Year off to a fast start with M&A deals

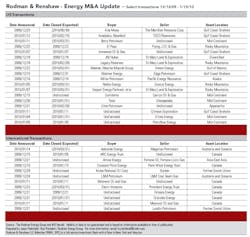

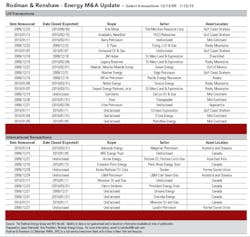

Energy M&A Update is a new monthly feature in OGFJ, brought to you in collaboration with The Rodman Energy Group. The tables include relevant information about oil and gas industry transactions in the United States and globally.

Last month, the still-pending ExxonMobil acquisition of XTO Energy was the big news. Indeed, the estimated $41 billion transaction was the largest of 2009 and many industry observers believe it may herald a significant increase in M&A activity for the year.

This month's (Dec. 15 — Jan. 15) transactions are far smaller in scale, if not number. The largest domestic M&A deal during this period is Total's purchase of a 25% interest in Chesapeake Energy's Barnett shale assets (see story, page 36). France's Total, the fifth-largest integrated oil company in the world, paid Chesapeake $2.25 billion for its stake in the Barnett properties. According to Chesapeake CEO Aubrey McClendon, this 25% interest accounts for about 6% of the Oklahoma-based independent's total production. More significantly, this deal establishes a joint venture between Total and Chesapeake, which also has JV deals with BP in the Fayetteville shale and with Norway's Statoil in the Marcellus.

The second-largest deal was Devon Energy's decision to sell its interests in Lower Tertiary development projects in the Gulf of Mexico to Maersk Oil for $1.3 billion. Established in 1962, Maersk Oil is a midsized international oil and gas company based in Denmark. The agreement covers Devon's 50% working interest in the Cascade project and its 25% working interest in the Jack and St. Malo projects. All three projects are located in the deepwater Walker Ridge federal lease area offshore Louisiana.

Devon's president, John Richels, called the sale "an important first step in executing our plan to divest all of our Gulf of Mexico and international assets and to reposition Devon as a purely North American onshore company."

The two largest transactions outside the US during this period were Calgary-based Penn West Energy Trust's swap of assets with Crescent Point Energy and the state-run Korean National Oil Corp.'s purchase of an 85% controlling share in Kazakhstan oil field owner Sumbe.