OGFJ100P company update

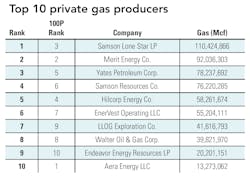

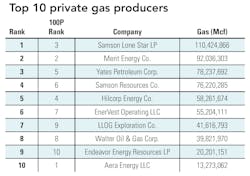

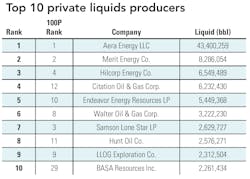

IHS Herold Inc., the independent research firm, has provided OGFJ with updated production data for our periodic ranking of US-based private E&P companies. The rankings provided by IHS are based on operated production only within the US. In this issue, the production data provided is year-to-date 2009.

Top 10

From the previous listing in October there were a few position changes amongst the largest private companies. In October, Yates Petroleum held the No. 4 spot. Currently, Yates is ranked No. 5 behind Samson Lone Star LLP and Hilcorp Energy Co. The companies currently rank No. 3 and No. 4 compared to their rankings of No. 3 and No. 6, respectively, in October. Dallas-based Hunt Oil Co. dropped out of the Top 10 in this issue, from No. 8 to No. 11, as did Mewbourne Oil Co. from No. 9 to No. 13.

Additions

Three new companies appear on the list this month. Talon Oil and Gas, Orion Energy Partners, and Border to Border Exploration appear on the ever-evolving list.

Dallas-based Talon, an EnCap Investments LP-backed company, makes it debut with a bang at No. 22. In June, the company acquired a 60% interest in Denbury Resources Inc.'s Barnett shale assets for $270 million. During 2008, the acquired interest averaged nearly 45.7 million cubic feet equivalent per day (77% gas).

Talon has interests in East Texas in Nacogdoches County with a focus on the Travis Peak formation, as well as the Texas Panhandle in Hemphill and Wheeler counties with a focus on the Granite wash.

Further down the list at No. 95, another newbie is Denver-based Orion Energy Partners. In June, the Independent Petroleum Association of Mountain States (IPAMS) honored Orion CEO and partner Jim Lightner with the Wildcatter of the Year award.

Austin-based Border to Border Exploration also appears on the list for the first time. In at No. 97, Border to Border is focused on the Austin Chalk Trend, the Barnett Shale play, and the Bossier Trend.

On the flipside, two companies fell significantly in the ratings…Smith Production and LCX Energy.

Smith Production fell from its October spot at No. 24 to its current position at No. 77.

Also falling hard in the ranks is Midland, Tex.-based LCX Energy. Previously, the company ranked No. 41. To date, the company, one of Edge Petroleum's largest unsecured creditors, is no longer in the top 100. Edge Petroleum filed for Chapter 11 bankruptcy in October.

Transactions

Various transactions occurred in the private company space since the October issue went to print.

Like public companies, private companies are actively working their gas assets.

Dallas-based Chief Oil & Gas LLC recently increased its leasehold in the Marcellus Shale. The company plans to spend a development budget of roughly $325 to $350 million in 2010. The company has 70 wells planned—most of which will be horizontal. To date, the company has 39 wells in the Marcellus Shale: 28 horizontal and 11 vertical.

Another private company, Patara Oil & Gas LLC recently signed a joint venture agreement with Contango Oil & Gas Co.'s wholly-owned subsidiary, Conterra Co. to develop proved undeveloped Cotton Valley gas reserves in Panola County, Texas.

Conterra will fund 100% of the drilling and completion costs in exchange for 90% of the net revenues. The agreement calls for drilling roughly 15 wells at a price of $1.5 million per well. Patara will serve as operator.

In another transaction, Parallel Petroleum Corp. is set to enter the private company space. Parallel Petroleum Corp. and PLLL Holdings LLC, an entity formed for the purpose of acquiring Parallel Petroleum Corp., have completed the transaction that merges PLLL with and into Parallel and leaves Midland, Tex.-based Parallel to survive as a private company.

The $483 million deal was agreed upon back in September, when Parallel signed a deal with an affiliate of Apollo Global Management LLC, a global alternative asset manager.

Parallel Petroleum's primary areas of operation are the Permian Basin of West Texas and New Mexico, North Texas Barnett Shale, onshore Gulf Coast of South Texas, East Texas and Utah/Colorado.

And, as the economy continues to improve, financial transactions are reemerging.

TARH E&P Holdings LP, an affiliate of privately-held Texas American Resources Co. (TARC) completed a new $15 million first lien first out term loan due June 2012. The Austin-based company, who was last listed on the OGFJ100P in July at No. 110, expects to use the majority of the proceeds to accelerate the company's development capital expenditure program and to repay accrued interest.

The company has also negotiated an amendment to its existing $160 million first lien term loan with its lenders.

TARC operates over 400 wells in Texas, Wyoming, and Colorado. The company has a total proved reserve base of 29 MMboe which is 34% developed and 41% oil and has 42 MMboe of 3P reserves. The company-wide total net production of roughly 2,500 boe/d is 39% oil.

Click here to download pdf of the 2009 Year-to-date production ranked by BOE

Click here to download pdf of the 2009 Year-to-date production - alphabetical listing

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com