4Q07 earnings, revenues see substantial increases

Don Stowers, Editor Oil & Gas Financial Journal

Laura Bell, Statistics EditorOil & Gas Journal

The combined earnings of the OGJ200 group have finally emerged from a prolonged slump, and total revenues also increased substantially in the fourth quarter of 2007. High commodity prices appear to be a significant factor in this break-out.

Compared to the 3Q07, revenues climbed 10.7% to $293.4 billion and net income jumped a whopping $23% to $30.4 billion. The earnings increase was the largest in more than a year. Compared to the same quarter in 2006, 4Q07 revenues were up 25.2% and earnings rose by 17.8%.

Lead by Exxon Mobil Corp., nearly all the largest publicly-traded companies tracked by PennWell Corp. showed increases in both revenues and net profits.

Year-to-date capital spending among these companies rose by $8.7 billion to $122.7 billion – a 7.7% increase. This represents a decrease in spending over the $15 billion increase reported in the previous quarter.

The OGJ200 group of companies consists of publicly-traded, US-based oil and gas producers. The group appears in Oil & Gas Journal’s annual special report, which ranks the firms by year-end total assets. To qualify for the list, a company must have operations in the United States.

Firms not reporting

The group includes 144 firms, the same number as in the previous edition of the OGJ200 Quarterly, published in the February 2008 issue of Oil & Gas Financial Journal. The financial results of 17 of the firms were not available for this edition of the report, as these companies had not filed their fourth-quarter results with the US Securities & Exchange Commission by press time.

Largest producers

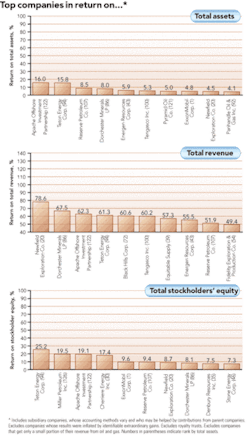

The top 10 producers as measured by total assets had few changes this quarter. The top four positions were occupied, respectively, by ExxonMobil ($242 billion in assets), ConocoPhillips ($178 billion), Chevron Corp. ($149 billion), and Anadarko Petroleum ($48 billion). These four were ranked the same in the previous quarter.

Marathon Oil ($43 billion) moved from No. 6 to No. 5, and Devon Energy ($41 billion) moved down a slot to No. 6. Holding positions 7 through 9 are Occidental Petroleum ($37 billion), Chesapeake Energy ($31 billion), and Apache Corp. ($29 billion), Hess Corp. ($26 billion) moved up to No. 10, while El Paso Corp. ($25 billion) fell out of the top 10 to the No. 11 slot.

Results

Thirty-eight of the firms in the compilation reported a net loss for 4Q07 – up by one from the previous quarter. Among the larger companies that reported losses are Swift Energy, Cheniere Energy, Delta Petroleum, Atlas America, Exco Resources, and Petrohawk Energy.

Of the top 10 companies, only three recorded income declines in 3Q07 compared with the previous quarter. Anadarko Petroleum’s net income dropped from $504 million to $265 million; Marathon Oil’s income fell from just over $1 billion to $668 million; and Chesapeake Energy’s income dropped slightly from $373 million to $303 million.

ExxonMobil recorded the largest income increase – nearly a $2.3 billion jump from the previous quarter to almost $11.7 billion.

Total collective asset value for all companies surveyed rose by $43.9 billion over the previous quarter to $1.06 trillion. Total collective asset values grew by $122.5 billion as of Dec. 31, 2007 compared with a year earlier, so the industry continues to see phenomenal growth.

Top 20 firms

There were several changes among the 20 largest oil and gas producers in terms of net income and stockholders’ equity during the fourth quarter of 2007 compared to the previous quarter.

Classified according to net income, two new firms joined the top 20: Quicksilver Resources at No. 10 and Newfield Exploration at No. 12. Two companies have fallen out of the top 20: Energen Resources, previously ranked No. 18, and Helix Energy Solutions Group, which formerly held down the No. 20 spot.

The top 10 companies, in descending order, in net income for the quarter are ExxonMobil ($11.7 billion); Chevron Corp. ($4.9 billion); ConocoPhillips ($4.4 billion); Occidental Petroleum ($1.5 billion); Devon Energy ($1.3 billion); Apache Corp. ($1.1 billion); Marathon Oil ($668 million); Hess Corp. ($510 million); XTO Energy ($464 million); and Quicksilver Resources ($369 million).

The next 10, also in descending order, are: EOG Resources ($361 million); Newfield Exploration ($313 million); Chesapeake Energy ($303 million); Noble Energy ($300 million); Anadarko Petroleum ($265 million); Murphy Oil Corp. ($206 million); Pioneer Natural Resources ($205 million); Williams Cos. ($185 million); El Paso Corp. ($160 million); and Questar Corp. ($131 million).

In all, the top 20 performers in net income reported combined earnings of about $29.2 billion – up from $23.5 billion for the same group the previous quarter. This represents about a 24% increase in income for this group over the same period.

Ranked according to stockholders’ equity, the 20 largest companies remain largely unchanged. Pogo Producing Co., previously the 20th-ranked company, was acquired by Plains Exploration & Production Co., so it drops off the list. In turn, Plains E&P, a newcomer to the top 20 performers, takes over the No. 17 position. Cimarex Energy, Pioneer Natural Resources, and Questar Corp. each move down a notch to the No. 18, No. 19, and No. 20 positions, respectively.

ExxonMobil leads the group with $121.8 billion in stockholder equity. Others in the top 10 include ConocoPhillips ($89 billion); Chevron Corp. ($77.1 billion); Occidental Petroleum ($23 billion); Devon Energy ($22 billion); Marathon Oil ($19.2 billion); Anadarko Petroleum ($16.4 billion); Apache Corp. ($15.4 billion); Chesapeake Energy ($12.1 billion); and Hess Corp. ($9.8 billion).

Rounding out the top 20 are XTO Energy ($8 billion); EOG Resources ($7 billion); El Paso Corp. ($5.3 billion); Murphy Oil ($5.1 billion); Noble Energy ($4.8 billion); Newfield Exploration ($3.6 billion); Plains E&P ($3.3 billion); Cimarex Energy ($3.3 billion); Pioneer Natural Resources ($3 billion); and Questar Corp. ($2.6 billion).

Stockholders’ equity for the top 20 companies grew by nearly $15.9 billion for the group, representing a 3.7% increase over the previous quarter.

Capex spending

Spending in the oil and gas sector continues to skyrocket upwards. The capital and exploration spending of the top 20 companies increased by a $30.5 billion over 3Q07 – representing a 43% increase. The collective spending for these 20 companies was slightly more than $101 billion. In the previous quarter, spending for this group increased by 59%.

Revenues rose by $27.6 billion to a total of $284.4 billion for the 20 largest companies – approximately a 10.7% increase from 3Q07 to 4Q07.

Fast growing firms

Houston-based ATP Oil & Gas Corp. led the 20 fastest-growing companies for the fourth quarter. ATP experienced a huge 245.7% increase in stockholders’ equity. The company, which was the subject of a cover story in the September 2007 issue of Oil & Gas Financial Journal, has a strategy of acquiring low-risk undeveloped properties in the Gulf of Mexico and North Sea and bringing them to production. Paul Bulmahn, chairman and president of ATP, says the company has a 98% success rate taking these projects to production.

In 2006, ATP gained attention in the mainstream media as well as the industry, by rewarding all 59 of its employees with a new Volvo S60 because of the company’s stellar performance. In addition, employees and their spouses or friends traveled to Sweden to visit the Volvo factory, received their new cars, drove around the countryside, and had their cars transported back to the United States by Volvo.

This year, Bulmahn says, if the company meets its ambitious goals, ATP will pay the mortgages for all its employees for one year.

Other fast-growing companies during the fourth quarter include Plains Exploration & Production, which grew at a 167.3% pace; Contango Oil & Gas Co., which had a 116.8% growth rate; and Quicksilver Resources, with a 58.2% growth rate.