ExxonMobil upgrades rig for Point Thomson drilling

ExxonMobil Production Co. has mobilized the drilling rig for the Point Thomson Project. The rig, owned by Nabors Alaska, has been upgraded to drill the high pressure wells at Point Thomson.

As there are no permanent roads to Point Thomson, Fairweather E&P Services Inc. and Nanuq/AFC constructed over 30 miles of ice road to enable the transport of heavy equipment and materials while protecting the North Slope environment.

Craig Haymes, Alaska production manager for ExxonMobil, said, “We are moving forward with drilling and development activities at Point Thomson, for the mutual benefit of Alaskans and the Point Thomson Unit working interest owners. We are on schedule to begin production at Point Thomson by year-end 2014 and look forward to working with the State to resolve the remaining Point Thomson issues to ensure the project schedule is not impacted.”

The initial phase of the project will process roughly 200 million cubic feet per day of Point Thomson gas in order to produce approximately 10,000 barrels per day of liquid condensate into the Trans Alaska Pipeline System by year end 2014. The remaining gas will then be recycled into the Point Thomson reservoir. The Point Thomson Unit working interest owners committed $120 million to the drilling and development activities in 2008, with additional investments of about $250 million expected in 2009.

Other major Point Thomson owners participating in the current drilling and development activity include BP Exploration (Alaska) Inc. and ConocoPhillips Alaska Inc.

Apache to acquire Permian properties from Marathon for $187.4M; drills three discoveries in Egypt’s Western Desert

Apache Corp. has agreed to acquire nine Permian Basin oil and gas fields with current net production of 3,500 barrels of oil equivalent per day from Marathon Oil Corp. for $187.4 million. The acquisition comes at a time when the company is making discoveries in Egypt’s Western Desert and along the Mediterranean coast.

The acquisition from Marathon includes assets located in Lea County, NM, and Reagan, Howard, and Sterling counties in Texas, as well as Marathon’s interests in the Chenot/Putnam area in Pecos County, Tex. The properties have current net production of 10 million cubic feet (MMcf) of natural gas, 1,332 barrels of oil, and 524 barrels of natural gas liquids per day.

John Crum, Apache’s co-COO and president - North America commented, “Properties with approximately 75% of the proved reserves and 61% of the current production offset Apache-operated units in Lea County. Based on our experience with well-spacing in the area, we have identified more than 200 possible drilling locations on the Marathon acreage.”

The company has also made two new Jurassic oil and gas field discoveries in the Faghur Basin play in the extreme southwest part of Egypt’s Western Desert producing complex and the first discovery in the North Tarek Concession along the Mediterranean coast.

“Development of the Faghur Basin play and the North Tarek Concession, along with continued drilling in Matruh and other established fields, will continue to add to Apache’s Khalda-area gross liquid hydrocarbon production, currently about 102,000 barrels per day,” said Rod Eichler, Apache’s co-COO and president - International. “These wells also highlight the resource to be found in the Alam El Buieb (AEB) formations, which contribute about 30% of Khalda-area oil output.”

Phiops-1x is a new oil field discovery located in the South Umbarka concession about 2.5 miles northwest of Apache’s Kalabsha field. The well encountered 173 feet of oil pay in the Cretaceous (AEB-3) and 103 feet in the Jurassic Safa formations. The discovery flow-tested 2,278 barrels of oil and 5MMcf/d from the Safa formation.

The WKAL-A-1x discovery, located in the West Kalabsha Concession, was drilled to test closures at three levels in the AEB and Safa formations. The well logged 202 feet of pay in the Cretaceous AEB-2 and AEB-3 formations and 17 feet of pay in the Jurassic Zahra formation. The Zahra tested at 770 barrels of oil (44 API) and 4 MMcf/d. A 28-foot perforated interval in the AEB-3G formation tested at 2,906 barrels of condensate (52 API) and 16 MMcf/d. Apache plans to apply for a development lease. Apache has a 100% contractor interest in the West Kalabsha concession.

The NTRK-C-1X is Apache’s first new field discovery in the North Tarek Concession along the Mediterranean coast. A total of 48 feet of AEB-6 pay was logged and tested at the rate of 3,489 barrels of oil (44 API) and 5 MMcf of gas per day. Apache has a 100% contractor interest in the North Tarek concession. Apache has a 100% contractor interest in the Matruh Concession. — Mikaila Adams

Chevron produces first oil from Tahiti Field; confirms offshore Congo discovery

Chevron Corp. has started crude oil production from its Tahiti Field, the deepest producing field in the Gulf of Mexico, and confirmed a discovery within the Moho-Bilondo license in the Republic of the Congo.

First oil from Tahiti was achieved on May 5. Daily production is expected to reach roughly 125,000 barrels of crude oil and 70 million cubic feet of natural gas before the end of the year.

The Tahiti Field is estimated to contain total recoverable resources of 400 to 500 million oil-equivalent barrels. The total cost for the first phase of the project is $2.7 billion and represents one of 40 projects in which Chevron’s share of the investment is over $1 billion.

Tahiti is located at Green Canyon Blocks 596, 597, 640 and 641, approximately 190 miles south of New Orleans, and in approximately 4,100 feet of water. Primary pay sands are Lower to Middle Miocene from 23,000 to 28,000 feet and lie below a salt canopy ranging from 8,000 to 15,000 feet thick. The deepest producing well is more than 26,700 feet, a record for the Gulf of Mexico.

Chevron holds a 58% working interest in Tahiti and is the operator, StatoilHydro holds a 25% working interest, and Total owns a 17% working interest.

The company has also confirmed a discovery within the Moho-Bilondo license in the Republic of the Congo.

The Moho Nord Marine-4 well, in which Chevron Overseas (Congo) Ltd. holds a 31.5% interest, is located nearly 46 miles offshore of the Republic of the Congo, in 3,537 feet of water in the northern part of the Moho-Bilondo license.

Moho Nord Marine-4 was drilled to a total depth of 13,907 feet and proved a 535 foot column of high-quality oil flowing at 8,100 bo/d.

The discovery follows two previous successful exploration wells, Moho Nord Marine-1 and 2, drilled in the permit area in 2007, and the positive appraisal well Moho Nord Marine-3 in 2008.

The permit area’s deepwater Moho-Bilondo project, which began production April 2008, consists of subsea well clusters that flow into a floating processing unit. Maximum total daily production of 90,000 barrels of crude oil is expected in 2010.

Chevron’s partners on the permit area are Société Nationale des Pétroles du Congo (15%) and Total E&P Congo (operator and 53.5%).

Goodrich Petroleum tests three Haynesville wells

Goodrich Petroleum Corp. has results on three Haynesville Shale wells. The company has completed its initial horizontal Haynesville Shale well in East Texas, the JK Williams 7H, which tested at a rate of 7.0 MMcf/d on a 34/64 inch choke with 2,800 psi. The well is located in the company’s Beckville/Minden area of Panola County, Tex. Goodrich is operator and owns a 100% working interest in the well.

The company has also completed two additional Haynesville Shale wells in the Bethany-Longstreet field of Caddo and DeSoto Parishes, La. The Chesapeake Energy - Branch 2H-1 tested at a rate of 14.3 MMcf/d on an 18/64 inch choke with 6,750 psi, and the Chesapeake Energy - ROTC 1H-1 tested at a rate of 14.1 MMcf per day on an 18/64 inch choke with 7,150 psi. The company owns a 50% working interest in both wells.

Emerson products monitor flow on StatoilHydro Gullfaks platforms

Using open WirelessHART™ products, Emerson Process Management’s Smart Wireless network is automating flow monitoring to increase production on StatoilHydro’s Gullfaks offshore platforms in the northern part of the Norwegian North Sea. The company required a monitoring approach that could be installed without interrupting flow, and are using wireless devices to transmit real-time temperature data that indirectly monitors flow, allowing quick reaction to any loss of well pressure and maximizing throughput from the well. The installation follows the success of Smart Wireless on StatoilHydro’s Grane platform.

In the past, StatoilHydro detected loss of flow by having an operator touch the pipe to feel the difference between the pipe temperature and the ambient temperature. Temperature readings were taken only at the start and the end of a shift, so a loss of flow could go undetected for long periods.

In contrast, Emerson’s wireless devices now transmit readings every 30 seconds back to the Smart Wireless Gateway. The gateway is hardwired into the existing control system.

IFC approves loan to further privatize Albanian heavy oil field

The International Finance Corp. has agreed to financially support further privatization of Albania’s Patos Marinza oil field with a $50 million loan to Bankers Petroleum Ltd. of Calgary, the World Bank Group member said on May 11.

The Canadian oil and gas producer operates and has full rights to develop the Patos Marinza and Kucova heavy oil fields under a 25-year license agreement with the Albanian National Agency for Natural Resources, and a petroleum agreement with Albania’s national oil company, Albpetrol ShA, according to information posted on Bankers Petroleum’s website.

Patos Marinza is the largest onshore oil field in continental Europe, with about 2 billion bbl of oil in place, it added. IFC, which also approved a $5 million environmental term loan to Bankers Petroleum, said that it also may make an equity investment of up to $9.5 million.

Its announcement came hours after the European Bank for Reconstruction and Development in London said that it plans to make a similar $64.5 million financial commitment.

IFC said that Bankers Petroleum’s Albanian subsidiary has been operating a small portion of the Patos Marinza field since 2004. The expansion of its activity will modernize the field’s operation by transferring specialized technical knowledge to a largely local workforce, it said.

This will contribute revenue to Albania’s government and help promote foreign investment in the country’s petroleum industry, IFC added.

The loans also will support significant environmental improvement in one of Europe’s most badly polluted oil fields following decades of mismanagement, both multi-government financing institutions said. They said that Bankers Petroleum will clean up existing wells it takes over and help reduce pollution and oil field contamination as it expands its activities.

IFC said that the United Nations Development Program classified Patos Marinza as one of Albania’s pollution hot spots. It said that since the cleanup involves additional stakeholders, IFC and EBRD have established a working group to formulate environmental and social strategies. The agencies already have spoken with Albania’s ministries to secure their support, and with the European Union to align ongoing initiatives, it added.

Bankers Petroleum said that it is in the process of creating a development plan for the second field, Kucova, which it expects to use a combination of reactivations, recompletions and secondary recovery techniques such as waterfloods. — Nick Snow

Production from Mariner Energy’s deepwater GoM Geauxpher Field begins

Houston-based independent oil and gas exploration, development, and production company, Mariner Energy Inc., has started production on Geauxpher, a deepwater development in the Gulf of Mexico on Garden Banks Block 462 in which it holds a 60% working interest.

Geauxpher lies in water depths of approximately 2,700 feet more than 150 miles from the Louisiana coast. The development includes two wells with current gross production of approximately 115 MMcfe/d. The wells are connected via a 40-mile subsea tieback to a third-party operated platform on Garden Banks Block 72. Production from the wells to pressurize the flowline to the platform commenced April 15, 2009, and sales commenced May 15. Mariner holds a 60% working interest and operates the Geauxpher field. Apache Corp. holds the remaining 40% working interest.

With the startup of the Geauxpher field, approximately half of Mariner’s current daily production of 390-400 MMcfe/d comes from oil and gas fields located in deepwater. In another joint venture with Apache, Mariner is currently drilling an exploration well on the Arden prospect on Garden Banks Block 949. Mariner operates the well, which is expected to reach its targeted depth over the next two to three months, and holds a 50% working interest.

“We are realizing production from Geauxpher less than a year after its discovery, which is exceptional for a deepwater project of this magnitude and a tribute to the expertise of our deepwater team. Even more impressive, first production could have occurred as early as last fall but for disruptions caused by Hurricane Ike,” said Scott Josey, chairman, CEO, and president of Mariner Energy.

Mustang enters floating LNG joint venture with Petronas, MISC

Mustang, part of international energy services company John Wood Group PLC, has entered a joint venture with Petronas and MISC Berhad to develop integrated floating LNG liquefaction, storage and offloading solutions, using Mustang’s LNG Smart liquefaction technologies. The joint venture is owned 60% by Petronas, 30% by MISC, and 10% by Mustang, and will be headquartered in Kuala Lumpur.

The first project-related activity of the joint venture, which will include a project team comprising personnel from Mustang and the other joint venture partners, will be the development of the front-end engineering design (FEED) for a floating LNG vessel, to be located offshore Malaysia. The project is expected to achieve first gas from a floating LNG FPSO facility in 2013.

Petronas will provide assistance in gas field sourcing and the marketing of LNG; MISC will provide assistance in LNG shipping fabrication, and Mustang will provide engineering design, procurement and project management services related to LNG liquefaction processes and gas pre-treatment for topsides facilities.

ConocoPhillips, Anadarko Petroleumunderscore new Alaskan discoveries

ConocoPhillips and Anadarko Petroleum Corp. have made a discovery and completed test production from two wells in the National Petroleum Reserve-Alaska: Pioneer 1 and Rendezvous 2. Pioneer 1 was tested in March of this year and Rendezvous 2 was tested in winter of 2008. Both are located in the Greater Mooses Tooth Unit, roughly 20 miles southwest of the Colville River Unit development on the North Slope of Alaska.

Test production rates for these wells ranged from about 500 barrels of oil per day to as high as 1,300 barrels of oil per day of high API gravity oil. Gas production rates averaged about 1.5 million cubic feet per day for each well.

No further delineation drilling is planned for Pioneer or Rendezvous at this time. These two accumulations will be pursued as possible satellite developments with processing at the Alpine facilities in the Colville River Unit.

ConocoPhillips is operator of and holds a 78% interest in the Greater Mooses Tooth Unit, while Anadarko holds a 22% interest.

Marathon makes Oberon discovery in Deepwater Angola

Marathon Oil Corp.’ subsidiary, Marathon International Petroleum Angola Block 31 Ltd., has participated in the deepwater Oberon discovery well in the southern area of Block 31 offshore Angola. The Oberon well, Marathon’s 30th discovery on Angola Blocks 31 and 32, is located roughly 250 miles off the Angolan coast.

The well was drilled in about 5,300 feet of water, to a total measured depth of more than 12,300 feet. Oil-bearing reservoirs were encountered in the Oligocene section. The well test results confirmed the capacity of the reservoir to flow in excess of 5,000 barrels per day.

Located in the northeast sector of Block 31, the PSVM development is proceeding with first production targeted in 2012.

The concessionaire of Block 31 is Sonangol, Angola’s state-owned oil company. Marathon holds a 10% interest in Block 31. The operator is BP Exploration (Angola) Ltd. with 26.67%. The other interest owners are Esso E&P Angola (Block 31) Ltd. with 25%, Sonangol P&P with 20%, Statoil Angola AS with 13.33%, and TEPA (Block 31) Ltd., a subsidiary of the Total Group with 5%.

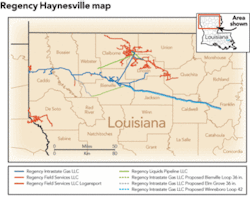

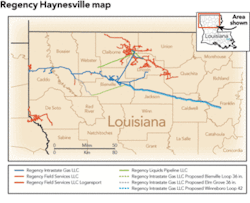

Mainland Resources, partner spud third Haynesville Shale well

Mainland Resources Inc.’s Joint Venture partner and operator has started drilling on the company’s third JV well to evaluate additional potential of the Haynesville Shale gas formation on Mainland’s Louisiana leases.

The Dehan et al 15#1H was spud on May 4, 2009 and is currently drilling at 6850 feet. The well will be drilled to roughly 12,000 feet. Mainland will own a 25.42% working interest in this unit. The JV partner and operator will have a 38.12472% working interest in the well.