Industry Briefs

Oklahoma City-based Kerr-McGee Corp. has entered into purchase and sale agreements involving all of the company’s North Sea operations. The sale of interests in four non-operated gas fields in the northern and central North Sea will go to Centrica PLC.

The $566 million sale will add approximately 1.1 billion therms of gas and 11 million barrels of oil to Centrica’s portfolio. The sale of all remaining North Sea assets will go to a subsidiary of AP Moller-Maersk for $2.9 million. While AP Moller is known mostly as a shipping company, it is also engaged in oil and gas exploration. This deal includes 10 oil fields with a current production of about 60,000 boe/d, a number of smaller oil and gas discoveries, and an exploration portfolio. A 50 percent increase in the Danish company’s daily North Sea oil production is expected from the takeover.

These transactions are expected to be completed by early in the fourth quarter of 2005, representing approximately 21 percent of Kerr-McGee’s total production during that period. The company plans to use all net proceeds to reduce debt brought on by Carl Icahn, the company’s largest shareholder. Earlier in the year, Icahn pushed the company for a $10 billion return to shareholders from a buyback program.

At closings, Kerr-McGee will receive proceeds of about $3.5 billion and expects net after-tax cash proceeds to be approximately $3.1 billion. News of the sale brought Kerr-McGee shares up more than four percent. The agreements are subject to approval from appropriate government agencies and customary closing conditions.

JP Morgan and Lehman Brothers advised Kerr-McGee and Citigroup advised Maersk. Kerr-McGee is an energy and inorganic chemical company with worldwide operations and assets of more than $15 billion.

Curtis Davis Garrard advises on major drillship project

UK-based maritime and offshore lawyers Curtis Davis Garrard advised Sweden’s Stena group on its recently announced $500 million plus contract with Samsung Heavy Industries for the construction of a dynamically positioned deepwater crude oil drillship. The vessel can operate in water depths of up to 3,000 meters and has been designed for worldwide drilling operations, including harsh weather environments such as Norway’s Barents Sea. The ship will be named “Stena Forth” following her intended delivery by Samsung in December 2007. An operational second vessel may also be ordered by Stena at a later stage. Curtis Davis Garrard provides commercial legal advice exclusively to the maritime and offshore industries. The firm specializes in commercial transactions, including major procurement and construction projects for clients developing offshore oil and gas fields.

Cheniere subsidiary asks Credit Suisse to arrange $500 million term loan

Houston-based Cheniere Energy Inc.’s new wholly owned subsidiary, Cheniere LNG Holdings LLC, has engaged Credit Suisse, one of the world’s largest financial services companies, to arrange a $500 million term loan facility. Cheniere LNG Holdings owns Cheniere’s 100 percent equity interest in Sabine Pass LNG LP and Cheniere’s 30 percent limited partner equity interest in Freeport LNG Development LP, each of which owns an LNG receiving terminal project currently under construction.

According to a Cheniere spokesman, the loan facility would be used to fund:

• Cheniere’s remaining equity requirements for the construction of the Sabine Pass LNG receiving terminal;

• a reserve account for facility debt service obligations and pre-operating expenses;

• fees and expenses of the transaction;

• Cheniere’s equity requirements, including funds for the potential expansion of the Sabine Pass LNG terminal, construction of the Corpus Christi and/or the Creole Trail LNG receiving terminals, and pipelines from Cheniere’s various terminals; and

• Cheniere’s general corporate purposes.

The loan facility would have a seven-year term and would be secured by the debt service reserve, all of the capital stock or other equity interests directly held by Cheniere LNG Holdings with respect to the various projects, and all of the capital stock of Cheniere LNG Holdings.

As a result of this activity, Standard & Poor’s Ratings Services on Aug. 22 lowered the corporate credit rating on Cheniere Energy to “B” from “B+” and said the outlook is stable. S&P said the lowered rating reflects the implementation of a ring-fencing structure around Cheniere LNG Holdings, the newly-formed, indirectly-owned subsidiary of Cheniere Energy.

“These assets currently provide essentially all of Cheniere’s contracted cash flows,” said S&P credit analyst Swami Venkataraman. “Two other LNG projects are still in the process of being permitted and may or may not be built.”

Total taps FMC Technologies to supply subsea systems for West Africa project

FMC Technologies Inc. has been chosen by Total to supply subsea systems for the Moho Bilondo project, offshore Congo, West Africa. The contracts have a total value of about $115 million in revenue to FMC Technologies. The scope of supply for the Moho Bilondo project includes 12 subsea trees and associated structures, manifolds, production control, and intervention systems. Deliveries are scheduled to begin in early 2007 and to be completed by the end of the year. The Moho Bilondo field is 50 miles off the Congolese coast, in water depths ranging from approximately 1,770 to 2,430 feet. Total is the operator and 53.5 percent interest owner within a production sharing contract with the Republic of Congo, which also includes Chevron (31.5 percent) and Societe Nationale des Petroles du Congo (15 percent).

Crusader Energy agrees to sell stock to Fort Worth-based Encore Acquisition

Crusader Energy Corp. has entered into a definitive purchase and sale agreement to sell all of its outstanding stock to Encore Acquisition Co., headquartered in Fort Worth. Crusader is an Oklahoma City-based exploration and production company funded by equity investments from its CEO, David D. Le Norman, and Kayne Anderson Energy Fund II, a private equity fund managed by Kayne Anderson Capital Advisors. Crusader’s assets are primarily located in the Anadarko basin and the Golden Trend areas of Oklahoma, as well as in the Texas panhandle and north Texas. The purchase price for Crusader’s stock is $93.5 million. An additional $14 million will be paid by Encore, reflecting the cash proceeds to be paid to Crusader by Crusader Energy II LLC for certain assets not transferring to Encore, bringing the total consideration to $107.5 million. Crusader Energy II is a newly formed entity capitalized by Norman and Anderson and will be operated by the management team departing Crusader with the stock sale to Encore. Assets will be transferred to Crusader Energy II right before the stock sale, which consists of land assets that the company intends to develop aggressively over the coming months. Lehman Brothers’ Greg Pipkin served as the financial advisor to Crusader.

DZ Bank opens office in Houston to focus on energy sector

DZ Bank, an independent commercial and investment bank, opened a representative office in Houston on Aug. 1. The office will be focused on providing structured finance, project finance, and related services throughout the energy sector. The initiative is led by Scott B. Lamoreaux who joined as vice president in June. Lamoreaux, who previously held senior-level energy finance positions at El Paso Merchant Energy, Stratum Group, and Williams Energy Capital, is supported by a team of 11 project and structured finance professionals in the bank’s New York branch. DZ Bank is central to the German cooperative banking sector and employs 23,000 worldwide.

Wentworth Energy negotiating to acquire additional acreage in oil sands project

Wentworth Energy Inc. is negotiating to acquire a major land position in a large oil sands project in Utah’s Uinta basin. The company has already signed a letter of intent to acquire an initial 600-acre lease in the project area, and is now negotiating to add several additional large acreages to the total project package. Wentworth has begun due diligence on the entire project, and subject to that review, anticipates closing the acquisitions within 60 days. According to historic geological reports, total recoverable oil reserves on the project are estimated at 100 to 500 million barrels of oil. The targeted oil sands project is located within the largest bituminous sandstone deposit in the Uinta basin. The oil-saturated sands are in the Mesa Verde Group and the Duchesne River formation and have been identified at varying depths from the surface to 250 feet. In the past, the cost of producing oil from bituminous sands has been prohibitive; however, with the development of “in situ” (thermal) recovery methods, the projected recovery costs can compete with extracting oil from conventional sources. Numerous major oil companies including Sun Oil, Texaco, Philips, and Shell extensively explored the area during the 1970s. Extraction plans were developed and local operations began, but the technology was not economically viable at the time. As part of the agreement, Wentworth retains the rights to use a technology approved in Utah that can economically extract oil from oil sands with no environmental impact. This technology, which uses a solvent closed-loop extraction process, was in operation until low oil prices made it too expensive.

Roxar to supply wet gas meters, wins court ruling to protect technology; announces project

Roxar, a technology solutions provider to the upstream oil and gas industry based in Stavanger, Norway, has won a contract to supply its wet gas meters and sand monitoring system to the Independence Hub Development in the Gulf of Mexico.

The wet gas meters were selected by Anadarko Petroleum Corp. and Dominion Exploration and Production Inc. to detect and measure real-time hydrocarbon flow rates and water production as well as flow assurance input through the meters’ online detection of formation water being produced from the wells. Anadarko has also selected Roxar’s new sand monitoring system to be included in its subsea system design.

The Independence Hub Development is a joint venture consisting of Anadarko, Dominion Exploration & Production, Kerr-McGee Oil & Gas Corp., Spinnaker Exploration Co., and Devon Energy Corp. It is located 165 miles east of New Orleans and in 8,000 feet of water. The hub will process production from 10 natural gas fields located in the Mississippi Canyon Block 290.

In related news, Roxar has won a ruling in the Norwegian Court of Appeal to protect its multiphase flow meter technology from unlawful use by other companies. The appeals court ruled against Norwegian company, FlowSys AS, founded by former employees of Roxar in 1999, and the technologies behind its TopFlow and Wellsense (SubFlow) multiphase meters. The court overturned the original ruling that came down in May 2003.

The court ordered FlowSys to halt producing, selling, or marketing its TopFlow and Wellsense multiphase flow meters for a period of three years and awarded US$1.25 million in damages and US$310,000 in court costs.

The company’s FieldWatchTM project on right-time integration of production data in reservoir characterization and fluid flow simulations has been approved by the Norwegian Research Council for funding from its Petromaks Research & Development program. Petromaks is a Norwegian research program governed by the Research Council of Norway and is assisting the Norwegian government in the implementation of its strategy initiative OG21, which addresses the needs of oil companies, supply and service industries, and the petroleum-related R&D sector. Roxar’s initial partner on this project is Statoil. It is funded one third each by Statoil, Roxar, and Petromaks.

Roxar employs close to 500 staff across a network of wholly owned offices in Europe, the Americas, Africa, CIS, Asia Pacific, and the Middle East.

Valero completes merger with Premcor

Valero Energy Corp. and Premcor Inc. closed on their merger Sept. 1, making Valero the largest refining company in North America. “With the addition of Premcor’s four refineries, which we bought for significantly less than their replacement cost, we have improved our leverage to product margins and further enhanced our sour crude processing capabilities. As I have often said, we are in a new era for refining where I believe you will continue to see higher highs and higher lows for both product margins and sour crude discounts. And now with 18 refineries, no one is better positioned to benefit from this than Valero,” said Bill Greehey, Valero’s chairman of the board and CEO. He went on to say that “2005 is clearly going to be another record year for Valero and the outlook for 2006 is even better, particularly when you consider the contribution of the Premcor assets, which most analysts have not yet factored into next year’s earnings estimates.” Valero Energy is a Fortune 500 company based in San Antonio, with approximately 22,000 employees and annual revenue of about $70 billion. The company owns and operates 18 refineries throughout the US, Canada, and the Caribbean with a combined throughput capacity of approximately 3.3 million bpd.

Offshore Logistics moves corporate headquarters from Lafayette to Houston

The formerly Lafayette, La.-based Offshore Logistics Inc. has moved its corporate headquarters to Houston. The company employs approximately 3,300 people worldwide and has been headquartered in Lafayette since its founding in 1969. Although the company has moved its corporate headquarters to Houston, it will continue to maintain a strong presence in Lafayette, New Iberia, and other south Louisiana communities through its subsidiaries, Air Logistics LLC and Grasso Production Management Inc. Bill Chiles, president and CEO of Offshore Logistics said, “In recent years, the energy industry has seen significant growth in international offshore drilling and production activities, The move to Houston strategically places us in the heart of the international energy industry and is consistent with our ongoing strategy to grow our helicopter transportation services globally.” Offshore Logistics is a provider of helicopter transportation services to the oil and gas industry worldwide.

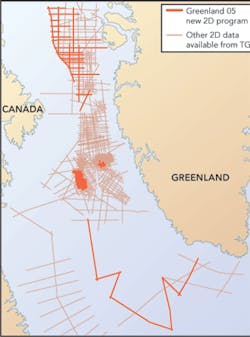

TGS-NOPEC Geophysical acquires new seismic survey in west Greenland

TGS-NOPEC Geophysical Co. has begun its acquisition of a new multi-client 2D survey offshore west Greenland. The 7,000 kilometer program fills existing TGS seismic grids in the Lady Franklin basin and Discos Island areas, but also extends into the northern Labrador Sea to investigate new structural trends. Upon completion, TGS will have over 34,000 kilometers of modern 2D seismic available offshore west Greenland. Data delivery to clients will begin in the fourth quarter of 2005 and extend into early 2006. TGS-NOPEC provides multi-client geoscientific data and associated products and services to the oil and gas industry. The company specializes in the creation of non-exclusive seismic surveys worldwide.

CB&I wins $100 million turnkey contract for LNG storage project in Nova Scotia

CB&I has been awarded a lump-sum turnkey contract valued in excess of US$100 million for the design and construction of storage tanks for a new LNG import terminal near Port Hawkesbury on Cape Breton, Nova Scotia, Canada. The facility will be owned and operated by Bear Head LNG Corp., a subsidiary of Anadarko Petroleum Corp. of The Woodlands, Tex. The Bear Head LNG project is designed to meet the growing demand for natural gas in markets in eastern Canada and the US Northeast. The project involves the construction and operation of about 7.5 million tons annual capacity LNG terminal with a sendout capacity of 1 billion scfd. First gas deliveries through the Bear Head terminal are targeted for late 2008. CB&I’s work scope for the project includes the turnkey engineering, procurement, and construction of two 180,000 cubic meter LNG storage tanks, including foundations, insulation, paint and piping to grade. Engineering and procurement activity for the project is underway. CB&I specializes in lump-sum turnkey projects for customers that produce, process, store, and distribute the work’s natural resources. The company has more than 60 locations and approximately 10,000 employees throughout the world.

Wood Group to provide O&M services for Bay of Campeche compression platform

Houston-based Wood Group Engineering & Production Facilities SA de CV, a subsidiary of international energy services company John Wood Group PLC, has signed a contract with Compania de Servicios de Compresion de Campeche, a joint venture between Duke Energy International LLC and Marubeni Corp., to provide integrated operations and maintenance services to the AKAL GC compression platform owned by CSCC in the Bay of Campeche, Mexico. The platform separates the liquids and compresses 250 MMcfd of gas for Pemex Exploration and Production’s North East Marine Region. Wood Group E&PF SA will have total operational responsibility for the platform, including offshore operations and maintenance, and onshore technical support, logistics, and supply chain activities. Wood Group will manage and execute the contract, which runs through October 2006, by using a combination of management and technical personnel from Mexico and other Latin American operations. Required overhauls of the PGT 25 turbine/compressor packages will be performed by TransCanada Turbines, a joint venture between Wood Group and TransCanada Pipelines. Wood Group is an international energy services company that employs more than 14,000 people worldwide and operates in 36 countries.

Chadbourne & Parke LLP expands practice, forms trading and derivatives group

The international law firm of Chadbourne & Parke LLP has formed a new trading and derivatives practice group, expanding the firm’s project finance area. The group will be led by Washington, DC office partner Merrill Kramer; London office partner Denis Petkovic; New York office partner Andrea Satty; Houston office partner David Schumacher; and Warsaw office partner Igor Muszynski. Chadbourne attorneys are experienced in negotiating complex matters in which swaps and derivative tools are utilized to hedge and allocate risk. “The formation of our trading and derivatives practice group recognizes the skill sets we have in our various offices and will significantly enhance our ability to serve the growing needs of our clients involved in the banking and energy industries internationally,” said Charles K. O’Neill, Chadbourne’s managing partner. Chadbourne & Parke is headquartered in New York City.

ConocoPhillips to start new share repurchase program

Over the next two years, ConocoPhillips will repurchase up to $1 billion of the company’s common stock. This plan is in addition to the existing $1 billion program announced on Feb. 4, 2005, under which the company has repurchased approximately $950 million of its common stock. Consistent with previous guidance, the company will use the new program as a means of offsetting dilution to existing shareholders from the company’s stock-based compensation programs. Acquisitions for the share repurchase program will be made at management’s discretion at prevailing prices as permitted by securities laws and other legal requirements, and subject to market conditions and other factors. Purchases may be increased, decreased, or discontinued at any time without prior notice. Shares of stock repurchased under the plan will be held as treasury shares. ConocoPhillips is an integrated petroleum company with interests around the world.