Hurricane damage may have lasting impact

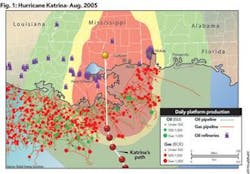

In the wake of Hurricane Katrina, oil and gas producers in the Gulf of Mexico moved quickly to size up how hard a pounding they took from the powerful Category 4 storm. On August 30, a day after the hurricane struck a severe blow to coastal Louisiana, Mississippi, and Alabama, the offshore industry in the Gulf still had nearly 95 percent of its output shut-in, as producers and drilling companies attempted to assess damage to their operations.

As energy companies ventured back onto offshore platforms and other installations after the storm, many found that damage to offshore rigs was greater than first thought. In addition, 12 refineries in Louisiana, one in Mississippi, and another in Texas were either shut down or operating at reduced capacity a week after Katrina came ashore. When electrical service is restored, some of the closed refineries are expected to begin producing quickly, but others that were damaged more extensively from the hurricane may be down for some time.

Several interstate gas pipelines were affected as well, the stoppages caused by a lack of power at pumping stations to keep the gas flowing. The Plantation and Colonial product pipelines and the Capline crude oil pipeline were initially shut down but have since been restarted, although at reduced volumes, according to company officials.

The power grid sustained major damage, hampering the refining and transmission of fuel supplies from the affected areas. Entergy and Southern, the largest utilities in the region, struggled to get the power back on for more than a million and a half customers as they attempted to rebuild destroyed infrastructure. An industry spokesman said the destruction to Entergy’s transmission lines and other facilities was probably the worst ever sustained by a US utility.

Ship traffic on the Mississippi River was halted for a time from New Orleans to the Gulf of Mexico due to debris and other objects in the shipping channels and the closure of the LOOP Clovelly oil storage facility in Galliano, La. Marine traffic, including ships carrying LNG, were backed up in the Gulf, unable to offload their cargo at receiving terminals. Some traffic has resumed as of this writing, and it is expected that crude oil flow will be back to normal by mid to late September. More than 10 percent of the nation’s imported crude oil typically enters at the LOOP.

Nariman Behravesh, chief economist with Global Insight, estimates it will take about a month to get 70 to 80 percent of Gulf of Mexico production back on stream. Drilling rigs seem to have been hit harder than production platforms, and it will take longer to get these back into operation.

A blow to the industry

Aside from the horrific human suffering and extensive property damage to an area larger in size than Great Britain, the powerful hurricane’s winds and storm surge dealt a blow to the oil and gas industry from which it may take many months to recover. Some offshore operators and pipelines were still recovering from damage suffered during the succession of hurricanes that struck the northern Gulf of Mexico in 2004.

It remains to be seen whether the problem is short-term or will be with us many months. Commodity prices, however, were impacted even before the storm came ashore, as futures traders and others anticipated a disruption in the flow of oil, natural gas, and refined products.

A disaster for the energy industry also spells trouble for the US economy, which runs on oil and gas from the Gulf of Mexico. The hub of the US oil and gas industry, the offshore waters of the Gulf account for 28.5 percent of oil produced in the country and 19.2 percent of the natural gas. The refining industry is even more concentrated, with this region accounting for 47.4 percent of crude oil refining capacity. In addition, more than 60 percent of US crude oil imports come through Gulf Coast ports, primarily in Texas and Louisiana.

The country’s dependence on oil and gas that flows through the hurricane-prone waters of the Gulf of Mexico is likely to grow as more and more deepwater fields go into production in the next few years.

As the nation’s natural gas supplies have tightened, the industry is turning increasingly to liquefied natural gas plans, where gas from foreign sources can be stored and converted for domestic use. Approximately two-thirds of these new and expanded LNG facilities will be located on the Gulf Coast, further concentrating the nation’s energy supplies.

Energy prices spike

For the moment at least, Katrina has triggered the worst energy crunch in the US since the late 1970s, as retail service stations around the country report spot shortages and prices continue to skyrocket. Even before the storm struck, gasoline prices in Texas had increased more than $1 over the previous year, according to the American Automobile Association’s Texas office - an increase of about 57 percent year to year.

Gasoline prices abruptly soared to more than $3 a gallon within a day or two of Katrina’s landfall, and some analysts are forecasting $4 a gallon gasoline by the end of the year.

“There’s no question gas will hit $4 a gallon,” said Ben Brockwell, director of pricing at the Oil Price Information Service. “The question is how high it will go and how long it will last.”

Some refiners and wholesalers are restricting the amount of fuel retailers can buy, according to a story on the Bloomberg news wire on Aug. 31. This has led to some retailers running out of gasoline and diesel fuel, which creates an appearance of scarcity, driving up prices even more.

On Aug. 31, gasoline had reached $3.31 a gallon at one Houston service station, and an Atlanta station was charging $5.87 for regular and $6.07 for its highest octane fuel - prices that reach or exceed levels found in European countries with much higher fuel taxes than the US. (The Atlanta station reduced its prices after it was threatened with a citation for price gouging by the state’s attorney general.)

The sudden price spikes in the week after Katrina have led some consumer organizations to call for government-mandated price controls on fuel supplies and more radical groups to demand a “windfall profits tax” on energy companies. While neither of these is likely to occur in the foreseeable future, they are signs of a growing frustration among consumers who see energy prices taking an ever-bigger bite from their household budgets.

Natural gas rose to $12.25/MMbtu in futures trading on Aug. 31. With more than 25 percent of domestic gas production coming from the Gulf of Mexico, some analysts are predicting $15 gas by the end of December. The tightness in the gas supply is expected to cause heating oil prices to rise as well, and residential customers may see heating bills increase by 50 percent or more this winter.

Offshore damage assessments

At presstime, as many as 20 drilling and production platforms were still missing in the Gulf, some presumed sunk. Here are some of the first damage reports from Gulf of Mexico producers:

• A spokesman for Houston-based Apache Corp. said it had lost eight of its production platforms, which collectively had produced more than 7,000 barrels of oil and 12,000 cubic feet of gas a day.

• London-based BP, Europe’s largest oil company, reported that seven of its platforms were “missing.” Together, these produced 1,000 barrels of oil per day.

• Royal Dutch Shell said its Mars and Cognac platforms were damaged, as was a large pumping station.

• ExxonMobil reported that aerial observations revealed “no serious damage” to its installations, but the company had shut in about 45,000 bpd of oil and 760,000 cubic feet per day of natural gas as the storm neared the northern Gulf Coast.

• Rowan Companies said that it had located all 22 of its rigs, with the exception of the Rowan New Orleans, a jack-up rig that the drilling contractor believes may have capsized and sunk offshore Louisiana. The other rigs appear to have suffered minimal damage, according to the company.

• Diamond Offshore reported it had found the Ocean Warwick, which had been listed as missing. Aerial photos show the rig sustained significant damage and is aground on Dauphin Island, near Mobile Bay. This is about 66 miles northeast of where the rig had been moored. Diamond Offshore also said the semisubmersible Ocean Voyager broke free from its moorings at the ATP-operated Mississippi Canyon Block 711 during the hurricane and is now located nine miles north of its pre-storm position. Damage to the vessel was still being assessed at presstime.

• Transocean Inc. said a preliminary inspection of its semisubmersible rig Deepwater Nautilus revealed significant damage. It drifted nearly 80 miles from its moored position prior to the storm.

• ENSCO International reported that none of its jack-up rigs were damaged from the storm. However, its ENSCO 29, one of the company’s three platform rigs, apparently sustained major damage as a result of Katrina. Further inspection was underway at presstime.

• The Bender Shipbuilding Yard in Mobile, Ala., said the large storm surge in Mobile Bay caused the PEMEX PSS Chemul, a 13,000-ton semisubmersible, to break free and strike a large suspension bridge. The bridge, which does not appear to have sustained major structural damage, has since reopened to vehicular traffic, and damage to the rig is currently being assessed.

Making up lost production

To make up for the loss of crude oil production, The International Energy Agency (IEA) directed its member nations to make an extra two million barrels of oil per day available to the market for the next 30 days, with half of this contribution to come from the United States’ Strategic Petroleum Reserve (SPR). A large portion of the oil from outside the US will be released in the form of refined products, which should allay some of the problems caused by reduced US refinery production.

The US will put up 30 million barrels of crude oil for sale from its SPR, with the proviso that the bids meet minimum acceptable levels. This oil is in addition to the 9.1 million barrels that will be loaned out from the SPR to ExxonMobil, Valero, Placid, and ATI, with negotiations underway for additional loans as announced by the Secretary of Energy on Sept. 1.

The Organization of Petroleum Exporting Countries (OPEC) issued a message of condolence to the US government and Americans following the devastation of Hurricane Katrina. In its statement, OPEC went on to say that its member countries, which account for roughly 40 percent of global oil output, will discuss additional measures to ensure stability in world energy markets. The OPEC message did not specify what measures these might be.

Political fallout

The record gas-pump prices are having a political impact on President Bush, according to a recent Washington Post-ABC News poll. Two-thirds of those questioned said gasoline prices are causing them financial strain, and high energy prices are now the No. 1 domestic issue. Many blame the government, and Bush’s job-approval rating has fallen to 45 percent, a decline of seven points since January and the lowest rating has had in the poll.

If gasoline prices hit $4 a gallon, it could spell disaster for the party in power, said one well-known industry analyst, who said he was speaking for background only. “$4 gas will have a psychological effect on consumers, and they will be looking for someone to blame,” he said, adding that high energy prices could be a major blow to the US economy, creating a condition called “stagflation” in which we have both inflation and an economic recession at the same time.

“This hasn’t happened since the Carter years of the 1970s,” he added.

Impact on hedge funds

When a hurricane rips through a city like New Orleans destroying homes and other infrastructure, insurance companies have to pony up huge sums to their policyholders. Over the years the insurers have learned to mitigate their losses by passing along some of this risk to third parties - reinsurance companies.

Although no one knows how much monetary damage has been inflicted by Katrina, estimates are running upward of $25 billion, making it the most costly storm in US history.

Hedge funds have been active investors in publicly-traded reinsurance companies and many have even set up their own reinsurance companies. They seemed to be an attractive investment because they did not suffer the ups and downs of bond markets and stocks. Katrina’s destruction could have a huge impact on some reinsurers that specialize in catastrophe insurance for events such as earthquakes and hurricanes.

Conversely, other hedge funds may come out ahead due to the hurricane. Funds with heavy investments in oil and gas companies likely will benefit from the higher prices that are expected to push energy stocks upward. OGFJ