ChevronTexaco’s $18 billion buyout of Unocal may spur asset divestiture

null

Speculation is rampant about what assets will be retained and which will be disposed of after regulatory approval of ChevronTexaco Corp.’s proposed $18 billion “friendly” takeover of Unocal Corp., which was announced on April 4. After regulatory approval, full integration of the two companies is expected to be completed in six months.

Although there seems to be a strong strategic fit between ChevronTexaco and Unocal, some industry observers expect the combined company to sell off some approximately $2 billion of Unocal’s non-core assets, including its string of 10 aging oil platforms in Alaska’s Cook Inlet. The Unocal platforms are old and the producing fields in that region are near the end of their economic lives, said an Anchorage-based consultant.

Unocal has had a presence in Alaska since 1959, the year it became a state, when the prolific Kenai gas field was discovered. The company remains a leading offshore producer in the Cook Inlet and also has a smaller role in the state’s main oil province, the North Slope.

Unocal never officially acknowledged that it was for sale, but it is widely known that Italy’s Eni SPA and China National Offshore Oil Corp. were among the company’s suitors. The Chinese company has long coveted Unocal’s reserves and other assets in Southeast Asia, where Unocal has a major presence, and is expected to make a bid for them from ChevronTexaco.

Unocal is one of the world’s largest independent oil and gas exploration and production companies with worldwide reserves at year-end 2004 of approximately 1.8 billion barrels of oil equivalent (boe). Natural gas accounts for about 62 percent of the company’s production mix. Unocal’s core operating areas are Southeast Asia, the lower 48 states of the US, Alaska, and Canada.

Most of the company’s reserves are in the Asia-Pacific region (56 percent), North America (32 percent), and in the Caspian Sea region. Unless ChevronTexaco disposes of the assets, the acquisition will place the company in the top tier of natural gas producers and marketers in the Australia-Asia-Pacific region and, in the Caspian area, will give the company the second-largest interest in the Azerbaijan International Operating Co. (AIOC) oil-producing operations, broadening its status as a leading oil company in that region.

In addition, ChevronTexaco will acquire a share in the Baku-Tbilsi-Ceyhan export pipeline, further expanding the company’s position in Caspian oil exports.

ChevronTexaco, which is second only to Exxon Mobil Corp. in size among US-based integrated energy companies, expects oil-equivalent production from the combined portfolios during 2006 to average about three million barrels per day.

The ratings services seemed to react favorably to the acquisition announcement. Standard & Poor’s Rating Services affirmed ChevronTexaco’s “AA/A-1+” corporate credit rating with a “stable” outlook. At the same time, it placed its “BBB+/A-2” corporate credit rating on Unocal on CreditWatch with positive implications.

Fitch Ratings placed the senior unsecured debt rating of Unocal of “BBB+” on Rating Watch Positive. Fitch currently rates ChevronTexaco’s senior unsecured debt “AA.”

Lehman Bros. Inc. is serving as financial advisor to ChevronTexaco, and Pillsbury Winthrop Shaw Pittman LLP is acting as legal advisor. Morgan Stanley & Co. Inc. is acting as financial advisor to Unocal, and Wachtell, Lipton, Rosen & Katz is serving as legal advisor to Unocal.

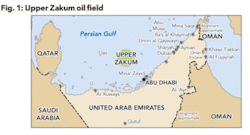

UAE, ExxonMobil enter final negotiations regarding participation in Upper Zakum

Exxon Mobil Corp. has been chosen by the Abu Dhabi Supreme Petroleum Council for final negotiations regarding its participation in the Upper Zakum offshore oilfield. The company beat out other bidders on the project, including BP PLC and Royal Dutch/Shell Group, and is the sole company to enter final negotiations on the development of the huge field.

The Upper Zakum development is a strategic part of the United Arab Emirates’ (UAE) and the Organization of Petroleum Exporting Countries’ plans to increase oil production capacity from 2.5 million b/d to 3.0 million b/d.

The UAE has approximately 10 percent of the world’s proven oil reserves, most of which lie in the vicinity of Abu Dhabi, the country’s capital and largest of the seven emirates.

Upper Zakum, one of the world’s largest oil fields, contributes significantly to Abu Dhabi’s current production and has potential for substantial growth. Successful conclusion of final negotiations will allow ExxonMobil to obtain a 28 percent equity interest in the Upper Zakum oil field. The company has participated in Abu Dhabi’s petroleum business for more than 60 years.

In a separate development, ExxonMobil’s wholly owned subsidiaries, Mobil Exploration and Producing Australia Pty Ltd and Mobil Australia Resources Company Pty Limited, have signed a framework agreement with ChevronTexaco and Shell subsidiaries resulting in a new ownership structure for the Gorgon project and the Greater Gorgon gas resource offshore Western Australia.

The agreement will provide access to 11 gas fields in the Greater Gorgon area, including Gorgon and Jansz, containing estimated total recoverable resources in excess of 40 tcf of natural gas. An ExxonMobil spokesman said the resources will supply the Gorgon project and will help ensure that these fields can be developed in the most technically and economically efficient manner. It will also increase the marketability of the Gorgon project due to the availability of increased gas resources.

Under the new framework agreement, the new ownership structure of the Gorgon project will be: ChevronTexaco (operator), 50 percent; ExxonMobil, 25 percent; and Shell, 25 percent.

Enterprise, Valero open Cameron Highway, linking deepwater developments to markets

Houston-based Enterprise Products Partners LP and Valero Energy Corp. of San Antonio have made the first deliveries of domestic crude oil to major refining markets on the Texas Gulf Coast via the recently completed Cameron Highway Oil Pipeline System. This 390-mile pipeline is the longest offshore oil pipeline in the US and is the first offshore link between the deepwater developments located off the coast of Texas and Louisiana.

Cameron Highway, operated by Enterprise, is a $500 million joint venture between Enterprise and Valero. The pipeline was built to move crude oil production from the large deepwater developments in the central Gulf of Mexico, and future discoveries in the western Gulf, to the huge refining complex on the Texas Gulf Coast, including major markets in Port Arthur and Texas City, Texas.

The pipeline has the capacity to deliver up to 600,000 barrels of oil per day and provides a lower cost alternative than pipelines located onshore in Louisiana, according to a spokesman for the joint venture.

Cameron Highway began service earlier this year and producers in the Southern Green Canyon area of the Gulf of Mexico are in the initial stages of completing pre-drilled wells from the Mad Dog and Holstein fields. The first five wells have been connected and the pipeline is currently delivering about 80,000 barrels per day of domestic crude oil production to Texas. Production is expected to ramp up throughout 2005 and 2006, as additional wells are completed.

Cameron Highway also represents a shift toward bringing a medium-sour crude oil mix to the Texas Gulf Coast refining market. Although sweet, light crude oils are easier to refine and represent an estimated one-third of the world refinery consumption, the sweeter crude oil has depleted its availability. Sweet crude now constitutes only about one-fifth of remaining world oil reserves.

Valero operates seven refineries that are tied to the company’s coastal distribution system in Texas. The company has strongly invested in a refining system that processes the heavier, sour crude oils. This is a primary reason Valero became a 50-percent partner in the Cameron Highway project, said a company spokesman.

FMC Technologies provides subsea Equipment for Independence Project

Anadarko Petroleum Corp. has signed a contract with FMC Technologies Inc. to supply subsea production equipment for certain Anadarko wells in the eastern Gulf of Mexico that will be connected to the Independence Hub. The contract for this project includes 10 subsea trees and associated equipment. The initial value of this contract to FMC Technologies is approximately $25 million in revenue.

Independence Hub LLC is an affiliate of Enterprise Products Partners LP and the Atwater Valley Producers Group, which includes Anadarko; Dominion Exploration & Production Inc; Kerr-McGee Oil & Gas Corp.; Spinnaker Exploration Co.; and Devon Energy Corp.

Independence Hub will be a deep-draft, semi-submersible platform that will be connected initially to eight natural gas fields. Anadarko is the operator of six of the eight fields and will be the operator of the Independence Hub facility. The fields are located in the Atwater Valley, DeSoto Canyon, and Lloyd Ridge areas of the deepwater Gulf of Mexico, where water depths range from 7,800 to 9,000 feet. Deliveries will be completed over a multi-year period and are scheduled to begin in 2005.

Roxar joins consortium for energy eCommerce

Roxar, a technology solutions provider to the upstream oil and gas industry, has joined the Petrotechnical Open Standards Consortium (POSC), an international not-for-profit membership consortium focused on the development, implementation, and use of energy eStandards - information exchange and interoperability specifications in support of eBusiness for the energy industry.

Roxar CEO Sandy Esslemont said his company is committed to total interoperability, connectivity, and real-time information exchange within the oil and gas industry and supply for industry-wide data management, application interoperability, and internet data exchange standards for transferring data between suppliers, operators, and regulatory bodies.

Among the most widely used POSC standards is Wellsite Information Transfer Standard (WITSML), a family of standards currently centered on drilling information and being extended to regulatory reporting and production operations through the POSC Special Interest Group (SIG) process.

Roxar aims to help E&P companies address their reservoir and production management needs through its reservoir interpretation, reservoir modeling, reservoir simulation, well and completion, production and process solutions, and consultancy services.

The company is headquartered in Stavanger, Norway, and employs nearly 450 people in offices in Europe, the Americas, Africa, the CIS nations, the Asia-Pacific area, and in the Middle East.

India plans to spend $25 billion on overseas energy ventures

The government of India intends to spend up to $25 billion on overseas oil and gas projects in order to meet spiraling demand for energy in the country, according to Mani Shankar Aiyar, India’s oil minister.

“We are in a position to raise $25 billion to invest in acquiring oil and gas properties abroad,” said Aiyar.

India has one of the world’s fastest growing economies and is expected to surpass China as the world’s most populous country within the next 25 years. The country’s state-owned oil firms already have stakes in oil and gas fields in Russia, Sudan, Iraq, Libya, Egypt, Qatar, Ivory Coast, Australia, Vietnam, and Myanmar, but lag far behind Chinese companies, according to the Press Trust of India news agency.

Aiyar said that his country and China will continue to compete in many areas, but his intent is not to compete with China but to explore ways and means of partnering with the other Asian giant.

India buys nearly 70 percent of its annual energy requirement from the global market, and its reliance on imported crude oil is expected to grow to approximately 85 percent in the next 20 years.

State-run Oil India Ltd (OIL) said that it had won the rights to prospect for oil in an oil field in Libya. Senior OIL officials signed an agreement with Libya’s National Oil Co. in Tripoli in March. OIL won the contract after outbidding some 56 international companies.