Second-quarter earnings aftermath: The path forward

Gianna Bern, Brookshire Advisory and Research Inc., Flossmoor, Ill.

Accounting charges proliferate

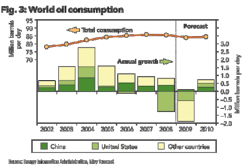

In a post financial crisis world, the second-quarter earnings season further documented the adverse impact of three consecutive quarters of weak global crude demand. While revenues and net earnings were expected to plunge on the heels of a 52% decrease in crude prices versus year-ago levels, we now observe that decreasing cost structures have become paramount in the oil and gas industry. The extremes in year-over-year prices have forced the industry to adopt aggressive cost-cutting measures. Moreover, cost structure adjustments in this new normal environment yields a new set of challenges for producers.

The second quarter of 2009 was expected to be a dismal one considering oil producers were rolling over year-ago crude prices in excess of $100 per barrel (See Fig. 1). Given those expectations in a quarter where few had a chance of posting even marginal net earnings, many producers took charges for impairments such as dry wells, poor-performing investments, asset sales, restructuring charges, and various other accounting treatments. If there was ever a quarter to take accounting hits, this was the mother of all clean-up quarters. Savvy producers utilized the opportunity to clean house and move forward.

Industry mantra: financial flexibility

All producers have implemented varying degrees of cost-cutting initiatives. What has become apparent is the inability to cut costs commensurate with a 50% decrease in revenues. Virtually all producers have managed to cut costs in non-crude-producing areas of the business. Where possible, marginal projects were shelved. Even though second quarter crude prices averaged $59 per barrel and have increased more than 50% since January 2009, all of the cost cutting implemented thus far could not make up for a 50% decline in year-over-year revenues. Going forward, cost containment will remain critical until crude prices begin to ascend upward, which Brookshire believes will be triggered by glimmers of a global economic recovery.

While Eni SA announced a dividend cut, most oil and gas producers are maintaining dividends and ostensibly preserving share price and shareholder loyalty. With the exception of Exxon Mobil, virtually all producers have eliminated share buyback programs and instead are utilizing cash to maintain financial flexibility or acquire crude-producing assets.

In the current environment, cash reserves are a strategic advantage. A Brookshire study of a broad sample of global majors and independents at the end of the second quarter reveals that most large-cap oil producers have maintained robust levels of liquidity. Chevron and Exxon Mobil remain at the forefront of the large cap segment with $9.3 billion and $25 billion in cash reserves, respectively. This level of prudence is helping the large cap producers navigate the current downturn in crude demand.

Aggressive cost-cutting begs the larger question of industry preparedness when crude prices do begin to increase with global economic recovery. Wisely investing through the down cycle is key to future strength and growth. Clearly, most producers would not cut core exploration and production (E&P) areas. Producers with the financial flexibility to maintain their investment programs despite weak crude prices will have a strategic advantage when crude demand returns.

EBITDA – Weak crude price casualty

While there are several proxies for cash flow, EBITDA is still held by the financial community as one of the standard proxies for cash flow. At a minimum, it provides a benchmark from which to measure the impact of the crude price downturn on a producer's ability to rein in expenses commensurate with the significant hits to revenues and operating income. Changes in EBITDA quantifies the widespread challenges associated with cutting costs to mitigate a 50% decrease in revenues versus prior year.

Our study reviewed 20 global large-cap producers in Canada, Europe, and the US. The study compared the last twelve months (LTM) earnings before interest, taxes, depreciation, and amortization (EBITDA) as of second-quarter 2009 with December 31, 2008 EBITDA levels (See Table 1).

The most notable finding was the considerable decrease in EBITDA across virtually all producers. With the exception of Chesapeake Energy, 19 of the 20 producers incurred a considerable decrease in second quarter 2009 EBITDA. The decreases in EBITDA ranged from 1.1% to 51.8%. Apache; Marathon Oil, and the UK's BG Group Plc posted the most modest decreases in EBITDA of 1.1%, 7.3%, and 5.5%, respectively.

Leverage creep gains a foothold

The study also reviewed leverage, defined as total debt to EBITDA (TD/EBITDA), comparing second-quarter 2009 with December 1, 2008 levels. The comparisons of 20 global producers show a pervasive impact with leverage levels creeping up virtually across the board. With the exception of EnCana and Imperial Oil Ltd., which were able to maintain leverage ratios at December 2008 levels, all other producers increased leverage. While the study group of 20 companies overall still has fairly modest leverage ratios, the evidence is compelling, there is considerable pressure on EBITDA, and leverage levels are on the way up.

The path forward

While the oil and gas industry is rationalizing investments, it is not retrenching. Industry participants acknowledge the importance of continuing capital investment throughout the down cycle in crude prices. The long-term importance of capital investment cannot be underestimated. With the industry rationalizing assets in the refining sector and some producers curtailing natural gas development, one can easily imagine supply inadequacies three to five years from now when there is some semblance of economic normalcy. When global economic growth returns in the latter half of 2010, we can easily see upward pressure on crude prices, pushing them considerably beyond today's $70 per barrel holding pattern.

Conclusion

The study group was by no means exhaustive, but it is a broad sample of major North American and European industry producers operating in key geographies. It is evident that, along with diminished second-quarter earnings, EBITDA has taken significant hits and leverage creep has established a foothold. Nevertheless, we continue to see opportunity in the oil and gas industry. Liquidity, as a whole, remains resilient throughout the large-cap segment of the oil and gas sector. Most large-cap companies reviewed in the study have fairly clean balance sheets and solid credit profiles despite poor second-quarter comparative results. And boding well for future opportunities, many large-cap producers used the bull run in the crude markets, over the last several years, to build cash reserves and consequently, financial flexibility and muscle. OGFJ

About the author