Building an E&P company and making exit decisions

Bill Pritchard

Peak Energy Resources Inc.

Houston

Peak Energy Resources Inc. was formed in November of 2002 with an initial equity commitment from Yorktown Energy Partners of $10 million. The company acquired its first significant set of properties in April of 2003 with the purchase of the assets of Merchant Resources, a GE Capital limited partnership. With that acquisition, Yorktown committed an additional $45 million in equity to Peak.

The Merchant assets consisted of producing properties located in the Texas Panhandle, the San Juan basin of New Mexico, and certain held-by-production (HBP) leasehold located in the developing horizontal Barnett play southwest of Fort Worth.

Initially, Peak’s focus was on the Panhandle assets, generally, and the Granite Wash play in and around the Buffalo Wallow field, specifically. The play met most of the criteria of our initial business plan-that is, to find and develop natural gas resource plays where Peak could exploit the assets through the drillbit. We believed this simple, repeatable gas play exhibited low geologic risk and would allow Peak, through improved drilling and completion practices, to lower costs and increase per-well reserves over time.

Still another criterion for our target plays was a view to “running room” in the form of available undeveloped acreage. At the time of the Merchant acquisition, several operators were competing for leasehold in the Granite Wash play in Hemphill and Wheeler counties, including Chesapeake, Patina, Newfield, Dominion, and Samson Resources.

Peak’s leasehold in the play initially consisted of only about four sections on the southeast flank of the Buffalo Wallow field. Accordingly, at the outset, we didn’t know how successful Peak could be accumulating additional acreage in the play. But, an aggressive leasing strategy supported by local contacts in Amarillo paid off for Peak. By the time the assets were readied for sale two years later, Peak was one of the largest leaseholders in Texas Railroad Commission (RRC) District 10 with more than 20,000 net acres under lease.

As to the simple, repeatable nature of the play, Peak drilled 63 wells in a little less than a year and a half on its leasehold without encountering a single dry hole. At the end, Peak had six rigs running and was the most active driller in Texas RRC District 10. Peak’s net production increased ten-fold, from around 2.5 MMcfe/day at acquisition to almost 25.0 MMcfe/day. At the same time, Peak’s completed per-well costs dropped to around $1.4 million per well and its estimated ultimate recovery (EUR) stabilized at an average of around 1.4 bcfe/well.

In late summer of 2004, Patina, Peak, and others petitioned the Texas RRC to down-space the Buffalo Wallow field to 20-acre optional spacing units. That petition was approved in the fall and, close on the heels of that order, Peak moved to sell the company.

The San Juan and Barnett shale properties were acquired for $23 million by an affiliate, Peak Oil & Gas Inc., to make the stock sale of Peak Energy a “pure play” on the Texas Panhandle. Lehman Bothers was retained and a full process ran in January of 2005. The company sale closed in April, almost two years to the day that the assets were acquired from Merchant Resources, for $230 million.

Following the sale, Peak Oil & Gas, was renamed Peak Energy Resources. Yorktown Partners capitalized the company with $75 million in new equity. Peak’s most valuable asset, the San Juan basin properties, was sold to Goldman Sachs in a VPP with the “tail” sold to Burlington Resources for a combined $30 million.

Peak then turned its attention to its Barnett shale leasehold located primarily in Hood County, Texas. There, Peak had acquired about 10,000 net HBP acres in the original Merchant Resources acquisition. This acreage was held by production from the shallow Strawn conglomerate. Beginning in the summer of 2004, Peak began acquiring adjacent leasehold in the play. Today, with six brokers working the area, Peak’s Barnett leasehold in Hood and the adjacent counties of Somervell and Erath is approaching 30,000 net acres.

The horizontal Barnett, like the Granite wash in the Panhandle, met Peak’s primary criterion of being a simple, repeatable natural gas resource play. In the area of Peak’s leasehold, the Barnett is almost 300 feet thick. However, the Viola limestone which underlies the Barnett in the eastern portion of the basin and which, in theory, acts as a barrier to fracture treatments extending down into the water wet Ellenberger below, is absent in the area. Consequently, the play in Hood, as in Johnson County to the east, is to horizontally drill the Barnett.

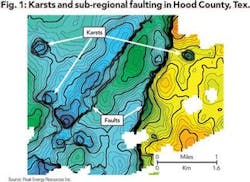

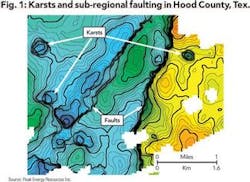

Some geologic risk does exist in the form of karsts and sub-regional faulting that serve as conduits for fracture treatment into the underlying Ellenberger. To mitigate that risk, Peak acquired almost 50 square miles of 3D seismic over its leasehold and found that only about 20 percent of its acreage is affected by local tectonics (Fig. 1). These features will be avoided in Peak’s upcoming drilling program.

Peak’s assessment of the horizontal Barnett play in Hood County identified the two main impediments to success as: (1) a shortage of rigs, and (2) a lack of pipeline infrastructure. On the shortage of rigs, Peak priced rigs and found the tight market at $17,500/day (with top drives leasing for another $2,000/day) with that rate applying whether the rig was drilling or moving from location to location.

That day rate was nearly twice what Peak had paid for rigs in the Panhandle. Moreover, contractors were requiring a two-year commitment to the rig and timing on when rigs might come available ranged from six months to a year. Peak did the math and decided that, if they could be found, it would be cheaper to buy rigs.

Over the course of the next few months, we identified two rigs in Amsterdam and one in Kuwait, and our subsidiary, Pinnacle Drilling, moved quickly to lock them up. One of the rigs is rated to 11,000 feet (1,000 HP) the other two to 18,000 feet (1,500 HP), so we have more than the necessary iron to drill 5,000 feet vertically and 3,500 feet horizontally through the Barnett.

One rig has been mobilized and is drilling our first well in the field (see photo, page 8). The second is being refurbished in Houston, and the third is being modified in Amsterdam to accommodate a top drive. Peak expects all three rigs to be operating in the field by November.

Next, Peak looked to solve the problem of pipeline infrastructure. Quicksilver’s modern Abby Bend processing facility and Cowtown Pipeline are east and on the other side of the Brazos River from Peak’s acreage. Other than antiquated pipeline systems dating back to the 1970s, when the shallow Strawn was at peak production, no gathering infrastructure existed in western Hood County.

Peak did, however, inherit on old Gulf Oil processing facility at Tolar, Tex. And, Energy Transfer and Atmos Energy have two main intrastate 36-inch lines running immediately adjacent to the Tolar Plant. But, Peak had to process and compress its gas to get into either of those intrastate lines. Accordingly, in fall of 2004, Peak established a gas gathering and processing subsidiary, Momentum Energy Group, to gather the company’s and third-party gas in Hood County.

To date, Momentum, has laid almost 25 miles of 16-inch pipe around Tolar. It has completely replaced and updated the old Tolar Plant by adding compression and a state-of-the-art cryogenic plant (see photo, page 12) so that the facility will be capable of processing 40 MMcfd by the end of the year.

EOG, Quicksilver, Republic (now Burlington Resources), Chief, and Encana are all active in Hood County, but the play is still very much in its infancy there. Given that we lack significant historical production data, we are using a low-case estimate of a first month’s average production rate of 1,000 Mcf/day with a 1.3 bcf EUR (gross) and find that, at today’s commodity prices, Peak can still make an attractive rate of return on a $1.8 million per-well capital expenditure.

Quicksilver’s published numbers on its horizontal Barnett wells at Abby Bend, five miles east of Peak’s leasehold, are 1,500 Mcf/day initial rate with an EUR of 2.5 bcf/well. As was the case with our Panhandle play, Peak’s goal in the Barnett will be to increase initial flow rates and EUR over time and reduce capital costs to improve the overall economics of the play.

The end game for Peak will be much as it was with the first company-that is, to build the company up to the point where it becomes attractive to one of the public upstream oil and gas companies trying to either establish a presence or extend its position in the Barnett.

Having said that, we found in our first sale process that consolidation in the industry has sharply reduced competition for upstream assets and that the multiples available in the public markets for Peak’s E&P assets, and certainly for its pipeline assets, may provide a better valuation for Peak’s shareholders. OGFJ

The author

Bill Pritchard [[email protected]] is chairman of Peak Energy Resources Inc. The company is based in Durango, Colo., with corporate headquarters in Houston. Prior to joining Peak, he was managing director of corporate finance in the energy group at Jefferies & Company.