Australia LNG excellence down under

| This sponsored supplement was produced by Focus Reports. Project Director: Jessica Santos Pereira. Editorial Coordinator: Manuel Felipe B. Mendoza. For exclusive interviews and more info, please log onto www.energy.focusreports.net or write to [email protected] |

The best view overlooking the energy world these days is from the land down under. A long time mining giant, the growth of Australia's petroleum industry is now adding a preponderant dimension to its international energy standing. With more than $200 billion worth of projects to exploit over 400 Tcf of gas, the eyes and resources of the oil and gas world are being drawn to Australia's free-market, OECD environment. Domestic industry and foreign investors, meanwhile, need only look north to energy hungry Asia for steady long-term demand that has helped Australia avoid an economic downturn and positioned it, as the IMF described, at the "forefront of the global recovery."

Despite the favorable outlook, 2010 has presented new challenges to the industry. Fallout from a proposed "super profits" resources tax spiraled into a mid-year prime minister change and subsequent federal elections, but still leaves industry yearning for fiscal certainty; Deepwater Horizon has heightened safety concerns, particularly as liquefied natural gas carries industry further offshore; and the infrastructure demands of prospective projects have exposed a looming labor shortage. Australia has the resources below the ground to grow into an energy powerhouse. How it surmounts the above ground risks go equally far in determining its success.

Gas is the biggest game in town

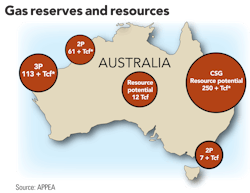

While a country of Australia's continental size is no stranger to big proportions, its plethora of "mega" liquefied natural gas (LNG) projects planned for the next 10 years are breaking new grounds for global oil and gas. Geoscience Australia — an entity of the Federal Department of Resources, Energy and Tourism (RET) — estimates conventional gas reserves off western basins to be 164 Tcf with as much as 250 Tcf of coal seam gas (CSG) assets in the eastern states of Queensland and New South Wales.

Belinda Robinson, chief executive of the Australian Petroleum Production & Exploration Association (APPEA) whose member companies represent 98% of Australia's oil and gas, estimates reserves-to-production to be in excess of 250 years. "Taking into account the other energy sources we have, it is an indisputable statement to say that we are an energy superpower," she asserts.

LNG is forecasted to be Australia's fastest growing energy export over the next two decades. Twenty-one years after the first LNG cargo delivery from Australia's flagship Northwest Shelf Venture (NWSV), there are over $200 billion worth of LNG projects in the planning phases, with final investment decision (FID) imminent for many of them. By 2015 Australian LNG exports could exceed 40 million tons per year as Chevron's Gorgon Gas Project and Woodside Petroleum's Pluto Project come onstream. Beyond 2015, up to 10 other projects could make Australia the world's second largest LNG exporter. Along the way Australia will be home to cutting edge developments: the first conversion of CSG-to-LNG; the first application of floating LNG technology; and the world's largest carbon capture and sequestration project.

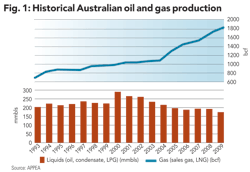

The proliferation of Australian natural gas projects coincides with declining levels of domestic crude oil production. Australia's oil production has been steadily declining since 2000 leading to a $16 billion trade deficit in crude oil, refined products, and liquefied petroleum gas. Geoscience estimates the deficit could reach $30 billion by 2015 with net imports of liquid fuels as high as ¾ of consumption by 2030 in the absence of a major new discovery.

"The outlook for oil is not too good," says Robinson. The oil reserves-to-consumption ratio is less than 10 years. The upside is that there is still the prospect of a major new discovery. Only 20% of our sedimentary basins have been explored. But barring a major discovery, the outlook for oil in Australia is very grim."

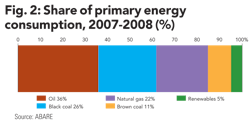

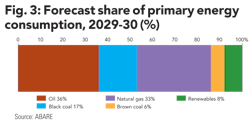

Meanwhile, gas production continues to grow to meet both domestic and export demand reinforcing its importance to the energy mix.

The wild and gaseous west

Gas in Australia is segmented between onshore CSG assets in the east and predominantly offshore deposits in Western Australia (WA) and the Northern Territory. While a palpable excitement is sweeping both markets, the offshore projects out west that are stimulating innovation and strengthening marine services suggest that the right time and right place for gas is today in WA.

"Seventy percent of Australia's oil and gas is off the Western Australian coast," says Colin Barnett, the premier of Western Australia. "The industry is dominated by WA. Of the three major reservoirs off the coast of WA — the Carnarvon, Browse, and Bonaparte Basins — only the Carnarvon has been relatively explored."

The offshore oil and gas reserves today in WA have been compared to the same stage of development as the Gulf of Mexico 30 years ago, a comment brought to the premier's attention on an April 2010 visit to Texas. Perth, consequently, has drawn references as the "mini-Houston" given its landscape of supermajors and multinational contractors. "What is happening here is of world significance," Barnett adds. "The sizes of the gas fields that have been and will continue to be discovered are large by international standards and certainly large by Gulf of Mexico standards. The significance of the gas reserves here is their proximity to the expanding markets of Asia."

Where to find the majors

Attractive linkages to Asia and a stable political environment have drawn substantial investment from the world's major oil and gas companies. Commitments vary from Shell and Chevron with over 100 years in Australia to GDF Suez and Petrobras, both relative newcomers. But the message is clear: Australia is a high priority market for global growth strategies.

Shell, a founding member of the NWSV, projects half of its global output to come from gas by 2012. "Globally Shell produces over 18 million tons of LNG per year," says Ann Pickard, country chair of Shell in Australia. "By 2020 we will add another 15 million tons per year, more than half of which will come from Australia. Australia is critical in terms of Shell's growth in the LNG marketplace."

Underpinning Shell's projections are its 25% equity in the Gorgon Gas Project and a joint venture (JV) with PetroChina which will acquire Australian junior and CSG rich Arrow Energy for LNG developments in Queensland. Shell is also pioneering floating LNG technology through 100% equity in the Prelude Project and 27% participation in Sunrise LNG. Prelude is widely expected to be the first successful demonstration of floating LNG. "Prelude will open up a whole new 'game' in terms of access to stranded gas reserves," Pickard adds. "It will also be the first of several FLNG facilities. Our plan is to design one and build many."

Given that the French were the original pioneers of the LNG trade launching the first shipment from Algiers to Britain in 1964, it is only fitting that GDF Suez, the industry giant in integrated LNG projects, has invested in offshore gas's hottest market. In January 2010 GDF Suez finalized an agreement to purchase a 60% share in three gas fields in the Bonaparte Basin. Already present in Australia through the waste and water businesses, the Bonaparte LNG JV with Santos, owner of the fields' remaining 40%, represents GDF Suez's first move into the Australian energy sector.

"Bonaparte LNG is a strategic project for us," say Jean-François Letellier, managing director of GDF Suez Bonaparte. "It adds a major component to the natural gas value chain of GDF Suez while reinforcing our position as a world leader in LNG."

Bonaparte LNG is an integrated project whose purpose is to build a floating liquefaction plant with 2 million tons per annum capacity in the Timor Sea. Final investment decision is expected by 2014. "We consider integrated projects as key to accessing competitive LNG resources," Letellier adds. "Australia provides the opportunity to have an LNG project with exploration, production, liquefaction, shipping, and marketing all together. LNG is becoming a global market and an LNG leader such as GDF Suez has to be present in the Asia-Pacific market."

While the French pioneered the LNG trade, many would argue that LNG today is very much an Asian industry in both production and consumption. Limited natural resource endowments have made Japan, South Korea, and Taiwan big customers of Pacific Basin LNG. China and India, of course, are growing consumers. Japan in particular — only 16% energy self-sufficient and the world's largest LNG importer — has a strong presence in Australia to address critical energy security needs. Osaka Gas, Tokyo Gas, and Kansai Electric all hold minority interests and long-term purchase agreements in Australian LNG projects. Japan Australia LNG Pty Ltd (MIMI) is a founding partner of the NWSV.

The face of Japan in upstream Australia, however, is INPEX. In the late 1980s INPEX targeted Australia as the next stop in its international diversification. A joint exploration block with BHP Billiton yielded ten years of successful oil production allowing for more aggressive growth in Australia. The result was WA-285-P. Better known as the Ichthys field, it is one of Australia's largest gas fields with an estimated 12.6 TcF of gas and an expected operating life in excess of 40 years. Ichthys's 527 million barrels of condensate makes it the largest petroleum liquids discovery in Australia since 1966. Joint venturing with Total to glean LNG expertise, the ambitious field development plans call for one of the world's largest offshore central processing facilities and an 885km pipeline to an LNG facility in the Northern Territory city of Darwin.

Ichthys will engender unprecedented engineering challenges as well as usher in what managing director Seiya Ito describes a "new beginning" for INPEX in Australia. "We have been successful as an exploration operator. It is now time for us to shift into a developing operator and ultimately a production operator. Ichthys is an asset that we will grow with towards these new stages of the company."

The new paradigm for Australian energy

Unequivocally, the project that brings Australia to center stage is Gorgon LNG, operated by Chevron with Shell and ExxonMobil holding 25% interests, respectively. Superlatives abound for the $43 billion resource investment, the single largest in Australia's history. Gorgon is estimated to produce 15 million tons of LNG per year — 8% of current global capacity — every year over its projected 40 year lifespan. "One project; 8% of global capacity. By any measure, that's huge," emphasized Geroge L. Kirkland, Chevron Corporation's executive vice president of Global Upstream and Gas, at Gorgon's FID ceremony in September 2009. According to ACIL Tasman, an economic consultancy, Gorgon will boost Australian GDP by A$64 billion and generate government revenues of A$40 billion over its first 30 years. It will also create 10,000 jobs during peak construction and 3,500 more throughout the project's life.

Gorgon's gas processing plant will be developed on Barrow Island, an A-class nature reserve located 56km off Western Australia's coast. As part of its environmental stewardship, Gorgon will host the world's largest carbon capture and sequestration project. Gorgon's externalities can be felt here and now in Australia in the way that project planning is categorically elevating the environmental standards and shaping the strategic directions of companies throughout the entire Australian oil and gas value chain.

An appetite for exploration

Just how untapped Australia's offshore basins are can now come to light after a change in regulatory framework that has made speculative surveying a growing business in Australia.

In 2007 Australia increased the time under which speculative survey data becomes public domain from five to 15 years, a move that is drawing the attention of the world's top geophysics companies. In practice, oil companies picking up relinquished blocks could have waited until data became public rather than pay for new data sets. "Essentially you only got one big 'bite at the cherry,'" explains Tony Weatherall, VP geomarket director Australia, New Zealand and PNG. Weatherall chaired the International Association for Geophysical Contractors for two years which lobbied hard for the government to change the regulation. As a result, he comments, "the regulatory change altered the landscape of seismic in Australia, probably forever."

Results of the change are evident. There were no speculative surveys shot in Australia after 2002 with Veritas (before the merger with CGG) being the last to shoot in 2D. Since 2007 CGGVeritas has shot at least 3,000km of speculative surveys by Weatherall's estimates.

CPRS & RSPT: politically charged acronyms Australians awoke on June 24 to the surprising headlines of a new prime minister in office. Julia Gillard replaced Kevin Rudd as head of the Labor Party and prime minister of Australia in a swift change of leadership that capped off a precipitous fall in Rudd's domestic approval ratings. Gillard has since called federal elections and on September 7, 2010 was elected prime minister on her own mandate following Australia's first hung parliament since World War II. Rudd's demise was largely blamed on two factors: first, his decision to delay legislation on an emissions trading plan known as the Carbon Pollution Reduction Scheme (CPRS) until 2013. Having labeled climate change "the greatest moral challenge of our generation," his abandonment of the CPRS in exchange for budget-balancing issues ahead of federal elections damaged opinions on his principles and eradicated support from climate change advocates. Second, and more unsettling for the resources industry, was his proposal of a resources "super profits" tax (RSPT) in April. The rancorous debate that ensued between industry and government for two months eventually cost Rudd his job. The debate centered on the rate at which government defined "super-profits." Any profits above 6% — equivalent to the long-term government bond rate — would be taxed at an additional 40%. While the RSPT would not have affected offshore projects, it would have drastically altered the economics of onshore developments, including major CSG projects in the works. Also damaging was the tax's retrospective component to apply to existing projects for which investment decisions had already been made. Equally alarming was the absence of consultation between industry and government prior to the tax's proposal. From a macro perspective, Australia's stable, low-risk environment that had attracted so much foreign investment had been compromised. Australian "sovereign risk" became an issue. Since assuming leadership, Gillard has rescinded the RSPT, proposed variations of existing petroleum rent taxes, and opened more transparent communications channels with industry. As of the writing of this publication, no final decision has been reached concerning reforms to the fiscal regime. Below are comments from industry leaders voicing their opinions and concern over the original RSPT. "Oil and gas is a long term investment. Long term investments need long term certainty. There are enough risks in the business through exploration, development, and oil prices without having to put regulatory and tax risk into it." — Brent Steedman, partner, oil & gas KPMG "Investment dollars go where the resources are and where regimes are stable. Australia is blessed with enormous resources, which is good news. But any sort of unexpected change in the tax regime discourages investment because people will wait and see what develops." — Ann Pickard, country chair, Shell in Australia "If the return on your investment is 6% and you are going to pay excess tax on anything above that, why don't you just buy government bonds and sit home and watch television? One thing I know about resources is that it attracts particular sorts of investors who are willing to take risks. It is a risky business and people expect a better than 6% return to be compensated for the risk." — Norman Moore, Minister of Mines, Petroleum, Fisheries and Electoral Affairs, Government of Western Australia "A really important point for us is trust and confidence. In Qatar, once we agree on things they don't get changed. We do not go and do funny things and ruin the market for ourselves." — Faisal Al Suwaidi, CEO of Qatargas |

Boasting the largest fleet in the world amongst geophysics companies and with seven vessels in Asia-Pacific, the goal for CGGVeritas is to bring its first vessel back into Australia since 2008. "We are certainly going to grow both proprietary and speculative surveys in Australia," he asserts. I would like to be shooting surveys up in the Browse Basin and in the Northern Territory. The other growth here is obviously processing. We have a very strong depth processing team here and we get a lot of work from Australia."

A piece of the pie for everyone In the early 1970s, after a decade of unsuccessful drilling, a small independent Australian company struck 50 TcF of gas off WA to form the basis of the NWSV. While offshore gas might be the biggest game in town, don't tell that to Australia's junior E&P companies actively drilling onshore with the hopes of becoming the next Woodside Petroleum. "Australian investors like betting on small stocks to see a little bit of exploration luck and watch our share price go up tenfold. They invest in a small company to see it become the next Woodside," says Russell Langusch, managing director of Orion Petroleum with exploration assets in New South Wales. Juniors in Australia work as scouting agents in a sense for the bigger players whose attention is diverted to offshore basins or, in the case of CSG, liquefaction facility planning. Strategies range as to how to draw the attention of larger farm-in partners. "We generally look at assets that are impaired in some way," says Langusch. "We would look for assets that companies have walked away from that have been too technically hard to commercialize. That is the edge we can bring — the technical ability to rescue assets that have been suspended rather than a prime A-grade asset." A company like Central Petroleum leans on its size by boasting the largest acreage package in Australia, predominantly in the Northern Territory's Amadeus Basin; certainly attractive farm-in potential for anyone. "Independent assessments have given us estimations of a viable exploration target of over 600 billion tons of coal above 1,000 meters that might be developed either through underground coal gasification or coal-to-liquid processor," says managing director John Heugh. Historically, the Cooper Basin has been the main onshore region for hydrocarbon production. As such, it is very crowded with companies looking to leverage off neighboring petroleum plays. "Almost every block in the Cooper Basin has been awarded," says Mike Scott, managing director of Cooper Energy. "In our portfolio we probably have three to four years of prospects left and then we will have to replace those exploration blocks with new acreage. We are active overseas precisely for that reason." The game changer for juniors in Australia could most likely be CSG — just ask junior CSG specialist Metgasco. David Johnson, managing director, describes Metgasco's acreage position as "similar to that of Queensland Gas Company at the time it was taken over by BG." Convenient for Metgasco, estimates cite the Bowen-Surat-Clarence Moreton system in eastern Australia to be a major gas producing province for a considerable period of time. "Translating gas in place to reserves and extracting gas commercially is an ongoing process that we are now in the middle of." It is a discussion that would certainly be of interest to a larger company, given the CSG-to-LNG infrastructure planning amongst a consortia of supermajors. |

If you build it they will come

LNG projects pushing the industry further offshore are stimulating a new generation of marine services. New ships break grounds in size and design and the importance of supply bases are becoming more apparent to address logistical challenges. Despite being entirely within Australian waters, the northwest's offshore gas fields are equidistant from the industrial hubs of Singapore and Perth. The competition amongst supply bases can very well see Singaporean marine yards servicing Australian offshore projects.

WA's response for infrastructure in support of local industry is the Australian Marine Complex (AMC). Located 20km south of Perth the AMC is an industrial cluster of manufacturing, fabrication, and assembly services for the marine, defense, oil and gas, and resource industries. Earlier this year the AMC commissioned WA's first floating dry dock which will prove critical in servicing upcoming projects. "We are expecting about 80 vessels to be on the Northwest Shelf over the next few years," says AMC general manager Mike Bailey. "A lot of those vessels will be running to and from this facility. All of them will need repair, maintenance, and dockings."

The AMC's most iconic representation and greatest asset is its Common User Facility (CUF). Bailey characterizes its enabling role as a form of "industrial empowerment." The CUF exists to provide Australian based businesses with access to large scale industrial infrastructure. The CUF was initially funded by $100 million and $80 million from State and Federal Government, respectively, which enabled the construction of wharves, fabrication halls, and a protected harbor.

"Our role is to enable a company to do projects that they could not undertake with just their facilities by giving them that virtual capacity increase," says Bailey. "Whereas they could fabricate something up to 200 tons in their workshop, our role is to give them the ability to make a module of 2,000 tons. We want to see projects coming to WA that can and should be done here. We are very biased in that sense."

A second piece of vital infrastructure for servicing Northwest Shelf projects is the Dampier Supply Base that is owned by Mermaid Marine Australia, the country's largest marine services provider for offshore oil and gas. A stand alone $100 million asset, managing director & CEO Jeff Weber also considers it Mermaid's single biggest competitive advantage. "People often underestimate the challenges of operating vessels in the northwest compared to Singapore where, if a vessel encounters a problem there are 20-30 suppliers to help at any time. It is a tremendous asset for a region where it is hard to operate because of minimal infrastructure and scarce supplies."

Mermaid's core business continues to be the provision of support vessels and has invested over $100 million in fleet renewals over the last five years. Utilizing its vessels for pipelay support on the Pluto Project not only insulated the organization from the financial crisis, but triggered growth in 2008-2009. But with Gorgon and other projects approaching production, supply base operations are becoming increasingly important. Since 2002 Mermaid's operations have shifted from 95% vessels and 5% supply base to 70% and 30% this year. "You can move boats around to meet the market. But with a supply base it creates a 'build and they will come' type scenario," he adds.

As projects and customers come, Weber sees a host of externalities driving business. "You get to know your clients very early on in the cycle. If you are doing offshore work, the first thing that you do is get an office and a warehouse to store your gear. By the time a client needs a vessel to begin their offshore work we already have an established relationship with them."

Exposure to long-term contracts was particularly beneficial to Australian marine service companies during the crisis. With Gorgon reaching FID in September 2009, losses carried into the crisis years were quickly recouped, if not, evaded altogether. Andy Cowan, QHSE manager at Bhagwan Marine, light-heartedly comments, "what financial crisis?"

Founded in 1998 with just one ship, Bhagwan Marine has flourished over the past 12 years into the owner and operator of a fleet of over 35 vessels. Its newest addition will be a custom built landing craft — the Bhagwan Shaker — to service Barrow Island; the Shaker's sister ship, appropriately named the Bhagwan Mover, has already been in operation for Gorgon for the past 12 months. In addition to obvious revenues, servicing Gorgon has provided an immediate opportunity to exploit the strength of Bhagwan's vessels while positioning it for future growth. "This is a niche market and there are not many companies dealing in the port services out to and around Barrow Island, which is largely shallow water," explains Cowan.

Made in Australasia

Construction of the AMC's floating dry dock and the Bhagwan Shaker was done by Strategic Marine, Australia's largest builder for oil and gas industry supply boats. Strategic Marine leans on a rich tradition of shipbuilding born out of WA. Chairman Mark Newbold explains that WA developed a commercial expertise in building aluminium boats before anyone else. "There were a number of companies in WA that became exporters and a host of reasonable sized yards that became experts. We are now exporting the technology that we developed over the years."

Adapting to the economics of the industry, Strategic Marine has exported its capabilities to its four shipyards in Australia, Singapore, Vietnam, and Mexico. While proximity to Asia allows operators to satisfy a hungry commodity demand, Australian manufacturers and fabricators benefit from cost-competitive labor and resources. Globalization and the fully developed Asian supply chain have shifted industry dynamics forcing Australian manufacturers and fabricators to adjust their strategies. John Sheridan, CEO of AusGroup, the largest fabricator in WA, explains that "what typically comes local is schedule-critical or a product that is price insensitive." Fully developed project modularizations, meanwhile, are sourced in Asia.

Strategic Marine has followed suit by developing niche specialties for its Asian yards. "Singapore is very much a specialist aluminium yard that is quite mature in its development and is producing high quality work. The Vietnamese yard has opened up quite a bit of business for us because of its steel capabilities," says Newbold. The Vietnam yard also played an integral role in the construction and assembly of the AMC's floating dry dock. The Australian yard, meanwhile, being located within the AMC, is shifting more into marine services repair and maintenance mindful of the future demands of the Northwest Shelf.

Global content, local continent

While State supported projects such as the AMC provide an important impetus for industrial development, the synergies from mature oil and gas provinces are proving equally beneficial in fostering service sector growth. The talent and resources that have made Aberdeen and Stavanger centers of subsea excellence are now gravitating to Perth. From executive managers to new global headquarters, WA oil and gas services are becoming a truly global mosaic, with a North Sea twist.

Perhaps no greater testament to Australia leveraging, and ultimately overtaking, North Sea activity is TSmarine, a subsea contractor specializing in integrated life of field services. TSmarine was founded in Aberdeen in 2004. The Perth office, which began in 2006 from a Woodside contract, quickly established itself as one of the best performing centers and completed a management buyout of the parent company in November 2009.

As chief executive John Edwards explains, "There was a period of nearly two years when this office was funding the head office which was in pretty bad financial shape. We decided that the best way to ring-fence what we had and make sure that our success continued was to buy the business from the parent company. That also gave the parent company the needed cash to resolve their financial issues." Shortly after finalizing the deal the Aberdeen head office shut down. To complete the circle, TSmarine plans to reopen an office in Aberdeen on the back of a service contract.

The technical challenges of subsea field developments are creating a market for life of field service providers. TSmarine, however, explains Edwards, is quite different from other subsea construction companies. "We focus most of our activities around the well. In addition to our rigless intervention capabilities we can do all the low margin work for a drill rig typically done by them because no one else has the technology to do so. In our business any activity close to the well is the highest margin work that we can do because of its value for oil companies."

TSmarine's integrated capabilities afforded by its vessels and ROVs were a serendipitous surprise for Woodside when fulfilling its first contract. Essentially TSmarine's services exceeded their original mandate. "We did not just do well intervention: we were the first company in this region to install and run a Christmas tree thereby freeing the drill rig to fulfil its real value of actually drilling; we installed flow bases, tied trees into each other with jumpers, and installed drilling conductors. It is not typical that a company has all of those services under one roof," says Edwards.

Scotland's North Sea neighbors and fellow experts in offshore services, the Norwegians, are also finding a comfortable home in Australia with multinational companies steadily increasing their presence to grow alongside major operators. Subsea specialist Acergy made the full leap into Australia in 2006 with the establishment of a permanent office in Perth. "The scale and complexity of the LNG projects coming to market over the next few years are of great interest to a company like Acergy," says Darren Cormell, managing director of Acergy Australia.

Well equipped with world class technology, Cormell considers Acergy's greatest growth driver in Australia to be its human assets of strong local talent that leverages the resources of a global corporation. "The Acergy model is around having the right mix of local knowledge that is backed by a global consistency," he explains. "We have been building a local track record over the past several years to understand the local issues. You back that up with a company that understands how to deliver very large projects and I think it is a model for success."

Acergy has been strategically building its portfolio of assets to support its local talent. SapuraAcergy, a JV between Acergy and SapuraCres, commands the Sapura 3000, a regionally based vessel with leading capabilities in heavy lift and deep end pipelay. A proposed combination with Subsea 7, currently awaiting regulatory approval, will see an enlarged global fleet of 42 vessels with the full spectrum of pipelay capabilities, several of which would likely be bound for Australia. According to Cormell, "the enlarged fleet will have the opportunity to make more vessels resident in certain parts of the world. As Australia becomes an ever increasing part of the world, it is likely that we will look to optimize the fleet to make them as attractive as possible in the region."

With over 20 years experience providing mooring solutions to the harsh conditions of the North Sea, Norwegian incorporated Viking Moorings now brings its suite of offerings to Australian waters. "In Australia we have not had the high caliber technical mooring solutions that we have now," explains Perth branch manager Trond Watland. "We have introduced different methods for semisubmersible rig mooring such as fiber ropes which are new to Australia."

A premium on safety has placed a strong emphasis on expert training. With the training still sourced from Norway, Viking Moorings embodies North Sea-Australian knowledge transfer. "Training people in anchor handling, fiber rope management and being able to certify, qualify, and repair on deck is a trait that the Australian market does not yet have, so most of our training has come out of Stavanger," Watland explains. "We have an all-Australian crew in Karratha and Dampier that is being trained by Viking Moorings staff that has come in from Norway. Everyone on that crew are the only ones who can do what they do in Australia. It is a valuable input that is coming into our workforce."

When combining North Sea know how with Asian manufacturing and a strong local industrial base, the oil and gas sector's organization has a truly multinational dimension. As Christian Lange, CEO of Neptune Marine Services, argues, "I am intolerant of people saying that Australia lacks the technology or expertise as the Gulf of Mexico or North Sea. Australia has a fantastic education system and most of the industry here have either come from those regions or have worked there and repatriated. In many cases we lead the charge."

Structured for success

Major multinationals with established expertise in their fields are finding that success in Australia comes as much from their corporate structuring as from their product offerings. Oilfield services giant Baker Hughes, for example, is comfortable accepting the challenges of Australia with the backing of an internationally innovative body of work. "A priority is to focus on more deepwater and high-temperature reservoirs, aligning with the work undertaken by major operators in the area. Most of the high-tech infrastructure required is very familiar to Baker Hughes," says managing director Bernie Kelly.

The biggest difference, however, for Baker Hughes in Australia has been the efficiencies generated from their geomarket model, developed over one year ago, which shifted vice-presidents to regions and consolidated the management of various product lines.

Historically, Baker Hughes' product lines were managed separately and entered the market at different times to coincide with stages of clients' oilfield production. "In Australasia, we inherited seven different offices and five different sites," says Kelly. "One of the areas we are focusing on is consolidation of our separate operational bases, which were the result of our previous divisional approach, to provide improved efficiencies to customers." New efficiencies now ready Baker Hughes to capitalize on both the offshore and CSG segments of the Australian market.

"Deep water and high temperature reservoirs are the areas in which there is a lot of exploration to come. The level of tools that we are going to run down in Australia are becoming much more high-tech than we have seen historically. We can export our learnings here to other areas," says Kelly. The immediate impact of Baker Hughes's offshore reservoir services will be complimented by future growth in the CSG arena by way of its September 2009 acquisition of BJ Services and its large CSG portfolio. Notes Kelly, "Baker Hughes will be reassessing its strategy in servicing CSG, leveraging the synergies gained with BJ Services' customer base, infrastructure and expertise."

Integration, meanwhile, is the defining feature of professional services giant Ernst & Young throughout Asia-Pacific. Just as major operators have set up regional centers for value chain operations, Ernst & Young has replicated its approach by establishing hubs of expertise for its practices: an upstream business in WA and Queensland; a trading business in Singapore; and a specialist service business to support buyers in Beijing. The result, as Perth's managing partner and oil and gas sector leader Jeff Dowling notes is that, "of the 'Big Four,' Ernst & Young is the only firm that is financially integrated throughout the whole Asia-Pacific region."

"Shell is a very good example of this," he adds. "Shell has relocated its upstream business in Oceania to Perth. They also have a trading hub in Singapore and they are interfacing with customers in Beijing. All of the global majors are doing the same and we are replicating our business model accordingly. We have evolved into three hubs with oil and gas specialists across our disciplines in those three areas to provide a seamless service between the producers, buyers, traders, and support services."

Innovation down under

The subsea systems for the Gorgon Project in the heart of the Northwest Shelf face combinations of high pressure, high temperature, and corrosive product. "One of the biggest challenges is the deep water element, and especially the continental shelf. It is effectively a subsea cliff 100km offshore across which you need to install a pipeline," explains Phil Brown, director & performance team leader of J P Kenny Perth.

"The environmental conditions there are possibly more challenging than any other place in the world," he adds. "The cyclones generated in the area are extremely powerful. You have a number of other interesting features like the solitons — giant subsea rolling waves that are within the water column — which you would not encounter in many other parts of the world. Adding the extreme tides, currents, and cyclones all together, it is a tremendous metocean design challenge."

Responding to these challenges, J P Kenny has applied its FEED expertise on some of the biggest and most difficult subsea projects in Australia: Gorgon upstream development in partnership with Technip; subsea development for the Julimar Project, Apache's largest ever gas project; and INPEX's Ichthys Project. "We have always had a focus on optimizing and eliminating the layers of design conservatism that have historically existed," says Brown. "We have also expanded that philosophy into other design features such as lateral buckling, for example." All of this has branded J P Kenny Perth an emerging center of excellence amongst it global offices for pipeline stability. Considering Wood Group Kenny's global presence and identity as the specialist of its kind in the world, the Perth office's recognition speaks to the degree of difficulty of subsea Australia.

Adding another dimension to subsea pipelines is the difficulty in their design, yet the ease in which they can be altered, even scrapped, from a project's plans. Eric Jas, managing director of Atteris, a design engineering company, cites that despite the difficulty of pipeline engineering, "it doesn't seem to me that offshore pipelines between a field and an onshore treatment facility are at the top of a developer's list. A lot of the focus from an engineering and developing point of view is at the field itself — wells, platform, onshore plants and the marine facilities to export LNG. The pipeline is often seen as the detail that connects the two. It is not underestimated infrastructure, but normally where we put the pipeline on the seabed depends on where the plant will be built."

In April Woodside announced plans to develop its Sunrise Field with a floating LNG facility rather than a pipeline to either East Timor or the Northern Territory. "That is how easily a pipeline can be eliminated on paper," asserts Jas. Several large projects are currently in the planning phase for pipeline design, construction, and first gas. Those whole views could easily change over the next year, Jas believes.

Meanwhile, for those pipeline projects that do go ahead, the northwest's seabed poses considerable challenges. Brown characterizes its unconsolidated limestone materials at the top and hard rock beneath as very difficult foundations for installing big platforms or trenching pipelines.

"There is significant variability from calcarenites and limestone to deep sand," agrees Marcus Hemsted, technical sales manager of CTC Marine. "There are not a lot of trenching machines capable of burying trunk lines in these seabed conditions in the current marketplace."

Recognizing this void, CTC Marine established a local presence in Perth in 2008 to grow its Australian operations bringing with it cutting edge technology that is customized for the Northwest Shelf. Operating one of the biggest trenching fleets in the world, the specific feather in the asset cap of CTC Marine is RT-1, a potential game changing technology for large diameter subsea pipeline stabilization. Weighing over 200 tons and capable of trenching pipes up to 1.5 meters in diameter, Hemsted described RT-1 as the biggest mechanical subsea pipeline trencher in the world. "With 2.3 megawatts of trenching power she is the most powerful mechanical rock trencher in the world. RT-1 is the premier reason for CTC Marine's increasing presence in Australia," he comments.

Traditionally pipeline stabilization in the Northwest Shelf has been done by rock dumping — an expensive exercise that carries environmental concerns. Using RT-1, CTC Marine's technique to bury pipelines is used in conjunction with dumping to minimize the effect of rock. "In sum," Hemsted concludes, "there is no other hard ground trencher like the RT-1 at the moment that can productively trench pipes as big as the ones she does in the hard seabed."

The local innovator turned global player

Local innovation ultimately built a growing international business in the case of Neptune Marine Services. What is today a broad-based subsea engineering company providing a suite of life of field services and bespoke engineering solutions across four continents, began with one proprietary technology. "Neptune was incorporated in 2003 in order to develop our underwater welding technology, NEPSYS®," says Lange. As Neptune's flagship technology, NEPSYS® was developed to provide a low-cost permanent weld solution equal to dry weld standards that was believed to be missing in the Australian market.

Lange joined Neptune in 2006 with the task of growing a business out of the technology. "My goal was to build a service organization with the NEPSYS® technology as the key differentiator. After spending six months reviewing the marketplace, I felt that there was a role for a domestic Australian company that offered our broad range of services; and that model could be expanded to key offshore areas," Lange explains. Neptune's growth and the development of a business from its technology has been largely fuelled by international acquisitions. Today operators look to Neptune for engineering prowess while construction companies are supported by surveys, diving, ROVs, pipeline stabilization services, and upfront engineering to support detailed design.

However, Neptune's diverse capabilities often put them in nebulous and unintended competition with traditional EPICs that is consequently is reshaping the traditional EPIC model. Explains Lange, "one thing that we that we need to address and contend with is a lot of EPIC companies looking at us as competitors. We have made the separation between 'church and state' so we very clearly support them and do not compete with them on the construction scope. That is not to say, however that they do not compete with us. A lot of those companies are looking at various life of field services — from seismic drilling to decommissioning — which is our sweet spot."

Power of the people

The fiscal uncertainty that is still looming as many LNG projects approach FID will likely "change development timeframes until people get a better handle on how to bring these projects on," predicts Dowling. Fiscal uncertainty notwithstanding, project timetables could be delayed on the basis of another major industry concern: a labor shortage. The construction boom for Australian LNG projects is estimated to create 55,000 new jobs. Additionally, projects moving into brownfield environments will place an increasing need on local services leaving many in the industry pondering about how to fill labor needs.

"I am concerned as to the collective plan of both industry and government to be ready for this without driving inflationary wage pressures, the flow on effect to cost of living, and production target assurance for the operating companies," adds Plexal Group CEO Steve Jones.

Construction for many LNG projects is not scheduled to begin for another few years so industry and government still have the silver lining of time on their side. Robinson points out that not all 55,000 jobs will be created at once. "There is going to be an elevation of a need for resources over a much longer term. Fortunately we will have time to work on mid-term and long-term solutions," notes Craig Follett, Australasia regional director of Brunel Energy, the global leader in white collar placement and the Australian leader for blue collar placement for the oil and gas industry.

However, time cannot breed complacency. Follett highlights a three pronged approach to address labor shortages. "The longer term solution is the stimulus of technically skilled people" to align students' technical directions with industry requirements.

Second are apprenticeships programs to transfer traditional heavy industry skills into oil and gas specific needs such as reservoir engineering or drilling. Third, is the continuous development of Australia's supernumerary program to team international specialists with local graduates and accelerate the knowledge program.

Australia's 457 Visa is a process in place to facilitate this type of transfer. "We even think that you can cherry pick certain projects of national significance and create a highway for them whereby the immigration process is tailored to match project requirements. That is where government and industry need to align their needs. If that highway is fabricated, Brunel is ready to travel on it," he adds.

A turning point in the industrial relations challenge could very well be the new Labor government. While still too early to tell, Brunel believes that positive signals have been sent regarding more active engagement between industry and government on this issue which could realistically inhibit the full development of Australian oil and gas.

Safety first and always

Three converging issues have heightened the safety mindset in Australia to new levels. In August 2009 the Montara rig, owned by Thai exploration company PTTEP, began leaking oil for two months off the coast of WA. The final results of a federal government inquiry into the report are expected by year's end with likely regulatory changes to follow. Second is Deepwater Horizon with its impact reverberating around the world. In response, 30 of Australia's biggest oil and gas producers are preparing an industry wide agreement to allocate financial resources in the event of an oil spill in Australian waters. Third, and perhaps most challenging, is the integration of a multitude of new workers under one common safety culture.

Lange asserts this might be easier said than done. Australia "will have a large influx of people who may not speak the language and have different cultures, educational backgrounds, and expectations. When you put all the new backgrounds, cultures, and expectations together, the management of the integration of all of these people is my main concern."

Specific changes to the regulatory landscape are still unclear. "I think there is no doubt that the Australian oil and gas industry wants to perform as the best in the world," says Brendan Fitzgerald, managing director and co-founder of safety and risk engineering consultancy Vanguard Solutions. In its 10 years of operations Vanguard and its personnel have taken the lead on safety engineering for many of Australia's largest projects such as Woodside's Chinguetti, North Rankin B, and Pluto. "The problem though is that sometimes people become overly focused on the slips, trips, and falls part of safety — which are easy to identify — rather than the management and process risk."

Any regulatory changes will add to an already progressive five years for safety standards in Australia. The National Offshore Petroleum Safety Authority (NOPSA) began operations in 2005. Today Australian law requires every offshore facility to have a NOPSA accepted safety case. The mandatory introduction of the safety case, Fitzgerald notes, is one of the biggest changes he has seen in his over 25 years in the industry. However, he believes, more action needs to support the plans. "A lot of people think that the job is over when the safety case is delivered. Producing the safety case and having it accepted by the regulator is just the first step. You then have the lifetime of the facility to operate. The safety case is a roadmap and you have to walk the talk."

Safety issues for drilling are an obvious concern with industry penetrating harsher environments and increasing water depths. Well designs are becoming more complex through extended reach, horizontal, and multi-lateral wells; all pose high risks and enormous costs of failure not previously encountered in Australia. The best accident prevention and safety enforcement is quality training as viewed by Welltrain, a rapidly expanding school for operationally relevant well control training. Welltrain addresses both the human element of accident prevention and harnesses the transferrable skills between offshore, onshore, and CSG drilling.

"Improved levels of training are required to match the skills necessary to operate more complicated equipment and well designs," says training manager Dave Pollack. "Today, we have cyber-outfitted drilling rigs where the work for a driller is all done through joysticks, not brake handles. The driller is more removed from the drilling process by being insulated inside a quiet, high tech environment."

Pollack notes that existing well control training tends to be more academic and does not provide sufficient practical and operational training. Welltrain aims to plug that gap by blending the practical with the theoretical.

Third party drilling training is still an evolving market in Australia that is necessarily driven by industry changes. "Previously, in-house training courses were a feature of working for major oil and gas operators," explains Welltrain managing director Tom Brand. "In the last 10 years, however, companies are tending more towards outsourcing training. There are also a lot of smaller rig owners who just don't have the resources or specialized skills to run their own training department."

Specialized training is also required in the comparatively new CSG industry. "Whilst the mechanics of the drilling process are essentially the same, crew members may not be aware of the hazards that are involved in drilling CSG wells where hydrocarbons are being exploited," adds Brand.

Engineering the future

While Australia is preparing for an eventful decade of major LNG projects whose production and economic impact will extend decades more into the future, the head of one engineering firm is looking ahead to life after LNG. "We have this unbelievable LNG energy source from which we hope to be the number two provider in the world," says Steve Jones, CEO of Plexal Group. "But it is a finite resource. Where will Australia be in 50-60 years when these fields are seriously depleted?"

No stranger to conventional hydrocarbon engineering, the Plexal Group's expertise is in brownfield expansions, upgrades, and marginal greenfield developments with a focus on control and safeguarding systems. Jones cites Plexal's work on Woodside's Goodwyn A Safeguarding System as a critical experience that underpinned its extension into Thailand and its continued expansion throughout Southeast Asia. Plexal proved its ability to upgrade and transfer under full production conditions, with no dedicated shutdowns, a gas platform of 3,500 safety devices.

But driven by a larger purpose — and a clear business opportunity — Jones is positioning Plexal to leverage technical IP from LNG and transfer it into renewables which he believes is the next big industry for Australia. "The LNG business is going to produce a lot of revenue. It is also going to bring in a lot of technical expertise. In the medium term, we would like to grow a lot of this expertise and get ourselves involved in geothermal energy, tidal power generation, or concentrated solar power," says Jones. Indeed WA's total natural resource endowment creates many synergies between conventional fossil fuels and renewable energies. "There are massive water and power issues in the northwest so it is rewarding to be involved in sustaining that cornerstone of the Australian economy in a way that has a lower environmental footprint. If we can really leverage off this industry maintaining an energy production or delivery focus to the world, that will be Australia's next fantastic export."

The best place on the planet for oil and gas

Natural gas is still the biggest game in town. With declining production in the North Sea, a drilling moratorium casting a shadow on the Gulf of Mexico, and Brazil still years away from first oil in its pre-salt fields, Australia is the darling of the offshore oil and gas world. "This is such an exciting and dynamic time," says Belinda Robinson. "This is the industry that has helped Australia evade some of the more negative consequences of the financial crisis. This industry provides so much optimism for the long-term economic sustainability of Australia and in doing so, supplying clean energy. It has so much going for it that it is hard to not be excited for it."

Perth, the capital of oil and gas Australia and this year's host of the World Energy Cities Partnership, is certainly reaping the benefits of the rising tide of the industry. Beyond the quantifiable returns on multi-billion dollar projects, a walk down St. George's Terrace or a stroll through an engineering office will bring to life the international face of oil and gas in Perth. "The industry is really putting us on the map in a global sense — it is profiling WA and the city of Perth to the world," beams Dowling, a native of WA. "The oil and gas industry being a global industry is really helping drive that cultural change in our society and it is a benefit that should not be underestimated."

Australia has all of the necessary assets to become the premier oil and gas province for the foreseeable future. Voracious Asian demand for preponderant natural resources has attracted global talent and capital which in turn are stimulating innovation and enhancing service industries. A very favorable picture is painted for Australia's future as an exporter of cutting edge technology and leader in clean energy if it can surmount today's obstacles of fiscal uncertainty and human resource deficits. The mixture of future promise and current challenges present unprecedented opportunities for coordination and collaboration between industry and government. All things considered, the right place, right time for exciting oil and gas activity is Australia, today.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com