OGFJ100P company update

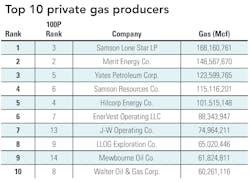

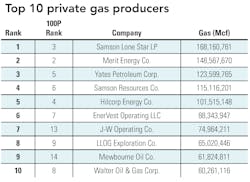

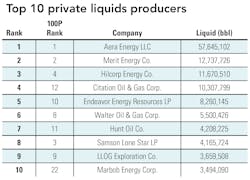

Independent research firm IHS Herold Inc. has provided OGFJ with updated production data for our periodic ranking of US-based private E&P companies. The rankings provided by IHS are based on operated production only within the US. In this issue, the production data is year-to-date 2009.

Not much has changed in the Top 10 slots since the private company ran in April. Endeavor Energy Resources dropped from the No. 8 spot to No. 10. Walter Oil & Gas Corp. and LLOG Exploration Co. each inched up one spot to rest at No. 8 and No. 9, respectively.

Movement in the Top 10 was minimal, but activity in the private sector continued.

Transactions

Mergers, acquisitions, and development agreements continued since the Apil issue, growing the private sector.

One such transaction included Houston-based Alta Mesa Holdings LP. The private company completed its merger with Meridian Resource Corp. after agreeing to purchase the financially distressed Austin Chalk/Gulf Coast operator in December 2009 for $147 million. Of that total, $102.5 million was the Houston-based company's working capital deficit. With the closing of the transaction, Meridian Resource Corp. stock has been delisted from the NYSE.

In another transaction, Jetta Operating Co. Inc., ranked No. 41 in this issue's listing, acquired Journey Operating LLC to focus on the Appalachian Basin. Journey Operating changed its name to Jetta Operating Appalachia LLC, as it is now a wholly-owned subsidiary of Fort Worth-based Jetta.

Jetta Operating Co. Inc. was founded in 1991 and operates over 450 properties in the Texas Gulf Coast, West Texas Region, Southern Mid-Continent Region, Louisiana Salt Basin, Mississippi Salt Basin, Rocky Mountain Region and the Appalachian Basin.

Jetta Operating Appalachia operates in Kentucky with development centered on the Devonian shale formation.

Voyager Oil & Gas Inc. is getting in on the Niobrara play, signing a $7.5 million exploration and development agreement with No. 40-ranked Slawson Exploration Co. Inc. to develop Slawson's 48,000 net acres in the Denver-Julesberg Basin Niobrara formation in Weld County, Colorado.

Wichita, KS-based Slawson will begin a drilling program in early July with an initial series of three test wells expected to be completed by October 2010. Depending on the results of these wells, the company expects to target 57 additional locations in the area throughout 2011.

Voyager purchased a 50% working interest in the approximately 48,000 acre block and will participate on a heads-up basis on all wells drilled, as well as participate for its proportionate working interest in all additional acreage acquired in an Area of Mutual Interest consisting of all of Weld and Laramie Counties.

Voyager will fund the purchase price and initial drilling commitments out of cash on hand and cash flows from current production. Voyager remains fully funded through 2010 with no debt and approximately $12.5 million of cash on hand.

Investments

In another transaction, No. 4-ranked Hilcorp Energy Co. has partnered with Kohlberg Kravis Roberts & Co. (KKR) to develop Eagle Ford shale acreage. KKR will invest up to $400 million in Hilcorp Resources LLC, a newly-formed partnership created to own and develop certain of Houston-based Hilcorp's oil and gas properties in the South Texas shale play.

The partnership combines a capital commitment from both parties as well as the contribution of a 100,000 net acre Eagle Ford position from Hilcorp. Hilcorp will hold 60% and KKR will hold 40% of the company, with Hilcorp's management and employees running the day-to-day operations.

Over the past year, Hilcorp has assembled approximately 100,000 net acres in the Eagle Ford, substantially all of which is operated by Hilcorp. Hilcorp is soon to begin its Eagle Ford development program and is currently running two horizontal drilling rigs in the play.

Jefferies & Co. Inc. served as sole financial advisor to Hilcorp in the transaction.

In addition to being ranked No. 4 in total BOE, Hilcorp Energy, founded in 1988, ranks No. 4 in private gas producers and No. 3 in private liquids producers. The company, with five offices and nearly 600 employees, has operated in South Texas since 1998 and is the largest producer of conventional oil in the region.

The Riverstone/Carlyle Global Energy and Power Funds, a group of energy-focused private equity funds managed by Riverstone Holdings LLC, is investing in Three Rivers Operating Company LLC, a private upstream oil and gas company based in Austin.

Recently, Three Rivers agreed to acquire certain assets of Chesapeake Energy Corp. primarily located in the Permian Basin of West Texas and Southeast New Mexico where the company has committed to focusing its efforts. Terms of the transaction were not disclosed.

Click here to download the pdf of the "2009 Year-to-date production ranked by BOE"

Click here to download the pdf of the "2009 Year-to-date production — alphabetical listing"

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com