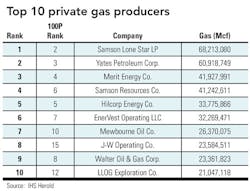

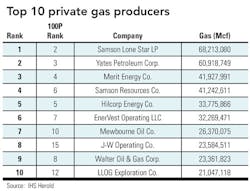

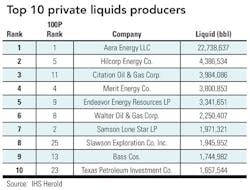

Independent research firm IHS Herold Inc. has provided OGFJ with updated production data for our periodic ranking of US-based private E&P companies. The rankings provided by IHS are based on operated production only within the US. In this issue, the production data is year-to-date 2010.

There were a few changes to the top ten producers from year-end 2009 to the current production numbers for 2010. Dallas-based Merit Energy fell from the No.2 spot to the No. 4 spot for this installment, while Samson Lone Star LP moved up one spot from No. 3 to No. 2. Yates Petroleum moved from No. 5 to No. 3 in this issue. LLOG Exploration fell out of the top 10 in this issue, down from to No. 9 to No. 12. New to the top 10 this issue is Mewbourne Oil Co. The Tyler, Tex.-based company moved from No. 14 to No. 10.

Mergers and acquisitions

In late July, Midland, Texas-based Concho Resources Inc. (NYSE: CXO) agreed to purchase all the oil and gas assets of privately held Marbob Energy Corp. and certain affiliated entities for $1.65 billion in cash and Concho securities. Marbob ranked No. 20 on the list with production of 2,669,977 boe tracked thus far in 2010.

Marbob is a privately-held exploration and production company with substantially all of its operations located in the Permian Basin of Southeast New Mexico, including a large acreage position contiguous to Concho's core Yeso play on the Southeast New Mexico Shelf and a significant acreage position in the emerging Bone Spring play in Southeast New Mexico. The buy would be the largest in Concho history. Not only would it complement the company's New Mexico position, but, according to Dahlman Rose, it would double Concho's Yeso drilling inventory.

Days after the announcement was made, Marbob informed Concho that BP America Production Co. elected to exercise its preferential purchase rights equal to, as Concho believes, approximately $400 million of Marbob properties, predominately on the New Mexico Shelf.

On the same day as the announcement of the execution of a purchase agreement between Concho and Marbob, BP and Apache Corp. a purchase agreement under which BP would sell all of its oil and gas properties in the Permian Basin to an Apache Corp. subsidiary. Certain of BP's Permian oil and gas properties are subject to the same operating agreements from which BP derives its preferential purchase rights described above.

To protect Marbob's preferential purchase rights, Marbob and Concho have initiated litigation in New Mexico state district court against BP and Apache's subsidiary seeking a declaratory judgment and injunctive relief to compel BP to provide Marbob the preferential purchase right notifications required by the applicable operating agreements.

As part of its second quarter 2010 financial and operating results report, Tim Leach, Concho's chairman, CEO, and president said the company is still working on the acquisition and that he expects the transaction to close sometime in the fourth quarter this year.

Financing, ratings

Not long after the July issue of the 100P came out, privately held Laredo Petroleum Inc. announced the arrangement of two new bank credit facilities. The Tulsa, Oklahoma-based company, who dropped from the No. 25 spot in July to the No. 33 spot in this issue, was issued credit from Bank of America and Wells Fargo Energy Capital.

The first facility is a $500 million Revolving Credit Agreement, agented by Bank of America, with a group of 10 other banks participating. The facility matures in July 2014 and is subject to a semi-annual borrowing base which is currently set at $220 million with $102.5 million outstanding. The facility is secured by a 1st lien on all of the company's oil and gas properties and has the customary debt covenants which are tested on a quarterly basis. This new facility replaces a $300 million Revolving Credit Agreement that was set to mature in June 2012.

The second facility is a $150 million 2nd Lien facility, agented by Wells Fargo Energy Capital, with a group of five other banks participating. This facility matures in January 2015. The availability under this facility is currently capped at $100 million with $100 million outstanding. This facility is secured by a 2nd lien on all of the company's oil and gas properties and has similar quarterly covenants as the Revolving Credit Agreement.

In late September, Standard & Poor's Ratings Service assigned its 'B+' corporate credit rating to Los Angeles-based oil and gas limited partnership BreitBurn Energy Partners LP. The ratings service also assigned a 'B+' senior unsecured and a '4' recovery rating to BreitBurn's planned $250 million senior unsecured note offering due 2020.

"The stable outlook reflects our expectations that the company's highly developed reserve base and solid hedge book over the next few years should result in total debt to EBITDA remaining below 3x, not inclusive of material acquisitions," noted the firm.

The '4' recovery rating indicates our expectations of average (30% to 50%) recovery prospects in the event of a payment default. BreitBurn will use proceeds from the offering to repay existing debt and for general corporate purposes. The outlook is stable. Approximately $540 million of pro forma debt is affected by this action.

"The ratings on BreitBurn Energy Partners LP reflect the company's relatively small asset base and production levels, some geographic concentration [about 68% of its total proved reserves are in Michigan], and modest organic growth prospects from its mature asset base," said Standard & Poor's credit analyst Patrick Jeffrey.

The firm continued to note that the ratings take into account the acquisitive strategy as a master limited partnership that focuses on maintaining its dividend, and its relatively high cost structure compared with other exploration and production companies. "These risks are mitigated somewhat by a solid hedge book over the next few years that should help offset natural gas and oil price volatility, a large concentration of proved developed reserves in its asset base, long-lived reserves, some diversity between oil and gas, and enhanced liquidity as a result of the note offering," the firm concluded.

Click here to download the pdf of the "2010 Year-to-date production ranked by BOE"

Click here to download the pdf of the "2010 Year-to-date production — alphabetical listings"

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.