Revenues increase by 5%, Net income dips 4% in 4Q

Don Stowers, Editor, OGFJ

Laura Bell, Statistics Editor, Oil & Gas Journal

Revenue nudged upwards by 5% in the fourth quarter of 2010 compared with the prior quarter and was up 12% over the fourth quarter of 2009 for the group of companies tracked by Oil & Gas Journal and Oil & Gas Financial Journal. Net income for this same group of companies fell by 4% compared to the prior quarter, but increased by 32% over the same quarter in 2009.

For the 110 companies reporting in 4Q2010, total revenue was $270.7 billion, up $11.7 billion over the $259 billion reported in the third quarter. This was a $29 billion increase over the $241.6 billion reported in the 4Q2009.

Net income for the group decreased by $764.9 million from $21.7 billion in the 3Q2010 to $21 billion in the fourth quarter. However, net income was still up $5 billion from the $16 billion reported in the 4Q2009 to $21 billion in 4Q2010.

Year-to-date capital spending continues to rise. It grew 13% ($15.4 billion) to $137.6 billion in the fourth quarter of 2010 compared to $122.2 billion in the same quarter in 2009. No doubt oilfield service companies are encouraged by the steady increase in capital and exploration spending.

Total asset value for the group increased to $1.19 trillion from $1.16 trillion the previous quarter, a 3% ($33.3 billion) increase. In the last OGJ150 Quarterly report in the February issue, asset value grew 4%. Both quarterly increases are significant. Total assets increased by $118.1 billion (about 11%) over the 4Q2009.

Stockholder equity continued to show gains. Equity for the group rose by $10.1 billion to $576.5 billion, representing a modest 2% increase. Growth from the same quarter a year ago was more dramatic — a $75.2 billion bump (about 15%).

Largest in net income

The 20 largest companies ranked according to net income had more than $21.8 billion in collective net income for the quarter. This compares with just under $21 billion for the entire group of 110 companies on the OGJ150 list. The disparity is because the 90 companies not among the top 20 showed a collective net loss of $893.7 million for the quarter.

The top 3 companies in net income — ExxonMobil, Chevron, and ConocoPhillips — had just over $16.6 billion in net income. This represents roughly 80% of the net profits of all the companies on the list.

The top five companies by net income for the quarter are ExxonMobil ($9.25 billion), Chevron ($5.32 billion), and ConocoPhillips ($2.05 billion). They are followed by Occidental Petroleum ($1.21 billion), Marathon Oil ($706 million), Apache Corp. ($689 million), Devon Energy ($562 million), Quicksilver Resources ($317 million), Kinder Morgan CO2 Co. LP ($254 million), and Chesapeake Energy ($223 million).

Leaders in stockholder equity

Combined stockholder equity for the top 20 companies grew by nearly $10 billion from $524.3 billion in the 3Q2010 to $534.3 billion in the fourth quarter — about a 2% increase.

Although the order changed slightly, there were no changes in the 20 companies that comprise the top 20 in stockholder equity. The 10 largest in this category are, in order: ExxonMobil, Chevron, ConocoPhillips, Occidental, Apache, Marathon, Anadarko Petroleum, Devon, Hess Corp., and Chesapeake.

Largest in total revenue

Most of the top 20 companies ranked by total revenue held their positions. The top 10 in order are ExxonMobil, Chevron, ConocoPhillips, Marathon, Hess, Murphy Oil Corp., Occidental, Apache, Anadarko, and Devon.

Total revenue for the top 20 companies increased by nearly $11.9 billion from $250.9 billion in the 3Q2010 to $262.8 billion in the fourth quarter. This represents a 5% increase.

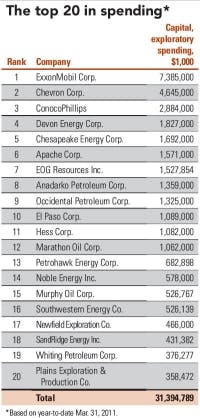

Top spenders

For the second consecutive quarter, the top 20 companies in spending showed a dramatic increase in spending over the prior quarter. Spending for the group grew from $81.7 billion in the third quarter to a whopping $117.4 billion in the fourth — an increase of $35.7 billion, or a 44% rise in capex. This follows on the heels of a 64% increase in capex from the second to the third quarter of 2010, which would seem to indicate a significant spending trend.

Top spenders were, in order, ExxonMobil, Chevron, ConocoPhillips, Devon, EOG Resources, Hess, Chesapeake, Anadarko, Marathon, and Apache.

Key changes from previous quarter

American Oil & Gas Inc. dropped off the list because it merged with Hess Corp. Atlas Energy Inc. was acquired by Chevron. Mariner Energy merged with Apache and Petroleum Development Corp. changed its name to PDC Energy.

Fastest-growing companies

Houston-based Swift Energy Co. takes top honors as the fastest-growing company for the quarter with a 21.3% increase in stockholders' equity over the previous quarter. Swift also showed a 10.6% increase in net income for the quarter.

Swift is an independent E&P company currently ranked #46 on the OGJ150 list by total assets. The company is focused on four core areas — South Texas, Southeast Louisiana, South Louisiana, and Central Louisiana/East Texas. A company spokesman says that Swift's strategy is based on a mix of exploratory and development drilling and producing property acquisitions with a continual rebalancing of drilling and acquisitions in response to changing industry conditions and strategic opportunities.

Oklahoma City-based Gulfport Energy Corp. was the second-fastest-growing company in the quarter. Gulfport had an 8.0% increase in stockholders' equity over the previous quarter and a 12.9% increase in net income.

Gulfport has operations in the Permian Basin of West Texas, South Louisiana, in the Niobrara shale play in Colorado, in the Alberta oil sands in Canada, and in Thailand.

Click here to download the pdf of the OGJ150 Quarterly

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com