BP, ConocoPhillips put up $600M for first leg of Alaska gas pipeline

Mikaila Adams Associate Editor, OGFJ

London-based BP and Houston-based ConocoPhillips have combined resources to start Denali – The Alaska Gas Pipeline. The historic project aims to construct a pipeline geared to move roughly four billion cubic feet of natural gas per day to markets.

Both companies plan to spend $600 million to reach the first major project milestone, an “open season” in which it will seek long-term customer commitments for pipeline usage. The season will be held late 2010 and early 2011. After that time, the companies intend to obtain Federal Energy Regulatory Commission and National Energy Board certification and move forward with project construction.

Total cost of the pipeline is estimated at $25 billion to $42 billion.

“This project is vital for North American energy consumers and for the future of the Alaska oil and gas industry. It will allow us to keep our North Slope fields in production for another 50 years.”

—Tony Hayward, BP Group chief executive

“This project is vital for North American energy consumers and for the future of the Alaska oil and gas industry. It will allow us to keep our North Slope fields in production for another 50 years,” said Tony Hayward, BP Group chief executive.

“Our goal of bringing Alaska’s North Slope gas to market is becoming a reality. Denali – The Alaska Gas Pipeline project will deliver natural gas to meet North America’s growing energy needs,” said Jim Mulva, ConocoPhillips chairman and CEO.

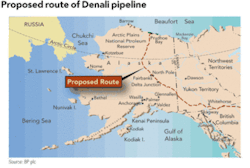

The project consists of a gas treatment plant on Alaska’s North Slope and a large-diameter pipeline that travels over 700 miles through Alaska, and then into Canada through the Yukon Territory and British Columbia to Alberta.

“Our goal of bringing Alaska’s North Slope gas to market is becoming a reality. Denali – The Alaska Gas Pipeline project will deliver natural gas to meet North America’s growing energy needs.”

—Jim Mulva, ConocoPhillips chairman and CEO

In addition to Alaska and Canada, discussions are expected to continue that could potentially extend the project to include a large diameter pipeline from Alberta to the Lower 48 states. Talk of constructing a comparable structure to pump natural gas to the Lower 48 states has been swirling for decades.

ConocoPhillips and BP have launched this project without the aid of the Alaska Gasline Inducement Act (AGIA), which was passed last year and introduced state incentives for companies. The legislation was designed to advance construction of a gas pipeline from the Alaska North Slope and requires pipeline builders to meet certain requirements in exchange for a license that provides up to $500 million in matching funds.

So far, a project proposed by Calgary-based

TransCanada is the only one to have been introduced and passed through to the next step in the AGIA process.

Other attempts

This is not the only Alaskan pipeline project plan on the table, nor is it the only one ConocoPhillips and BP have put forth.

In 2006, ConocoPhillips, along with ExxonMobil and BP negotiated a $25 billion natural gas pipeline deal with Alaska Gov. Frank Murkowski. When Sarah Palin defeated Murkowski in the 2006 GOP primary, that deal fell by the wayside.

As mentioned above, TransCanada also has a pipeline proposal in the works. The company’s plan is in the second stage of the Alaskan approval process and the company expects to hear word from Palin’s office in May. If the governor approves the application, it goes on to the legislature for further approval.

Challenges

As for the ConocoPhillips, BP plan…done and done, right? Not so fast. A project of this nature faces numerous hurdles. The Denali pipeline would be the largest private sector construction project ever built in North America. Not only is the project itself a huge undertaking, but it is set to pass through some of the world’s harshest climates.

Additionally, if one uses TransCanada’s Mackenzie Valley pipeline as a guide, the Denali project could face environmental and community opposition once it reaches the Canadian border–not to mention possible right-of-way battles since the gas to be transported is non-Yukon, non-Canadian gas.

Conclusion

Regardless of possible snares, BP and ConocoPhillips have started the ball rolling. Roughly 150 employees are expected to be positioned at the joint project team’s headquarters in Anchorage by the end of the year. Eventually, the companies expect to employ close to 500, plus several thousand contractors once the project is up and running.

The companies will seek other equity partners, including pipeline companies, who can add value to the project and help manage the risks involved. While discussions with TransCanada and ExxonMobil have taken place and involvement talks have heated up as of late, word of a larger group effort has yet to be heard.