UK, Canadian assets command month's largest sums

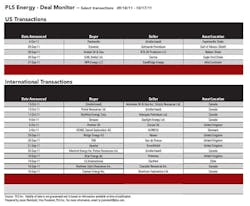

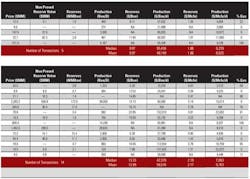

Sinopec added to China's Canadian asset grab in the largest deal of the 30-day period from mid-September to mid-October with its $2.9 billion (including debt) takeover of Daylight Energy Inc. Sinopec achieved a recommendation from the board of Daylight by offering C$10.08 per share, a substantial premium over the $4.59 trading price of Daylight Energy one day prior to the offer. In addition to a company 67% weighted towards gas with a majority of reserves already developed, Alberta-based Daylight offers additional upside with its land holdings in both the Montney and emerging Duvernay shale plays. In his weekly analysts of M&A deals for OGFJ, Evaluate Energy analyst Eoin Coyne points out the acquisition metrics after the upside and tax pools have been considered equates to under $18 per proved boe.

In the first of a handful of deals involving UK assets, Apache agreed to acquire a mature portfolio of UK North Sea assets from ExxonMobil for $1.75 billion. The deal, announced September 21, is the largest in the region since the UK government increased the supplementary tax rate to 32% in the March 2011 budget, which increased the tax burden for some fields to 82%, noted Coyne. "The portfolio of assets acquired from ExxonMobil is weighted 70% towards oil and the cash consideration equates to an unadjusted cost per proved barrel of $26. Factoring in the valuation of the midstream and exploration assets that are part of the deal however decreases the cost per barrel to a more respectable $19," Coyne continued. Apache gained entry into the region in 2003 via the Forties field and hopes to use experience from the field to extend the current 6.5-year reserve life of the recently purchased assets.

The second largest UK asset transaction of the period saw Italy's ENI commit $844 million to acquire GDF SUEZ's 10.4% interest in the Elgin-Franklin gas condenstate fields in the UK North Sea. The acquisition adds to Eni's current 21.8% interest in the fields.

In yet another UK North Sea asset transaction, Premier Oil made an offer for fellow North Sea exploration company Encore Oil for $325 million (net of cash held by Encore).

In the US, NFR Energy was the buyer in one of the period's largest deals. On September 27 the company announced its acquisition of natural gas assets in East Texas from SandRidge Energy for $231 million. The sold properties include approximately 25,000 net acres with average 2011 production of approximately 25 MMcfed. Transaction metrics calculated by NFR Energy sit at $7,092 per flowing Mcfe/d (LTM), and $1.38/Mcfe of PDP reserves, $0.46 Mcfe of total proved. According to an NFR conference presentation October 11, the assets, mainly in Harrison and Rusk counties, offer a strong liquids component and are considered to be an excellent bolt-on acquisition to the company's current East Texas position.