Refinancing debt was critical to unlocking value of assets

Robert L. G. Watson and

Barbara M. Stuckey

Abraxas Petroleum Corp.

San Antonio

Abraxas Petroleum Corp., a small-cap natural gas and crude oil exploration and production company with 121.1 bcfe of proved reserves at year-end 2003 and an average daily production rate of 23.7 MMcfe for the first nine months of 2004, was in a quandary. Our current issue of public debt had an annual capital expenditure limit of $10 million and also imposed certain restrictions on production payments, farmouts, and asset sales - additional means to fund development.

With an F&D cost of $1.15 per Mcfe and production of 7.9 bcfe in 2003, it would take more than $9 million in capital just to replace production. With numerous enviable projects in inventory, how do we unlock the incremental value these projects could generate, while increasing production and reserves, given this constraint?

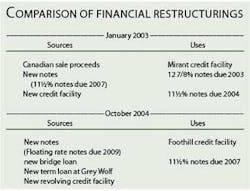

Let’s first step back to January of 2003 when we completed a complex financial restructuring whereby we sold a significant portion of our producing assets in Canada to a royalty trust for $177 million US or $217 million (Can.), but retained all undeveloped lands.

The proceeds from this sale combined with a new credit facility repaid the 127⁄8 percent notes due 2003 and a credit facility with Mirant Canada Energy Capital Ltd. and funded the cash portion of an exchange offer of our 111⁄2 percent notes due 2004 for cash, new notes, and common stock.

These transactions reduced the company’s total proved reserves by 36 percent, reduced long-term debt by 45 percent, and reduced cash interest expense by more than 90 percent, as the new notes provided for PIK (pay-in-kind) interest. However, the new notes introduced new restrictive covenants, namely the capital expenditure limit, which reduced to $10 million beginning in 2004.

A solution was needed. After exploring the costs and benefits of several options, the decision was made to approach the bondholders of the 111⁄2 percent notes due 2007 first, in an attempt to have certain restrictive covenants eliminated or modified - in particular, the capital expenditure limit.

In May 2004, we engaged Guggenheim Capital Markets LLC to act as our financial advisor and commenced a consent solicitation of the holders of the notes, for which a majority was needed.

Even a successful solicitation would have been a short-term patch to a long-term problem, so when the cost, as determined through negotiations with the bondholders, became too high for our shareholders, we allowed it to expire.

Back to the drawing board - the notes needed to be eliminated. The discounted redemption schedule of the notes gave us every incentive to take them out, but as a highly-leveraged small-cap company, we were unsure of the options readily available to us. We endeavored to explore them all.

The basic question of equity versus debt was quickly answered. We felt our stock was undervalued (as do most, if not all, small companies), and too much dilution or too great a discount would be detrimental to the existing shareholders.

Debt, currently at historically low interest rates, became the obvious solution. But was there sufficient appetite in the market for debt of our sort?

With commodity prices at or near all-time highs (and projected to stay there), a solid reserve base, an enviable inventory of exploitation projects on our existing leasehold, determined senior management, and a capable financial advisor, the answer was yes.

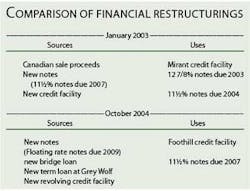

We successfully issued and sold, in a private placement, $125 million of floating rate senior secured notes at par. The notes contain standard covenants, and all restrictions on capital expenditures were eliminated.

To complete the refinancing of our outstanding indebtedness, we entered into a bridge loan ($25 million), a new term loan ($35 million) to our wholly-owned Canadian subsidiary, Grey Wolf Exploration Inc., and a $15 million revolving credit facility, which was untapped at closing.

The term loan and the bridge loan were arranged by Guggenheim Corporate Funding LLC, while Guggenheim Capital Markets, LLC, acted as initial purchaser of the notes. Durham Capital Corp. also advised us in the refinancing.

The revolving credit facility was placed with Wells Fargo Foothill Inc., which had led the original credit facility in January of 2003. The assets in the United States provide the collateral for the notes, bridge loan, and revolving credit facility, while the assets in Canada provide the collateral for the term loan.

Bifurcating the collateral pools between the United States and Canada is an important component of the debt structure, as it provides us with the flexibility to capitalize on market conditions in one country or the other without significant cross impact.

In October 2004, Grey Wolf engaged CIBC World Markets Inc. to evaluate various financing alternatives, including the public or private sale of debt or equity securities. The retention of the undeveloped lands in January of 2003 has been the catalyst for Grey Wolf’s increased production of more than 250 percent in less than two years. This significant growth will lead to an initial public offering for Grey Wolf in 2005, with closing expected by press time for this issue of Oil & Gas Financial Journal.

With the capital expenditure limit removed, we can now focus on unlocking the incremental value from our identified exploitation projects and maximizing shareholder value in the marketplace. OGFJ

The authors

Robert L. G. “Bob” Watson founded Abraxas Petroleum in 1977 and has served continuously as president, CEO, and chairman of the board. In 1995, Watson founded Grey Wolf Exploration, Abraxas’ wholly-owned subsidiary in Canada.

Barbara M. Stuckey, recently named director of corporate development for Abraxas, joined the company in 1997 and has held numerous positions in land, marketing, and corporate development. Her recent promotion added investor relations to her responsibilities.