Volatile outlook for M&A activity for offshore contract drilling firms

Todd R. Cimino,Hitachi Consulting, Houston

This article examines the financial mechanics that shape the merger and acquisition climate for offshore drilling companies. In the first part of this article, the financial structures comprising the landscape are described across two substantially different economic climates – spring 2008 and spring 2009. The second part of the article considers the impact of the financial turmoil on the M&A climate and offers leading practice guidance for M&A activities.

The newly-built Discoverer Clear Leader, an ultra-deepwater drillship, has begun work for Chevron in the deepwater US Gulf of Mexico under a five-year contract with Transocean. The vessel is capable of drilling wells in 12,000 feet of water to a total depth of 40,000 feet.

Photo courtesy of Chevron

Spring 2008 – a look back

Twelve months ago, the perceptions of executives within the drilling industry were quite positive. Everyone recognized that commodity (oil and gas) prices would continue to be in strong demand as a result of the continuing economic expansion. This global economic expansion was fueled by infrastructure growth and energy demand in developing countries, most notably India and China.

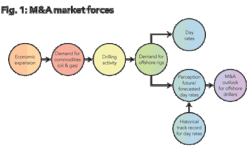

Figure 1 outlines the high-level economic causal relationships between market forces and the outlook for M&A activity among offshore drilling companies. Within this diagram, each arrow represents a proportional relationship between the two connected business variables (represented by the circles). For example, as economic expansion increases, demand for commodities also increases.

As depicted in the somewhat simplified diagram, demand for commodities triggers drilling activity, which drives demand for offshore drilling rigs and services. In addition to driving day rates, this demand forms the baseline perception of future/forecasted day rates. This perception of forecasted day rates, along with a solid understanding of the historical track record for day rates, forms the basis of the M&A outlook for offshore drillers.

In the spring of 2008, commodity prices had been gaining strength for several years and drilling activity was robust. As a result of these and several other economic conditions, day rates were expected to rise (or remain flat at a minimum), depending on specific offshore markets. In fact, the industry on the whole was poised to accommodate additional drilling assets as new orders were being placed for a variety of offshore assets including jack-ups, drillships, etc.

Until the spring/summer of 2008, the most significant constraint on growth of the offshore drilling industry was not GDP growth, or credit, or other fundamentals. Instead, the limiter to growth was the availability of shipyards and engineering and construction capacity in terms of increasing the aggregate offshore rig fleet size. The rig construction backlog was strong.

As a result of the construction backlog, potential asset valuations swelled quickly. In many cases, asset prices were often 1.5 times the implied cost to build, and multiples for deepwater assets were even higher.

In an environment of well-heeled balance sheets and high asset valuations, M&A activity for offshore contract drillers was scant and primarily limited to individual assets (single rig) or small groups of assets, as opposed to full scale company acquisitions.

What's happened since spring 2008

Subsequent to oil prices peaking in July 2008 (high $140s/bbl), the world economy demonstrated overt signs of failure. However, trouble was brewing long before oil peaked last summer.

Since late 2007, the capital markets have showed significant signs of stress. In the second half of 2008, both the debt and equity markets degraded severely, restricting businesses' abilities to raise external funds.

The freezing of the capital markets had an obvious and painfully familiar effect on the world economy. As a result of the credit crisis, the downturn in the global economy signaled significantly reduced forecasts for energy demand and prices.

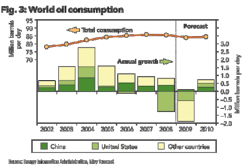

As illustrated in Figure 3, total world oil consumption has moderated, partially as a result of long-term demand destruction for oil.

This well-accepted trend is acutely reflected by the graph of oil prices in Figure 4.

Since November 2008, OPEC announced production cuts of 4.2 million bbl/day and has implemented 80% of these as of March 2009. Recent strength in oil prices has been attributed to these cuts as well as stabilized demand.

As the world economy headed into a tailspin, the collapse of the financial markets exerted a double whammy on forecasted drilling activity.

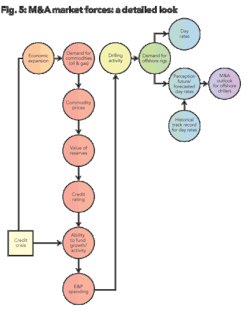

Figure 5 (an expanded version of Figure 1) demonstrates the effects of the credit crisis on drilling activity by examining the causal linkage between commodity prices and drilling activity.

In Figure 5, the credit crisis is represented by the red objects on the left side of the diagram. The first punch of the credit crisis double fisted whammy arrested GDP growth across the globe, destroying demand for crude oil, gas, and finished grade products, as economies began to substantially contract. Notice how these two variables have an inverse or opposite relationship (as depicted by the red "O" in the diagram).

As the credit crisis increased in severity, economic expansion decreased. As economic expansion deteriorated, commodity demand also eroded, which in turn negatively impacted commodity prices.

As commodity prices (specifically oil and gas prices) retreated, there was a corresponding decline in the value of reserves for E&P companies. And since reserves are the primary valuation index for E&P companies, a decrease in the value of reserves can have a significant impact on an E&P company's credit rating.

As the credit worthiness of an E&P company comes under pressure, the ability to fund growth/activity is negatively impacted, which in turn constrains E&P spending on drilling programs.

The second punch of the credit crisis comes as the direct impact on the availability of credit in traditional capital markets. As the credit crisis intensifies or continues, E&P company's ability to fund growth/activity is substantially curtailed for those companies seeking capital to fund new programs. (As with the "first punch" variables, this relationship is also denoted with a red "O" since the variables move in opposite directions.)

Impact of events on M&A outlook

The M&A outlook for drillers is substantially different today compared to a year ago. In 2008, drillers cherry-picked the market looking for strategic asset additions in an environment where prime assets carried a premium. In addition, relatively very few company acquisitions were in serious play.

Today, in the wake of the financial crisis, the M&A outlook is on the opposite end of the mood spectrum. As stacking infiltrates many classes of rigs (perhaps most prevalent with shallow-water assets), the cherry-picking days are over. The game has turned into a survival struggle whereby health and viability are measured in terms of cash on hand. Those companies with cash, decent balance sheets, and access to credit are well-positioned to acquire less financially-stable competitors.

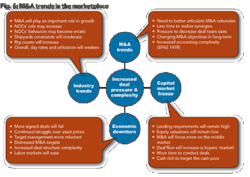

In this new environment, there is increased deal pressure and complexity as drillers covetous of acquisitions must now articulate stronger M&A rationales than ever before.

Figure 6 outlines a comprehensive framework illustrating the consequences of general M&A trends in the marketplace (including new accounting rules as spelled out in SFAS 141R for reporting business combinations), observed industry trends, and the impact of the economic environment and corresponding capital market freeze.

M&A practices for offshore contract drillers

Hitachi Consulting recently concluded a study that looked at M&A practices among offshore contract drillers. For this study, there were two areas of focus with respect to M&A business practices. The first area involved practices associated with the M&A decision process, while the second area reviewed resident skills and capabilities within companies to perform M&A activities.

M&A decision progress

Table 1 presents the observations as well as leading practices and associated benefits for offshore contract drillers with respect to M&A decision making. In general, the M&A decision-making process for offshore drillers can be described as rather informal.

Most M&A activity is executed by a relatively small group of executives, and the work is opportunistic in nature and mostly focused on specific rig assets as opposed to corporate entities (companies tend to look at acquiring individual assets rather than whole companies). In the high-price environment of 2008, this was certainly a sign of the times.

As depicted in the middle column of Table 1, leading M&A decision making practices favor a more formalized and standardized approach that is more collaborative in nature offering the benefits outlined in the right hand column.

Skills and capabilities

Table 2 presents the observations, leading practices, and associated benefits associated with M&A skills and capabilities. In general, drilling companies retain the required skills to conduct due diligence and decision-making M&A activities among a small, concentrated number of executives within the company.

Also, in light of the rather informal nature of the decision process, drillers do not typically use outside professionals to augment or accelerate internal capabilities (except for arranging/obtaining deal financing). However, companies are beginning to consider expanding the use of outside professionals since executive and staff resources have been trimmed in the wake of the continuing financial crisis. OGFJ

About the author