil company of the Republic of Equatorial Guinea with a 30% participating interest, and Glencore Exploration Ltd. with a 25% participating interest.

This discovery comes on the heels of the natural gas discovery at the Tamar prospect in the Matan license, offshore Israel in January.

The company recently completed flow testing from the discovery. The Tamar #1 well, located in roughly 5,500 feet of water and drilled to a total depth of 16,076 feet, encountered more than 460 feet of net pay in three high—quality reservoirs.

Testing procedures, which were performed over a limited 59—foot section of the lowest reservoir and with equipment available on the rig, yielded a flow rate of 30 MMcf/d of natural gas. Performance modeling indicates the well can be ultimately completed to achieve a production rate of over 150 Mmcf/d.

The pre—drill gross mean resource potential for Tamar was originally estimated at 3.1 trillion cubic feet (Tcf) of natural gas. Immediately following discovery, we estimated the gross resource potential to be at least equal to the pre—drill mean estimate. After analysis of all the post—drill and production test data, the estimated gross mean resource potential of Tamar has now been increased to 5 Tcf.

Based on these results, the company and its partners have elected to keep the Atwood Hunter, a semi—submersible drilling rig, offshore Israel for two additional wells. Subsequent to operations at the Tamar #1 well, the drilling rig will proceed to the Dalit exploration prospect in the Michal license.

Immediately after concluding operations at Dalit, the rig will be relocated to Tamar where it will drill an appraisal well to further define the resources of the structure.

Noble Energy operates both the Matan and Michal licenses with a 36% working interest. Other interest owners are Isramco Negev 2 with 28.75%, Delek Drilling with 15.625%, Avner Oil Exploration with 15.625%, and Dor Gas Exploration with the remaining 4%.

– Mikaila Adams