AUSTRALIA: Eastern Rising PT.II

| This sponsored supplement was produced by Focus Reports. Editorial Directors: Karim Meggaro, Manuel Felipe B. Mendoza Project Coordinator: Merlin Ozkan For exclusive interviews and more info, plus log onto energy.focusreports.net or write to [email protected] |

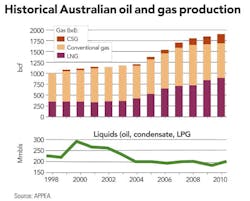

In any continental sized country there exists room for several mega-industrial regions. Not to be outdone by surging offshore activity in Western Australia, the eastern seaboard states of Queensland, New South Wales, and Victoria are developing their own prized assets at a frenetic pace. Onshore coal seam gas (CSG) deposits estimated at 250 trillion cubic feet have the industry abuzz. The viability of their conversion to liquefied natural gas (LNG) received major votes of confidence with recent final investment decisions for two large-scale projects. Meanwhile, Victoria, the birthplace of Australia's oil and gas industry, will soon commence another 40 years of offshore gas production, adding to its already rich history as the source of 30% of the country's gas.

"We see the LNG industry as an opportunity to create a new generation of employment and prosperity in Queensland," says Anna Bligh, the state's premier. "We have just come out of the global financial crisis, and are still building the recovery. We identified the LNG industry as a very important part of rebuilding and creating new industries." Despite the challenges confronting Queensland from devastating floods in early 2011, the burgeoning CSG industry is still gaining momentum. The government has played an instrumental role in creating the correct environment to encourage the development of the world's first CSG-to-LNG projects, and today four liquefaction terminals are planned for the coastal town of Gladstone. Speaking in December 2010, Bligh explained that "the emergence of the CSG and LNG industry is a natural progression from our gas policy – our energy policy – in the early part of this century. But it is equally true that it could not have reached the stage that it has, as quickly as it has in the last 8 months, without enormous focus from government."

As a well-established coal exporter for several decades, Queensland has taken advantage of relatively new technologies to bring gas out of the state's coal seams in response to global shifts towards cleaner energy. As Bligh explains, "these projects are, in both resource and investment terms, as big as the Gorgon Project in Western Australia. They have been brought to regulatory approval and financial decision stage within 2-3 years which in world terms is remarkable."

Eastern flagships

Over the past year huge progress has been made to ensure that Australian CSG-to-LNG will deliver. Of the four mega-LNG projects planned, two have reached final investment decision (FID) totalling over $30 billion, and one has crossed the crucial threshold of environmental approval.

Queensland Gas Company, a subsidiary of British Gas, reached FID for its $15 billion Queensland Curtis LNG Project (QCLNG) in November 2010. A 380 km pipeline will link CSG fields in the Surat Basin to its 8.5 mtpa LNG plant on Curtis Island with first gas expected in 2014.

The Santos-Petronas-Total-Kogas consortium rang in 2011 with FID for its $16 billion, 7.8 mtpa Gladstone LNG (GLNG) project. With first gas expected for 2014, Mark Macfarlane, ceo of GLNG, describes it as "a world class CSG-to-LNG project that will put Gladstone and Queensland on the world LNG stage. It is a project of great significance for Queensland and all of Australia."

The ConocoPhillips and Origin Energy joint venture, Australia-Pacific LNG, gained federal environmental approval in February, paving the way for FID by mid-2011. Still waiting in the wings is environmental approval and FID for Royal Dutch Shell and PetroChina's Arrow Energy LNG project.

Economic studies indicate that a medium-sized 28 mtpa LNG industry – far below what Queensland will produce – could create over 18,000 jobs, generate $40 billion of private sector investment, and increase gross state product by one percent. Output from these four projects will propel Australia to become a top-two global LNG exporter over the coming decade.

A rising tide

Movement from the majors is mobilizing industry across the greater eastern seaboard. Much of the buzz about Queensland and New South Wales CSG stems from the relative proximity of fields to mass markets and their connectivity to existing infrastructure.

Feedstock for LNG is an enticing option. But when considering domestic clean energy targets which favor investment in gas-fired plants, then asset prospectivity becomes highly valued for internal consumption. "New South Wales currently imports 7% of its energy requirements and consumes about 27% of Australia's total energy," states Ian Halstead, ceo of Sydney-based junior Planet Gas. "Another 12-14 gas-fired power plants are projected for construction between now and 2016. Additionally, large scale LNG projects in Queensland will consume much of the gas produced in the eastern Australia, leaving a potential deficit in the domestic market. Planet is targeting that deficit." Backing Halstead's assertion are Planet Gas's well addressed CSG licenses in the Sydney and Gunnedah Basins that are adjacent to existing discoveries; Cooper Basins blocks containing significant thicknesses of coal with high gas formations; and exploratory shale potential in its Cooper reserves. With a diversified portfolio of asset classes in strategically proximate areas to market and infrastructure, Planet Gas embodies the strategy for success of the next generation of CSG-minded juniors.

While gas-fired plants are in the planning phases and the major LNG projects ramp-up construction, some companies have more independent ambitions. Rather than waiting for the big consortia to bring LNG facilities online, Eastern Star Gas is building one of its own. Originally focused on conventional oil and gas, Eastern Star Gas shifted to CSG in 2005 in New South Wales – away from the traditional hotbed of Queensland. David Casey then joined as managing director to apply his 20 years experience in CSG to the company's new assets.

The company currently has three agreements to provide over 1,700 petajoules to domestic power generation companies. But, as Casey explains, "the challenges from a CSG perspective were produceability: the fact that unlike a conventional reservoir you do not get maximum production on day one. Looking at those challenges, we realized that you cannot change how a CSG field can be developed; so we looked at how to liquefy it, and not necessarily at the liquefaction process itself, but rather the size and scaleability."

The company is now progressing to front-end engineering and design on a mid-size LNG plant with Hitachi and Toyo. This is particularly groundbreaking given the size of the company and their ambitions for the future scale of their plant. "Small scale has been done elsewhere," says Casey. "What hasn't been done is looking at a large project using small-scale technology: genuinely looking at a project that could deliver four million tons, but doing it in half million ton increments. One of the attractive qualities for Hitachi and Toyo in dealing with Eastern Star Gas is the opportunity to prove that their technology and their skill sets can actually match world-scale projects, only with smaller trains. The more we look at it the more we get excited by the prospects and the benefits of using smaller scale technology."

Start local, think global

In addition to innovative methodologies, international players have been converging on the state to strengthen their global brands. "In terms of development opportunities there is nowhere in the world that has as many opportunities as Queensland does right now," says Terry Bayliff, Laing O'Rourke's global leader for oil and gas. The British construction giant recently made its first foray into the hydrocarbons sector bringing Bayliff on board to lead the charge after a distinguished career at Bechtel.

The global oil and gas move began in Australia with a contract to build a liquefaction plant for mid-scale specialist LNG Ltd. The deal was suspended when Arrow Energy, the plant's originally slated buyer, was acquired by a Royal Dutch Shell-PetroChina joint venture. Undeterred, Laing O'Rourke has since been awarded contracts for a Gorgon Gas utility project and a BG water treatment plant. The company also recently completed the Dalby Power Project for Origin Energy, which is powered by gas from unconventional fields.

Bayliff is confident in Laing O'Rourke's strengths to compete in a crowded oil and gas construction market. The company specializes in multi-discipline, self-perform construction for which there are few general contractors in Australia. "Most contractors are single discipline," says Bayliff. "They are either civil, mechanical, or they are electrical disciplines. Laing O'Rourke offers a full suite of packages."

Bayliff hopes to use Australia as a springboard for launching Laing O'Rourke's oil and gas offering across the world. "I expect that there will be a period of up to three to five years of growth here in Australia: winning projects and demonstrating excellence in execution. This is the offering we are going to take around the world and it has to be grown here in Australia initially."

The Australian experience that Bayliff aims to replicate at the global level has already come to fruition for another multinational resources contractor, Nacap. The Dutch pipeline construction company looks to Australia for a high benchmark of technical learnings and, more lucratively, 30% of total global turnover. "Australia is somewhat unique in our global pipeline market," says Mark Bumpstead, managing director of Nacap Australia. "Contrary to most other Nacap markets, our pipelines here are characterized by long distances." Indeed, the tyrannies of distance and strict environmental codes in Australia require many service companies to streamline logistics and innovate their operational models. These models will certainly be tested with the construction wave of transmission infrastructure to connect CSG fields to markets. "When considering not just the trunk lines but the upstream gathering facilities, there are many thousands of kilometers of pipelines to be built to support these CSG projects," says Bumpstead.

Daunting as the challenge might be, a company such as Nacap leans on paramount experience. Nacap is currently constructing pipelines for two nationally significant projects – a $5.4 billion desalinization plant in Victoria and 940 km of looping for an Epic Energy pipeline from Queensland to South Australia. Traversing vast stretches of Australian outback, the Epic Energy project, QSN3, is being constructed at astonishing rates of 4 ½ - 5 km per day. As Bumpstead notes, "it is a long way to even walk each day much less construct a pipeline." As a result of successful execution and project delivery, "Nacap worldwide has benefitted very much from its presence here. A lot of the risk management systems, procedures, and practices that we have developed for 'business as usual' in Australia have been taken to Nacap globally."

Aussie rules

Despite Laing O'Rourke and Nacap's success, the trap for new players in the sector can be huge. Australia's rich resources can naturally invoke exuberance amongst service companies from afar. But the country's array of regulatory and environmental codes can prove difficult for new companies who do not fully comprehend the impact of regulations on project delivery. Troy Campbell, ceo of Easternwell Group, Australia's largest integrated well servicing and drilling provider for CSG and mining, concurs. "Foreign companies are entering a very restricted market. There is also a complexity around the logistics and management of operations."

Mat-supported jackups fared well in hurricanesSteve Hearn, managing director and chief geophysicist of Velseis, a Queensland-based geophysics company explains the merits of a local company over larger seismic players, and the challenges of bringing a science-focused company to the market. For the full interview, log onto energy.focusreports.net.

What can Velseis offer to clients that they cannot get from the bigger geophysical companies?

There are definitely some things that the bigger players can offer that are arguably more difficult for us, one of which is volume. Sometimes there will be a need for a company to supply a huge amount of equipment for a very big project. It is possible for Velseis to compete for these projects. We have some long-standing arrangements with rental organizations – when we want to push our channel count up we bring in more gear. However, it is perhaps easier for the larger players to do those types of projects.

Velseis's unique offering comes in the company's ability to tailor a service to a particular problem or technical requirement quickly and efficiently. The company has an effective in-house R&D division, which is perhaps unusual for a company of our size. We routinely do specialized software development - this might be to tune a particular acquisition program, or to model a particular geological problem. This is all about giving our clients customized, scientific service. I am a geophysicist and am always willing to explore something interesting or something new, and I am the one that has to sign off on it. Arguably this enables more flexibility than in some bigger companies where developmental work might be subject to more formal procedures.

A lot of geophysical start-up companies are very science driven, very into innovation, but trying to commercialize that in a competitive marketplace can be difficult. Why is Velseis different?

It is quite possible that if more entrepreneurial people had been running the company, it might have had a totally different direction, but this is the way that it has come out. The people running the company generally make reasonably intelligent decisions on the basis of information available to us. We like to think that there are upsides to the model that we have. There have been plenty of cases with the big geophysical companies starting out as technology driven companies, and at some point in the growth cycle they have moved to having more professional business people running the companies, which hasn't always worked out for the better.

An established local presence and strong market familiarity breed an Australian advantage. Easternwell Group's industry standing is a result of a series of diversifications in response to market needs. Originally focused on well servicing and drilling since 1976, the surge in CSG exploration from 1999 onwards and an oil price spike that attracted foreign players led Easternwell Group to enter new service sectors. By merging into a broader mining services group in 2009 and most recently, joining forces with maintenance and service heavyweight Transfield Services, Easternwell Group now has access, as Campbell describes, "to the front and tail end of projects." Integrated services combined with local market knowledge produce a winning formula for Easternwell Group. "Obviously being an Australian contractor we know the conditions quite well. We specifically design our kit to be compliant to local regulations, but with the restrictions in work crews we innovate the rigs and design the equipment to have the least amount of people operating them."

Local market insight paid dividends for another Australian company further down the value chain. In February 2011, multi-discipline consultancy and specialist engineering firm Synertec was awarded a landmark contract for the QCLNG project. In one of the largest orders to an entirely Australian systems integrator, Synertec will engineer 45 analyzers for lead EPC contractor Bechtel. Managing director Michael Carroll specifically noted Synertec's Australian edge. "In terms of process analytics, one of our big differentiating points is local knowledge which starts with standards and follows right through to environment. Curtis Island, sitting in a hurricane prone area, calls for very complex Australian standards which are not just a derivative of the US or Europe. Bechtel was very engrossed in the rigidity of Australia's standards and dove into specific details with our experts." Originally specialized in process analytics for pharmaceuticals, Synertec diversified into oil and gas as the pharma market consolidated and CSG expanded. The commonality that enabled the shift was expertise in equally complex, risky, and stringently regulated Australian industrial environments.

A growing company still breaking into the CSG market with IP in sampling systems, Carroll is confident that local knowledge, local presence will pave the way for Synertec. "International players are converging on Australia. Australian engineering is innovative and has an in-depth understanding of the regulatory environment that will overlay all of these projects."

Victoria: back to the future

Western Australia and Queensland fittingly grab the lion's share of headlines given the size of their offshore and CSG industries. Yet as the state of Victoria demonstrates, size and industrial weight do not necessarily go hand-in-hand. Resting at the foot of continental Australian and smaller than every state except Tasmania, Victoria was the birthplace of the country's petroleum industry and is still very much a cornerstone of its future.

"Victoria has up to 30 years in proven conventional gas reserves spread across three producing basins – Gippsland, Bass and Otway," says Michael O'Brien, Victoria's minister for energy and resources. "GeoScience Victoria estimates that 4-8 trillion cubic feet of gas remains to be discovered along with up to 600 million barrels of liquids."

Australia's first oil discovery was in Victoria in 1924 at an onshore field with an estimated 50 million barrels of oil in place. In December 1964 the Glomar-III exploration vessel drilled Australia's first significant offshore well and discovered gas. In 1967 the Kingfish-1 well encountered Australia's largest oil field with 1.2 billion barrels recoverable. Fifteen of the Victoria's first 16 offshore wells were successful, yielding three major gas fields and Australia's two largest oil fields to-date.

ExxonMobil, the country's oldest oil and gas company, was instrumental in all of these discoveries. John Dashwood, chairman of ExxonMobil Australia notes that "we have a long history and heritage of developing resources for the benefit of this nation. We have produced two-thirds of the country's oil out of the Gippsland Basin and one-third of the country's cumulative gas. There is indeed a legacy feeling that Australia has been a real jewel in ExxonMobil's history." Modeling the economic impact of its Gippsland Basin Join Venture's operations, ExxonMobil calculates that its Bass Strait hydrocarbon production has generated over $200 billion to Australian GDP over the past four decades.

As Bass Strait oil production declines, gas output still has substantial life ahead. "We are only about halfway through the gas reserves and have a significant number of years to continue to extract gas," adds Dashwood. While production in the Gippsland Basin is 40 years old, we are about to put the biggest steel structure in the Bass Strait – the Marlin B platform – to develop the Turrum field." ExxonMobil Australia's Kipper Tuna Turrum Project is currently one of the largest domestic gas developments on the eastern seaboard. An estimated $4 billion project which holds enough natural gas to power a city of one million people for 35 years, Kipper facility construction is expected to be complete by 2012 and Turrum in 2013. "There are still another couple of decades of production to come from the Bass Strait and a lot of business yet to be done here."

Eyes fixed north

While Victoria's offshore basins are largely the plays of majors such as ExxonMobil, BHP Billiton, and Santos, there is still substantial activity amongst juniors who accumulate acreage through joint ventures and proprietary bidding. Juniors such as Bass Strait Oil Company, Oil Basins, and Cue Energy are all active in coastal Victorian waters.

However, the compelling presence of majors in a relatively confined offshore space leads many Victorian-based juniors to seek more distant markets. Leading the charge of Melbourne-based companies with eyes fixed north is Cue Energy behind its new ceo Mark Paton. With an extensive background in production and operations Paton joined Cue Energy in early 2011 keen to build on its already successful corporate foundation. While Cue joint ventures in the Bass Strait, its operational strengths stem from international markets. Cue Energy is among the rare batch of Australian juniors that enjoys mature production – slightly over half a million barrels in 2010 – through tenements in New Zealand, Indonesia, and Papua New Guinea. The company will see a further production boost when its joint venture Wortel field, operated by Santos, comes onstream in December 2011 in Indonesia.

Paton is now targeting $1 billion market capitalization over the next 3-5 years by combining new exploration plays with maximization of existing assets. "Rather than meteoric growth from a zero base asset, we see value in assets that are near to or in production. We are long on exploration opportunities but short on near term additive production opportunities. I do not want to wholly rely on exploration success for growth."

Although keen to maximize existing production, Cue is equally well-poised to capitalize off exploration in the Carnarvon Basin – Australia's "hot" offshore LNG province. "We have extremely good partners in these blocks," admits Paton, referring to Woodside and Apache. Having firm partnerships with the companies who are looking to aggregate additional gas and build more LNG trains speaks a great deal to the fine work done by my predecessor."

Operating under a similar philosophy is Oil Basins Limited which explores in the offshore Gippsland Basin; offshore Carnarvon Basin; and onshore Canning Basin in Western Australia. Like Cue Energy, Oil Basins' acreage is in strategically proximate areas to existing or future development infrastructure. Since listing on the Australian Stock Exchange in August 2006, Oil Basins has significantly expanded its initial portfolio of two permits and now stands to earn interests in drill-ready assets in both the Gippsland and Canning Basins. The company's upstream interests which hold game-changing potential include 100% rights to Backreef, a low cost oil play in the Canning Basin, and 100% equity in R3 situated in the Carnarvon Basin. Oil in place for the undeveloped Cyrano Oil Field within the R3 block was upwardly revised by 250% in April 2011.

Oil Basins aligned with LNG Ltd last August to evaluate projects in the Canning Basin using future Oil Basins gas as feedstock. Oil Basins will have the right to invest up to 20% on an at-cost basis in any LNG project, with a maximum of 30% should the company deliver certified 2P gas reserves of at least 1 Tcf. A potentially significant long-term investment opportunity, it is consistent with the company's strategy of "sweating the value of its assets" nearby existing or future infrastructure. With the agreement in place, Oil Basins is confident in its ability to attract farm-in interest in its strategic and untapped CSG and shale gas portfolio.

The enabler

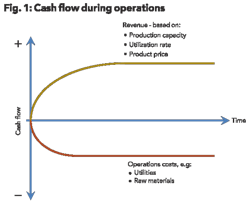

Despite the promise and potential of attractive petroleum plays, life as a junior can be tough in Australia. A long coast, huge mobilization costs, and hefty compliance fees make it difficult for naturally cash-strapped juniors to fund offshore campaigns. The commodity price spike of 2006-2008 exacerbated cost dilemmas while engendering a new model of consortium management to assist juniors exploring offshore.

"The rapid rise in oil prices in 2006 created a worldwide shortage of offshore drilling rigs," says John Bell, ceo and founder of Australian Drilling Associates (ADA). "Every oil company wanted to drill and the demand in Australia was unprecedented. It was also difficult for the smaller independents to get the attention of drilling contractors for a one or two well program, particularly when rig utilization worldwide was peaking at 98%." Recognizing the synergies of scaling costs, the opportunity arose for Bell in 2006 to create consortiums comprised of junior independents and medium sized E&Ps with sufficient terms to attract drilling contractors with rig availability. "The consortium model spread the mobilization and demobilization costs, reduced third party costs as a direct consequence of purchasing volume, and gave flexibility for campaigns to drill more wells with the added commercial benefits normally expected for major oil companies," he explains.

Over the past two years ADA has managed several consortiums which equated to $1 billion worth of exploration and appraisal wells. By coinciding with diminishing recruitment rates of drilling personnel by the majors over the past 20 years, ADA functions, as Bell describes, as "a virtual traditional drilling department where we could make a contribution to the industry by optimizing on personnel resources and drilling equipment. We provide well engineering and well planning; materials and logistics management; procurement of well consumables; contracting of all associated services to drill; HSE management; and well operations management just as any oil companies drilling department would."

Victorian innovation

"Melbourne is Australia's knowledge, innovation and technology capital and is home to a large cluster of research institutes ready to collaborate on innovative cross-sector projects," asserts Minister O'Brien. Outmatched by Western Australia and Queensland on resource size, Victoria's culture of innovation gives it a comparative advantage in cutting-edge hydrocarbon infrastructure. Several gas process engineering firms lead the way in revolutionizing Australia's downstream landscape.

Uhde Shedden, a ThyssenKrupp company specialized in gas processing and multi-disciplinary engineering for the oil and gas and petrochemical sectors, relies on Australia as a fulcrum for rotating talented labor amongst its global projects. "We very much benefit by utilizing Australia as a skills base from which to move smart people around the region for various projects," says managing director Ron van der Schalk. Already a major player in CSG processing, van der Schalk is looking beyond traditional industry to other avenues where Uhde Shedden can build sustainable legacies. According to van der Schalk, Australia lacks a robust national chemical complex to turn energy from natural gas to downstream projects, a void which Uhde Shedden and ThyssenKrupp technologies can fill. Having previously managed Uhde Shedden in Thailand, he admires Thailand's ability to turn natural gas into specialty chemicals through a serious of processing stages whereby converting several dollars per gigajoule of gas to thousands of dollars per ton of chemical product.

Another Achilles heel of Australian oil and gas, and potential Uhde Shedden breakthrough, is the unanswered question of utilizing salt in water that is co-produced with CSG. "We are interested in finding those solutions since part of our business involves understanding how to turn salt into chlorine through the technology of our parent company. We are looking at how to develop solutions that deal with salt and convert it to a potentially marketable product."

More than wishful thinking these technological revolutions have tangible inroads through synergies with parent company ThyssenKrupp's knowledge and expertise. "Because we are part of a larger conglomerate we are looking at how to integrate other 'family company' expertise into our solutions. We are always trying to look for a unique problem and determine the issue at play."

A big stimulus for new technologies is the potential introduction of Australia's much-mooted but still elusive carbon tax which many believe will provide investment certainty. Until that comes, however, Australian companies are taking the lead in creating new markets and forging new trends.

2 questions about LNG to David Dennison, managing director – Wood Mackenzie – AustraliaDo you think that Australia's gas connectivity to foreign markets and the true globalization of LNG will eventually lead to pricing parity between Atlantic and Pacific Basin LNG?

The key question on peoples' minds will instead be, "what will happen to gas prices in Australia?" Anyone who has a gas /LNG project on the eastern side of Australia exposes themselves to oil price linkages. We have a positive view on oil prices in the medium to long term therefore having an attractive LNG project in eastern Australia and exposing yourself to international gas pricing with its inherent oil price link would have its appeal.

The global LNG market has many lump-sum projects coming on stream . Considering increasing supply, voracious Asian demand, and declining LNG production out of Southeast Asia over the next decade, is LNG a buyer's market or a seller's market?

Actually we see the market is quite well balanced. We have however seen prices come off the highs of 2007/08 and there appears to be downward pressure on prices for proponents of the CSG to LNG projects versus the more conventional. The key issue is around cost inflation and the challenge to the more recent projects is to deliver on time and as close to budget as possible. The LNG business is cyclical in nature and not so long ago the race was on to fill the perceived shortfall of gas in the large US gas market. Subsequently we saw the meteoric rise of unconventional gas that has negated the pressing need for LNG into North America.

Pandora's Box

"All I wanted to do was produce facilities and service our customers in a more professional manner than what I had seen in the past," admits Peter Ramsey, founder and managing director of The GLP Group (GLP). "My initial vision was to move into larger projects in alternative energy. However, with the picture being drawn up about the energy boom we quickly got involved with natural gas processing." The pinnacle of that trajectory was launched in February with the opening of Australia's first micro-LNG plant in Tasmania, constructed by GLP. Using BOC/Linde's liquefying phase technology, the country's flagship micro-LNG plant will provide fuel for over 120 natural gas-powered heavy vehicles in the state.

Initially looking to import units from overseas, BOC recognized GLP's engineering flexibility and ultimately contracted with the family-owned company to design, build, and commission the Westbury Micro-LNG plant. According to Ramsey, while GLP originally designed the plant for 50 tons per day of output, recent runs have pushed capacity up to 55 tons per day. "This can be attributed to our optimized process plant design and careful quality control during construction," he notes.

As CSG-to-LNG projects break barriers in size and scale, BOC and GLP are proving that micro-LNG has boundless potential to usher in a mega-trend for transport fuels. With proven technology, micro-LNG is currently used for long haul transport applications. Ramsey, however, believes that future LNG plants will be able to service any fuel consuming commercial transport. "The diesel market in particular will dry up in 5-10 years especially if India and China continue rapid energy consumption growth. The mining sector sees the benefit to convert from diesel to LNG with the idea of having a central LNG processing facility that links to satellite stations for fuel dispatch. I believe that this is where the micro LNG market is headed in the future for Australia." Beyond Australia Ramsey sees micro-LNG as greatly beneficial for countries that cannot afford to build extensive gas pipeline networks. "It is much cheaper to build a central micro LNG processing facility and distribute the LNG by tanker trucks, and get those areas to convert their transport to LNG."

As one Melbourne-based engineering executive confident in the country's ability to continuously break new grounds, stated, "I like to think of Australians as innovative because we challenge the norm. We are an isolated country so we must be ingenuous. When people think of Australia I would like for them to think 'innovative, thorough, and well built." The degree of innovation coming out of Victoria indeed justifies this Aussie assessment.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com