Revenue and net income plummet for most in 4Q08

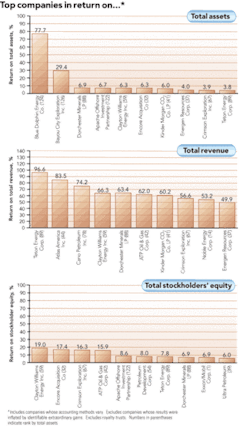

If there is any one indicator that shows how far US-based oil and gas companies fell from the third-quarter of last year to the fourth quarter, it is the OGJ200 list of the 20 fastest-growing companies. For the final quarter of 2008, only one company – Fort Worth-based Encore Acquisition Co. – made the list. To qualify, companies needed to show positive growth in net income for two consecutive quarters. Encore was the only company that did. Ranked as the 32nd-largest domestic producer according to total assets, Encore grew at a 17.9% clip in stockholders’ equity during this period of global economic decline.

The revenue decline from the third to the fourth quarters among the entire OGJ200 group of companies was dramatic, and the plunge in net income was unprecedented for most of the group. Third-quarter revenues of $387.1 billion fell to $228.8 billion in the fourth, a decline of 41% in the three-month period from Sept. 30 through Dec. 31. Net income for the same periods plummeted from $52.7 billion to a net loss of $41.9 billion – a change of $94.6 billion.

Compared with the same quarter in 2007, revenues for the OGJ200 group declined 22% and net income was down a whopping 235.4%.

Capital and exploration expenditures for the group grew by $53.2 billion from the third quarter to $160.9 billion in the fourth, an increase of more than 33%. This was down significantly from the 56% increase in capital spending from the second quarter to the third and reflects a drop-off in activity during the final quarter of 2008.

The total asset value of the OGJ200 companies fell, as did stockholders’ equity in the companies. Total assets declined by nearly 10% during this period, while stockholders’ equity dropped by just over 13%. By contrast, total assets for the group rose 0.7% from the second to the third quarter, and stockholders’ equity was up 9% during that period.

Looking at the top 20 companies (as ranked by assets), net income fell an astonishing $77.5 billion – from plus $48 billion in the third quarter to minus $29.5 billion in the fourth, a drop of 163%. Total revenue for the top 20 dropped from $373 billion in the third quarter to $220 billion at the end of the fourth quarter.

Capital spending for the top 20 companies jumped 54% from $82.6 billion in the third quarter to $127.3 billion in the fourth. Total assets for this group of companies fell in value by nearly $100 billion. The value at the end of the third quarter was just over $1 trillion, and this figure decreased by about 10% by year end.

Stockholders’ equity in the top 20 companies declined by 12.3%.

We reported last quarter that the top 20 companies accounted for 96.2% of total revenues and 90.2% of total net income of the entire OGJ200 group. For the fourth quarter of 2008, total assets of the top 20 companies were 84.9% of the entire group of companies, down 1.1% from the previous quarter. Previously, the stockholders’ equity of the top 20 companies was 88.7% of the group total. At the end of the fourth quarter, this percentage had risen to 90.6% of total stockholders’ equity.

Who spends the most? In capital spending, the top 20 producers spent $127.3 billion, just $33.6 billion less than the total spent by all the OGJ200 companies. This amounts to 79.2% of the total expenditures.

The OGJ200 group of companies consists of publicly-traded, US-based producers. The group appears in the Oil & Gas Journal’s annual special report, which ranks the firms by year-end total assets. To qualify for the list, a company must have operations in the United States.

Firms not reporting

The group includes 146 firms, down by 10 from the 156 companies listed in the previous edition of the OGJ200 Quarterly Report, published in the February 2009 issue of Oil & Gas Financial Journal. The financial results of 20 of these companies was not available for this issue of the report, as these companies had not filed their fourth-quarter results with the US Securities & Exchange Commission by press time.

Largest producers

In terms of total revenue for the fourth quarter of 2008, most of the top 20 companies remained in the same position relative to their peers. ExxonMobil Corp., Chevron Corp., ConocoPhillips, Marathon Oil Corp., Hess Corp., and Murphy Oil Corp. are ranked one through six, respectively. Occidental Petroleum moved up one notch to seventh place, while Anadarko Petroleum also improved its position from ninth to eighth place. Chesapeake Energy dropped from seventh place to ninth. Devon Energy remained in 10th place. Rounding out the top 20 are XTO Energy (No. 11), Apache Corp. (No. 12), EOG Resources (No. 13), El Paso Corp. (No. 14), Dominion Energy (No. 15), Questar Corp. (No. 16), Noble Energy (No. 17), Helix Energy Solutions Group (No. 18), Williams Cos. Inc. (No. 19), and Southwestern Energy Co. (No. 20). Helix and Southwestern are new to the top 20 list in total revenue. Exco Resources and Plains Exploration & Production Co. dropped off the list.

There was a bigger shift in the net income category. Although ExxonMobil and Chevron remained entrenched in the No. 1 and No. 2 positions, respectively, previously third-ranked ConocoPhillips fell to No. 126 due to a fourth-quarter loss of nearly $31.8 billion. Another big loser was Devon Energy, which fell from fifth place in the third-quarter rankings to No. 125 in the fourth due to a reported loss of over $6.8 billion. Other producers that dropped off the top 20 net income list are Newfield Exploration, Plains Exploration & Production, El Paso Corp., Forest Oil Corp., and Williams Cos. Inc.

Anadarko Petroleum moved from seventh place to the No. 3 position, taking the position previously held by ConocoPhillips. EOG Resources moved from ninth place to fourth, Occidental Petroleum moved from sixth to fifth place, XTO Energy climbed from No. 15 to No. 6, and Noble Energy rose from No. 11th to seventh place overall. Murphy Oil moved up from No. 14 to No. 11, while Hess Corp. fell from No. 12 to No. 17. Newcomers to the list include Encore Acquisition Co. (No. 8), Kinder Morgan Co2 Co. LP (No. 9), Dominion Energy (No. 10), Legacy Reserves LP (No. 12), Questar Corp. (No. 13), Energen Resources Corp. (No. 14), Southwestern Energy (No. 15), Range Resources Corp. (No. 16), Ultra Petroleum (No. 18), Atlas America (No. 19), and Clayton Williams Energy (No. 20).

null

null

Fastest-growing company

Jon S. Brumley, president and CEO of Encore Acquisition Co., our solo fastest-growing company this quarter, noted a key reason for his company’s success in the fourth quarter: “Encore was formed around long-life, shallow-declining properties and that has continued as core to our business philosophy and strategy. When you couple our long-life, high-margin oil properties with our hedging portfolio, the result is a company poised to weather storms and take advantage of uncertainty. As commodity prices rose, service costs rose right alongside them. Now commodity prices have dropped, but service costs remain inflated. So, to make us more opportunistic and improve our already strong liquidity position, we are reducing our 2009 budget by $150 million. However, even with a lower budget, the company can keep production flat. I think it is important to note that we are not losing projects, but deferring them until service costs reflect the current commodity price environment. If you were to drill the projects under the current scenario, you would be wasting those projects.”

Encore said it believes oil prices will increase in late 2009 or 2010, and the deferred projects will have a higher rate of return than today. The company’s strategy for 2009 continues to be focused on allocation of capital to the company’s most efficient and highest rate of return projects, expansion of the company’s position in the Bakken and Haynesville plays, repurchase of common stock, and reduction of debt.

Encore has a strong hedging portfolio in place for 2009 that includes floors at $110.00/bbl for 11,630 barrels of oil per day, swaps at $84.09 for 3,500 bbl/d, and floors at $80.00 for 8,000 bbls/d. The counterparties to these hedges are a diverse group comprising eleven institutions, all of which are rated A- or better by Standard & Poor’s and/or Fitch, with the majority rated AA- or better. The company recently cashed in approximately $25 million of hedging gains on 2,500 bbls/d of swaps.

Click here to download a .pdf of the OGJ200 Quarterly ending Dec. 31, 2008