NORWAY Part 1: A Pioneering Hydrocarbon Producer

This sponsored supplement was produced by Focus Reports. Project Director: Arthur Thuot. Project Coordinators: Anna Aguilar & Anne-Lyse Raoul. Project Assistant: Karim Meggaro. For exclusive interviews and more info, please log onto energy.focusreports.net or write to [email protected]

@ 40 years old, it would be somewhat premature to say Norway's oil and gas industry is going through a midlife crisis. However, despite a lack of sports cars or young blondes – genetic predispositions notwithstanding – the warning signs are clear for quite literally a sectoral sea change. Following in the footsteps of its UK nautical neighbours, oil and gas production in unquestionably in decline, and with no new large discoveries in over a decade, this trend is predicted to continue. Turning the tide is Norway's cold climate, long warm on innovation, encouraging via generous tax incentives the types of enhanced oil recovery techniques that can stem, and even reverse, falling output. Furthermore, opening up sensitive environmental areas along the pristine coastline extending thousands of miles northward brings new possibilities of exploring the Arctic, moving into the Barents Sea, believed to contain one third of global undiscovered hydrocarbons. As Norwegian companies hope this northern exposure pays off, they will keep building on a reputation for subsea and deepwater expertise evermore in demand as not only their country, but indeed the world, evolves further beyond the era of easy oil. For the time being, Norway remains the only European country in the world's top five oil and gas exporters. But to keep this position, it will need to stride confidently into this next stage of maturity.

2009 marks what many regard as the 40th anniversary of Norway's O&G sector. With initial recoverable reserves at over 3 billion barrels, Ekofisk, Norway's first "elephant" field and most memorable Christmas present was initially predicted to last 15-20 years – now, 40 years out, current predictions peg production past 2050. Just four decades into its history, it's no exaggeration to say that the oil and gas industry has transformed Norway. Not that the country was still paddling around in Viking longboats in the late 1960s, but its speedy ascendance to among Europe's richest countries is a tale to make Horatio Alger blush. Now with the world's second-highest GDP per capita – at least in nominal terms, thanks to the strong Norwegian Krone (NOK) – of around US$95,000, Norway is over twice as rich as the United States, and ranked #1 on the UN's Human Development Index.

This latter statistic indicates the particular way Norway has shared its increased wealth, driven by a unique socioeconomic model fostering prosperity through social democratic values. A belief that the country's resources should be used for the benefit of all is the underlying precept around many current opportunities, and challenges, facing the sector's development.

In the context of this fall's election, Prime Minister Jens Stoltenberg astutely acknowledges the different stakeholders within Norway's oil and gas framework: "During the coming decades we will have to transform our societies dramatically. Our production methods will have to change. Our consumption will have to change. We will have to make the transition to a low-carbon world. And in order to make that transition, we will need to make use of all our abilities to develop and deploy new technologies. Failure is not an option."

Stoltenberg's transitional mindset was presaged by the creation of StatoilHydro in 2007, a historic merger from an early 1970s genesis in the trifecta of Statoil, Norsk Hydro, and Saga, established to manage the then-newfound wealth.Controlling some 80% of Norwegian Continental Shelf (NCS) production, the NOC's importance to Norway perhaps ranks only behind its primary beneficiary, The Government Pension Fund. This global equities basket, traceable to the Petroleum Fund begun in 1990, is forecasted to hit NOK 2.794 trillion ($399 billion) by the end of 2009. Although impressive, this figure comes on the heels of its worst-ever performance in 2008, losing 23% of market value, or NOK 633bn ($92bn) – a sum greater than the GDP of Cleveland.

It's an oft-heard refrain that the money is to secure a prosperous collective livelihood, with a goal of turning finite "petroleum assets" into long-term "financial assets.¨ And although Norway's 4.8 million inhabitants have enjoyed an unusually equitable distribution of their natural resources' bounty, some locations have seen a higher concentration of the spoils.

One of the most obvious beneficiaries of this wealth has been the City of Stavanger, which has arisen from post-WWII stagnation to being voted as European Culture Capital in 2008, embracing a welcoming atmosphere to sublimate its rightful reputation as Norway's oil and gas hub, as home to 50% of the sector's national workforce. Mayor Leif Johan Sevland, the city's charismatic ambassador, is a well-known figure around town and familiar face internationally at events such as OTC in Houston, who emphasizes that "being in Stavanger represents long-term thinking. We have good health, welfare, international schools, and housing, and thus attract people to be part of a very important industry. When people come, they want to come back."

And people are coming, and staying – with around 15% of the city's population born outside Norway, UK expats make up the majority. They come for the jobs, drawn by a 1.3% unemployment rate, and stay for the fun. Mayor Sevland is striving to ensure that culture remains not just an episode, but an epoch, already evidenced by a rich variety on offer, from public art installations, 2009 World Beach Volleyball Championships, and a new NOK 1.3 billion concert hall.

Such success and thoughtful use of wealth has made Norway the economic envy of Scandinavia. As the apocryphal tale goes, once upon a time Norway offered Sweden an exchange of half its hydrocarbon potential for half of Volvo, which was declined – a decision certainly regretted now in every Starbucks and H&M from Nordkapp to Krstiansand. Looking at Volvo's last-year profit, it would take over three centuries to reach the Pension Fund's reserves.

Europe's O&G Safe Haven

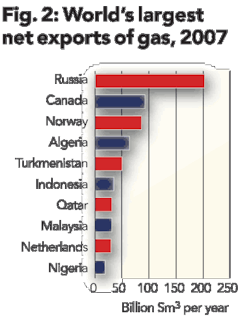

If Norway's wealth has been the envy of Scandinavia, a major source, namely ample gas supplies and the necessary infrastructure to fuel Europe's needs, have caused green eyes further afield. As Europe's second largest source of natural gas, Norway is seen as a safer alternative to Russia, particularly with heightened concerns over energy security following a halt in supplies due to a row over gas transit with the Ukraine in early 2009.

The Norwegian Petroleum Directorate's (NPD) primary role is ensuring sound resource management on the NCS. Falling under the Ministry of Petroleum and Energy, the organization is involved in decisions regarding all acreage in both the ordinary and Awards in Predefined Areas (APA) rounds, as well as access of new companies to Norway.

NPD Director General Bente Nyland paints a clear picture of the situation, explaining "The fact is that oil production will decrease and gas production will increase, and in a few years Norway will turn into a majority gas-producing country."

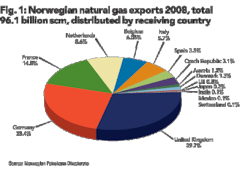

"Norway is the second largest supplier of natural gas to Europe, with 29% of production destined for Germany, although more and more is heading to the UK and France," elaborates Nyland, a former Statoil geologist and 20-year NPD veteran. Nyland points to Norway's stable and predictable framework conditions as allowing companies to calculate and predict incomes over the license lifetime. Such an environment will grow increasingly important, particularly as other governments change rules, tighten conditions, or open fewer and fewer areas.

"Since 2000, Norway has seen more than 50 newcomers on the continental shelf," Nyland states, and says that while success varies, "there have been definite entrant trends, in particular European downstream gas companies like Wintershall, GDF Suez, Bayerngas, and PGNiG, who have seen the need to secure their own gas supplies and found Norway important in this regard."

The fact that these companies can enter the market is due to changes in its structure, explains Brian Bjordal, Gassco's President and CEO. "In 2001 there was a significant restructuring in Norway, where Statoil was partially privatized and listed as a company," he says, and points to the watershed moment dissolving Statoil's dominant position as operator of the gas transportation system. "This system was a natural monopoly, and the question was whether they should retain that position as a listed company."

Consequently, Gassco was created to act as "the independent system operator on behalf of the owners, Gassled. This is an integrated system, which operates based on the strength of a natural monopoly." Bjordal stresses the system's function is "to be neutral and independent, and not to make money as such but to offer excellent services for gas producers and shippers," which it does through four roles administering hardware, system operations, booking system management, and architect.

All this is done by a relatively lean workforce, which manages among others Langeled, the world's largest subsea pipeline at over 750 miles long, connecting Nyhamma in Norway to Easington in the UK. "Gassco has 300 employees. This system takes about 3000-4000 to operate. We outsource most of our work, but we sit in the centre of the whole operation, managing the system. I always say that you should never count heads in an organization; you should count active brain cells," Bjordal quips.

Taking advantage of these active brain cells are a slew of cash-rich foreign utilities, who in recent years have gained renown for snapping up assets unavailable back home.

The Austrian OMV has imported their mountainous native land expertise and familiarity with complex geological formations, operating five out of the company's seven operational licenses. General Manager Bernhard Krainer explains that OMV's Norway presence is driven by two factors. The first, perhaps predictably, is access to interesting exploration opportunities. On this note, Krainer says, "we are more interested in the frontier areas – mid-Norway, and further out in deep water, especially in the Barents Sea. The company now has three licenses in the Barents Sea, which fits strongly into OMV's overall exploration strategy: going into emerging basins and deeper water, and becoming an operator there."

The second factor, Krainer notes, is that "OMV is not just an exploration company, but for a large part also has a lot of downstream." As an integrated organization with its own gas business, the company was "naturally interested in accessing the more mature areas with gas reserves in the North Sea and the mid Norwegian Sea." And despite OMV in Austria receiving around 10% of its gas imports from Norway, "if the company is involved in the whole value chain from production to transport to the end consumer, it's more interesting than just buying gas from Norway," which Krainer points out OMV has been doing on long-term contracts from the Troll area since the early 1990s.

Nice day for Norway M&A

Another player moving up the value chain is German gas importer VNG, which entered Norway in 2005, because, as Managing Director Kare A. Tjonneland explains, "the company decided to be part of the upstream business, and wanted to do so in Norway because they knew Norway very well and appreciated the stable political system." Tjonneland, who has been VNG Norge's head since qualification in August 2006, recently presided over the $150 million acquisition of the company formerly known as Endeavour. Speaking of the deal, Tjonneland sizes up the rationale: "VNG had already partnered with the company in two licenses, and knew them fairly well. VNG examined their portfolio, with potential reserves more than 90% gas. It was a perfect match."

Serendipity aside, navigating choppy North Sea waters for the first time is not always smooth sailing. "This is the first time VNG has gone upstream. VNG is a downstream company, with activities in pipeline distribution, storage, and selling gas bought mainly from Russia and Norway," says Tjonneland, adding that entering in a booming 2006 also put significant pressure on G&G recruitment. Suggesting the company's strong capital, history, and long-term orientation as success factors in starting in a small team from scratch, progress from zero to 29 licenses in three years seems to support the approach, perhaps to be duplicated as Norway is the first VNG affiliate to go upstream, with future possibilities in Russia, North Africa, Central Asia, and the UK.

Of course, for every acquirer, there must be an acquiree. Harald Vabø assumed the latter position after the company he founded, Revus Energy, was acquired by German Wintershall, where he is now Managing Director. Explaining the history behind the original company's founding, Vabø remarks that "about 10 years ago, the Norwegian authorities realized they needed more players on the shelf, and opened it up to new competition. What they had in mind was to attract large independents: companies with large financial muscles alongside operational and technical capacity. It was never the intention that there would be new Norwegian companies."

Such companies were commonplace in the UK, US, and Canada, but at "a new and wild idea in Norway at the time," says Vabø, when only the supermajors plus Statoil, Hydro and Saga were allowed to operate on the NCS.

Contrary to many of their counterparts, Wintershall had a less flatulent urge to enter the country. Vabø explains, "Wintershall's drive for this acquisition was that they wanted a new core area, with political stability and oil rather than gas," to complement significant gas production in the Netherlands and Russia. To this end, Vabø hopes that "by 2015, we will have Jordbær and Luno onstream. On top of this, we hope to be taking part in 6 to 8 exploration wells per year."

Such activity, while nothing new in oil, is a change in gas. Arne Westeng, Bayerngas Norge's Managing Director, notes that "In the early days, everything was nice and easy in the business, with a gas monopoly in Norway," referring to Saga Petroleum, which sold to Ruhrgas, which in turn sold to Bayerngas. "Both companies got their margins, there were no problems, and everyone was making money. This is not how it works today, which is partially the reason why shareholders of Bayerngas want to go upstream."

Aware of the notoriety for Germanic reliance on systems and processes, Westeng is quick to pre-empt any organizational presuppositions: "When we started here, our mother company Bayerngas GmbH established a set of rules between ourselves and the shareholders, and the rule is that if we are making a proposal of small or medium size, the board has five days to give their acceptance. Big acquisitions have a maximum of 10 days. The board has always stuck to the rules, and if any deviation from the rules occurs, it's in giving much less time than promised!"

Naturally, this attitude comes in handy on the M&A front. "This fast decision-making has been absolutely instrumental in making acquisitions, particularly in the case of PA Resources," says Westeng, referring to the Swedish firm's Norwegian assets acquired in late 2008. "Bayerngas Norge entered very late in the process, performed due diligence assessment, and could tell the owners of PA Resources that we would make all the necessary decisions in time. In fact, the first time the board was informed of the purchase opportunity was on the 24th of November on the regular board meeting, and the $220 million deal was signed on December 1st."

M&A activity hasn't been limited to E&Ps. NCA and IOS, KCA Deutag and Prosafe Drilling Services, MSS and RK Offshore; these are just some of the many names in the service sector's growing deal activity. Add to this list Acona Wellpro, whose two namesakes are themselves the product of numerous consolidations, with the combined entity doubling the company's size to 320 people, with some 215 falling within well engineering and drilling management, making the company's department the second largest in Norway after StatoilHydro according to CEO Torkell Gjerstad.

"Acona doesn't have a vision of becoming super large, but we understand the need to have a breadth of competencies, because we help oil companies become an oil company. In a sense, Acona is an integrated oil company on a microscopic scale," says Gjerstad, with macroscopic StatoilHydro the company's biggest client, alongside independents like Aker Exploration, Nexen and Centrica. This integrated approach has not hindered new projects such as the Barents Sea Report and Arctic Web, the latter already seeing interest from US and Canadian governmental bodies in extending the system to their territories.

"If you want to provide these kinds of services which are often integrated, particularly with environmental and safety related regulatory matters, you have to have a certain size," notes Gjerstad, adding that it also allows the means to respond to a wider sized client base. "This ability to man up and down means that our capacity, and thus flexibility, is key."

A great case of gas

Some of the world's biggest corporations themselves have been flexible in size. GDF SUEZ E&P Norge Managing Director Terje Overvik notes that when he started in 2007, daily production was around 5,000 barrels, compared to today's 40,000, and "from 2011, we will produce 70,000 barrels a day – 60% gas and 40% oil – and that will make us one of the top ten producers on the NCS after 10 years. This shows me that the company really has potential, that there is a will to succeed, and that GDF SUEZ has a very long-term view on the NCS."

Overvik elaborates on the strategy of the world's second-largest utility. "Gaz de France and Suez merged last summer, and the desire to commit to E&P was confirmed at that time: we came up with a long-term growth strategy regarding E&P, to make it part of the new company's outlook," of which Overvik says E&P is a large part, at least in terms of contributions.

Leading the way is the Gjøa operation, which Overvik notes "will be the most advanced on the NCS, and we believe that all fields developed on the NCS should be at the forefront." Through integrated operations, "thanks to new technology, the company can have people collaborating from many different locations: in the office, at the installations, and at the operational base in Florø, north of Bergen."

Moving south and crossing the Maginot Line, the world's largest investor-controlled utility, German E.ON Ruhrgas, continues its longstanding NCS interest, dating back to predecessor Ruhrgas, which was according to Managing Director Haakon Haaland "instrumental in developing the foundations of the Norwegian gas industry via Ekofisk."

Despite such tenure, there are still only two facets of the company's strategy in Norway, says Haaland: "The first is the basic staying power, and the ability to participate in long-life, large projects requiring a lot of upfront capital. The other is the willingness to step out and participate in finding solutions to problems at hand, whether maximizing existing assets' value or extending life, with the best way to either increase recovery ratios or tie-in satellite fields."

Exemplifying this staying power is Skarv, Norway's biggest current field development, of which E.ON is a 28% owner. "It's a big undertaking. The PDO investments were 32 billion NOK gross, making some 10 billion NOK for E.ON's share. 2009 is the biggest year of expenditures, and the field will come on-stream Q3 2011, so we basically have another couple of years in huge investment outlays before payback."

E.ON's strategy has been around expanding from the company's Njord assets. "The company started drawing concentric circles around the infrastructure, and went further out with more data and a better understanding," with now a pretty much complete picture of the Norwegian Sea from the inside out, says Haaland. As a result, he notes this strategy has meant "E.ON is not in the Barents Sea, and there are a couple of reasons for that. One is that we believe it's right to be focused, and that requires resource concentration, investing in data and techniques necessary for understanding, which implies resources for people as well as hardware like industry-standard interpretation tools and workstations."

Aching for acres

Although E.ON may not yet be in the Barents Sea, attention is being increasingly focused on this oil province containing a sizeable amount of the world's future hydrocarbon potential. The Yamal peninsula, in Siberia, Russia, meaning "End of the World" in the native Nenets language, alone accounts for over 22% of known global gas reserves.

As Minister of Petroleum and Energy Terje Riis-Johansen puts it, "Government strategy aims to secure a sustainable development in the High North. To achieve this, increased activity and sustainable resource management are prerequisites. These perspectives create great possibilities for Norway – especially in the form of positive economic and social effects in the Arctic – but also real challenges."

Such challenges list among the top priorities at OLF, the Norwegian Oil Industry Association. Director General Per Terje Vold, explains: "Norway has opened up its continental shelf in a very successive way, starting in the North Sea, continuing to the Norwegian Sea in middle Norway, and now approaching the Barents Sea, as well as the prospective areas of Lofoten and Vesterålen, which we will hear more and more about in coming years." Vold gets to the heart of the matter: "It's a coincidence, but it happens to be the most prospective areas for fisheries and oil and gas as it is seen today. With this co-existence in the sea, it is very important to run seismic without disturbing fishermen more than necessary."

Vold hits the nail on the head in identifying the more sensitive issue. Traditional fisheries contrast to the cutting edge driver of Norway's wealth, but there is a strong political linkage – perhaps fitting, then, that Minister Riis-Johansen assumed his post as top oilman after his former role as Minister of Agriculture.

Vold points not only to necessary cooperation between fisheries and hydrocarbons, but between E&Ps and service companies in field development, and the subsequent required investments, which in total amounted to over 120 billion Norwegian Kroner (NOK) in 2008, and is estimated at approximately 127 billion NOK in 2009, a downward revision of 6-7% from previous figures. "To give a comparison statistic to demonstrate the importance of this amount in relative terms, the entire Norwegian defense budget is approximately 30 billion NOK," he says. Perhaps unsurprisingly, then, "the financial crisis has not significantly affected activity, with three of four companies with more than 25 per cent oil-related sales report that the recent developments in the share and financial markets have not led to reduced activity. The companies with the highest percentage of oil-related turnover are the least affected."

As gas eclipses oil production in Norway by 2011, such companies will become scarcer. In large part due to projects like Snøhvit LNG field, of which Hess Norge has a 3% interest, alongside the company's 28% share in Valhall. Managing Director Alf Frugaard, who returned to the Norwegian branch of Hess in October 2008 via Malaysia, US, Denmark, and France, explains the LNG project's significance: "Gas that will be found in the North has to find an LNG solution, because it's so far away from the markets that piping is not feasible. Hence if more gas is to be found up in the north, Snøhvit with all its challenges and learnings has been important for Norway. For Hess the experiences we have gained from Snøhvit will be important in our ambition to become an LNG operator globally."

Turning to local ambitions, Frugaard states, "In ten years, my dream would be to see Hess become a Norwegian operator, find a big field through the drill bit, and start to develop that discovery. When you become an operator, your whole company changes – it's a game-shift." As to where such opportunities lie, he is unambiguous: "It's certainly up in the north. In the North Sea, towards the south of Norway, there is still oil and gas to be found, but it is mainly deposits which can be tied into existing infrastructure. However, there are still some elephants in the Barents Sea and Norwegian Sea. There's a large area that has not been explored, and that is very exciting. Hopefully, that area will be opened up next year."

Hess' northerly neighbours Nexen have indeed kept to their native Canada's true north strong and free credo. Nancy Foster, President & GM notes that "The bulk of Nexen's licenses are in the Northern North Sea; the company has developed a core area, and will be looking to develop and build from there." Already active in the North Sea, with the UK's Buzzard field the company's single largest cashflow contributor, Foster explains the company's shift to Nordic waters: "Nexen is very much interested in the frontier areas, although the same can be said for what's already open, and that's part of the reason the company came to Norway, for the longer-term opportunity already evident in the APA rounds."

"Although this latter category is considered mature, it is less mature than the UK North Sea. Even though the finds have been smaller, the success rate has been higher in the last few years, and there's existing infrastructure to take advantage of. Nexen has found this a good way to enter into the NCS: get a foothold, build a foundation, all the while still targeting the frontier areas. According to the data from the NPD or Konkraft, they should prove to be very lucrative, Nexen sees itself being a player there, and feels confident in being able to succeed."

Some entrants have done so much closer, such as Oslo-based Concedo, where Managing Director Geir Lunde's exploration philosophy is already reaping rewards, from recently second discovery on PL348 called Gygrid, with current volume estimates is in the range 3-5 MSm3 (20-30 mill. bbl) recoverable oil. This philosophy entails "to be partner, not operator, which allows us to have a large amount of flexibility, and to keep the organization focused on exploration and not on operations. Companies that expand become slower moving, and keeping everyone up to speed and involved takes a lot more time." Speaking to the ballooning figure of 70 E&Ps now qualified as operators on the NCS: "A lot of those that have already qualified as operators should just forget it!"

Lunde observes that "It's not optimum for an operator to work one well one year and another the next, and Concedo prefers operators planning to operate many wells. StatoilHydro was chosen as the most efficient driller last year, and when they have so many rigs and qualified people, it's hardly surprising. The rest of the operators have to compete with that."

However, while the NOC may provide stiff competition, from time to time others step up and take the lead. Take for example the Luno field, one of Lundin Norway's 19 operatorships.

Lundin Norway's Managing Director Torsten Sanness explains how the "odd couple" matches up, with "a huge monster of a company next to 60 people in Lysaker", and how the latter group drives the show: "Where Lundin has concentrated is in having 3D seismic, and the latest and greatest in technology, with a toolbox as advanced as StatoilHydro's. In fact, since StatoilHydro joined Lundin on Luno, it has been a kind of quality check affirming that yes, Lundin has that toolbox and knows as well as anybody else how to use that toolbox technically, in addition to understanding the economics reasonably well too."

As happens so often in the business world, most of Lundin's people have a past in big companies, constituting a collective competence which proves as or even more efficient than that of the industry's goliaths. "We're so close that operating, communicating, and making decisions works totally differently. Of course, a larger company is able to do some things because they're so big, that we couldn't hope to duplicate. However, the coupling is complementary, in that we need what they do, and they need what we do. In the case of Luno, both parties understood the synergy in this little area between us, and that's why we made a deal."

The allure of such potential means that future coupling opportunities are sure to abound. Sanness remarks, "The operator projects we have look interesting to everybody, and are of the size usually reserved for a major company's project, like Luno. Over the next 18 months, Lundin will drill three wells to show whether it's 100, 200, 300, or 400 million barrels, and of course that's why the big company couldn't just let us loose and had to get in on it!"

In search of new acreage, Norway is being approached from all sides. Yet another from the east in the form of Svenska, another Swedish company owned by Ethiopian tycoon Sheikh Mohammed Al-Amoudi, from the West with UK's Premier Oil, and from the south. Maersk Oil, from its beginnings in Denmark operating the DUC with Shell and Chevron in the early 1960s, accounts for 95% and 85% of Danish gas and oil production, respectively. With this taking place mostly in tight chalk reservoirs, the company had to develop expertise it has now exported elsewhere in the North Sea. After acquiring Kerr-McGee's UK assets in 2006, Managing Director of Maersk Oil Norway Åke Hesselbom notes that "Maersk Oil therefore developed a very strong position in the Danish and UK sectors of the North Sea and a move to Norway was natural."

Hesselbom is looking forward to developing chalk expertise with StatoilHydro, hoping to duplicate the success of Qatar's Al Shaheen discovery, once thought unviable, but now producing more than 300,000 bpd and proving the possibility of low-permeability discoveries.

"It is also important to say that our UK and Danish experience leads us to believe there could be a lot of additional potential in the mature areas of the North Sea," says Hesselbom, pointing to fewer environmental concerns combined with existing facilities to leverage exploring nearby acreage opportunities. Hesselbom sums up the strategy: "From a technical point of view, it's to get access to exploration and producing acreage. From a financial point of view, it's weathering the storm."

Technology – Norway pays to play

Norway has weathered the storm quite well, and while special taxes amounting to 78% for oil and gas production mean the government receives a high proportion of the upside, a similar 78% tax rebate on exploration and innovation expenses provides a significant hedge on the downside risk.

However, even with a welcoming attitude, technology is not always an easy sell. For example take the case of when Morten Alstadsaether and Kjetil Jacobsen, General Manager and Sales & Marketing Manager of Module Solutions & Systems, decided in 2002 to introduce composite grating to the Norwegian market with top-of-the-line US provider Strongwell. "Because of the challenges with weight on existing platforms – especially on new floating platforms – this product could replace a lot of steel, offering an easy-to-handle, low weight alternative with much lower life cycle cost . Despite these advantages, however, MSS tried with difficulty for three years to enter the market against steel and aluminium, but eventually persevered, and now have supplied upwards of 45,000 sqm on the NCS."

Such solutions represent just one of the four main categories of modules, grating, rental, and passive fire and blast protection offered. Noting that the high-quality ethos permeates their offerings, they summarize the sales process: "The challenge is when going to the buyer: they have a budget, and tend to focus on present cost rather than lifecycle cost. However, this mindset is changing for the better, and there has been a shift from the era of 10-15 years ago. Clients know that with higher quality, maintenance costs are reduced."

A change in this mindset also stands to benefit Remora's HiLoad technology, borne out of the answer to simple criteria put forth by Managing Director Tore Lea: "Is it possible to develop a system which is independent of water depth, field, and can be utilized on any tanker without any vessel modification, while still being able to meet high operational requirements?"

Remora, the continuation of Hitec Marine with more than 20 years history as a major supplier within different generations of loading systems, offers a simple cost-benefit. "taking two tugboats and a typical moored buoy along with the average budgets used by operators in West Africa today, the typical cost of one HiLoad system is about one third of the cost of the alternative."

The technology, which will be ready for sea trials together with the world's largest operators in Autumn 2009, can be used on any water depth – the deeper the better, "because the cost benefits of a system without moorings increases proportional to depth, and also where there are environmental challenges. Therefore, Remora has identified the deepwater regions of the Atlantic as a key focus right now. This incorporates the Gulf of Mexico, Brazil, and West Africa."

Another high-technology company targeting international markets is FORCE Technology. Managing Director Henning Arnøy notes that the particularity is, "It's easier to export products than services – you need to be closer to the clients when you have a service activity. Why should a company in Houston buy a service in Norway when they could buy it down the road in Houston? For that to happen, you'd need to have something quite unique."

Fortunately, he seems to be on the right path. While in recent years oil and gas has moved from 12 to 30% of the Danish parent's turnover, the segment accounts for 80% of FORCE Technology's business in Norway, and in doing so the company has evolved to be #1 in the niche of Non-Destructive Testing (NDT) using ultrasonic or eddy current.

"It is true that FORCE Technology uses Norway as a hub and base for exports in some of the services we provide, but when it comes to the buzzwords of integrity management, inspection planning, and subsea inspection, Norway is the hub within the centre of excellence in FORCE Technology. We are the vehicle for expansion in the world, sitting on the back of some of the major players like Subsea 7, Acergy, and Technip, and all of a sudden the world market opens up," says Arnøy. This opening is evidenced by instrumentation deliveries to the Gulf of Mexico, which alongside two other focus areas of West Africa and Brazil, will be driving growth towards achieving "X3": a triple turnover forecasted two and a half years ago for the period of up to five years, which has already doubled the figure since the target was set with 80% of income coming from abroad.

Indeed FORCE Technology is yet another example of efforts to ensure the NCS evolves into an alternate acronym, for Norwegian Continued Success.

Look for Norway Part 2 in the November 2009 issue of Oil & Gas Financial Journal