Tide starting to turn: total revenue, income up substantially over 1Q09

Don Stowers, Editor, OGFJ

Laura Bell,Statistics Editor Oil & Gas Journal

The second quarter of 2009 saw net income for the publicly traded companies tracked here rise by 191% over the previous quarter from a collective net loss of more than $10.7 billion to a collective net income of over $9.7 billion. This turnaround in net income accompanies a gain of nearly $23.7 billion in total revenue from this same group of companies – an 11.7% increase.

However, before we get too enthusiastic, revenue and net income from this group are both down considerably from the comparable quarter in 2008. Income dropped by 69% from 2Q08 to 2Q09 (from $31.8 billion to $9.7 billion) and total revenue fell 46% from the comparable quarter in '08 (from $373.6 billion to $202.1 billion).

Before continuing, let us note that the OGJ200 Quarterly has been renamed the OGJ150 due to a gradual and steady decline in the number of publicly traded companies whose financial results are recorded here. Once called the OGJ400 and more recently the OGJ200, this report now includes the results for 142 companies, only 132 of which reported results by the deadline for this issue of Oil & Gas Financial Journal.

Year-to-date capital spending for the companies included in this report is down from a little more than $69 billion in 2Q08 to slightly over $62 billion in 2Q09 – a decline of roughly 10.7%.

Total assets for the group grew by $144.2 billion from the 1Q09 to 2Q09 – a 13.6% increase. However, the new figure for total assets represents a drop of $125.5 billion (or 10.7%) from total assets in 2Q08.

IHS CERA (formerly Cambridge Energy Research Associates) reported last month that it expects oil demand to rebound in 2010 and return to its 2007 high of 86.5 million barrels per day by 2012 – a five-year turnaround. Oil demand dropped by 2.8 mbd from its high point of 86.5 mbd in 2007 to 83.8 mbd in 2009. The last time the world experienced such a severe decline in oil consumption was in the early 1980s, and it took nine years for demand to return to the 1979 pre-recession high. A five-year turnaround would be swift in comparison.

Natural gas and crude oil prices have both rebounded significantly from lows in the 4Q08 and 1Q09, and higher prices have begun to drive E&P activity. Chesapeake Energy, for example, a leading North American gas producer, recently said its gas production is at an all-time high.

For the past few quarters, OGFJ has reported on the stark differences between the Top 20 producers' financials and those of the remaining 112 producers researched for this report. The differences are marked and clearly show the dominance of the larger US producers over their smaller counterparts.

For the second quarter of 2009, that difference is most discernable in net income. The 20 largest producers showed a net income of just over $10.8 billion for the quarter. By contrast, all 132 companies covered by the report had a net income of a little more than $9.7 billion, which means that, as a group, companies ranked from No. 21 to No. 132 actually had a net loss of about $1.1 billion.

In terms of total revenues for the quarter, the Top 20 producers had almost $194.8 billion in revenues compared with $202.1 billion for all companies in the report. This breaks down to roughly 96.4% for the 20 largest companies and 3.6% for the rest.

Year-to-date spending totals for the Top 20 are $53.3 billion (85.5% of the total) versus $8.7 billion (14.5%) for the remaining producers in the report.

The Top 20 in assets (market capitalization) controlled 77.5% of the total, while the next 112 companies had 22.5% of the group's assets. Stockholders' equity among the 20 largest firms was $440.2 billion (91.4% of the group total), and companies No. 21 through No. 132 accounted for just $40.3 billion (8.6%) of stockholders' equity for the companies surveyed.

Largest producers

Among the Top 20 producers, total revenues grew by almost $23.2 billion (11.7%) in the second quarter over the prior period. Net income increased by about $1.2 billion (10.7%) over the same period of time. Although energy stocks have generally been climbing and outperforming the Dow Jones Industrial average and the S&P 500 broader base, stockholder equity among the Top 20 declined by just over $11.7 billion (about 2.6%) from 1Q09 to 2Q09.

Capital expenditures among the Top 20 in the second quarter jumped by more than $25.2 billion (a whopping 47.5% increase), nearly doubling the $28.1 billion spent in the first quarter.

Fastest-growing companies

Dallas-based Dorchester Minerals LP, the No. 91 ranked company on the OGJ150 for this quarter, takes honors as the fastest-growing company in growth of stockholder equity for the quarter. Its reported $156 million in equity is a 23.4% jump over the previous quarter. The company is listed on the NASDAQ exchange under the symbol "DMLP."

Plains Exploration & Production, headquartered in Houston, came in second with a $307 million increase in stockholders' equity – a 12.8% increase over the first quarter. Net income for the company shot up 739.7% for the second quarter. Plains E&P is the No. 20-ranked company on the OGJ150.

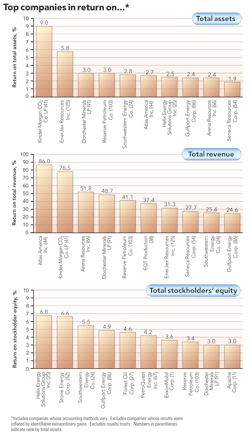

Rounding out the list of fastest-growing companies are: No. 3-ranked ConocoPhillips with a 6.8% increase in stockholders' equity and a 54.5% increase in net income; No. 66-ranked Arena Resources with a 1.9% increase in equity and a 123.3% increase in net income; No. 69-ranked Contango Oil & Gas Co. with a 1.6% equity increase and a 510.4% jump in net income; No. 6-ranked Occidental Petroleum with a 1.5% increase in stockholders' equity and an 85.3% rise in net income; and No. 5 Marathon Oil with a 1.4% increase in stockholders' equity and a 46.5% jump in net income.