Offshore industry reels in wake of BP blowout

Don Stowers, Editor — OGFJ

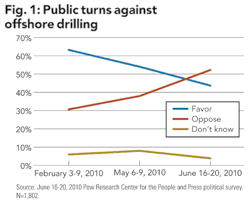

The ultimate economic consequences of the catastrophic BP well blowout and spill in the Gulf of Mexico have yet to be calculated, but the damage done to the offshore industry's reputation may be even worse than the financial impact. Public opinion in the United States about offshore drilling has plummeted since the April 20 explosion and sinking of the ultra-deepwater, semisubmersible Deepwater Horizon rig (see Fig. 1).

In February of this year, 63% of the public supported more offshore drilling as a policy response to address our energy needs and just 31% opposed more offshore drilling. According to a poll by the Center for American Progress released June 28, a majority of the public — 52% — now opposes offshore drilling, and support has fallen to 44%.

Contrast this change with current public attitudes towards alternative energy and non-hydrocarbons. The same poll shows that 75% of the public favors increasing federal funding for research on wind, solar, and hydrogen technology. Seventy-eight percent favor requiring that new homes and buildings meet higher efficiency standards, and 64% want more spending on public transportation, including light rail and commuter rail.

Clearly, the BP blowout and the continuing flow of oil into Gulf waters has affected the public perception of offshore drilling — and perhaps all drilling operations. The industry obviously has to figure out how to overcome this public relations nightmare.

The media have used terms like "catastrophe in the Gulf," "a major environmental disaster," and "the worst oil spill in US history." Daily images show clumps of crude oil coming ashore in the Louisiana marshes and shore birds covered in oil as well as live images of crude spewing from the BP well, which reinforces images of that company and the entire petroleum industry as "irresponsible."

It's clear that a tragedy did occur. Eleven workers died when the rig burned and sank into the ocean depths. And it is difficult to overstate the economic and ecological impact on the nearby Gulf Coast from Louisiana to Florida. By June 2, the federal government had banned fishing in more than 37% of federal Gulf of Mexico waters — more than 88,000 square miles. Livelihoods have been severely affected, and the region's valuable fishing industry has suffered a body blow.

Kenneth R. Medlock III, a fellow in energy economics and resource economics at the Baker Institute, Rice University, commented in a recent blog, "I cannot overstate the potential economic and ecological devastation [of the spill]. But, before we react, we must weigh all of the options. Of our domestically produced oil, about one-third of it comes from offshore ventures."

He noted, "If the snap judgment is to suspend offshore drilling indefinitely, we will see increased imports, absent a policy to cut oil demand, and regional economic dislocation."

Medlock continued, "Some companies have impeccable offshore records and have already safely completed wells in water depths exceeding 5,000 feet. This should have some weight in the discussion. So, as tempting as it may be, painting the offshore industry with a broad brush may not be appropriate.

"Nevertheless, this accident has marred the entire industry," he added. "Moreover, we must recognize that even if this is a one-in-a-million type accident, the potential cost of offshore drilling may simply be too high."

Most people in the petroleum industry would take issue with that. And, frankly, government officials are savvy enough to realize that the economic blow of losing all domestic offshore oil and gas production would be more catastrophic to the United States than even the damage from another blowout and spill. Such a huge loss in production would result in the loss of critical tax revenue and innumerable jobs throughout the energy chain and probably would send the country back into recession.

Mark Tranfield, managing director of the OCS Group of Companies, which is comprised of several respected engineering and consulting companies serving the global oil and gas industry, had this comment on the deepwater drilling moratorium in the Gulf of Mexico.

"While the damage has already been felt by the tourism and fishing industries due to the oil spill, President Obama's moratorium on deepwater drilling will threaten employment on the other major industry that supports this area, and that is the offshore oil and gas industry," he said. "If [the administration] does not quickly reverse its decision and allow drilling to continue, they are very likely going to put the USA in a deeper and more sustained recession, which will have a ripple effect across the rest of the world's economy."

So what's the solution?

US Interior Secretary Ken Salazar has taken a first step by shaking up the agency charged with regulatory oversight of the offshore energy industry. The Minerals Management Service is being split into three separate organizations, and former Justice Department inspector general Michael Bromwich will serve as director and oversee the restructuring. The names of the three new agencies are: Bureau of Ocean Energy Management; the Bureau of Safety and Environmental Enforcement; and the Office of Natural Resource Revenue.

US Sen. Jeff Bingaman (D-NM) and US Sen. Lisa Murkowski (R-AK) introduced legislation in late June to overhaul Interior Department programs responsible for offshore oil and gas development. Bingaman said the bill is "a good starting point" for comprehensive changes in US energy policy that will respond to the Gulf of Mexico oil spill.

Bingaman commented that prior to the BP incident "there was a level of confidence in the safety of these drilling operations that is clearly not justified given what just happened in the Gulf." He added, "We would need to rethink that."

Several industry sources have suggested that the federal government should create a mandatory minimum best practices standard that would reflect the most stringent standards used in the industry today. The penalty for failure to comply would be severe. In the event of a major accident, the offending company would get what would amount to a "death penalty." That is, the company would be prohibited from drilling in the Gulf of Mexico for a specified period — perhaps 10 years.

Such a penalty structure would have a huge impact on a company's revenues and would, in their view, be sufficient to assure compliance with the most stringent safety standards. Certainly it would change the corporate culture of any firm tempted to cut corners in order to reduce drilling costs.

OCS's Tranfield noted, "Yes, we have to put more safety regimes and new legislation in place to prevent this from happening again. By now it is well known what the main causes of this disaster were, and these concerns can be addressed very quickly without the need for a moratorium on drilling. There are additional concerns that need a much longer approach that will need to be addressed, such as the need for training, especially in electrical equipment and its maintenance, BOP equipment, and operations and general safety."

We do not yet know the extent of BP's liability, but the company has accepted responsibility for the disaster and promised to compensate those affected. To this end, the Obama administration convinced BP's management to create a $20 billion escrow fund, which the government will administer. It seems likely that when this fund is depleted that the company will be asked to fork over even more cash. Could the ultimate liability be $40 billion, $50 billion, or more? Nobody can say at this time.

In a June 27 story in the New York Times, Nelson D. Schwartz, the publication's European economics correspondent, commented that BP has lost its "trading floor swagger" in energy markets. Schwartz claims that traders and industry experts say the company's "reputation for taking risks in the oil fields is matched only by its daring in the energy markets."

With BP facing billions of dollars in liability claims from the Deepwater Horizon accident, Schwartz says the BP trading unit's prospects are uncertain and the resources it once took for granted are threatened.

Bank of America Merrill Lynch has halted its long-term contracts with BP, and on June 15 the credit ratings agency Fitch downgraded the company to one notch above junk bonds. Analysts have estimated that BP's profits from its trading operation amounted to nearly 20% of the company's total earnings of $16.7 billion in 2009.

Some industry observers have speculated that BP will be forced to file bankruptcy. Others have said the company may become a takeover target. JP Morgan Cazenove analysts in London noted the sharp decline in BP's stock price, more than a 50% drop since April 20, and commented that the low price makes it a prime candidate for a buyout.

"The market has lost sight of the intrinsic value that is resident in an asset-rich company like BP," said JP Morgan Cazenove's Fred Lucas. "We very much doubt that keen-eyed industry players have lost sight of BP's value."

Lucas named ExxonMobil Corp., Royal Dutch Shell, and PetroChina as potential suitors.

Other analysts are dubious that another company would be interested in taking over a firm with BP's potentially vast liability issues. They say that a more likely scenario is that another major oil company would purchase some of BP's assets as the company struggles to pay for containment and clean-up costs as well as victim compensation.

One possible inadvertent casualty of the BP disaster is Matt Simmons, founder and former chairman and CEO of Simmons & Co. International (read our exclusive interview with Simmons in the August 2008 issue of OGFJ). Simmons, who is famous for speaking his mind, declared in an interview with Fortune magazine that he expects BP to file for bankruptcy — a comment that may not have gone over well with the firm's current CEO Mike Frazier and the board of directors.

Simmons exact comments were: "They [BP] have about a month before they declare Chapter 11. They're going to run out of cash from lawsuits, cleanup, and other expenses. One really smart thing that Obama did was about three weeks ago he forced BP CEO Tony Hayward to put in writing that BP would pay for every dollar of the cleanup. But there isn't enough money in the world to clean up the Gulf of Mexico. Once BP realizes the extent of this, my guess is that they'll panic and go into Chapter 11."

Simmons, who had previously stepped down from his position as chairman and CEO to focus his attention on the Ocean Energy Institute, a renewable energy think tank and venture capital fund that he founded in 2007, announced his retirement from Simmons & Co. International effective June 30. In a statement, Frazier said that Simmons' personal views and those of the company he founded have "significantly diverged on some important fronts."

The Gulf of Mexico disaster undoubtedly will be costly for the entire offshore oil and gas sector — not just BP, which is running up about $100 million a day in cleanup and containment costs and has yet to stop the deepwater oil gusher.

As of this writing, some 33 deepwater rigs remain idle in the Gulf of Mexico. Drilling contractors and the huge offshore services industry are losing enormous amounts in revenues for every day this goes on, and employees have been laid off. If the current situation continues much longer, companies may fail and others may decide it's easier to operate in another part of the world with fewer draconian restrictions on exploration and production.

On June 29, US Sen. Diane Feinstein (D-Calif.) introduced legislation to remove financial incentives for deepwater drilling, one of several efforts to remove tax breaks and other financial benefits for the petroleum industry.

Feinstein said she thinks incentives should be given to emerging clean energy technologies rather than deepwater drilling. If enacted, the bill would not be retroactive but would apply only to new leases. The legislation also would impose a 20 cents/barrel tax on domestic crude and a 60 cents/barrel tax on imported refined products in order to increase the Oil Spill Liability Trust Fund from its current $2.7 billion to a maximum of $10 billion.

Speaking at a renewable energy finance forum in New York on June 29, Andrew Safran, vice chairman of global banking at Citigroup, told the audience that the Gulf disaster will cause oil majors to exit deepwater drilling and will change the way in which oil companies invest capital.

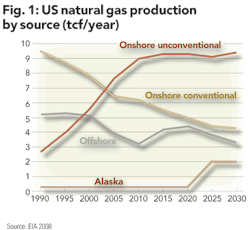

Safran added that the spill will speed investment dollars towards "safer" onshore oil and natural gas exploration and production in an investment climate that has becoming acutely aware of environmental risk.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com