KNOC is acquirer of two largest deals of the month

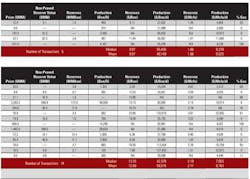

Interest by foreign companies in US unconventional resource plays, particularly shale gas and oil assets, seems to have reached a crescendo. The latest major transaction (and the largest M&A deal of the 30-day period between mid-March and mid-April) was Anadarko Petroleum's decision to sell a one-third interest its Eagle Ford shale assets in South Texas to state-owned Korea National Oil Company (KNOC) for $1.55 billion on March 21. Earlier this year, China's CNOOC signed a $1.3 billion deal with Chesapeake Energy for a share in its oil-rich shale deposits in the Niobrara shale play of northeast Colorado and southeastern Wyoming. Prior to that, Chesapeake and CNOOC inked a similar deal in the Eagle Ford shale. The list of overseas investors in US shale plays goes on and on.

The value of the KNOC-Anadarko deal is estimated at $13,000 to $16,000 per acre and represents among the highest prices ever paid for acreage in the Eagle Ford, which is a high-value play because much of the shale contains crude oil and liquids-rich natural gas that can be sold at a premium over the price of dry gas.

Anadarko says it will not receive any cash up front in the deal, but KNOC will pay for all of the company's 2011 capital costs in the basin. In addition, KNOC will pay 90% of Anadarko's costs until the funds are spent, which is projected to happen by the end of 2013.

The South Korean company receives roughly 80,000 net acres in the Eagle Ford shale and 16,000 additional acres in the adjacent Pearsall Shale, which is primarily dry gas. Jefferies & Co. and Deutsche Bank Securities advised Anadarko on the deal.

Two smaller US transactions involved Tana Exploration and Maritech Resources in the Gulf of Mexico and Eagle Rock and Crow Creek Energy II in the Mid-Continent region.

Houston-based Eagle Rock Energy Partners LP has acquired the assets of Tulsa-based Crow Creek Energy II LLC for $525 million. The offering includes $303 million in Eagle Rock equity to the sellers, who are Crow Creek senior management and Natural Gas Partners VIII LP, which is also Eagle Rock's largest unitholder. The deal also includes $15 million in cash and $207 million in assumed Crow Creek II debt.

The Partnership's lenders have pre-approved an increase of $245 million to Eagle Rock's current $160 million borrowing base related to Crow Creek Energy's reserves, resulting in a total borrowing base of $405 million effective upon closing.

Eagle Rock estimates that the acquired properties contain 268 bcfe of proved oil, gas, and natural gas liquids reserves. The company's core assets include 327 operated wells and 1,040 non-operated wells in the Golden Trend, Cana Shale, Barnett Shale, and other plays.

Maritech Resources, a business unit of Tetra Technologies, will sell its exploration and production properties in the US Gulf of Mexico to Tana Exploration for $222.3 million. The assets include $72 million of associated asset retirement obligations. Tetra says the assets it is selling represent 79% of Maritech's total proven reserves. Both Tetra/Maritech and Tana Exploration are headquartered in Houston.

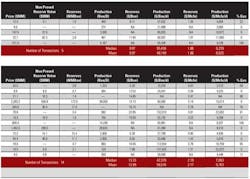

The largest international (non-US) transaction during this 30-day period is KNOC's acquisition of 95% of Altius Holdings for an estimated $515 million, announced on March 21. Altius Holdings owns four oil blocks in Kazakhstan in Central Asia — Akzhar, Besbolek, Karataikyz, and Alimbai — with reserves totaling 56.9 million barrels of oil equivalent, according to a KNOC spokesperson. Altius is the Kazakh arm of Arawak Energy, a unit of closely held commodity trader Vitol Group.

In a smaller international transaction, Grupo C&C Energia (Barbados) Ltd. has acquired oil and gas properties from Ramshorn International Ltd., an oil and gas exploration and production company that is wholly owned by Nabors Industries, which is headquartered in Hamilton, Bermuda, but has its main offices in Houston. The properties sold in the $89 million transaction are located in Colombia.