Azerbaijan, South America award Saipem $1.1B in offshore contracts

Following its $1.2 billion award in onshore contracts yesterday, Saipem has won three new offshore contracts for a total amount in excess of US$1.1 billion. The three contracts have been awarded in Azerbaijan, Brazil, and Venezuela respectively.

Azerbaijan

Saipem has signed a 5-year underwater service contract with BP Exploration (Caspian Sea) Ltd. under which Saipem will be responsible for the activities required for the inspection, maintenance, and repair of the existing BP facilities in the Azeri offshore, including the platforms installed by Saipem in the previous years.

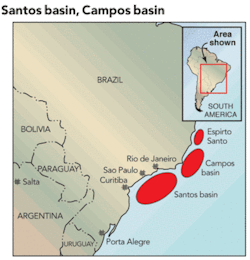

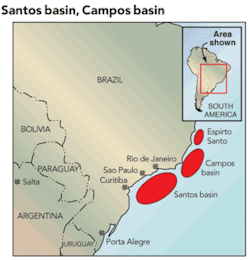

Brazil

Petrobras awarded the contract for the Urugua-Mexilhao pipeline. Saipem will transport, install and test an 18”, 174-kilometer long gas pipeline in the Santos Basin, offshore Brazil. The pipeline will link the floating production, storage and offloading vessel Urugua, located in the Exploratory Block BS-500 in roughly 1,300 meters water depth, to the Mexilhao gas platform in the Mexilhao field in 172 meters water depth. Completion is expected in the first half of 2010.

Venezuela

PDVSA Gas S.A. awarded Saipem the contract for the Dragon -- CIGMA pipeline in the Mariscal Sucre complex in offshore north-east Venezuela. Saipem will transport and install a 115-kilometer, 36-inch gas export line connecting a platform located in the Dragon field to PDVSA’s CIGMA complex on the southern side of the Paria peninsula, in the state of Sucre. Marine activities will be mainly carried out by the Semac pipelayer vessel and are scheduled to be completed by the end of 2009.

Brazil helping Cuba drill for oil in Gulf of Mexico

Following on the heels of a cooperation agreement signed in January that marked the first involvement for Brazil in the Cuban oil and gas sector - previously dominated by Venezuela - Petrobras and Companhia Cubana de Petróleo (Cupet) have recently joined together to explore and produce Block 37, in the Cuban sea, in the Varadeiro region of northern Cuba. The agreement is expected to be in effect for 32 years (seven for exploration and 25 for production).

Located between Havana and Matanzas near the Cuban onshore oil reserves, Block 37 covers an area of 1,600 kilometers at depths ranging from 500 to 1,600 meters.

The exploration phase will be divided into four periods of 18 to 24 months each. At the end of each period, Petrobras will decide whether or not it will continue in the project. The initial investment will be $8 million. In the event reserves are discovered, Cupet will have the option to participate by paying for past and future investments in field exploration, development, and production.

Kodiak sets preliminary 2009 CAPEX, highlights joint venture, ops update

Kodiak Oil & Gas Corp. has set a preliminary 2009 CAPEX budget along with an activity update.

2009 preliminary CAPEX

Kodiak has approved its preliminary 2009 capital expenditure budget, which is focused on the Bakken oil play on the Fort Berthold Indian Reservation (FBIR) in Dunn County, ND. The initial CAPEX relates to Kodiak-operated wells in Dunn County. The company is allocating $40 million toward drilling and completion activities, installation of associated surface facilities and related infrastructure. An estimated 14 gross (7.8 net wells) wells, using two rigs, are included. Kodiak’s working interest ranges from 50% to 70% in the 2009 drilling program.

Because of current market conditions and lower natural gas prices in the Rocky Mountains, the company has put drilling plans on other ND and Mont. acreage outside the Bakken play, and drilling on prospect acreage in Wyo., on the back burner. Kodiak intends to maintain the properties for future opportunities.

Potential leasehold acquisitions are not included in the initial CAPEX; however, given current market conditions, the company does not expect to see significant acquisition opportunities in 2009.

Kodiak expects to fund the budget primarily from cash on hand, utilization of tubular goods acquired in advance of drilling, cash flow from operations, and borrowings under the company’s reserve-based revolving line of credit.

Williston Basin update-Dunn County, ND

As of November 3, Kodiak had nearly 56,000 gross and 36,000 net acres under lease on the FBIR. These acreage totals include acquisitions subsequent to September 30, 2008 as well as the recently signed letter agreement entered into with a private, third-party. Up to seven wells will be drilled on certain of Kodiak’s lands. Kodiak will pay 20% of the drilling and completion costs associated with the first, third, fifth, and seventh wells for its 60% working interest and the JV partner will pay 80% of the wells’ costs for its 40% interest. All other wells under the agreement will be drilled in proportion to the 60% / 40% working interest of each party. The total promote on the wells to be drilled will not exceed $8.5 million to the third party.

Kodiak operates all of its leasehold on the FBIR, with the exception of approximately 7,000 net acres that are in a participating area previously established with another operator.

The Moccasin Creek (MC) #16-34-2H well (60% WI - Kodiak operates), the initial drilling location, will be drilled to a proposed true vertical depth of 10,300 feet and a projected total measured depth of 15,700 feet. The company’s new-build rig, the Unit #117, is currently being mobilized.

Upon reaching total depth, the rig will drill the MC #16-34H well (60% WI - Kodiak operates). Drilling and completion costs are estimated at approximately $6.2 million with an estimated 30-45 days to total depth for each well.

Three Forks/Sanish potential

To the west and north of Kodiak’s leasehold, several operators have drilled and completed wells in the Three Forks/Sanish formations. Kodiak intends to evaluate the Three Forks/Sanish formations with at least one exploratory well in 2009.

Vermillion Basin update-Sweetwater County, Wyo.

Drilling activities, with Devon Energy as operator, began in August in the Vermillion Basin to further evaluate the Baxter shale at an approximate depth of 10,000 feet to 13,000 feet. Two of the three wells have been drilled to accommodate horizontal drilling at a future time and the third is currently drilling approximate projected 3,000 foot lateral well. Completion activity is expected to begin in the 2Q09.

Kodiak has an approximate 50% working interest in each of these wells. The well costs are being funded under the Vermillion Basin Exploration Agreement.

“Looking forward to the next 12 to 18 months, we foresee a solid level of activity for our company, assuming commodity prices stabilize at an economic level to justify our exploration efforts. Our strategy since inception is to balance oil and gas projects in an effort to be able to respond to the commodity price environment,” noted Kodiak president and CEO Lynn Peterson.

Paradigm provides consulting to Dubai Petroleum Establishment

Earth Decision Sciences FZ-LLC, an affiliate of Paradigm, a provider of enterprise software solutions to the oil and natural gas exploration and production industry, has extended its consulting contract with Dubai’s national oil company, Dubai Petroleum Establishment (DPE).

“Paradigm’s Strategic Consulting team has added significant value to our business by providing consultancy services to create a new petrophysical database with clean, consistent data and parameters for basic interpretation,” said Fred Chemin, head of production development, DPE.

Baker Hughes launches new telemetry service

Baker Hughes INTEQ has introduced its new aXcelerate™ High-Speed Telemetry service, offering high-speed mud-pulse and wired-pipe data transmission for logging while drilling and measurement while drilling applications.

INTEQ president Paul Butero said, “the aXcelerate service enables real-time transmission of high-speed, high-resolution data from all of INTEQ’s downhole services. Clients gain a more comprehensive understanding of the downhole environment and are then able to optimize their drilling programs and take remedial actions when it matters the most: while drilling.”

The aXcelerate service provides fast mud-pulse telemetry, with data rates of 20 bits per second having already been consistently achieved. This data rate is more than 500% faster than the three bits per second industry standard.

The service also enables wired-pipe telemetry connectivity in conjunction with The IntelliServ® Network.

INTEQ, a division of Baker Hughes, is a provider of advanced while drilling technologies and services, including directional drilling, measurement while drilling, logging while drilling, and wellsite information management services.

The IntelliServ® Network is a mark of NOV (National Oilwell Varco).

Petrohawk makes gas field discovery; makes comparisons to Haynesville

Petrohawk Energy Corp. has discovered what it believes to be a significant new natural gas field discovery in the Eagle Ford Shale in South Texas. This new field in La Salle County, Tex., was discovered after extensive regional subsurface and seismic mapping, geochemical analysis, and petrophysical study.

Already, the company has leased over 100,000 net acres for prospective commercial production in the area.

Dick Stoneburner, the company’s COO touched on the company’s knowledge and experience in the Haynesville and Fayetteville shales with regard to this new field. “Leveraging that expertise to uncover new opportunities like the Eagle Ford Shale adds significantly to our playbook,” he said.

The discovery well, the STS #241-1H, was drilled to an approximate depth of 11,300 feet and placed on production at a rate of 9.1 MMcf of natural gas equivalent per day.

A confirmation well, the second well drilled on the project, the Dora Martin #1H, was drilled roughly 15 miles from the first. At presstime, the company was expected to spud a third well.

Drilling and completion costs for development wells are expected to run between $5 and $7 million. To lower overall development costs, Petrohawk plans to access existing gathering and transportation infrastructure.

Petrohawk is the operator and owns 90% working interest in the project, with 10% owned by industry partners.

Chevron draws first oil from Blind Faith in GoM; facility expected to produce 70,000 boe/d

Chevron Corp. has started crude oil production from its Blind Faith Field in the deepwater Gulf of Mexico. Daily production is expected to increase to roughly 65,000 barrels of crude oil and 55 million cubic feet of natural gas over the next three months.

Blind Faith utilizes a deep-draft semisubmersible hull located about 160 miles southeast of New Orleans, La., on Mississippi Canyon block 650. Chevron’s deepest offshore production facility, Blind Faith is located in 6,500 feet of water, and with subsea systems located in 7,000 feet of water in Mississippi Canyon blocks 695 and 696.

Gary Luquette, president, Chevron North America Exploration and Production, said, “First oil from Blind Faith is another milestone in Chevron’s efforts to tap the vast deepwater energy resources in the Gulf of Mexico. Chevron is the largest leaseholder in the Gulf of Mexico, where we have a robust program of exploration and production activities, especially in the deep water.”

The Blind Faith discovery well was drilled in June 2001 and encountered more than 200 feet of net pay in Miocene sands at depths of 20,900 feet to 24,300 feet. The field has an estimated gross resource potential exceeding 100 million barrels of oil-equivalent. Chevron holds a 75% working interest in Blind Faith and is the operator, and Anadarko Petroleum Corp. holds the remaining 25% working interest.