OGFJ100P company update

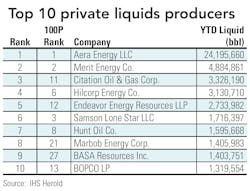

IHS Herold Inc., the independent research firm, has provided OGFJ with updated production data for our periodic ranking of US-based private E&P companies. The rankings provided are based on operated production only within the US. In this issue, the production data provided is year-to-date 2009.

There have been a number of changes to the private company space since the list last ran in the July issue.

Top 10

For the most part, the shuffling of companies in the Top 10 from the July issue to present was minor. Yates Petroleum Corp. traded places with Hilcorp Energy Co. Yates is now ranked No. 4 while Hilcorp has dropped two spots to No. 6. Hunt Oil Co. jumped one place from No. 9 to No. 8, while Citation Oil & Gas Corp. dropped out of the Top 10 from No. 8 to No. 11. Mewbourne Oil Co. moved into the Top 10 by jumping three spots to No. 9 from its previous position at No. 12.

Management changes

In August, Michael Reddin joined Houston-based Davis Petroleum as president and CEO. Just last October, Reddin joined another Houston-based private company, Kerogen Resources, as president and CEO. Reddin brings 27 years of experience to Davis, a company focused on onshore Gulf Coast and offshore Gulf of Mexico opporunities.

Davis Petroleum is backed by Evercore Partners, Sankaty Advisors, and Red Mountain Capital Partners.

Oklahoma City-based Kirkpatrick Oil Co. Inc. added four to its family-owned oil and natural gas exploration and production company.

Eric Cummins was named district exploration manager for the company's Permian Basin division, and Kevin Preston is leading the company's recently opened Denver office as business development manager. Cindy Birdsong, CFO, and Nichole Buckner, geologist, are serving in Kirkpatrick's headquarters office in Oklahoma City.

Before joining Kirkpatrick, Cummins was employed with David H. Arrington Oil & Gas, Yates Petroleum Corp. and Texaco Exploration and Production. He holds a bachelor's degree from New Mexico State University and a master's degree from the University of Southwestern Louisiana.

Preston previously spent 23 years at Aviva Inc. He holds a bachelor's degree from Texas Tech University.

Birdsong was previously employed with Kerr-McGee Corp. She is a graduate of the University of Oklahoma with a bachelor's degree.

Buckner came to Kirkpatrick from SandRidge Energy. She holds a bachelor's degree from the University of North Carolina at Chapel Hill and masters degrees from East Carolina University and the University of Oklahoma.

Finally, Houston-based Wapiti Energy LLC added Ryan P. O'Shaughnessy to its team as senior vice president of corporate development. He joined from Merrill Lynch & Co. where he served as a director in the firm's energy and power investment banking group. He holds a bachelor's degree from Princeton University.

The company, partially backed by Quantum Energy Partners, is the owner and operator of Conroe Field, in Conroe, Tex.

Development

In September, Black Dragon Resource Cos. Inc. executed an agreement with privately-held Kingdom Energy Partners (KEP) for a 25% working interest (18.75% net revenue interest) in an oil development project in the Humble Field in Harris County, Texas.

This project is located in a low risk, proven salt dome reservoir with existing offset production. The lease covers 70 acres with 50 drillable acres. The program with KEP will involve drilling five wells to establish the EOR pattern. The project estimates initial production from 10-20 b/d per well under normal pumping conditions increasing to 25-80 b/d per well with EOR.

Live Oak Operating will handle all drilling and daily operations.

In August, privately-held Houston Energy LP reached contract depth of 9,300 ft on the third well drilled with publicly-held US Energy Corp. (USE) this year.

The prospect is located in Lafourche Parish, LA and is a one well, six zone primary oil target. HE believes the prospect has a resource potential of 2.1 million barrels of oil. USE has paid a sunk land cost and prospect fee of roughly $200,000 and then paid an additional one third (roughly $320,000) of the costs to drill the initial test well to earn an after casing point 25% working interest (17.625% net revenue interest). USE is responsible for 25% of all costs going forward.

Productive zones have been identified with approximately 38 ft. of net pay and preliminary analysis indicates the well is commercially productive.

Resolute IPO

In one of the most widely-publicized transactions in the private space, No. 52-ranked Resolute Natural Resources Co. (down from its No. 34 spot in the July issue) has set its sights on transitioning into the public sector through a $582 million transaction with Hicks Acquisition Co.

When asked about the deal's metrics, officials close to the transaction cited Resolute's reserves as a factor. The Denver-based company's reserves are predominantly long lived oil and a significant portion of the proved reserves are comprised of proved developed non-producing and proved undeveloped reserves. These non producing reserves consist mostly of expansions to Resolute's existing enhanced oil recovery projects in the Aneth Field in southeast Utah.

"When compared to other E&P companies with long lived assets we believe the $11.80/boe metric is an attractive valuation from an investors perspective and, when viewed in the context of the deal as a whole, a fair valuation from Resolute's perspective," the official told OGFJ.

"At the time the transaction was announced the companies viewed as peers for Resolute were trading at a median valuation of $16.37/boe. This discount to the peers is to be expected when you consider that this transaction is effectively an IPO of Resolute," he continued.

It is expected that Resolute will exit the transaction with an equity capitalization of $513 million and with 74% of the shares held by public investors. This size of capitalization and public float should provide liquidity in the shares and make Resolute an attractive candidate for analyst coverage.

It is estimated that $346 million in cash held in trust will be made available for Resolute's debt reduction.

Resolute's principal assets are a tertiary oil project in southeast Utah and a conventional gas field in the Powder River basin of Wyoming. In addition to producing properties, Resolute owns exploratory acreage in the Big Horn basin of Wyoming and the Black Warrior basin of Alabama.

Resolute's assets are 91% oil with estimated proved reserves of 49.3 million boe. In the first quarter, Resolute produced an average 7,626 boe/d, net to Resolute, with about 85% of first-quarter revenue coming from crude oil sales.

Nicholas J. Sutton, Resolute chairman and CEO, will become CEO of the combined entity, to be named Resolute Energy Corp.

Click here to download the pfd of the 2009 Year-to-date production ranked by BOE

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles