2Q earnings surge for OGJ200 firms

Marilyn Radler, Senior Editor - Economics, Oil & Gas Journal

Laura Bell, Statistics Editor, Oil & Gas Journal

Collectively, the OGJ200 firms posted higher earnings for the second quarter (2Q05) as a result of improved market conditions from a year earlier.

Increased oil demand, product prices, and refining margins drove the collective revenue and net income of this group of 138 companies during the quarter. The group’s total revenue was up 28 percent from the same 2004 quarter, and net income grew 31 percent. For the first six months of 2005, capital expenditures by the group were up sharply as well, totaling $37 billion vs. $27.7 billion for the first half of last year.

The OGJ200 group consists of the US-based oil and gas producers that appear in Oil & Gas Journal’s annual special report (OGJ, Sept. 19, 2005, p. 24), which ranks the publicly traded firms by year-end total assets.

Changes

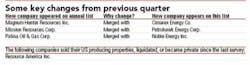

There are fewer companies in this edition of the OGJ200 quarterly report. Three firms no longer appear in the compilation because they merged into others that also appear in the group.

Magnum Hunter Resources Inc. merged with Cimarex Energy Co., Mission Resources Corp. merged into Petrohawk Energy Corp., and Patina Oil & Gas Corp. merged with Noble Energy Inc.

Additionally, Resource America Inc. no longer appears in the OGJ200 group. The Philadelphia-based company in June spun off its oil and gas operations to Atlas America, with which Resource America formerly consolidated.

Market forces

Although some companies recorded production volume declines, a spike in oil prices benefited their second quarter 2005 earnings.

The US wellhead price of crude oil averaged $47.04/bbl in 2Q05, up from $34.61/bbl in the second quarter of 2004, while the average crude oil spot price worldwide excluding the US was $49.96/bbl for the second 2005 quarter, up from $33/bbl a year earlier.

Natural gas prices were higher too, but by smaller margins. The US wellhead price of gas averaged $6.20/MMcf in 2Q05, up from $5.56/MMcf a year earlier. And the wholesale price of heating oil in the US jumped 53 percent year-on-year.

US refining margins were up from the second quarter of 2004, also. The US Gulf Coast refining margin during 2Q05 was $11.39/bbl, up from $9.10/bbl in the same 2004 quarter, according to Pace Consultants Inc. Meanwhile, the US West Coast margin climbed to $16.45/bbl from $15.88/bbl a year earlier.

Results

Production volumes were lower for some firms, which still reported mostly stronger results for the quarter as compared with the same 2004 period. The group’s collective earnings totaled $22.8 billion for 2Q05, with revenues of $231 billion.

Marathon Oil Corp. posted a 91 percent earnings gain as compared with the second quarter of last year, along with a 28 percent rise in revenue. Marathon reported that strong exploration and production operations results-especially larger production volumes in Equatorial Guinea and higher prices-were complemented by favorable downstream performance, which benefited from favorable crack spreads, sweet/sour differentials and strong wholesale and retail margins.

Chevron Corp. reported an 11 percent decline in net income from the second quarter of 2004. Chevron’s worldwide production was down 6 percent following asset sales, and the company recorded lower earnings from its US downstream operations for the quarter.

Among the larger independent oil and gas producers, Kerr-McGee was the biggest earnings gainer, recording a 233 percent increase in second-quarter earnings year-on-year.

Some firms in the OGJ200 group recorded small declines in earnings for 2Q05, including Murphy Oil Corp. (down 1 percent), Houston Exploration Co. (down 3 percent), and Cano Petroleum Inc. (down 4 percent).

The OGJ200 group’s total assets and stockholder equity posted modest gains during the quarter. Collective assets increased 7 percent to $735.9 billion, and stockholder equity gained 3.6 percent, totaling $315 billion.

Top 20 results

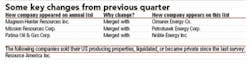

The group of 20 firms at the top of the OGJ200 as ranked by their total assets at the end of 2Q05 is little changed from the previous quarter.

ExxonMobil Corp. remains as the top-ranked firm. Chevron Corp., at No. 2, switched places with ConocoPhillips, which is now ranked No. 3. Williams Cos. Inc. is no longer in the top 20, having dropped to No. 21 in the current ranking, as Noble Energy moved up to No. 16 from No. 23 at the end of the first quarter of this year.

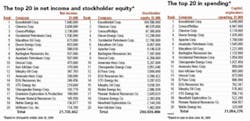

As the top 20 firms go, so goes the entire OGJ200 group. These largest firms accounted for 94 percent of the entire group’s net income for 2Q05 and held 91 percent of all the assets. The top 20 posted the same percentage increases in earnings and revenues as the entire group, too.

The top 20 recorded a slightly smaller amount of capital and exploration spending for the first half of the year, however. Whereas the entire OGJ200 group spent 33.5 percent more on such outlays as compared with first-half 2004 spending, the top 20 group increased their year-on-year spending 28.5 percent.

The market capitalization of the top 20 firms dipped slightly during 2Q05, as oil and gas companies continued to enjoy favor in the equity markets. The market cap of the largest 20 companies declined to total $818 billion as of June 30, 2005, from $826.8 billion three months earlier.

Fast growers

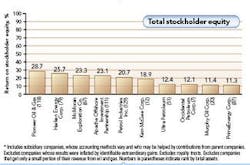

Based on 2Q05 results, the new fastest growing company in the OGJ200 group is Cimarex Energy Co. Ranked No. 23 by assets, Cimarex recorded a 44 percent increase in net income for the most recent quarter and grew its stockholder equity 229 percent.

Click here to view additional tables in pdf.

The list of fastest-growing companies is determined by growth in stockholder equity. For a company to qualify for the list, it must have posted positive net income for the second quarters of 2005 and 2004, and it must have increased its earnings in the most recent quarter vs. the year-ago quarter. Limited partnerships, newly public companies, and subsidiaries are excluded from this list.

Cimarex, with headquarters in Denver, also appeared on the list of fast growers in the previous edition of the OGJ200 Quarterly Report. In that edition, Cimarex was the eighteenth fastest-grower.

Currently, the second fastest-grower is Noble Energy, which posted a 105 percent gain in stockholder equity and a 90 percent increase in earnings for 2Q05 as compared with the same 2004 quarter.

Dallas-based Toreador Resources Corp. is the third fastest-grower. Toreador in the second quarter boosted its stockholder equity 65 percent as its earnings improved 40 percent from a year earlier.

Ultra Petroleum, which has appeared on the fast growers table in each edition of the OGJ200 Quarterly Report since its inception-based on results of the final 2003 quarter-is the fourth fastest-grower for 2Q05. Ultra Petroleum’s earnings in the recent quarter grew 159 percent from the second quarter of last year.

The remaining companies in the current fastest-growers table that also ranked on this list in the previous OGJ200 Quarterly Report are Unocal Corp., Occidental Petroleum Corp., Credo Petroleum Corp., Delta Petroleum Corp., and Remington Oil & Gas Corp.

The largest earnings gainer among the fast-growing firms is GeoResources Inc. GeoResources recorded a 2Q05 earnings gain of 264 percent from a year earlier to $848,000 and is the twentieth fastest-grower in the group. OGFJ