Fracturing and completion expertise boosts Liberty Resources in Bakken

Liberty Resources turning the drillbit in the Bakken

All photos courtesy of Liberty Resources.

EDITOR'S NOTE: OGFJ's editor, Don Stowers, recently spoke with the management team at privately held Liberty Resources LLC about their company's operations and plans for the coming year. Chris Wright is CEO; Mark Pearson is company president; and Paul Vitek serves as CFO. All three executives have extensive experience in hydraulic fracturing and well completion technology. Denver-based Liberty is a Riverstone Holdings portfolio company. |

OIL & GAS FINANCIAL JOURNAL: Liberty Resources' focus is the Bakken shale play. Can you tell our readers about your background and your decision to start up your own E&P company?

CHRIS WRIGHT: The decision to start Liberty Resources was driven by changes in the way oil and gas reservoirs are being developed and our specific areas of expertise. The process of drilling oil and gas wells has changed dramatically in recent years. If you look back 15 years, a typical well cost $1 million to drill and $150,000 to frac. Today, in unconventional reservoirs – and the Bakken in particular, we're spending $4 million to drill a well and $4 million to $5 million to frac and complete it. Fracturing has changed from a production enhancement process after drilling to the central process in connecting hydrocarbons to horizontal wellbores in unconventional reservoirs. Advances in fracturing practices, together with advances in horizontal drilling and completion practices, have enabled the unconventional resource revolution. We recognized immediately that hydraulic fracturing would be a key differentiator in creating value in the Bakken and we assembled a team with that expertise. Many of us have spent the vast majority of our careers in hydraulic fracturing. We understand the technology of hydraulic fracturing, the application of hydraulic fracturing, and the products and services critical to hydraulic fracturing…we're frac guys.

OGFJ: Could you elaborate a little on your individual backgrounds in fracturing? What role did this play in securing the necessary funding for operating in a play like the Bakken where drilling and completion costs are through the roof?

WRIGHT: Prior to forming Liberty Resources, Mark Pearson and I both developed and utilized hydraulic fracturing techniques and products in the service sector and the E&P industry. Mark came to prominence in the fracturing world more than 20 years ago. Immediately after completing his PhD in hydraulic fracturing in England, Mark came to the US where the majority of hydraulic fracturing was taking place. While working for ARCO, Mark had tremendous success in pioneering fracturing and completion approaches for the more permeable reservoirs of the Alaskan North Slope where maximum frac conductivity was the central issue. Later, he was a professor at the Colorado School of Mines where he taught fracturing and completion technology. Following his time at Colorado School of Mines, he moved over to the service and supply side of the business and served as president and CEO of CARBO Ceramics, the world's largest manufacturer of high conductivity ceramic proppants.

OGFJ: How about your background, Chris?

WRIGHT: Like Mark, I'm a career frac guy. After leading an effort to develop a hydraulic fracturing modeling system that is still the world's most widely used, I founded Pinnacle Technologies in 1992 to develop fracture mapping technology so the industry could see how hydraulic fractures actually propagate in reservoirs. I was CEO of Pinnacle for 14 years and learned a great deal about how hydraulic fractures grow. Pinnacle's fracture mapping technologies and design expertise were very instrumental in Mitchell Energy's radically changed approach to Barnett Shale fracture designs. This abrupt change helped launch the revolution in unconventional reservoir development. Our work with Mitchell produced the first wells with several million square feet of reservoir contact area, where previously around one hundred thousand square feet was the maximum. In addition to founding Pinnacle, I was also a partner in recapitalizing a small E&P company named Stroud Energy. We raised significant capital and I became Chairman of the company. Together with a great CEO (Pat Noyes) we moved into the Barnett Shale and grew rapidly. As we were preparing to complete an IPO in May 2006, we sold Stroud to Range Resources.

OGFJ: Paul, how did you get involved in this and what is your role?

PAUL VITEK: After spending my early career with Diamond Shamrock/Maxus Energy on the E&P side of the industry, I joined CARBO Ceramics where I served as CFO for over 20 years. I worked closely with Mark and Chris during my tenure at CARBO and knew that their knowledge of hydraulic fracturing was world class. When they called me to assist in raising capital for an E&P venture in the Bakken, I did not hesitate to join the team. My primary role has been to handle day-to-day finance and administration issues while continuing to explore financing alternatives to fund future growth.

OGFJ: How smooth or rough was it to transition from a service provider to the operator side of the business? I understand that Liberty Resources is a portfolio company of Riverstone Holdings.

PEARSON: While we continue to learn new things on a daily basis, it has not been a difficult transition to date. The founders of the company have considerable direct experience in the E&P sector and throughout their careers in the service sector have worked closely with operators in solving problems they had in the field. In fact we are again in both the service and E&P sectors with our recent launch of Liberty Oilfield Services. We have assembled teams with considerable operating experience in both our E&P and service companies. As for our relationship with Riverstone, we met with a number of potential private equity partners while forming Liberty but chose Riverstone as our lead backer due to their extensive knowledge of the industry and their compatible working style.

WRIGHT: The original idea was for Liberty Resources to raise money from individuals that we knew and who had invested with us in the past. We were able to line up about $50 million from these individuals but quickly realized that the Bakken opportunity was larger and moving more quickly than we originally appreciated, so we decided to raise institutional equity as well. I had done previous transactions with Riverstone and knew them well. We had a comfort level and compatibility with each other, so we were able to close a deal with them very quickly. Riverstone has been a terrific partner and enabled a dramatic expansion from our original plans. Our current equity structure includes both institutional money and side-by-side money from individuals.

Liberty Resources Team

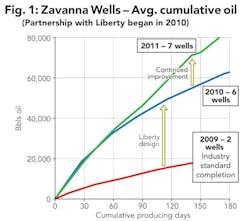

We completed our first land acquisitions with Zavanna LLC, a savvy Denver-based company that had acquired Bakken acreage quite early. We brought Zavanna a different approach to completing Bakken wells with our fracturing expertise. Using a fracture design developed by Mark, Zavanna's well performance improved by a factor of two to three times (see Figure 1). That opened the door for our first transaction, which was essentially an acreage deal following which we agreed to continue to provide fracturing and completion technology. Since that initial transaction, we have completed nearly a dozen additional acreage transactions. Our fracturing and completion expertise has been instrumental in getting deals done as we have allowed the sellers of the acreage to remain as working interest partners. The vast majority of the acreage we have today came from creative deals based on our fracturing expertise. We now have nearly 44,000 net acres in the Central Basin of the Bakken and we control the fracturing and completion expenditures on the wells in about 80% of that acreage. We feel fortunate to have founded the company in September of last year and to be in this position today.

OGFJ: Who is the operator on these wells, Liberty Resources or the other companies?

WRIGHT: We currently have two operated drilling rigs on which we control all drilling and completion activities. Zavanna also has two operated drilling rigs and we are the largest working interest owner in the majority of those wells. On the Zavanna operated rigs, they control the drilling activities and we are providing the fracturing and completion operations. So we control the fracturing and completion operations for four rigs at the present time. The other 20% of our development is fully non-operated.

While we have great confidence in our ability to design fracture treatments for the Bakken, execution represents a potential problem. The rapid growth in demand for hydraulic fracturing services has led to three things: 1) constricted availability of supply to get wells fractured; 2) high prices for fracturing services; and 3) relatively low service quality. Based on our background in oilfield service and supply, we decided to form a company that could supply these services in a timely fashion with high quality and reliability. In March of this year, we formed Liberty Oilfield Services, which recently began fracturing operations in Williston. Liberty Oilfield Services will be the fracturing entity for the majority of our development. We have had great early success in building the team for this company, starting with hiring two individuals we knew well as our service leadership: our business manager for Liberty Oilfield Services has a PhD in hydraulic fracturing, and our operations manager has a distinguished career in operational excellence.

OGFJ: What completion technologies are you and your team utilizing? Does your understanding of the geology across your acreage footprint lead you to believe you can implement the same completion designs on all your wells?

WRIGHT: The unconventional resource revolution began when it became possible to create millions of square feet of reservoir contact area from a single well. To develop unconventional reservoirs, you need two things – contact area with the reservoir rock and conductivity in fractures. With a vertical well and a single fracture you get a limited amount of reservoir contact area. Unconventional reservoirs are 10 to 100 times less permeable than conventional reservoirs, so you need massively more contact area to make the wells economic. Without the massive contact area, it's uneconomic to conduct those fluids back to the wellbore.

Unconventional development moved to liquid-rich or oil reservoirs by also maximizing fracturing conductivity. Of course you need a sufficient resource in place but, beyond having viable rocks, production performance is driven by the Two C's: Contact area and Conductivity.

In liquid-rich or unconventional oil reservoirs, operators have typically sacrificed some contact area to maximize fracture conductivity. They have done this by lowering fluid volumes, pumping gelled fluids, and altering completion practices. We came to the Bakken intent on maximizing both contact area and conductivity. Our goal for a Bakken well is to expose five million square feet of reservoir contact area per well. To the best of our knowledge we are the only Bakken operators employing large volume slick water fracturing to place millions of pounds of ceramic proppant. So far the results have been very encouraging (See Figures 1 and 2).

There are nearly 20 different operators with more than five wells in the Central Basin and there is a remarkably wide spectrum of average well performance among these operators. Our belief is that Central Basin well performance reflects primarily the different completion performance of the operators. The bar-graph (see Figure 2) shows the strength of our production performance to date.

To make a highly successful Bakken well we need to average about one tablespoon of oil production per day per square foot of exposed reservoir area over the first year of production. However, if we can get only a teaspoon of oil out of that square foot, it doesn't work. It's not an economic well.

OGFJ: Brigham Exploration is being acquired by Norway's Statoil. As one of the early players in the Central Basin, Brigham was able to acquire acreage at a fairly low cost. As a relative newcomer, it must have cost Liberty considerably more.

WRIGHT: We certainly were not one of the early entrants in the basin. Yet we are quite comfortable with the economics of our investment based on our expected well results with our fracturing technology. EOG and Whiting were really the pioneers of the North Dakota Bakken. Their geologists found the sweet spots, which they developed, and put the Bakken on the map. However, it's a little trickier to make things work in the Central Basin of the Bakken. Early attempts were not successful. It took a different fracturing approach to make things work and Brigham was the first to do that. They deserve tremendous credit for opening up the vast region that is the Central Basin.

OGFJ: Given the high cost of drilling and completing wells in the Bakken shale, what is your breakeven point for the price of crude for these wells to be economical? With $90 and $100 oil, it may be worthwhile, but what if the price drops significantly in the future?

WRIGHT: Our breakeven price is probably around $50 right now, but this will drop with time. $90-plus oil makes for extremely attractive economics.

PEARSON: Newer technologies are critical to development in the Williston Basin and definitely impact the economics. All but one rig currently drilling in North Dakota is drilling a horizontal well. You cannot make a well work here with vertical drilling and conventional fracturing. Horizontal wells without good multi-stage fracturing don't work either.

OGFJ: How unique is the Bakken compared to other shale formations? Is the drilling and completion technology applicable in one shale play transferable to another, particularly the Bakken, which is an oil play?

PEARSON: The technology being deployed in various reservoirs is fundamentally the same. However, the details vary significantly from reservoir to reservoir. The permeability of the shale, natural fracturing, and other reservoir characteristics are all different, but the overall approach of horizontal drilling with multi-stage fracturing to maximize contact area and conductivity are the same in any shale reservoir. The key to successful completions is understanding the differences in the reservoirs and designing an appropriate strategy.

OGFJ: Can you describe the midstream infrastructure situation in the Bakken? Do producers like Liberty have problems transporting crude due to lack of infrastructure and takeaway capacity constraints?

PEARSON: Capacity seems to be increasing almost in step with production. The infrastructure is very dynamic with oil being moved by rail, truck, barge and pipeline. Most of the larger operators have the ability to utilize any of these alternatives. For the smaller operators, there are a number of midstream companies that will provide monthly quotes for oil and will purchase oil at the wellhead. While the infrastructure for oil has kept pace with the growth in production, there is more of an infrastructure issue for gas. We are operating in the Central Basin of the Bakken where there are gas pipelines, but not enough of them. So there is a big push for infrastructure, which will further enhance production economics as it gets built out.

OGFJ: How do you plan to meet your capex needs during 2012, and when do you expect to be able to operate from cash flow?

VITEK: We have a number of different avenues to finance our development drilling program. We've been very successful with our land acquisition program and probably spent more on land quicker than we had anticipated. But our private equity partner has been pleased with those land acquisitions and is increasing their capital commitment to fund drilling. This is key as we are moving into a period in which we'll be rapidly ramping up drilling activity. The production profile of Bakken wells is that they generate significant cash flow upon initial production, and that will provide a base that will allow us to put in place a reserve base borrowing facility with commercial banks. We expect to have that in place shortly. There are a number of different avenues we could explore later in 2012 if the pace of drilling exceeds our expectations, including royalty trusts. We set this company up from the start so that we would have maximum financial flexibility. Although we wouldn't anticipate an initial public offering, we all have experience in running public companies and that's also an avenue we could explore.

OGFJ: How far ahead do you plan?

VITEK: We have currently planned through the drilling program that will hold all our acreage by production by mid-2013. At some point next year we will make a decision as to how quickly we want to do infill drilling and how we will finance that drilling.

OGFJ: Are you looking at other drilling targets than the Bakken, for example the Three Forks? Or are you solely focused on the Bakken at this point?

PEARSON: We've been intrigued from the start by the prospect of expanding into other horizons. The Three Forks is one of those, but there are other targets above and below the Bakken. For now, we're watching the efforts of some of the other players around us and they are drilling successful Three Forks wells so it's absolutely part of our portfolio. However we won't move on other horizons until we think the timing is appropriate.

OGFJ: What was your reaction to the news that Statoil is acquiring Brigham Exploration, one of the early operators in the Bakken? Will this have any effect on Liberty Resources?

WRIGHT: We expected that eventually there would be major consolidation. Perhaps it is happening faster than expected. We're glad we moved quickly on our acreage acquisitions. The amount of oil present not only in the Middle Bakken but in the other drilling horizons in the Williston Basin is substantially better than most people thought it was. When a company like Statoil moves in, that reinforces our belief.

Liberty Oilfield Services rigged-up to frac

PEARSON: What really attracted us to this venture is that in the Central Basin area, there had been 500 wells that penetrated through the Middle Bakken before the first Middle Bakken well was drilled in 2006. Everybody knew about the resource in place because it had been logged, but the industry hadn't cracked the nut with respect to how to develop the resource. As Chris said, Statoil's entry into the basin reaffirms our belief in the long-term potential. We are quite bullish on the Bakken's future and suspect that within the next three to five years production may exceed one million barrels of oil per day out of the Williston Basin.

OGFJ: Where does Liberty Resources go from here?

WRIGHT: The important thing to remember is that we are here to create value for our investors and ourselves. That will dictate the route that we take. All three of us have taken companies public and have experience in public markets if the decision is made to go that route. We think we have a team in place that has the capability to pursue the best value-creation route, public or private. We'll be looking to partner in other basins and seize on other opportunities, wherever our experience and our expertise can create value.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com