ConocoPhillips, Origin Energy form CBM-to-LNG joint venture, create long-term Australasian business

ConocoPhillips has teamed up with Origin Energy, the largest holder of proved and probable gas reserves in eastern Australia, to create a long-term Australasian natural gas business focused on coal bed methane (CBM) production and liquefied natural gas (LNG) processing and sales.

The transaction is conditioned upon approval from Australia’s Foreign Investment Review Board and, if required as a result of an outstanding offer from BG to purchase all outstanding shares of Origin Energy stock, the approval of Origin Energy’s shareholders.

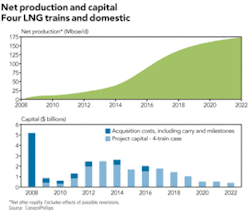

As it stands, ConocoPhillips would initially contribute US$5 billion to the joint venture and carry Origin Energy for their first AU$1.15 billion in joint venture expenses. ConocoPhillips would make up to four additional payments of US$500 million based on project milestones, for a total possible cash acquisition investment of roughly US$8 billion. As a result of these investments, ConocoPhillips would receive 50% equity in Origin Energy CSG Ltd., which holds Origin Energy’s Queensland, Australia, coal bed methane assets.

The 50/50 joint venture would be comprised of coal bed methane development, operated by Origin Energy, and a liquefied natural gas project, operated by ConocoPhillips. As planned, the joint venture would market the LNG, primarily targeted to Asian markets, with ConocoPhillips leading the marketing venture for the first 10 years.

It is anticipated that the JV will be managed by a board composed evenly of ConocoPhillips and Origin Energy representatives and that the project director will be supplied by ConocoPhillips.

“With this investment, ConocoPhillips has gained access to the leading coal bed methane resource in Australia, comprising 8.1 million net acres. Moreover, the company has enhanced its LNG position with the creation of an additional Australian LNG hub serving Asia-Pacific markets.” said Jim Mulva, ConocoPhillips’ chairman and CEO. “This joint venture better balances ConocoPhillips’ oil and gas resource mix. In addition, the company’s long-term production growth is expected to benefit from a steady, secure source of resource additions.”

Origin’s managing director, Grant King, said, “ConocoPhillips’ investment gives confidence in the delivery of a coal bed methane-to-LNG project. We believe the joint venture will deliver both companies with a strong and competitive position in a rapidly growing market for LNG.”

Origin Energy estimates a gross resource base of 42 trillion cubic feet (tcf) of coal bed methane, including 17 tcf of prospective resources, located in the Bowen and Surat basins in Queensland. Four or more LNG trains, utilizing ConocoPhillips’ proprietary Optimized Cascade® LNG technology and each processing an estimated nominal 3.5 million tons of LNG per year, are anticipated. An estimated 20,500 wells are envisioned to supply both the domestic gas market and the LNG development.

Initial plans for a four-train development would enable production of 23 tcf gross (11.4 tcf net) of the coal bed methane resource, with significant upside potential. ConocoPhillips anticipates peak production of 175,000 net barrels of oil equivalent (boe) per day in 2023, excluding effects of possible reversions. Based on Origin Energy estimates as of June 30, 2008, ConocoPhillips anticipates booking reserves of nearly 100 MMboe in 2008.

Mulva expects the company’s debt-to-capital ratio to remain in the targeted range of 20% to 25%.

Credit Suisse acted as financial advisor, and Allens Arthur Robinson and Wachtell, Lipton, Rosen & Katz acted as legal counsel for ConocoPhillips.