Special Report: NORWAY Part 2

This sponsored supplement was produced by Focus Reports. Project Director: Arthur Thuot. Project Coordinator: Anne-Lyse Raoul. Project Assistant: Elyse Deutscher. For exclusive interviews and more info, please log onto Energy.FocusReports.net or write to [email protected]

@ the dawn of its fifth decade, Norway's oil and gas industry could easily be mistaken for quietly entering its golden years. Following the path of North Sea neighbours in the UK, and with no elephant discoveries found since the 1990s, declining oil and gas production is a trend predicted to persist. However, Norway's Northern Lights provide a symbolic a beacon of hope for innovators to build upon an attractive fiscal regime and the prospect of opening up big plays in the High North, whose sensitive environment extends into the Barents Sea, where a third of undiscovered oil and gas potential may now lie. As Norwegian players keep going harder, deeper, faster, and stronger, their success will impact the transition away from easy oil toward a brave new global oil and gas reality.

As a country of under 5 million inhabitants, Norway can only make so much global impact. However, not since two of of the modern week's days were named in homage to Norse gods has an arguably broader force been felt as in the oil and gas service industry, where subsea and deepwater innovations are displacing conventional wisdom as Archimedes would never have predicted.

Ketil Lenning, President & CEO Odfjell Drilling

Many of these innovations are piggybacking on StatoilHydro, Norway's partially privatized, totally dynamic NOC. Like Atlas carrying the innovations abroad on its shoulders, StatoilHydro has also shouldered part of the burden on building them up, through direct funding and indirectly taking advantage of the State's tax subsidies for technology to foster overall NCS development. As Minister of Petroleum and Energy Terje Riis-Johansen succinctly puts it, "The merger of Statoil and Hydro in 2007 has given us a new company that will make its mark on the Norwegian economy and the activity on the Norwegian shelf. The State's role as owner in the company and manager for the Norwegian shelf will be an important perspective in the years to come."

Of course, despite a single entity controlling the majority of Norway's activity, there are other important players driving the industry. With recent amendments to tax laws designed to attract independent players from around the world, and a continuing drive towards internationalizing their supplier base, there is a more shared responsibility than ever in realizing Riis-Johansen's vision of "a large energy producer with a pioneering position that is – and will remain – a long-term, reliable and predictable energy supplier and energy partner."

Indeed, this pioneering position has been questioned in the run-up to September´s elections, which put a left-centrist coalition government to the task of justifying a murky view on, among other hot topics, opening up the country's northern frontier areas to development. Head of the re-elected Arbeiderpartiet (Labour Party) Prime Minister Jens Stoltenberg will be working hard to maintain the fact that, as he says, "The Norwegian supply industry is a truly globalised industry. And it reminds us that through international competition, new technology is born." But there is much work to be done.

This work to be done is emphasized by Pål Engebretsen, CEO of conglomerate Bergen Group, who speaks to the importance of state institutions to his company's biggest division. "For shipbuilding, the most important tools are GIEK and Eksportfinans," Engebretsen says. "The authorities have to give them a framework and capacity to finance more of the shipbuilding than actually seems to be the case these days. For example, we have customers today with approximately 20% equity in their shipbuildings, and GIEK and Eksportfinans are not too willing to take the 80% financing for the rest. Two or three years ago, this would have been no problem at all. When the financial situation gets worse, such institutions must take more risk to compensate for the lack of capacity in the private banks. That's the most important thing for Bergen Group," he adds.

As Helge Lund, CEO of StatoilHydro, emphasized during September's Pareto Securities conference in Oslo, Norway's oil and gas prospects are divided into three distinct provinces, with unique challenges and opportunities for each: the North Sea, Norwegian Sea, and Northern areas. The latter will require the expertise of Norway's largest company, controlling some 80% of domestic production, which will be leveraging its position as the world's biggest deepwater operator and looking to boost international production ratios, currently around one quarter.

Manifesting this globalized industry on a local scale is the city of Stavanger, which has been one of the most obvious beneficiaries of Norway's oil wealth. Bjørn Vidar Lerøen, 20-year veteran of StatoilHydro and now Political Adviser to the Mayor of Stavanger, gives a brief history lesson: "The city of Stavanger was in a bad position in the mid-1960s, with a lot of unemployment and pessimism, until the first oil explorers knocked on the door. When they came here primarily from America, it was a revolution, from recession to boom. The first oil exploration rig came into the Stavanger harbour in 1966, the Ocean Traveler, all the way from New Orleans, traveling 45 days across the Atlantic and turning Stavanger upside down."

Since oil happened, organizations like Greater Stavanger Economic Development have been hard at work ensuring it remains not just an episode, but an epoch, attracting the people and the companies who employ them to the region. Managing Director Elin Schanche elaborates on how her organization makes Stavanger the preferred location in Norway for petroleum companies and their offshoots, saying that "currently, although petroleum is the real industry at the moment, the transition into more renewable energy for the supply industry will be of vital importance; some energy companies believe they will be a part of this as license holders but really it's going to be largely up to supplying companies to drive this diversification."

Despite alluding to the future importance of renewable energy, Schanche is clear about the dominance of the hydrocarbon economy in the short term. "In the petroleum industry, Greater Stavanger Economic Development is monitoring the marketplace, because while looking to improve other sectors, petroleum will be the most important industry in our economy for many more years to come, so we do not want to lose focus here," she says. In doing so, the organization will hopefully attract the companies that have made Stavanger the home to some 50% of the country's oil and gas workforce.

Super Stavanger Service

One such company Schanche can gladly chalk up as a success is Baker Hughes. Recently reorganized into 23 geomarkets, one being Norway, the local division is headed by Zvonimir Djerfi, who recently returned to Stavanger after a decade abroad. Comparing the difference 10 years make, he notes "the biggest change is that there are many more operators in Norway now than when I left. Ten years ago, there was a handful of operators in the NCS, and now, there are many more of various sizes and needs in terms of support in technology, services, or management. In a sense, as the NCS has become more mature, it has also become very similar to the UK situation of five or 10 years ago."

As a consequence, Djerfi remarks "this new state of affairs is quite exciting, because with more operators, there are more ideas coming in, many different views on resource development, and added flexibility and efficiency" for operators in aspects like rig-sharing.

And sharing they may have to, especially in Norwegian waters, where activities earlier this year were at all-time highs, compared to the UK side, where drilling was down 57%. Paul Horne, CEO of the North Sea's leading platform drilling contractor KCA Deutag, comments on the situation: "The political involvement and pressure in Norway's energy market shows why there is a difference in activity level here compared to the rest of the world; the financial support is sustained by long-term contracts which are not immediately affected by downturns. There has been political pressure to increase the production rate here as well, which means both activity and efficiency have to increase in order to keep the same production level for the next five years that we have today."

Of course, this pressure may result in a necessity to diversify service offerings, as evidenced by Aanestad Engineering. Managing Director Ulf Pettersen, whose company's three main divisions comprise baggage and bulk handling in addition to oil and gas, speaks to the impact of changing times on his business. Pettersen explains, "The drop in oil price has affected the decision making process of our customers, projects have been postponed and it takes longer to decide on future investments. This has affected Aanestad as any other business in the oil industry. It is difficult to assess our market shares, but we want sustainable growth while taking care of customers all the way from the design phase to the end result." The diversification has also meant an increased focus on the industry's newcomers, and applying 'out of the box' reasoning gleaned from this wide cross-section of clients.

Some companies, however, have kept to a narrower focus, such as Sverdrup Hanssen, a company ranking among Europe's top stockers of high-nickel alloys, whose remarkable efficiency has resulted in turnover exceeding NOK 20m for each one of its 22 employees. The company's Managing Director Torstein Erevik remarks that, "Sverdrup Hanssen has a very slim organization and that makes us less vulnerable in these times. We can have the same people employed, and I would say we have very competent people. That's very important, because we don't want and don't have to let them go – we can wait out the market until it turns." This slimness, however, is at risk, because financial strength has led to recent acquisitions, namely of Laholm Stål AS, to add to a majority ownership in Cronisteel. Erevik is quick to point out that with risk comes reward: "I feel that in all businesses one of the main factors is streamlining the organization . What we have obtained now are three interesting companies with a platform for growth with the goal to expand up to 1 billion NOK within the next six years. I think we have all the possibilities in the world," Erevik concludes, implying a large reward indeed.

An out of the box strategy applies to CAN AS, despite the fact that, as Managing Director Rolf Olavesen says, "Our business is focused on the long term, (modification and maintenance,) and is therefore not significantly affected by ups and downs in the market." Going further in depth, Olavesen notes "The nature of CAN's business is to use rope access, instead of scaffoldings which can be time consuming and costly. Clients reduce the time on platforms by 300% to 400% by using our methods instead of spending two weeks building a complex of scaffolding structures." This reduction means that some companies, at least, will have help in weathering the storm. And if not, Pettersen offers some calming words. "Don't panic when the price goes down for 6 months. It will reduce the costs in the long term and we have to adapt," he says.

Harder, Deeper, Faster, Stronger

Adaptation has required not only moving into different industry sectors, but different sectors of the country as well. As head of one of the first integrated solutions providers to open an office in the northern Norwegian outpost of Hammerfest, Aibel AS's CEO & President Jan Skogseth explains that such frontiers represent a big and important opportunity, and that the company has "had an operation in Hammerfest since 2006 with 300-1000 personnel onsite annually." However, despite these relatively large numbers for a city numbering under 10,000 permanent residents, he notes that "It is difficult to get permanent employees locally as there is a lack of oil and gas background in the region, so we are moving some people as well as hiring and training in the vicinity. The facility is a strategic move to broaden our marketplace and we take the same systematic execution methods as in other locations."

Speaking of the greater significance of internationalization, he considers it "an important but broad issue, and we are more at a micro level at the moment. Looking at regions like Russia, I don't think we would enter unless on the back of an international company like StatoilHydro, and we are not there yet. We're comfortable with our growth strategy but if you look in the longer term, then yes it is important to pay attention to the development of such regions over time," Skogseth states.

Developing regions implies declining ones, and the wisdom to tell between the two. As one of the few privately-owned drilling contractors which have resisted Transocean's economic gravitation, Odfjell Drilling has been on a path of rejuvenation, divesting interests in older rigs, focusing on management activities and operating its own assets, increasingly the most advanced rigs capable of the harshest environments and deepest waters. Moving away from the shallow water and land rig markets, the company's CEO Ketil Lenning talks about the feasibility of such a 'deep' shift, saying "The interesting thing is that it's already a reality, because the first unit acquired a contract with StatoilHydro, and it's going into contract in the harsh environment segment in the midwater sector initially, and is also capable of going into the northern areas. This is part of the flexibility Odfjell Drilling has had in properly addressing that market segment, while the second, third, and fourth unit will probably go into the world's ultra deepwater markets." Lenning continues, noting "You must keep in mind that although we are not opening up the new acreage in the short term in Norway – and we are very disappointed about that – the harsh environment, northern areas of the Barents Sea still need a lot of exploration and drilling work to be done in the time to come. The fleet is now getting to an age where some replacement will have to take place, and that's where we see openings for rigs like the Deepsea Atlantic and Deepsea Stavanger."

Twenty thousand leagues under the North Sea

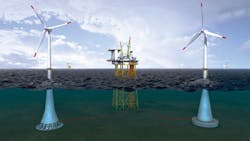

Deep waters call for deep structures, and so enters Dr. techn. Olav Olsen, bearing the name of current Managing Director Tor Ole Olsen's father. The company joined the offshore world by combining their specialty in shell structures – light, efficient, and traditionally found in airplanes, rockets, and roofs – with the solution of gravity-based structures. With 100 times as many steel platforms as concrete, the niche nature of the business naturally exposes it to ups and downs.

Olsen, who also acts as Chairman of the Norwegian Concrete Association and the Nordic Concrete Federation, stresses that despite any personal ambitions, a rising tide will lift all boats: "My dream is not that Olav Olsen – and this is important for the way we think – it's not to have our stamp on every concrete structure, because the oil companies are hesitant towards monopoly. I would much rather increase market volume, and welcome participation from other competitors."

The welcome competition might put a dent in an incredible market share, with the company participating in some two thirds of all global concrete projects. Still, opening an office in Houston was a recent development to get its name "down the road" for those locally-based clients, bringing the robustness of concrete to the less-anticipated harsh environment of the United States' fourth biggest city.

The fluctuation Olsen feels in the concrete market is seemingly extended to the authorities' enthusiasm about innovations. This summer, the Norwegian Petroleum Directorate, charged with awarding the Increased Oil Recovery Prize for 2008, didn't award it because no company had lived up to expectations. According to Zvonimir Djerfi, "there is no secret that in mature oil fields, you want to see further ahead of where you're going, to determine the pockets of reservoir which are there and can't really be seen through seismic interpretation. The end result is using various methods while drilling to foresee and investigate to better access those pockets of reservoir," alluding to his record-setting exploits Troll brought to Asia, where recovery rates are often less than half of their Norwegian counterparts.

One must not pass too far off the shores of Stavanger to see industry action up close. Johan Pfeiffer, FMC Technologies' General Manager based in Norway with responsibility for what the company calls the Eastern Region – Africa, Russia, and Europe – notes that as a global company, "we apply internationally, technology developed here. It's important to note that oil companies are also global, and many are partners in the fields where our technology is being developed, so they're often very well aware of the technology as it's in progress. One example is the first all-electric subsea system, which we're developing for StatoilHydro on the Tyrihans field, in which Total is also a partner."

Pointing to technologies that may be winning plaudits abroad, Pfeiffer notes "There was a lot of excitement around the Tordis separation project as the world's first subsea commercial separator, and FMC Technologies had many foreign operators come to look at what the company did. Although perhaps not a direct result, both Sonangol and Total visited that project during its completion, and FMC Technologies was subsequently awarded the Pazflor contract in Angola, the world's largest subsea development," counting the involvement of fellow Norwegians StatoilHydro, Grenland, and Bergen Group.

Already doing business in over 20 countries, COSL is a foreigner coming to look at what many of its partners are doing. Qi Meisheng, President & CEO of COSL Drilling Europe AS, mentions among them "StatoilHydro, BP, ConocoPhillips, and many others. COSL counts close cooperation with all of these companies in China for the past two decades, and has already provided many services to them in China. Therefore, COSL already knows its clients' technical service requirements. In Norway, the biggest challenge for COSL is the working environment, but this is a challenge to all the service companies in the country – not just COSL."

Integrating in that culture will help with COSL's acquisition of Awilco Offshore in October 2008 for $2.36 billion, adding the zest of youth into the rig fleet, with average age of less than two years. This move toward the future is evidenced in Qi's enthusiasm for important technologies COSL is adopting in deepwater exploration. "COSL has recently finished a project called ASDD (Artificial Seabed Deepwater Drilling), a joint venture with Kristiansand-based Atlantis Deepwater Technology Holding AS representing almost four years of collaboration," he says, having come to Norway to kickstart the project at its inception. After four years, a successful trial well in the South China Sea has meant the technology will be rolled out more broadly, in order to "get more out of deepwater operations for third and fourth generation rigs which can only reach 400m of water depths – this will help reach water depths of up to 1200m," Qi concludes.Norway's Alchemy: Black Gold to Green Gold

Norway's Alchemy: Black Gold to Green Gold

Minister of Environment Erik Solheim, unsurprisingly, emphasizes that with respect to fighting global climate change, "there is no way we will accept the international financial crisis being used as an excuse for reducing our ambitions" and "to the contrary, the financial crisis should be another argument for strengthening our dedication and commitment." Such statements fall right in line with his counterpart at the Ministry of Finance Kristin Halvorsen, who notes "All polluters around the globe must be given sufficient incentives to reduce their emissions. However, rich countries must take a large share of the costs. In Norway we recognise that it is in our own best interest to fight climate change even if our income from petroleum exports could be hit. Long run sustainability cannot be traded against short run profits."

Climate Change has been recognized by public and private players alike. StatoilHydro´s Helge Lund has declared global warming "the challenge of our time", and notes "the dilemma of fossil fuels is that they are perceived as both a blessing and a curse. Fossil fuels drive economic development, but they also impact our climate. Any constructive sustainability discussion has to recognise this dilemma." Throwing the ball back in the court of country politicos, he offers, "In fact, it challenges the capability of the very system of global policy-making."

Helge Lund, StatoilHydro

Image courtesy of Trond Isaksen & StatoilHydro

Although the melting of polar ice caps may ironically offer opportunity to further explore the Arctic regions, at any rate, companies like Multiconsult will be there to assume the mantle. As CEO Haakon Sannum says, having partnered with companies like Barlindhaug and Aker Solutions in harsh northern environments, his company ensures to take the right expertise into account, where not doing so can be a recipe for icy disaster. "A counter case study would be of when, on Snøhvit, structures were designed without taking into account that it would be full of ice - not because of the cold, but because the polar lows coming with lot of humidity."

Multiconsult, with activities outside oil and gas in areas like building and property, energy and environment, and natural resources, counts hydrocarbons around one quarter of its business, and in the long-term foresees a 50/50 split between domestic and international contracts. Comprised in the current split are projects like Ormen Lange, and outside Norwegian waters on Russian projects, like Sakhalin with Aker Solutions or Shtokman with StatoilHydro, or an LNG receiving terminal with ExxonMobil outside Venice, Italy.

Although such a list of international projects may now be commonplace, according to Scandpower's President & CEO Bjørn Inge Bakken, this wasn't always the case. Bakken notes that shifting attitudes towards risk have meant that, whereas a decade ago, the Norwegian approach was unfamiliar to markets like the US, now it is recognized and welcomed with open arms. "The way the oil and gas industry thinks about risk has evolved," he begins. "The industry is getting more and more complicated, with deepwater developments and complex systems, and it has realized that simply having standards dictating different designs is insufficient and that a risk-based approach is needed. This trend is also supported by the authorities and by international standards organizations such as ISO and API."

Since performing the first risk analysis, on the North Sea's massive Condeep structures in the late 1970s, Scandpower has used its nuclear background, combined with process, transport, and offshore, to cross-hybridize in a way that would make Mendel salivate: "our broad-based approach and exceptional expertise are the keys to our success," says Bakken.

But why does his company in particular benefit from this trend? "Scandpower's experience is based on utilizing a risk-based approach. We have been working with a risk-based approach since the late 1970s on both the UK and the Norwegian sides of the North Sea. The first guideline on risk analysis was issued by the Norwegian authorities in 1981, long before Piper Alpha in the UK introduced the safety case regime. This is what makes being from Norway an advantage as I see it, and we've had this confirmed around the world, from the USA to China," Bakken concludes.

Safety extends not only to current operations, but taking care of the past's legacies. Although the name NCA, which originated from Norse Cutting & Abandonment, suggests services at the end of the oil and gas lifecycle, CEO Carl Lieungh has driven growth in the core areas: repair and maintenance, the company's bread and butter, mooring services, and P&A/Decommissioning, from which all told Lieungh plans to double revenues in the next three years.

Putting these three business areas together, Lieungh notes "The dream project will be one in which NCA does it all: take the responsibility for project management, execution, removal and recycling of equipment, and having the full value chain and vessels to do the job and sent it ashore to leave a clean, safe spot behind, returning back to only the ocean again. It's a very nice picture, to make the environment clean and safe for eternity, and we owe it to those who come after us." Or, to paraphrase Jens Ulltveit-Moe – making sure that, with any luck, we may still have a planet.

Pioneer profile: Jens Ulltveit-Moe, Founder & CEO – Umoe Group

Jens Ulltveit-Moe is a rare breed in Norway's oil & gas sector. After graduating from the country's top business school, NHH, he crossed the pond to the Ivy League, studying International Affairs at Columbia, before a four-year stint at McKinsey in New York and London. Returning to his native country, Ulltveit-Moe transformed a troubled shipping company into an industrial conglomerate, comprising diverse interests from advanced seismic technology to Burger King. With decades of first hand experience, he advocates radical changes for the oil and gas industry to face the challenges posed by climate issues, and a fundamental accounting shift that must take place for the industry to act responsibly. Now, one of Norway's wealthiest entrepreneurs casts a light on an uncertain market and the next bets for his $500m fortune.

One quote appearing quite regularly around Umoe Group is "the future does not belong to the largest or the strongest, but those who can adapt quickest," which is perhaps particularly appropriate in the recent economic context. How does this quote relate to your actual business mindset?

It's really spot on, but there are several things. For one, I really think there's a major change in the world and its energy supply, where there will be increasing pressure on the hydrocarbon industry to clean up. Secondly is energy security, in the sense that the Middle East is far less reliable than before. This means that, in my mind, there's a major growth opportunity in alternative fuels, such as bioethanol, in which I have a big operation in Brazil. But these points represent only one part of the issue, because the world is changing dramatically. It used to be that 500 million people in the West dominated the world. Previously, there was a relative shortage in manufacturing capacity, because the Earth had an abundance of material to support those 500 million people with high living standards, but that's not the case when another billion people aspire to that life. This means, to my mind, that oil and energy prices will be high, and this will extend to other raw materials as well. That is a major shift, and will be accompanied by a shift away from the EU and US, which are the undisputed leaders in manufacturing, knowledge, and research.

You've mentioned that although IOCs have a lot of trouble, the service industry on the other hand does have some bright spots. Nonetheless, you've been divesting your oil and gas assets. What can we expect in terms of your future oil and gas investments in the sector?

I don't think I will make any. The commitments I am making in renewables are so big that I will not make any further new investment in oil and gas. I will develop the Harding company, which is a service company, and see what I do with the shares of PGS, (Petroleum Geo-Services) which I feel is a very well-positioned company to capitalize on the NOCs' demand to explore both onshore and offshore. But I'm definitely not going to invest in an oil company, coal, or tar sands - forget it.

You are on the council for the Copenhagen Climate Change Conference. What are your expectations for the event, what's the best we could get out of it?

The best thing would be for the US and China to agree on some sort of limit, an emissions cap based on proportion of GNP. They will not agree to an absolute cap of a release per capita, and such alternatives are dead. I would like to see some sort of deal that commits the US to reducing releases and for China to have increasing energy efficiency in their economy. Something like that could work, is in their interests, and that I would count as a great success. I think we'll come out of Copenhagen with a commitment to reduced emissions without teeth in it, but with working parts that can, over the next few years, come up with something. If it then gets unpleasant enough in India and China, there will be a binding agreement within a few years. Unfortunately, if you do not have lots of typhoons, floods, and people dying, it just won't happen. Only when we are hit directly we are willing to push changes through. In this respect, the devastation caused by the Katrina hurricane in New Orleans did help make Americans a bit more aware of the deadly effects of climate change. Let us hope that it won´t take another tragedy for America to act.

What is your final message to OGFJ readers?

There's no doubt that for the next few decades, they will have a major role to play in solving the energy needs of our world. But it depends on solving the carbon capture storage (CCS) - problems, and finding solutions for producing electricity. If they do that, then obviously they have an important function and will be welcome in the world for a long time. Basically, we have a pricing problem, in the sense that the oil and gas industry is pouring waste into the atmosphere without paying for it. In cities, we pay for disposing our garbage, and so in a sense, oil and gas products are grossly underpriced for the total cost of having them.

There's no doubt that the oil and gas industry is a mainstay of the quality of life in the west, and indeed the world, but once the negative externalities are priced properly, you'll have a mixture of oil and gas, renewables, nuclear, hydro, and so on that makes sense. And, lo and behold, in 100 years, we may still have a planet.

More Oil & Gas Finacial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles