1Q08 revenues rise by 6%; net income is basically flat

After a strong comeback in the fourth quarter of 2007, profits for the OGJ200 group of companies declined slightly in the first quarter of this year. Net income dipped by $570 million (1.9%) on total revenues of $311 billion, up 6% from $293 billion in the 4Q07. Total net income was slightly more than $29.8 billion for the quarter compared with $30.4 for the previous reporting period.

High commodity prices once again appear to be a significant factor in the increased revenues, while the upstream companies cited high operating costs for the disparity between increased revenues and flat profits.

Compared to the same quarter in 2007, 1Q08 revenues grew by 36% and net income by 26%.

Nearly all of the largest publicly-traded companies tracked by PennWell Corp. showed increases in both revenues over the previous quarter. However, profits were down slightly among many.

The OGJ200 group of companies consists of publicly-traded, US-based oil and gas producers. The group appears in Oil & Gas Journal’s annual special report, which ranks the firms by year-end total assets. To qualify for the list, a company must have operations in the United States.

Firms not reporting

The group includes 137 firms, down by seven from the 144 companies listed in the previous edition of the OGJ200 Quarterly, published in the May issue of Oil & Gas Financial Journal. The financial results of eight of the firms were not available for this edition of the report, as these companies had not filed their first-quarter results with the US Securities & Exchange Commission by press time.

Largest producers

The top 20 producers as measured by total assets (market capitalization) had more changes than usual this quarter. The top four positions are occupied, respectively, by ExxonMobil Corp. ($447 billion in assets), Chevron Corp. ($177 billion), ConocoPhillips ($118 billion), and Occidental Petroleum ($60 billion). Oklahoma City-based Devon Energy ($46 billion) moved past Marathon Oil Corp. ($32 billion) to occupy the No. 5 slot. Houston-based Apache Corp. ($40 billion) is in the No. 6 position, while Marathon slipped to No. 7.

Rounding out the top 10, XTO Energy ($32 billion) moved up two notches from No. 11 in 4Q07 to No. 8 currently. EOG Resources ($29.8 billion) occupies the No. 9 position, moving up three places from No. 12, and Anadarko Petroleum ($29.5 billion), headquartered in The Woodlands, Tex., fell from No. 9 to the No. 10 position.

The remainder of the top 20 include: Hess Corp. ($28 billion); Chesapeake Energy ($23.7 billion); Dominion Energy ($23.6 billion); Williams Cos. ($19 billion); Murphy Oil (16 billion); El Paso Corp. ($12 billion); Newfield Exploration ($7 billion); Pioneer Natural Resources ($5.8 billion); and Plains Exploration & Production ($5.7 billion).

Results

Thirty-nine of the firms in the compilation reported a net loss of income for the first quarter of 2008 – up by one from the previous quarter. Among the larger companies that reported losses are Chesapeake Energy (-$132 million); Newfield Exploration (-$64 million); Forest Oil Corp. (-$4.7 million); Exco Resources (-$88 million); Petrohawk Energy (-$56 million); Cheniere Energy (-$50 million); and Delta Petroleum (-$21 million).

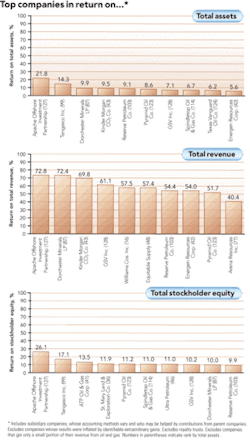

Eleven of the top 20 companies (ranked by assets) showed an increase in net income over the 4Q07. They are: Chevron (up 6%); Anadarko (up 8.3%); Marathon (up 9.4%); Occidental (up 27%); Hess (up 49%); El Paso (up 37%); XTO (up 0.2%); Murphy (up 98%); Williams Cos. (up 132%); Dominion (up 61%); and Plains E&P (up 104%).

Occidental’s net income jumped by $394 million to $1.8 billion for the quarter, the largest numerical increase of all the OGJ200 companies showing income increases over the prior quarter. Oxy is followed by Chevron with a $293 million rise in profits to $5.2 billion, and Hess with a $249 million increase to $759 million. Even though its net income was down slightly from the previous quarter, ExxonMobil again had the largest net income ($10.9 billion for 1Q08 compared with $11.7 billion for 4Q07) of all companies in the OGJ200.

null

Top 20 firms

There were quite a few changes among the 20 largest oil and gas producers in terms of net income and stockholders’ equity during the first quarter of 2008 compared to the fourth quarter of 2007.

Ranked according to net income, four new firms joined the top 20. Kinder Morgan CO2 Co. LP entered at the No. 16 position with a net income of $199.8 million; Dominion energy at No. 18 with a reported income of $182.2 million; Plains E&P with $163.5 million in profits; and Cimarex Energy with $149.8 million in income.

Firms that dropped out of this quarter’s top 20 in net income include Quicksilver Resources, Newfield Exploration, Chesapeake Energy, Pioneer Natural Resources, and Questar Corp.

Ranked according to stockholders’ equity, the 20 largest companies remain largely unchanged. Murphy Oil moved up a notch to No. 13 in the rankings and El Paso Corp. moved down one place to No. 14 on the list. Cimarex Energy (No. 17) and Plains E&P (No. 18) switched places also.

ExxonMobil again leads the group with $123 billion in stockholder equity. Others in the top 10 include ConocoPhillips ($89.6 billion); Chevron Corp. ($79.2 billion); Occidental ($24 billion); Devon ($22.4 billion); Marathon ($19.7 billion); Anadarko ($16.7 billion); Apache Corp. ($16.1 billion); Chesapeake ($11.5 billion); and Hess Corp. ($11 billion).

Filling out the top 20 are: XTO Energy ($9.1 billion); EOG Resources ($7.2 billion); Murphy Oil ($5.4 billion); El Paso Corp. ($5.3 billion); Noble Energy ($5 billion); Newfield Exploration ($3.5 billion); Cimarex ($3.4 billion); Plains E&P ($3.2 billion); Pioneer Natural Resources ($3.1 billion); and Questar Corp. ($2.6 billion).

Capex spending

Spending in the oil and gas sector continues to climb steeply. The 20 companies with the largest capital and exploratory spending in 1Q08 saw their capital outlay increase by 22% over the same period in 2007. First-quarter spending in 1Q08 among these firms was $27.9 billion compared with $22.8 billion in 1Q07.

The top 20 in total revenue saw a whopping 35% increase in 1Q08 compared with 1Q07 and a more modest 5.8% rise over 4Q07.

Fast-growing firms

Contango Oil & Gas Co. led the 20 fastest-growing companies in the first quarter with a 50.5% increase in stockholders’ equity. Interestingly, the Houston-based producer announced on June 17 that its financial adviser, Merrill Lynch & Co. has begun meeting with parties potentially interested in acquiring the company, which operates primarily in the Gulf of Mexico. Contango reported $112.7 million in net income in the most recent quarter.

Other fast growing companies during the 1Q08 include Knoxville, Tenn.-based Tengasco Inc., which showed a 20.8% rise in stockholders’ equity; San Antonio-based TXCO Resources, which grew at a 20.1% pace; McMoran Exploration Co, headquartered in New Orleans, which grew 15.7%; and Fort Worth-based XTO Energy, which achieved a 14.7% growth rate.

Houston-based ATP Oil & Gas Corp., last quarter’s fastest-growing company, came in seventh this time with a 12.2% growth in stockholders’ equity.