Oil, gas prices propel 1Q earnings

Marilyn Radler,

Senior Editor - Economics

Oil & Gas Journal

Laura Bell,

Statistics Editor

Oil & Gas Journal

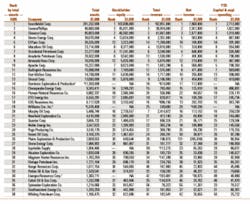

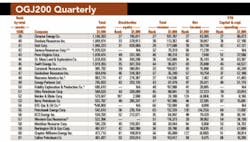

The OGJ200 companies recorded another surge in earnings in the first three months of this year. Oil and gas prices strengthened throughout the first quarter of 2005 (1Q05) on fears of inadequate supplies, resulting in much stronger profits than for the same year-ago period.

As a group, the OGJ200 firms posted a 40 percent gain in net income as compared with the first quarter of 2004. Total revenues were up 23 percent, while 1Q05 capital and exploration expenditures were more than 25 percent stronger than during the same 2004 period.

The OGJ200 group consists of the US-based oil and gas producers that appear in Oil & Gas Journal’s annual special report (OGJ, Sept. 13, 2004, p. 28), which ranks the publicly traded firms by year-end total assets.

Only one company from the previous edition of the OGJ200 Quarterly no longer appears with the group. That’s Dallas-based Trek Resources Inc., which became a privately held company in May 2005. And data for four firms in the group don’t appear in this report because those companies had not released their 1Q05 results as of press time.

Oil, gas prices

With demand strong, supply increases during 1Q05 failed to cool oil and gas prices, which were significantly higher than they were during the first quarter of 2004. The average US wellhead crude oil price in the first three months of 2005 jumped to $43.21/bbl from $31.47/bbl a year earlier, while the average US wellhead natural gas price gained nine percent.

Futures prices moved up also. The March contract for light sweet crude on the New York Mercantile Exchange closed at $51.15/bbl vs. $35.60/bbl on the last day of trading of the March 2004 contract. This compares to a closing price of $46.91/bbl for the February 2005 contract and $45.64/bbl for the close of the January 2005 contract.

Natural gas futures also gained from a year earlier. The March 2005 contract closed at $6.42/MMbtu, up from $5.15/MMbtu for the March 2004 final closing price.

Financial results

The OGJ200 group collectively posted much improved results for 1Q05 as compared with a strong first quarter of 2004. The group’s 1Q05 net income was $19.8 billion, up from $14.2 billion, and revenues were $208.7 billion, up from $169.1 billion a year earlier.

Capital expenditures for the OGJ200 group climbed 25.5 percent from the first quarter of 2004 to $16.5 billion, even as many companies in the group used excess cash to purchase shares of their own stock.

The large, integrated oil and gas firms mostly reported higher 1Q05 earnings, but smaller downstream margins, reduced production volumes, and other factors tempered some of the companies’ results.

ConocoPhillips recorded an 80 percent surge in net income as compared with the first three months of 2004 on 29 percent stronger revenue. The company said that results could have been better if not for unplanned downtime in both its exploration and production segment and its refining and marketing segment.

Amerada Hess Corp. reported lower net income for the quarter, as upstream earnings gains were not enough to overcome declines in the company’s downstream business segment.

Chevron Corp. (formerly ChevronTexaco Corp.) posted a four percent earnings gain to $2.7 billion. Upstream earnings increased 20 percent to $2.4 billion on higher oil and gas prices, while downstream earnings declined 36 percent to $0.4 billion, reflecting the impacts of refinery downtime.

ExxonMobil Corp.’s earnings gained on the strength of oil and gas prices, refining margins, and chemicals despite lower production volumes during the quarter. Exxon Mobil’s upstream earnings were a record $5 billion, up $1 billion from first quarter 2004 results.

Meanwhile, many independent oil and gas producers announced improved results due to a combination of higher production volumes and stronger prices. Although a handful of these companies recorded a loss for 1Q05, the group’s results were improved from a year earlier, with earnings up more than 30 percent collectively.

One of the biggest gainers among the independents is Range Resources Inc., which ranks at No. 32 in the OGJ200 based on its total assets at the end of March 2005. Based in Fort Worth, Range Resources more than tripled its earnings in 1Q05. The company’s average gas price rose 24 percent during the quarter, as its average oil price surged 49 percent year-on-year. With production up 29 percent over the same 2004 period, revenues gained 70 percent.

Other independent oil and gas producers that posted sizable earnings gains for 1Q05 are No. 87 Gulfport Energy Corp., No. 64 Mission Resources Corp., and No. 117 Aspen Exploration Corp.

And ranked at No. 125, Pioneer Oil & Gas recorded earnings of $1.9 million for 1Q05, up from $45,000 for the same 2004 period. The company’s revenues grew more than seven-fold year-on-year.

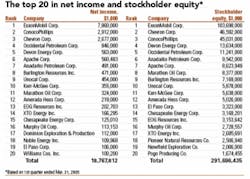

Top 20 firms

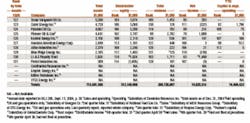

The top 20 firms as ranked by total assets account for more than 90 percent of the entire group’s net income and revenue for 1Q05.

Collectively posting earnings of $18.7 billion for the first three months of this year, the top 20 companies’ net income comprised 95 percent of all earning for the 131 firms with results in this edition of the OGFJ200. And at $202 .2 billion in revenue, the top 20 companies accounted for 97 percent of the entire group’s revenues.

Additionally, the top 20 firms hold 91 percent of the assets of all the companies in the OGJ200, and their market capitalization continued to grow. As of March 31, 2005, the market cap of the top 20 companies totaled $826.8 billion, up from $708.1 billion as of year-end 2004.

This report also ranks the companies by capital and exploratory expenditures during the quarter. While almost all of the companies in this ranking also are the top 20 by assets, there are a few surprises.

Apache Corp., which ranks by assets at No. 10, was the company that spent the fifth-largest amount on C&E outlays during 1Q05. Similarly, Burlington Resources Inc. and Chesapeake Energy Corp. ranked higher by spending than by assets, as did Murphy Oil Corp.

Two firms in the top 20 by spending list do not appear in the top 20 by assets list. These are Newfield Exploration Co. and Stone Energy Corp.

Newfield Exploration ranks at No. 21 by assets. With 1Q05 C&E spending of $244.4 million, the Houston-based company ranks eighteenth among the top spenders. Stone Energy, with headquarters in Lafayette, La., ranks at No. 27 by assets, but at No. 20 by C&E spending.

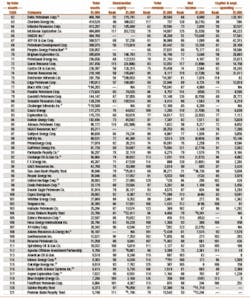

Fast growers

For the quarter ended March 31, 2005, the fastest-growing company in the OGJ200 is Basic Earth Science Systems Inc. The No. 116-ranked firm improved its 1Q05 earnings 203 percent from a year earlier, and stockholder equity in the Denver-based oil and gas producer increased 48 percent from year-end 2004.

The OGJ200 Quarterly table of fast-growing companies ranks firms by growth in stockholder equity. For a company to appear on this list, it must have recorded positive net income for the first three months of 2005 and 2004, and it must have posted a gain in earnings during 1Q05 as compared with the same period a year earlier. Limited partnerships, newly public companies, and subsidiaries are excluded from the list.

The second-ranked fast grower is Aspen Exploration, which reported a 45 percent increase in stockholder equity since the end of last year and an 812 percent gain in earnings. However, Aspen Exploration’s long-term debt climbed to $821,000 at the close of 1Q05 from $376,000 at the end of 2004.

The third-fastest grower is Sabine Royalty Trust, which ranks at No. 120 in terms of assets in the OGJ200 group. Sabine Royalty Trust’s stockholder equity gained 34 percent during the first three months of 2005, and its earnings were up 27 percent.

The next two fast growers, Ultra Petroleum Corp. and Magnum Hunter Resources Inc., also appeared on this list for their performance during the last three months of 2004. In 1Q05, both of these producers posted large earnings gains and reduced their long-term debt.

Delta Petroleum Corp., which ranks at No. 62 in terms of assets, is the sixth-fastest grower. This Denver-based company more than doubled its net income from the first quarter of 2004, but added to its debt during the first three months of this year.

Stockholder equity in Unocal Corp. jumped almost 13 percent during 1Q05 from the end of 2004. This makes the takeover-target the seventh-fastest grower for the quarter. Unocal posted earnings of $454 million during the period for a 69 percent gain versus the same 2004 quarter.

Following Unocal are Credo Petroleum Corp., PrimeEnergy Corp., and Remington Oil & Gas Corp. The eleventh-fastest grower is Texas Vanguard Oil Co., which was also among the fourth quarter 2004 fast growers. Texas Vanguard significantly reduced its long-term debt during 1Q05 and saw its net income surge 65 percent. The company’s stockholder equity climbed eight percent during the quarter.

The twelfth-fastest grower, EOG Resources Inc., doubled its earnings from the first quarter of 2004, while growing its stockholder equity seven percent and incurring a four percent increase in long-term debt.

But the biggest earnings gainer by far among the fast growers is Comstock Resources Inc. Comstock Resources’ net income rocketed to $15.9 million from $25,000 a year earlier. The first quarter 2004 results included a charge of $19.6 million, or $12.5 million after income taxes, relating to the early retirement of the company’s senior notes.

Two other firms on the current fast growers list also made the list for results of the final 2004 quarter. These are Edge Petroleum Corp. and Kerr-McGee Corp., which are the fourteenth and twentieth fastest growers, respectively, for 1Q05. OGFJ

Some key changes from previous quarter

The following companies sold their US producing properties, liquidated, or became private since the last survey:

Trek Resources Inc.