As blame game over spill goes on, engineers are working to stop leak

The blame game goes on in Washington, Baton Rouge, Houston, and elsewhere. Energy executives and politicians alike are pointing their fingers at one another in an attempt to downplay their role in the deadly April 20 blowout disaster in the Gulf of Mexico and place the responsibility elsewhere. Meanwhile, engineers and scientists are continuing to search for solutions to one of the worst oil spills in history. Oil has been gushing from the drillhole for 35 days as of this writing and has started to come ashore in the Louisiana delta.

Financial giant Morgan Stanley has released a comprehensive, although preliminary, report on the financial implications of the Deepwater Horizon blowout and its potential impact on the various players involved. Although plaintiffs' attorneys are likely to have a field day filing lawsuits, some of the companies will have less exposure to liability than others.

The Transocean-owned Deepwater Horizon drilling rig was leased to BP. It had a crew of 126 when it was struck by an explosion on April 20 and sank two days later. Eleven workers are missing and presumed dead. Crude oil continues to pour into the ocean, and the resulting oil slick threatens beaches and coastal wetlands and wildlife. Some experts believe currents may eventually take the oil south to the Florida keys where it could enter the Gulf Stream and move up the US East Coast.

Prominent New Orleans attorney Keith Hall of Stone Pigman predicts a "wave of litigation" in the wake of the explosion, fire, worker deaths, and the subsequent sinking of the Deepwater Horizon, which was known as a state-of-the-art unit with a highly professional and experienced crew and a long record of exemplary safety. The continuing crude oil spill and its potential damage add to the complexity of the issue. Another consequence, says Hall, will be more stringent enforcement of government regulations, new regulations, and even congressional hearings concerning offshore drilling and production, particularly deepwater exploration.

Ten days after the blowout, Morgan Stanley hosted a conference call with several industry experts for a technical, legal, and political discussion on the incident. The Wall Street firm brought together a 15-year Transocean veteran; an Oil Pollution Act litigation expert; a former US Government career attorney with over 27 years' experience dealing with ocean policy; several political consultants; and the firm's equity research analysts.

Companies with some degree of exposure to the incident include BP, Transocean, Halliburton, Smith International (through M-I SWACO, a 60/40 joint venture of Smith and Schlumberger), and Cameron. Although there are conflicting accounts as to the cause of the accident, the consensus among Morgan Stanley's experts is that contractual protections likely provide legal cover for Cameron and Transocean, while legal contacts and the practical difficulties of investigating the incident likely limit exposure for Smith International and Halliburton.

The rig had discovered oil after drilling BP's Macondo well, located in 5,000 feet of water, at a depth of about 18,000 feet below the seabed. The rig was approximately 40 miles offshore Louisiana when the incident occurred. BP operates the well and owns a 65% stake. Partners include Anadarko (25%) and Japan's Mitsui (10%). Transocean was the drilling contractor; Halliburton performed cementing operations; M-I SWACO handled drilling fluids; and Cameron manufactured the blowout preventer (BOP) purchased for the rig about 10 years ago.

Conflicting reports from industry contacts and survivors make it difficult to know the precise chain of events that occurred leading up to the accident, so much of the information about the incident remains speculative.

Morgan Stanley's experts believe that Cameron and Smith International have the least to worry about from a liability standpoint given that the BOP was past warranty and the drilling contractor (Transocean) is responsible for its maintenance, while the operator (BP) is in charge of determining the mud density appropriate to use in a given wellbore. Halliburton also has relatively limited exposure, say the experts, because investigating the cement plug, if it had even been installed, which the company denies, would be very difficult.

Transocean is responsible for the fuel leaking out of its unit, but likely is contractually protected from any environmental liability resulting from a blowout. The experts went on to say that Transocean's $1 billion insurance policy should cover the majority of liabilities resulting from diesel spill from the unit and loss of life.

In addition, the experts went on to state that they see potential regulation deriving from the accident as a positive for the drilling equipment industry, as drilling rigs may require more redundancy of equipment as well as more frequent servicing and replacement of equipment. On the drilling side, they expect established offshore drillers with the newest deepwater units to benefit as demand for their rigs is likely to increase. Those with older fleets and higher exposure to the Gulf of Mexico are more likely to be disadvantaged.

Morgan Stanley's conclusion is that the operator and the other lease interest owners will absorb the lion's share of the financial liability for the oil spill and any potential punitive damages. The firm expects the following outcome: 1) Cameron and Smith International to be fully absolved of liability; 2) Transocean's potential liability to be relatively small and well within insurance policy; 3) Halliburton unlikely to be held responsible, as the company claims it had not plugged the well, and even if it had plugged the well, it would be extraordinarily difficult to demonstrate flaws with the cement; 4) industry-wide implications to be a long-term positive for equipment manufacturers and somewhat mixed for offshore drillers; and 5) impact on shipping lanes in the Gulf of Mexico to trigger a congestion-like effect on tanker rates. The spill could also spur tighter tanker regulation in the US and could help accelerate the ban on single-hull vessels in the US. This would make the long-term supply outlook for tankers more favorable, says the firm.

Meanwhile, President Obama said he had ordered "top to bottom" reform of the Minerals Management Service that oversees offshore drilling after allegations that the agency had allowed BP and other oil companies to drill in the Gulf of Mexico without first obtaining required permits.

An environmental group, the Center for Biological Diversity, said it had formally filed notice of intent "to sue Interior Secretary Ken Salazar for ignoring marine-mammal protection laws."

"Under Salazar's watch, the Department of the Interior has treated the Gulf of Mexico as a sacrifice area where laws are ignored and wildlife protection takes a backseat to oil-company profits," said group spokesperson Miyoko Sakashita.

Obama, who recently lifted a moratorium on offshore drilling, acknowledged the federal government also had to bear its responsibility, pledging to strengthen oversight of the oil industry.

"For too long, for a decade or more, there's been a cozy relationship between the oil companies and the federal agency that permits them to drill," he said.

Experts now fear oil may be spewing from the site at a rate of up to 70,000 barrels (2.9 million gallons) a day, more than 10 times faster than a government estimate of 5,000 barrels (210,000 gallons) a day.

The findings suggest the spill has already eclipsed the 1989 Exxon Valdez spill, which was the worst environmental disaster in US history.

BP was quick to contradict the figures, with Robert Dudley, BP's executive vice president for the Americas, telling CNN that "70,000 barrels a day isn't anywhere I think within the realm of possibility."

And BP chief executive Tony Hayward told Britain's Guardian newspaper that the spill is "tiny" by comparison with the amount of water in the area.

"The Gulf of Mexico is a very big ocean," said Hayward. "The amount of volume of oil and dispersant we are putting into it is tiny in relation to the total water volume."

But Hayward sounded a different tone following Obama's harsh criticism of BP's apparent inability to stem the leak.

"We absolutely understand and share President Obama's sense of urgency over the length of time this complex task is taking," Hayward said.

"BP... is focused on doing everything in our power to stop the flow of oil, remove it from the surface, and protect the shoreline."

Coast Guard Real Admiral Mary Landry said efforts were underway to assess the flow of oil, but insisted it would not alter plans to combat the massive spill.

"Whether the flow is one, five, 10, or 15,000 barrels per day, the mobilization of resources has been from day one to prepare for a worst-case scenario."

Canadian oil sands poised to become top source of crude oil imports to the US in 2010

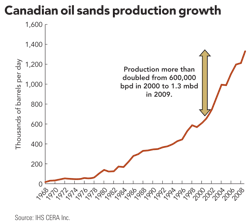

The Canadian oil sands have increasingly become an important source of global oil supply growth and are now poised to become the number one source of US crude oil imports in 2010, according to new research from the IHS CERA Canadian Oil Sands Dialogue. Oil sands imports could ultimately increase to a range of 20% to 36% of US oil and refined product imports by 2030 from the 2009 level of 8%, according to the Dialogue's first report, The Role of Canadian Oil Sands in US Oil Supply.

"The fact that oil sands by themselves—were they a country—are set to become the largest single source of US crude oil imports this year, emphasizes the importance they have attained as a supply source for the United States," said IHS CERA chairman Daniel Yergin. "This ranking demonstrates the impact of investment and innovation over the last decade. It also shows how integrated Canada and the United States are in terms of energy, as in their overall economies."

Oil sands production, combined with exports of Canadian conventional crude oil, has already put Canada in the position of number one foreign supplier of oil to the US. Over the past decade, production from oil sands more than doubled from 600,000 barrels per day (bpd) in 2000 to 1.35 million barrels per day (mbd) in 2009, more than offsetting declines in conventional Canadian production. But the potential is much larger and oil sands growth could be three or four times greater than today to a range of 3.1 mbd to 5.7 mbd by 2030, according to the report.

While oil demand in the US is not likely to return to its 2005 peak, the US will maintain its position as the world's largest oil market over the next two decades, the report notes.

"The oil sands will play a key role in meeting future world oil demand," said IHS CERA managing director Jim Burkhard. "Oil will continue to play a critical role in US energy supply and the oil sands offer the possibility of increasing oil supply security while offsetting reduced supply from some of the United States' traditional suppliers."

In addition to their contribution to energy security, oil sands projects constitute billions of dollars in spending, and the economic benefits radiate far beyond the borders of Alberta, creating jobs in both the US and Canadian economies, according to the report.

Energy trade is an important part of the overall relationship between the United States and Canada, each of which is the other's largest trading partner. Canada and the United States have a highly efficient and integrated energy trade in oil, natural gas and electric power via an interdependent network of transmission grids and pipelines.

"The growth of oil sands production in the past decade is a testament to Canada's open investment climate," said IHS CERA director, Jackie Forrest. "The oil sands are among a group of oil development opportunities that are accessible to oil companies—projects in which firms can openly and securely invest."

Oil sands, like other complex oil projects, face the challenge of high development costs, the report notes. However, a comparison of the economics of some of the largest sources of new supply—ones with the greatest ability to add new productive capacity over the next 5 to 10 years—shows that numerous projects are in the same range as oil sands.

The Role of Canadian Oil Sands in US Oil Supply identifies the environmental questions around oil sands development.

Environmental footprint concerns related to oil sands development include water and land use and the reclamation of tailings—the fine silt-like waste material produced during oil sands production. At the project level, government regulation of oil sands activities is highly developed and is as robust as in many other oil-producing regions in the world, the report finds. However, high growth will require further advances in water management practices and the pace and scale of tailings management and site reclamation.

IHS CERA's previous multiclient study, Growth in the Canadian Oil Sands: Finding a New Balance found that the total "well-to-wheels" greenhouse gas emissions from oil sands—from extraction and processing through combustion of its refined products—are approximately 5 to 15% higher than the average crude oil processed in the US. But comparison to an average can be misleading, the report noted. Emissions from oil sands can be higher, lower or on par with other crude oils processed in the US.

The Role of Canadian Oil Sands in US Oil Supply notes that innovation is a central element of the oil sands story. The pace of technological innovation in the production of oil sands has been substantial in the past, with major technological strides in optimizing resources, innovating new processes, reducing costs, increasing efficiency, reducing GHG emissions, and reducing its environmental impact. However, new techniques and technologies will be needed to continue to grow production sustainably. Cooperation between the Canadian and US governments and the private sector will continue to be crucial to the continued advancement of new technologies, the report finds.

Magnum Hunter, JV partner to explore Texas Eagle Ford shale

Magnum Hunter announced a new joint operating and exploration agreement with privately-held Hunt Oil based in Dallas, Texas. The area of mutual interest (AMI) covers existing mineral lease acreage positions currently owned by both companies in Gonzales and Lavaca Counties, Texas.

The new agreement has Magnum Hunter and Hunt Oil working together within the acreage on an equal and joint basis throughout the two counties for a period up through December 2014. Magnum Hunter and Hunt Oil will share all future leasing, exploration, drilling, completion and development costs and other expenses in the area a 50/50 basis and each has also agreed to allow the other company to be the designated operator for all wells on lease acres specifically contributed by each company to the AMI under the agreement.

The agreement covers 28,187 (gross acres) and 26,822 (net acres) with 50% ownership interest owned by each company being 14,094 (gross acres) and 13,411 (net acres).

The agreement potentially allows for two wells to be drilled within the AMI during 2010. One, the Magnum Hunter operated "Gonzo Hunter #1-H" well located in Gonzales County, is anticipated to be spudded around the first of June 2010. The agreement allows for the option of a second well to be drilled on the Hunt Oil acreage in the AMI during 2010 with Hunt Oil as operator. It is presently anticipated that Magnum Hunter and Hunt Oil will own a 50% working interest in each of the contemplated wells.

Magnum Hunter has allocated nearly $30.7 million out of its fiscal year 2010 total capital expenditure budget of $55 million (55.7% of the total capex budget) for the Eagle Ford Shale oil-window of South Texas. Roughly $10.6 million out of the $30.7 million capex budget for 2010 will be for purposes of horizontally drilling three unbooked Eagle Ford Shale exploratory locations. The balance of the company's 2010 capex budget is dedicated to the Eagle Ford Shale play for additional leasing related activities that are currently ongoing.

Williams nearly doubles Marcellus acreage

With a recent acquisition, Williams has nearly doubled its exploration and production holdings in the Marcellus Shale.

The company acquired roughly 42,000 net acres from Alta Resources LLC and its partners for $501 million. The acreage is primarily located in Susquehanna County in northeastern Pennsylvania. The company estimates that it represents approximately 1.2 trillion cubic feet equivalent (tcfe) in total net natural gas reserves potential. Gas in place is estimated to be 100-130 billion cubic feet equivalent (bcfe) per section.

The company is also purchasing a 5% overriding royalty interest on the approximately 48,500 gross acres associated with the acquisition for $84 million, which reduces the royalty burden.

Williams expects to invest additional funds for drilling, completion, seismic and facilities costs totaling approximately $55 million in 2010 growing to $100 million to $200 million by 2012 as operations expand. The company will fund the acquisition and 2010 capital expenditures with cash on hand and subsequent investments will be funded from operating cash flows.

Ralph Hill, president of Williams' exploration and production business, noted, "This is our largest Marcellus acquisition to date - and for good reason."

"The rock quality, thickness and density of the shale and gas in place are among the best in the basin - and recent results from other operators in the area have consistently exceeded expectations," Hill said.

He noted that Alta Resources' track record in mapping shale plays, particularly their development efforts in the Fayetteville Shale, was one of the key factors in the acquisition.

In addition to this acquisition, Williams has committed to lease approximately 8,000 net acres in another area of Pennsylvania. Once the deals are complete, the company expects its holdings in the Marcellus to reach 94,000 net acres at an average cost of approximately $7,000 per acre.

"We are very pleased with the position we have accumulated in the Marcellus Shale in just the past 11 months," Hill said.

Steve Malcolm, Williams' chairman, president, and CEO, said the acquisition further diversifies Williams' drilling portfolio.

"The new position is also consistent with our strategy of moving the overall Williams businesses toward a large-scale presence in Marcellus Shale," Malcolm said. "Our increasing scale will provide more potential opportunities for bolt-on E&P acquisitions as well as Gas Pipeline and Midstream growth opportunities via Williams Partners."

This acquisition was not included in the 2010-12 capital expenditure or other guidance provided on May 5. The company will update its guidance when it reports second-quarter 2010 financial results. Williams expects the transaction to close in third-quarter 2010.

Through this transaction, Denham Capital has sold its participation in the Marcellus shale.

In February 2009, Denham and Alta entered into a partnership wherein Denham provided additional capital for Alta to purchase natural gas leases from landowners primarily located in Susquehanna County in northeastern Pennsylvania.

Toreador, Hess join forces in Paris Basin

Toreador and Hess have signed a definitive agreement, under which Hess may become co-holder of Toreador's exploration permits in the Paris Basin, France, which represent approximately 1 million gross acres (of which 680,000 acres awarded and 360,000 acres pending).

Craig McKenzie, president and CEO of Toreador, said, "We are excited to have chosen Hess as our partner in the Paris Basin. The agreement is a significant step in the execution of Toreador's growth strategy and a strong source of value for our shareholders."

Greg Hill, president of Worldwide Exploration and Production of Hess said, "The technology we use to produce oil in US unconventional plays will have a direct application to the Paris Basin."

Under the terms of the agreement, Hess will make a $15 million upfront payment and invest up to $120 million in fulfillment of a two phase work program. Phase 1 will consist of an evaluation of the acreage and drilling six wells, with the first well planned for later this year. Depending on the results of Phase 1, Phase 2 is expected to consist of appraisal and development activities. Following Phase 2, provided contractual obligations have been met, Hess will hold a 50 percent share of Toreador's working interest in the covered permits.

Marathon oil drills discovery well in GoM

Marathon Oil has drilled a discovery well on the Flying Dutchman prospect, located on Green Canyon Block 511, in the Gulf of Mexico.

The Flying Dutchman well is located approximately 100 miles south of New Orleans, La., and was drilled in about 3,700 feet of water, to a total depth of approximately 30,000 feet. The well encountered 100 feet of net hydrocarbon-bearing sands in an Upper Miocene reservoir.

The results of Flying Dutchman will be evaluated along with additional potential drilling on Green Canyon Block 511 to determine overall commerciality.

In the second quarter, the company expects to expense approximately $45 million pretax related to a lower zone that was not successful.

Marathon holds a 63% working interest and is operator of Green Canyon Block 511, and is responsible for 100% of the Flying Dutchman drilling costs.

Apache's latest Matruh tests 44 MMcf, 2,910 b/d in Egypt's Western Desert

Apache Corp.'s second discovery of the year in Egypt's Matruh Basin - the Samaa-1X - tested 44 million cubic feet (MMcf) of natural gas and 2,910 barrels of condensate per day from two zones.

The nearby Opera-1X discovery, drilled earlier in 2010, test-flowed 890 barrels of oil per day from the Cretaceous-age Alam El Buieb (AEB-3D) formation.

The Samaa-1X is located in the Matruh Concession, approximately 1.2 miles (2 km) northwest of the Matruh field and 3.7 miles (6 km) southeast of the 2008 Maggie-1X discovery. The latest discovery tested 21 MMcf and 913 barrels of condensate per day in the Lower Safa and 23 MMcf and 1,997 barrels of condensate per day from the Upper Safa.

The Matruh Concession, acquired through farm-out from Shell in 2001, currently produces 130 MMcf of gas and 18,000 barrels of oil per day from 16 wells; the concession has yielded 119 billion cubic feet of gas and 11.2 million barrels of oil since Apache established production on the concession in 2003. "Since early 2009, production on the concession has grown from 60 MMcf and 5,000 barrels of oil per day to its current rate, and these two new discoveries prove that the basin has more to give, " said Tom Voytovich, vice president of Apache's Egypt Region.

Apache is planning to drill 11 additional exploration wells and two appraisal wells in the Matruh Basin during 2010.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com