Industry Briefs

FMS Technologies Inc. chosen by Petro-Canada, Statoil for challenging subsea projects

FMC Technologies Inc. (FMCTI) has signed subsea systems agreements with Petro-Canada and Statoil ASA. The frame agreement with Petro-Canada defines offshore developments off the east coast of Canada. It covers the supply of subsea systems and equipment for the potential expansion of and new developments in the Terra Nova field, the second-largest field off Canada’s east coast, and other potential developments in the area. This agreement is for three years, with options for three additional years.

FMC Technologies Inc.

Revenue from this agreement will be based on call-off work orders for specific subsea trees and associated equipment. If all the subsea trees contemplated under the agreement are actually ordered, FMCTI estimates total revenue will be $100 million over three years. To date, one work order has been issued under the agreement, for equipment totaling about $8.7 million.

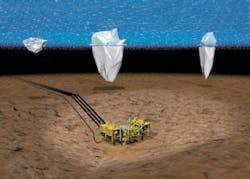

“We have been working with Petro-Canada on the three phases of the Terra Nova project, beginning in 1998,” said Peter D. Kinnear, executive vice president - FMCTI. “We welcome the challenge of supplying projects such as this - the world’s first major subsea project in iceberg-infested waters.”

The Terra Nova field is roughly 218 miles off the coast of Newfoundland and Labrador, where icebergs are commonly encountered. Production from the field began in January 2002.

FMC Technologies has also signed a contract with Statoil ASA to supply a subsea system for Statoil’s existing Norne field project in the Norwegian Sea. This agreement is in conjunction with a new-build Norne Improved Oil Recovery (IOR) - Template K, which includes two subsea trees, a manifold, a template, and two subsea control modules. The agreement also includes retrofitting an electric subsea control module, which operated eight electric gate valves and one electric pig valve for the control of manifold functions for an existing template, also in the Norne field. The contract is valued around $28 million.

Kinnear commented, “The Norne system will be the first conversion of a production manifold to all-electric operation. This is an important advancement of our all-electric subsea production system technology...”

The Norne field began production in 1997 and is located about 125 miles off the Norwegian coast in approximately 1,250 feet of water.

Weisser, Johnson & Co. forms GasRock Capital LLC to make mezzanine debt investments

Houston-based Weisser, Johnson & Co. and its principals have formed GasRock Capital LLC to make direct mezzanine debt investments in oil and gas as well as midstream energy projects and companies. GasRock has received commitments from financial institutions that manage investment funds exceeding $7 billion. Its primary focus is project debt investments in upstream or midstream energy projects or acquisitions of between $5 million and $50 million, or larger.

“Mezzanine debt has been a preferred source of capital for domestic independents for well over the last two decades,” commented Frank Weisser, managing director of GasRock. “The structure doesn’t have the control issues of equity and is far less dilutive, which is why it is a very popular source of capital for development projects and acquisitions.” Debt investments are typically structured as non-recourse to the sponsors, with royalty or other equity kickers.

Weisser Johnson will act as manager of GasRock. The company has advised numerous growing energy companies on arranging private equity and debt financings from institutional sources and on mergers, acquisitions, and divestitures. Brittany Capital Group Inc. of New York City was advisor to GasRock. The business and finances of GasRock and those of Weisser Johnson will remain separate and independent from one another.

NYMEX announces joint venture to develop futures exchange in Dubai

The New York Mercantile Exchange Inc. and Dubai Holding have joined forces to create the Dubai Mercantile Exchange (DME), a joint venture to develop the Middle East’s first energy futures exchange.

It is expected that the DME will initially trade sour crude and fuel oil. It will be based in the Dubai International Financial Centre, a financial free zone designed to promote financial services within the United Arab Emirates. In addition, the DME will be regulated by the Dubai Financial Services Authority, a regulatory body established within the DIFC. The DME is expected to open for trading in early 2006.

NYMEX and Dubai Holding will each contribute capital and services towards establishing the DME, which will house both open outcry and electronic trading platforms. NYMEX will contribute software and systems to run the trading operations. The DME will leverage NYMEX’s knowledge of compliance, marketing, research, and information technology to develop its platform. Trades will be cleared through the NYMEX clearinghouse in New York.

Far East Energy begins drilling its first horizontal well in China

Far East Energy Corp. has commenced the first of two horizontal wells to be drilled in the Shouyang block of Far East’s 4,280 square kilometers coalbed methane project in Shanxi province, which it holds by virtue of a farmout agreement from ConocoPhillips. It was announced in May that the company signed contracts with Zhongyuan Petroleum Exploration Bureau to drill its first two long-reach, underbalanced horizontal wells in the Shanxi province of China beginning with the FCC-HZ01 well. These two wells will be drilled to approximately 1,800 feet, and will be large horizontal wells drilling to the numbers 15 and 3 coal seams, respectively. Laterals will be drilled with a goal of completing over 13,100 feet of horizontal drilling inside the coal seam for each well. The company anticipates the two wells will each require 35 to 60 days to drill and complete, with additional time to dewater and test the wells for sustainable production of coalbed methane.

The West-East Pipeline to Shanghai runs about six miles south of the southern border of Far East Energy’s Shanxi Project, and the Shanjing II Pipeline to Beijing is roughly twenty-five miles north of the northern border of the Shouyang block.

Based in Houston, with offices in Beijing and Kunming, China, Far East Energy is focused on the acquisition of, and exploration for, coalbed methane though its agreements with ConocoPhillips and China United Coalbed Methane Co.

Oretech obtains license for new oil extraction method

Phenix City, Ala.-based Oretech Inc. is in the final stage of an agreement to obtain a limited license for a newly developed, environmentally friendly method of extracting oil from tar sand. H. Stephen Shehane, CEO of Oretech, believes that the system could enable the US to utilize its own resources and reduce its dependency on foreign energy sources. He also believes it could reduce the cost per barrel of oil and avoid further pollution of the environment.

According to Shehane the benefits of the proprietary system include: the utilization of an unconventional heat source; no depletion of natural gas or coal reserves; no polluted water or chemicals released into the environment; the small amounts of water used in processing remain in a closed system; the system requires no chemical catalysts; there is a low consumption of electrical energy; recent tests consistently extracted higher percentages of bitumen than published extraction ratios from other extraction methods; the process is environmentally friendly; and the technology can also be used in refining crude oil.

Oretech is known for its materials processing technology, which extracts specific minerals from diverse feedstock and raw materials without the use of harmful chemicals or the emission of environmentally unsafe gases.

Australia’s Woodside Energy awards EPC contract to Foster Wheeler

Foster Wheeler Ltd. announced that its Australian subsidiary, Foster Wheeler Pty Ltd., has been awarded an engineering, procurement, and construction management contract with Woodside Energy Ltd. on behalf of the North West Shelf Venture following final investment approval by its six joint venture participants to invest A$2 billion on a Phase V LNG expansion project to be built at Karratha, Western Australia. Foster Wheeler is leading a joint venture with WorleyParsons Services Pty Ltd. to execute this project, which involves the addition of a fifth LNG processing train with a production capacity of 4.2 million metric tonnes a year to the existing 11.7 mtpa LNG complex.

The project also includes an additional fractionation unit, acid gas recovery unit, boil-off gas compressor, two new gas turbine power generation units, a second loading berth, and a new fuel gas system compressor.

Wood Mackenzie partners with Candover to fund growth

Edinburgh, Scotland-based Wood Mackenzie has signed an agreement with Candover Investments PLC, the European buyout house, to finance the company’s next stage of growth. The deal provides Wood Mackenzie with an opportunity to extend its portfolio of products through organic investment and strategic add-on acquisitions, as well as providing the means to further develop its international presence.

Wood Mackenzie’s energy clients include all of the major energy companies worldwide. In 2001, Wood Mackenzie was bought by its management and staff from Deutsche Bank. The MBO was financed by the company’s staff and an integrated finance package from Bank of Scotland Corporate. Bank of Scotland will retain a small equity share in the company moving forward. Corporate finance advice was provided by Deloitte.

The investment in Wood Mackenzie will be the fourteenth investment made by the Candover 2001 Fund.

Enterprise to construct new NGL fractionator

Enterprise Products Partners LP will construct a new natural gas liquids (NGL) fractionator located at the interconnection of the Mid-America Pipeline System (MAPL) and the Seminole Pipeline System (Seminole) near Hobbs, NM. The fractionator will be designed to handle up to 75,000 b/d of mixed NGLs which will be sourced from current and future processing plants in the Rocky Mountain region, the Permian basin, and in the panhandle area of Texas and Oklahoma on MAPL.

The company will also construct a high-rate purity ethane storage well near the new fractionator and reconfigure the interconnection between MAPL and Seminole. The project will cost approximately $130 million and is expected to be in operation by mid-2007.

When complete, the Hobbs fractionator will have access to the largest NGL market in the US at Mont Belvieu, Tex. through Seminole and the nation’s second-largest NGL market located at Conway, Kan. Enterprise will continue with its 15,000 b/d expansion of the existing NGL fractionator at Mont Belvieu, which will increase Enterprise’s NGL fractionating capacity to 225,000 b/d. In total these projects will result in Enterprise operating 300,000 b/d of fractionating capacity on MAPL between Hobbs and Mont Belvieu. The 15,000 b/d expansion is expected to be completed in 2006.

Houston-based Enterprise Products Partners is a publicly traded energy partnership with an enterprise value of about $14 billion, and provides midstream energy services to producers and consumers of natural gas, NGLs, and crude oil.

GE Commercial Finance partners with Locin Oil, expanding reserve base

Stamford, Conn.-based GE Commercial Finance Energy Financial Services and The Woodlands, Tex.-based Locin Oil Corp. have partnered to acquire 96 bcf of net proved gas reserves for approximately $147 million. The properties, located in the Appalachian Gas Fields, include about 1,200 wells in Pennsylvania and Ohio and were acquired from Equitable Production Co. Over 220 proven and probable, low-risk, undeveloped drilling locations have been identified in the fields. Energy Financial Services holds a 95 percent limited partnership interest in NCL Appalachian Partners LP and will share in capital expenditures to develop the reserves.

The principals of Locin Oil formed NCL Appalachia LLC to be the five percent General Partner and operator of the fields, which include 69 bcf of net proved producing gas reserves. The acquisition includes the reserves and over 400 miles of related gathering systems in the Noble (Lordstown) and Cambridge fields in eastern Ohio (gas production sold to contracted industrial customers in the region) and the Snowshoe and Grugan fields in central Pennsylvania (gas production sold through multiple sales points to four major gas pipelines accessing diverse US gas markets).

Locin Oil is a privately held Texas corporation with operations in over 290 wells in seven states. GE Commercial Finance Energy Financial Services invests about $3 billion annually in the energy industry. The company offers structured equity, leveraged leasing, partnerships, project finance, and broad-based commercial finance to the industry.

El Dorado Exploration uses new oil discovery process, CEO makes statement

Eldorado Exploration Inc. will use a proprietary process (PIP) that has been used to find three new oil and gas fields. When used with the standard geology, seismic, geochemical, and other technologies, it can increase the odds on a wildcat well from one in 10 to as much as one in two, said a company spokesperson. Eldorado retains the right to participate in any new prospects generated by the PIP process of which there are now five major-sized targets the company has committed to drill. The company hopes to drill up to 10 wells during 2005 and 20 wells in 2006. The first wildcat well in New Mexico has the potential to produce $20 billion in recoverable gas reserves, said the company.

David T. Laurance, Eldorado president, has exchanged 40 million shares of his common stock for 10 million shares of preferred stock.

On a related note, because of a large run-up in volume and volatility of the Eldorado share price recently, the company reminded present and potential stockholders of the basic business of the company.

Laurance stated, “The company went public through a reverse merger with a publicly traded shell in March of 2005 and started trading on the Pink Sheets soon after a name change and transfer of stock to the shareholders of Eldorado...the business of the company is oil and gas exploration using what we think is a breakthrough technology to increase the odds of finding oil and gas.” He went on to say that “...the company has already hit its first well in Texas and the well started producing the first week of June 2005. The company has a 10 percent working interest in the well and the offset locations...Eldorado has identified several very large company-making prospects it hopes to drill this year in Texas, New Mexico, and Montana.”

He added that “...the company has an agreement with a venture capital company in Newport Beach, Calif., to raise drilling capital that would be more than sufficient to fund Eldorado Exploration’s efforts for the next two years until production from wells can finance further activities...Eldorado [has] very good prospects comprising over 50,000 acres in three states.”

Triple Point Technology will deploy its Commodity XL software at General Maritime, Noble Group

General Maritime Corp., a provider of seaborne crude oil transportation services, is deploying Triple Point Technology’s Commodity XL software to improve the physical operations and revenue-generating potential of its global tanker fleet. Triple Point’s solution integrates physical positions to show freight dependencies with freight hedges, enabling General Maritime to more profitably hedge tanker positions and enter the global freight forward market. The system’s risk management capabilities identify areas of risk involving its physical freight routes while analyzing “what-if” scenarios and results of forward freight agreements.

In addition, Noble Group has selected Commodity XL to manage its global physical and financial trading of multiple commodities, including petrochemicals, clean oils, coal, coke, metals, ores, coffee, cocoa, sugar, grains, shipping, and freight. Noble Group, a global merchandiser of industrial, energy, and agricultural raw materials, is deploying the software for physical and financial trading, risk management, and commodity movement and logistics. Once operational, Noble Group will have approximately 250 users on the Triple Point system in Hong Kong, Singapore, and Lausanne, Switzerland.

Westport, Conn.-based Triple Point manages the logistical and financial complexities of commodity trading and movement. The platform enables producers, traders, refiners, marketers, distributors, and consumers to profitably manage the opportunities and risks involved in the purchase, sale, movement, and storage of commodities including gas, power, crude oil and refined products, coal/coke, base metals and ores, agri-foods and other soft commodities, and shipping and freight.

Lloyds TSB offers UK utilities operating leases for mid-ticket capex programs

Lloyds TSB Corporate is making it easier for heavily-regulated utilities to meet their capex or equipment procurement needs while meeting regulatory consumer pricing restrictions. The bank’s mid-cap Corporate Asset Finance (CAF) team is offering the operating lease product against purchases valued between £1 million and £100 million. The leases allow asset purchasers to procure, install, and utilize new plant over the life of the operating lease while title is retained with the bank. Because the operating leases are being offered by the bank’s mid-market CAF division, the availability is extended to much smaller equipment purchase programs. This was accomplished by combining the bank’s regional sales offices with the “big-ticket” structuring techniques developed by the bank’s Structured Asset Finance division. “The regional CAF network was set up a year ago, following a consultation exercise that showed those asset buyers with more everyday equipment and capex needs were being overlooked by banks’ main leasing divisions,” says Mike Chappell, head of CAF at Lloyds TSB Corporate. Proposed changes to the UK corporate tax rules are set to increase the importance of operating leases.

BPZ Energy signs mandate letter with IFC for up to $70 million

Houston-based BPZ Energy Inc. has signed a mandate letter with the International Finance Corp. (IFC), a member of the World Bank Group based in Washington, DC, to facilitate the financing of the company’s initial capital expenditure program to monetize its offshore natural gas assets in Block Z-1 in northwest Peru. The company plans to build a gas-fired power plant that will utilize its nearby gas resources to produce electricity. The approximately $70 million is currently expected to include an equity/quasi-equity investment for IFC’s account of up to $8 million plus a long-term senior debt package of up to $62 million for the account of IFC and other potential lenders. The company will need additional financing of up to $30 million.

Manolo Zúñiga, president and CEO of BPZ Energy, stated, “BPZ believes that support from an internationally recognized organization such as IFC will give additional credibility to this important project and enhance our ability to attract future investors and gain the confidence of potential long-term purchasers of our natural gas and electricity.”

BPZ Energy Inc. is an oil and gas exploration and production company with properties in northwest Peru and Ecuador. It has exclusive rights and license agreements for oil and gas exploration and production covering about 2.7 million acres in four properties in northwest Peru. It also owns a working interest in a producing property in southwest Ecuador.

New product launch by IHS Energy and UNEP-WCMC to deliver global biodiversity information

IHS Energy, a leading provider of oil and gas information, and related software and consulting services, announced today it has signed an agreement with the United Nations Environment Programme World Conservation Monitoring Centre (UNEP-WCMC) of Cambridge, UK, to market a global biodiversity information module to the energy industry. The module delivers desktop access to protected areas and other sensitive terrestrial and marine habitats, including WWG (R) Ecoregions - in context with IHS Energy’s own comprehensive E&P datasets and map-based analysis tools. The offering will provide an early warning system for companies to evaluate potential environmental impacts early when planning oil or gas projects.

Houston-based IHS provides and integrates E&P information, software, and consulting services. UNEP-WCMC is the biodiversity assessment and policy implementation arm of the United Nations Environment Programme. It provides objective, scientifically rigorous global products and services that include ecosystem assessments, support for implementation of environmental agreements, research on threats and impacts, and development of future scenarios for the living world.

Petris acquires RECALL from Baker Hughes

Houston-based Petris Technology Inc., a developer of vendor-neutral data management and exchange technologies, has signed an agreement to acquire the RECALL well log storage and analysis software from Baker Atlas, a division of Baker Hughes Inc. With the agreement, Petris will acquire the RECALL business and will assume worldwide responsibility for the development, sales, service, and future development of the software. The combination of RECALL with Petris’ own data management product, PetrisWINDS Enterprise, expands possibilities for customers for well bore data management by increasing overall compatibility and reducing the complexity for interface.

Petris’ Software as a Service (SaaS) approach, PetrisWINDS Now!, allows RECALL applications and data editing tolls to be delivered via the internet on a rental basis. These combinations give existing customers of RECALL an open data management solution for well bore data management, while expanding the possibilities for use of the RECALL petrophysical applications.

Founded in 1994, Petris provides IT-based solutions for energy clients by leveraging its expertise in data management, application hosting, geospatial information systems (GIS), and professional services. Petris designs and deploys technology that integrates data from diverse data stores to enable better decision-making and application transparency.

Exploration sign services deal

Gryphon Exploration Co. has renewed its contract with Object Reservoir Inc. for dynamic reservoir characterization (DRC) services. Gryphon will utilize Object Reservoir’s services over the next year on various reservoirs located in the shelf area of the Gulf of Mexico.

Object Reservoir’s technology-enabled DRC service and process will be used by Gryphon to characterize new reservoirs and update existing reservoir models with new production data. The DRC process supports development of highly precise and predictive reservoir models.

An Object Reservoir spokesman says that knowledge gained from DRC models with various clients has been shown to accelerate development decisions by six months; lead to a 30 percent reserves improvement; improve return on capex by 15 percent; and change one out of three drilling decisions.

DRC represents more than 100 man-years of development and an investment of more than $18 million, says the spokesman, who adds that Gryphon, a Houston-based company of Warburg Pincus, focuses on the shallow waters of the Gulf of Mexico.

Gryphon pursues a strategy that utilizes highly contiguous pre-stack time migrated regional 3D seismic databases covering approximately 2,300 offshore blocks in the Gulf of Mexico to identify significant reserve potential prospects in deeper geologic strata.

Austin-based Object Reservoir delivers reservoir knowledge that enables early decision-making and proactive management of exploration and production company assets.

Roxar launches new fault seal analysis tool RMSfaultseal

Roxar announced the launch of RMSfaultseal, its multi-platform fault seal analysis solution which analyzes fault zone properties within the integrated reservoir model workflow and exports final results for reservoir simulation. RMSfaultseal comes with a broad range of algorithms and calculation methods that can calculate fault zone permeabilities and transmissibilities for input to reservoir simulation. Roxar is an international technology solutions provider to the upstream oil and gas industry with head offices in Stavanger, Norway.

Object Reservoir and Gryphon KRG Capital Partners acquires Varel International

Denver-based KRG Capital Partners has acquired Carrollton, Tex.-based Varel International. Founded in 1947, Varel is an independent supplier in the drill bit market. The company services oil and gas, mining, and industrial markets with its roller cone and fixed cutter drill bits. KRG was founded in 1996 and is a private equity firm that acquires and recapitalizes middle-market companies.

The transaction was financed with equity from the $450 million KRG Capital Fund II in conjunction with debt provided by Royal Bank of Scotland (Agent), Freeport Financial, and Area Capital Management. Simmons & Co. International acted as financial advisor to Varel. Following the acquisition, Varel’s headquarters will remain in Carrollton, and there are no plans for changes at the executive level.