OGJ200 earnings surge 61 percent in 4Q

Marilyn Radler,

Senior Editor - Economics

Oil & Gas Journal

Laura Bell,

Statistics Editor

Oil & Gas Journal

The OGJ200 group of companies reaped the benefits of strong commodity prices and downstream margins during the final quarter of 2004 (4Q04). Collectively, these US-based oil and gas producers recorded a 61 percent increase in net income as compared with the same period a year earlier.

The OGJ200 firms’ collective revenues for the quarter posted a year-on-year gain of about 38 percent, and their annual capital and exploration expenditures gained 22 percent over such 2003 outlays.

This sixth edition of the OGJ200 Quarterly reveals strong growth for many companies, although the top 20 firms have less of a hold on the group’s total assets.

The group of firms in this quarterly roundup comprises those producers that appear in Oil & Gas Journal’s annual OGJ200 special report (OGJ, Sept. 13, 2004, p. 28), which ranks the publicly traded companies by year-end total assets.

There are now 136 firms in this group, down from 138 in the previous quarterly review. Matrix Energy Services Corp. no longer appears in the group because the company no longer has US producing properties, and Vineyard Oil & Gas Co. is no longer a publicly traded firm and was therefore removed from the group.

Two other companies, Continental Resources Inc. and Empiric Energy Inc., as of press time had not yet released their 4Q04 results, so none of their data appears in this report.

Market conditions

Oil and gas wellhead prices surged during 4Q04 from year-earlier levels. The average 4Q04 wellhead price of crude oil was $42.40/bbl, up from $27.42/bbl in the final 2003 quarter.

On the New York Mercantile Exchange, the closing futures price of oil peaked at $55.17/bbl on Oct. 22, 2004. This closing price-the highest for the quarter-had theretofore not been attained on the NYMEX in nominal dollars.

Likewise, the futures price of natural gas on the NYMEX reached a 4Q04 peak on Nov. 3, 2004, closing at $8.752/mmbtu. For the quarter, the closing gas futures price averaged $7.263/mmbtu, up 34 percent from the final 2003 quarter.

Downstream earnings got a strong boost from a tight products market, especially in Asia. Cash refining margins soared in 4Q04 on strong demand and limited refining capacity.

In all major refining centers, margins posted big gains, according to Muse, Stancil & Co. In Southeast Asia the cash operating margin averaged $3.56/bbl, a 584 percent gain from a year earlier.

Meanwhile, the US Gulf Coast cash operating margin climbed 157 percent, and the US East Coast and US West Coast cash margins gained slightly more so.

Financial results

The group of firms in this edition of the OGJ200 Quarterly posted earnings of $20.3 billion for 4Q04, a solid gain from $12.6 billion a year earlier.

The integrated firms in the group mostly reported marked gains due to big improvements in their downstream segments’ performance.

For example, Marathon Oil Corp. reported that its 4Q04 net income declined to $429 million from $485 million a year earlier, but earnings from its downstream operations, Marathon Ashland Petroleum LLC, were $389 million vs. $97 million a year earlier. The company attributed the gain to improved margins as a result of wider-than-normal price differentials between sweet and sour crude.

In spite of slightly lower upstream production volumes, ExxonMobil Corp. recorded its highest quarterly earnings ever of $8.42 billion for 4Q04, up from $6.65 billion in the last quarter of 2003. Upstream earnings were $4.9 billion and downstream earnings were $2.3 billion for 4Q04, each up $1.6 billion from a year earlier.

ExxonMobil attributed the upstream earnings increase to higher average oil and gas prices, while the robust downstream performance was due to strong refining margins and improved marketing results. Additionally, the company’s chemical earnings were $1.25 billion, up $772 million as a result of strong worldwide demand.

Among the independent producers, 4Q04 results were mostly up, with only two dozen firms reporting losses for the period.

Forest Oil Corp. reversed a loss in the final 2003 quarter and earned $43.6 million in 4Q04. Forest’s sales volumes increased 14 percent from a year earlier, and it realized higher per-unit netbacks. The company reported that its 4Q04 earnings were adversely affected by an impairment of $2.4 million relating to international operations, though.

Forest also incurred a $2.2 million charge to write off its interest in an oil pipeline destroyed by Hurricane Ivan in the Gulf of Mexico, a charge of $5.1 million to establish a reserve for insurance surcharges related primarily to Hurricane Ivan and $1.6 million of merger expenses related to the acquisition of Wiser Oil Co. Net earnings were favorably affected by a $4.7 million foreign exchange gain related to a Canadian investment liquidated during the quarter.

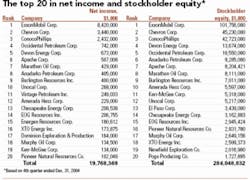

Top 20 firms

The 20 highest ranked companies in the OGJ200 group as ranked by assets are the same firms as those in the previous edition of the OGFJ Quarterly.

The only differences are that the rankings of four of them changed. Occidental Petroleum Corp. and Anadarko Petroleum Corp. switched places and are now the No. 7 and No. 8 companies, respectively. And EOG Resources Inc. and Murphy Oil Corp. switched as well and now occupy the No. 18 and No. 20 slots, respectively.

The concentration of assets at the top of the OGJ200 Quarterly declined 1.1 percentage points in 2004. At the end of the year, the top 20 companies held 90.8 percent of the entire group’s assets, down from 91.9 percent at the end of 2003.

Of the entire OGJ200 group’s 4Q04 revenues, the top 20 firms contributed 96 percent. And these 20 companies were accountable for 93 percent of the group’s total earnings.

This subset, however, did not perform as well financially during 4Q04 as the entire group, though. The top 20 firms on the list reported that their collective net income increased 54 percent from the last quarter of 2003.

As far as their full-year 2004 capital budgets, the top 20 firms grew their capital and exploration expenditures 12.5 percent, but the entire OGJ200 group’s spending climbed 17.5 percent last year.

The market capitalization of the top 20 companies at the end of last year was $708 billion, up from $680 billion at the close of the third quarter.

Fast growers

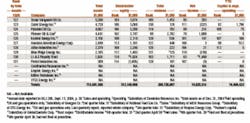

The OGJ200 Quarterly table of fast growers ranks companies based on growth in stockholder equity. For a firm to appear on this list, it must have recorded positive net income during the fourth quarters of 2003 and 2004, and it must have grown its net income during 4Q04 as compared with the same year-earlier period. Excluded from this list are limited partnerships, newly public companies, and subsidiaries.

There are nine companies on the current list that also appeared in the previous fast-growers list.

At the top of the list of fast growers is Petrohawk Energy Corp., which was not on the prior list. Petrohawk Energy’s stockholder equity grew to $247 million at the end of 2004, from $29 million a year earlier. The company’s long-term debt grew to $239.5 million from $13.3 million at the end of 2003, however.

With big increases in production volumes and price realizations, Petrohawk’s 4Q04 earnings soared to $9.1 million from $383,000 for the fourth quarter of 2003.

During 4Q04, Petrohawk produced 20.7 MMcfd of natural gas and 1,400 b/d of oil. These volumes represent increases of 283 percent and 265 percent respectively from the same 2003 period due to the acquisition of Wynn-Crosby Energy.

Houston-based Petrohawk’s realized price for gas during 4Q04 was $6.96/Mcf, compared to $4.80/Mcf a year earlier, and its oil price realization was $43.34/bbl vs. $29.38/bbl received in the final 2003 quarter.

The second-fastest grower is Plains Exploration & Production Co., whose stockholder equity grew 146 percent. Following Plains is KCS Energy Inc., which also appeared on the previous fast-growers list.

KCS Energy not only more than doubled its stockholder equity but also tripled its earnings in 4Q04 as a result of stronger commodity prices and higher production volumes.

The next two firms on the list of fast growers-Range Resources Corp. and Kerr-McGee Corp.-also reported that their stockholder equity more than doubled from the end of 2003.

One of the biggest earnings gainers, Edge Petroleum Corp., is the sixth-fastest grower in this edition of the OGJ200 Quarterly. Edge Petroleum’s net income in 4Q04 jumped to $5.6 million from $544,000 in the comparable 2003 period, as its production climbed 23 percent.

Chesapeake Energy Corp. has appeared on the list of fast growers in each edition of the OGJ200 Quarterly except for the one based on results at the end of 2003.

At the end of 2004, Chesapeake Energy’s stockholder equity was up 82.5 percent from year-end 2003, although its long-term debt was up substantially. Quarterly income moved up three-fold from the fourth period of 2003 to $208.5 million.

Ultra Petroleum, the eighth-fastest grower, has appeared on this list in all six editions of this quarterly report. Ultra, which ranks at No. 54 in terms of assets, recorded a 75 percent increase in 4Q04 production from a year earlier with an aggressive drilling program in Wyoming and China. OGFJ