Net income dips by $2.7B, but still up 42% over 3Q09

Don Stowers, Editor, OGFJ

Laura Bell, Statistics Editor, Oil & Gas Journal

While revenues have made a rebound from the economic doldrums of 2009, net income for the OGJ150 group of companies slipped a little in the third quarter of 2010, with a few notable exceptions.

For the group of companies tracked by Oil & Gas Journal and Oil & Gas Financial Journal, net income fell by 11% (about $2.7 billion) in the third quarter of 2010 compared to the previous quarter. However, income increased by 42% (around $6.4 billion) compared to the third quarter of 2009. Total net income for the OGJ150 group of companies was $21.7 billion for the quarter.

Total revenue for the group exceeded $259 billion, a 1% increase (roughly $2.0 billion) from the second to the third quarter of 2010. However, the upward surge reflected a 17% ($37.5 billion) bump over the same quarter a year ago in 2009.

Year-to-date capital spending rose from $87 billion in the third quarter of 2009 to $96 billion in the same quarter a year later, representing an 11% increase.

Total assets for the group increased to $1.16 trillion from $1.12 trillion the previous quarter, representing about a 4% gain. This is a significant increase for one quarter. Last quarter, total assets grew by just 0.84%. Total assets increased by $100.1 billion (about 10%) over the third quarter of 2009.

Stockholder equity continues to grow as well, which is good news for investors. Equity for the group rose by $22.9 billion to $566.4 billion, a 5% increase. Growth from the same quarter a year ago was even more dramatic – a $75.2 billion bump (about 16%).

Largest in net income

The 20 largest companies ranked according to income had more than $22.8 billion in collective net income. This compares with just $21.7 billion for the entire group of 127 companies on the OGJ150 list. The disparity is because the other 107 companies ranked behind the top 20 showed a collective net loss of $1.1 billion.

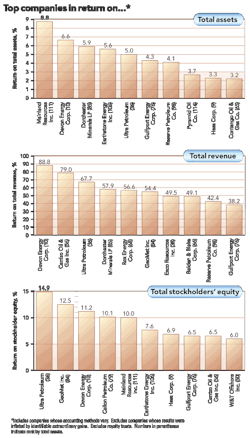

The top five companies by net income for the quarter are ExxonMobil Corp. ($7.6 billion), Chevron Corp. ($3.8 billion), ConocoPhillips ($3.1 billion), Devon Energy Corp. ($2.1 billion), and Occidental Petroleum Corp. ($1.2 billion). The next five include Hess Corp. ($1.1 billion), Apache Corp. ($778 million), Marathon Oil Corp. ($696 billion), Chesapeake Energy Corp. ($558 million), and SandRidge Energy Corp. ($308 million) – a new addition to the top 20 income-earners and the OGJ150 Quarterly.

Other companies that moved up into the top 20 in income are Ultra Petroleum, Newfield Exploration Co., and Petrohawk Energy Corp. Falling out of the top 20 this quarter are Exco Resources Inc., Denbury Resources Inc., Whiting Petroleum Corp., and Concho Resources Inc.

Leaders in stockholder equity

Looking at the top 20 companies ranked according to stockholders' equity, there were few changes from the prior quarter. The top five companies remain ExxonMobil, Chevron, ConocoPhillips, Occidental Petroleum, and Marathon Oil. Apache Corp. and Anadarko Petroleum switched places with Apache moving up to No. 6 and Anadarko falling a notch to No. 7. Hess and Chesapeake did the same with Hess moving to No. 9 and Chesapeake falling one place to No. 10. No. 20 Southwestern Energy fell out of the top 20, and QEP Resources took over that position.

Largest in total revenue

Most of the top 20 companies ranked by total revenue held their positions. The top 10 in order are ExxonMobil, Chevron, ConocoPhillips, Marathon, Hess, Murphy Oil, Occidental, Apache, Chesapeake, and Anadarko. Chesapeake moved up from No. 11 to the No. 9 position. Anadarko dropped one spot to No. 10. Devon fell from No. 10 to No. 11. Southwestern moved up one spot to No. 16, while Pioneer Natural Resources fell from No. 16 to No. 17. Denbury moved up to No. 18 and Newfield fell one spot to No. 20. Cimarex Energy dropped off the list, while QEP Resources entered the list at the No. 18 position.

Top spenders

The top 20 companies in spending showed a dramatic increase in capital spending over the previous quarter. Spending for the group grew from $50 billion in the second quarter of 2010 to $81.7 billion in the third quarter – an increase of $31.7 billion, or a 64% rise in capex.

Top spenders, in order, were ExxonMobil, Chevron, ConocoPhillips, Devon, EOG Resources, Chesapeake, Marathon, Anadarko, Hess, and Apache. New additions to the top 20 spenders are QEP Resources (No. 18 on the list) and Pioneer Natural Resources (No. 19). Plains Exploration and Production Co. (previously No. 18 on the 2Q10 list) and Continental Resources Inc. (previously No. 20) fell off the list of top 20 spenders.

Fastest-growing companies

Ultra Petroleum takes top honors as the fastest-growing company for the quarter with an 18.1% increase in stockholders' equity over the 2Q10. The company also showed a 164.5% rise in net income over the prior quarter.

Houston-based Ultra Petroleum is an independent E&P company focused on developing its long-life natural gas reserves in the Green River Basin of Wyoming – the Pinedale and Jonah fields – and is in the early exploration and development stages in the Appalachian Basin of Pennsylvania – the Marcellus Shale.

Devon Energy (10.8% growth in stockholders' equity) and El Paso Corp. (10.4% growth) were the second and third fastest-growing companies in the third quarter of 2010.

Click here to download the pdf of the Quarter ending Sept. 30, 2010

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com