BHP Billiton-Petrohawk deal is month's largest

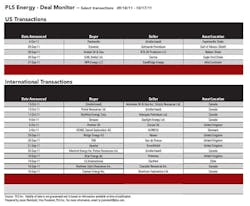

Australia's BHP Billiton Ltd. said July 14 that it will buy Houston-based Petrohawk Energy Corp. for US$12.1 billion in an all-cash offer and will also assume about $3 billion in Petrohawk's debt, bringing the total value to about US$15.1 million. Petrohawk is one of the largest shale gas and oil producers in the US, and this is BHP Billiton's second acquisition of US shale assets this year. The company acquired properties in the Fayetteville Shale in Arkansas from Chesapeake Energy for US$4.75 billion in February.

Laredo Petroleum completed its $1 billion acquisition of fellow US private company Broad Oak Energy Inc. during the 30-day reporting period. Laredo says the combination, its first acquisition since 2008, will bolster the company's position in the Permian Wolfberry oil play, and complement its presence in the liquids-rich Granite Wash play in the Anadarko basin. The deal is the largest Permian-focused acquisition so far this year, almost tripling W&T Offshore's $366 million acquisition in April, accoeding to analysts at Evaluate Energy who also note it is the biggest Permian-focused acquisition since Apache's $2.44 billion purchase of BP assets in July last year.

In transactions involving non-US assets, Australia's Santos signed an agreement to acquire 100% of Eastern Star Gas Ltd. (ESG) and subsequently sell a 20% working interest in ESG's permits in the Gunnedah Basin, northern New South Wales, for A$284 (roughly US$308 million) to TRUenergy Holdings Pty Ltd. Pursuant to the transactions, Santos will assume operatorship and own 80% of ESG's coal seam gas permits with TRUenergy owning the remaining 20%. Based on Santos' closing price of A$13.23 on 15 July, the transaction values ESG at A$924 (US$1 billion).

In another large transaction, Repsol and Alliance Oil announced June 18 that the two companies have agreed to a joint venture to expand their Russian businesses. It is expected that Repsol will initially invest US$400 million in cash to the joint venture. Alliance, who will hold 51%, will contribute US$600 million in producing assets in the Volga-Urals region. Evaluate Energy analysts say the deal gives Repsol access to producing assets in the world's biggest oil and gas producing country. "Alliance will benefit from the joint venture with Repsol beyond the initial cash investment, gaining from the Spanish giant's vast technical expertise," the analysts continued. PLS Energy - Acreage Values of Unconventional Resource Plays – Select Transactions YTD 2011