Wastewater technologies critical for continued growth of Marcellus

Kyle Wendel, GE Power & Water, Bellevue, Washington

In the last few years, Pennsylvania has experienced tremendous growth in shale gas production through the development of the massive Marcellus Shale. The number of natural gas wells drilled has increased from 195 in 2008 to over 1,000 in the first half of 2011. This growth has been driven by the use of horizontal drilling and hydraulic fracturing, which uses large volumes of water combined with sand and chemicals to "fracture" the earth, allowing the extraction of the gas.

Roughly speaking, each well requires 2.0 million to 6.5 million gallons, or 50,000 to 150,000 barrels, of water to fracture each well. In the first 30 days, roughly 15% to 25% of this water flows back to the surface. The remainder of the water flows back in decreasing volumes over numerous years. This year in Pennsylvania over 2,000 wells will be drilled in the Marcellus Shale, generating around 25 million barrels of wastewater.

The Pennsylvania Department of Environmental Production (PADEP) has been proactive in its response to the growth in shale gas development in its state. In 2010, the DEP under Secretary John Hanger along with Governor Ed Rendell passed Chapter 95, which limited as of Jan. 1, 2011, the discharge of wastewater greater than 500 parts per million (ppm) of total dissolved solids (TDS) to Pennsylvania rivers. Then in April of 2011, the DEP backed by new Secretary Mike Krancer and Governor Tom Corbett strengthened these regulations by calling on producers to stop delivering wastewater from shale gas extraction to 15 facilities that were exempt from Chapter 95.

The PADEP publishes a website that provides a high level of transparency into the shale gas drilling activities in the state. Specifically with respect to wastewater, the website categorizes every barrel that is generated and specifies the time period, the county, the producer, and the method of disposal. This article analyzes the data from this website to provide an overall landscape of the shale gas wastewater in Pennsylvania.

There are numerous types of waste products identified in the waste reports. For the purpose of this analysis, all solid wastes such as drill cuttings and flowback fracturing sand are not included. Additionally, servicing fluid, spent lubricant, and basic sediment are also not included. The three waste types that were analyzed were broken down into three categories: frac fluid, brine and drilling fluid. The data set looks at these wastes over three six-month periods: 1H 2010, 2H 2010 and the 1H 2011 (Note: the 1H 2010 data is estimated based on a 12-month period of July 2009 to June 2010).

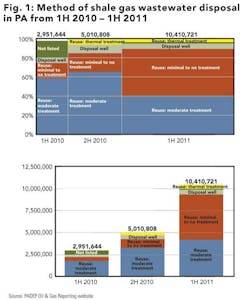

Overall the volume of wastewater generated from shale gas operations in Pennsylvania grew by more than 250% from nearly 3 million barrels in the first half of 2010 to over 10 million barrels in the first half of 2011. Given increased disposal regulations and the high cost of transporting the wastewater to out-of-state disposal wells, the majority of the wastewater is being "reused."

The term reused is fairly broadly defined within the industry as there are multiple types of treatment the wastewater undergoes before it is reused. On one end of the spectrum the wastewater is not treated at all and reused in future drilling, plugging or hydraulic fracturing operations. On the other end of the spectrum the water is transported to a thermal treatment facility where the wastewater is pretreated to remove solids, hardness and heavy metals and then evaporated to remove the salts creating a pure distillate that is then reused in future hydraulic fracturing operations. The highly concentrated brine is then transported to disposal wells.

The vast majority of the wastewater is currently undergoing minimal treatment where the solids are removed using a filter and then being reused. Except in the case of thermal evaporative treatment, this water still contains high levels of hardness, heavy metals and total dissolved solids so it must be blended with large volumes of freshwater before it is reused.

Given the large cost of transporting wastewater to central industrial treatment facilities, water treatment companies are developing mobile solutions ranging from conventional technologies which provide moderate treatment removing solids, hardness and heavy metals to thermal technologies which remove the high level (>100,000 ppm) of sodium chloride found in Marcellus flowback and produced waters. Thermal treatment creates a pure distillate and concentrated brine which reduces the volume of fresh water and wastewater that needs to be transported to and from the drilling site as well as the associated truck traffic.

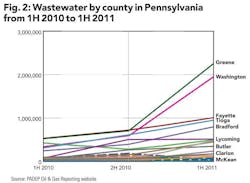

The DEP website also breaks down the volume of wastewater by county. The three top producing counties in Pennsylvania are Greene, Washington, and Fayette, which are located in the southwest corner of the state near West Virginia. The next three – Tioga, Bradford, and Lycoming – are located in the north-central part of the state near New York. These (north central) counties actually represent the majority of the wells drilled in the first half of 2011, yet this region is producing less wastewater. This could be the result of a multitude of factors, but most likely is being caused by the "capping" of these wells, so they can be produced at a later date.

Over the last two years, there has been significant consolidation among producers in the Marcellus Shale. Notably, the international oil companies (IOCs) have invested heavily in the region by acquiring some of the larger local and independents producers. In 2010, Chevron acquired Atlas Energy for $3.2 billion, Shell acquired East Resources for $4.7 billion, and Exxon purchased XTO Energy for $31 billion. Exxon also added Phillips Resources for $1.7 billion earlier this year.

With the emergence of IOCs like Chevron, Shell, and Exxon, combined with recent State of Pennsylvania regulations, there is a greater emphasis in pursuing technologies that not only improve the economics of shale gas development but also limit its environmental impact. Wastewater treatment and reuse technologies will be critical for the continued growth of the Marcellus Shale as wastewater volumes continue to rise.

About the author

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com