Fayetteville inventory update

Southwestern calls the shots

Hanwen Chang, IHS, Houston

The Fayetteville shale is located on the Arkansas side of the Arkoma Basin and cuts a swath through the north-central part of the state east to the Mississippi River. Unlike the Barnett and Marcellus, which have sizable liquids-rich and super-rich windows, the Fayetteville is overwhelmingly a dry gas play.

Southwestern was the earliest entrant in the Fayetteville and still claims nearly three times the natural gas production of its nearest competitor in the formation. The Fayetteville is an important component of the US natural gas supply with the field's output remaining stable at around 3 bcf/d. Production may grow at a modest pace in the next few years should natural gas prices recover towards the $4/MMbtu level.

Endowment: Hot spots and not-so-hot spots

As with all unconventional plays, there are clearly delineated areas of highly productive acreage; however, much of the acreage is expected to produce sub-par production results. This natural distribution means that E&P operators prefer to:

- First hold acreage parcels by establishing production. Depending on the play, this can drive drilling for the first three to five years, then diminish as companies then…

- Focus disproportionately on the most productive portions of their acreage. Companies thus maximize NPV until they begin to exhaust the best areas, which leads them to…

- Migrate to less attractive areas. The lower productivity means lower capital efficiency and slower growth.

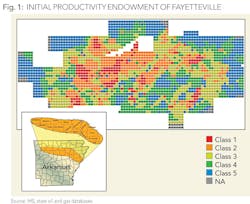

Fig 1 reflects an estimate of the initial productivity endowment of the Fayetteville shale play. Squares represent drilling units of one square mile - known as "sections". Most have been designated by the state oil and gas authorities to establish spacing parameters and operational controls.

Neighborhoods matter for results

Given the current trends in technology in North American drilling, IHS standardizes well performance based on peak production per lateral foot of wellbore for horizontal wells and peak production for vertical/directional wells. Peak production is used as a proxy for overall well economics and near/medium-term productivity. Our analysis has shown this to be an effective and accurate substitution. Within the context of a specific play, we then divide the wells into quintiles based on the metric. Through a developed algorithm, we use well results to characterize the acreage itself and create "classes" of acreage.

Though the distribution of wells across productivity quintiles will always be equal, first class acreage is a disproportionately small percentage of the play's total areal extent. Additionally, productivity levels differ significantly, as peak gas per foot of lateral length drop by one-third between the first and second quintile wells (See Fig 2.)

We would estimate that Class 1 acreage would, on average, produce wells which would rank in the historical First Quintile. Future wells in Class 2 acreage would qualify as Second Quintile, and so on. Note that all unconventional plays show significant variability even among wells drilled in neighboring sections. The Fayetteville pattern suggests higher than average local variability, but the overall designation of acreage quality remains robust.

Current state of development

Activity in the play has declined somewhat as low gas prices drove both constraints in cash flow (e.g., Southwestern) and unattractive returns (XOM and BHP). As operators have drilled less, the rate of consumption of the best parts of the play have not declined. Rather, the percentage of fourth and fifth quintile wells drilled has dropped significantly – from 35-40% of new wells in 2011 to less than 20% by the end of 2012.

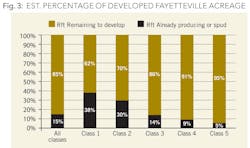

As should be expected in times of low prices, development closely follows the quality map. Importantly, while the overall play is only 15% developed, we have already drilled about one third of Class 1 and Class 2 lifetime inventory. Fig 3 reflects an estimated percentage of developed acreage of the Fayetteville shale.

Despite accelerated development, lots of room left

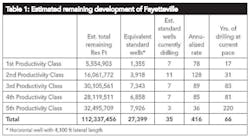

At current activity levels, even the best acreage has many years left for development. Given the footprint of the play and the current low development rate, the best acreage in the play will not be fully developed for decades (See Table 1).

Who has the future inventory?

The leading Fayetteville producers by far are Southwestern Energy, BHP Billiton, and ExxonMobil's XTO Energy. During 2012, Southwestern posted 1.98 bcf/d in Fayetteville gas sales, good for 70.4% of the play's total sales that year. BHP sold 0.42 bcf/d (15.1%) and XTO Energy sold 0.41 bcf/d (14.4%). The remaining 0.2% of sales was spread out among nine companies.

Despite being the largest operator in the play, Southwestern also has a better portfolio than others in the play. Its portfolio is nearly 50% comprised of first and second quintile assets. This, along with the sheer number of producing wells in the play, makes the company dominant in the Fayetteville (See Fig 4).

Noting the disproportionate distribution of top producing assets that are currently unpeaked, recently spud, or permitted, it appears that operators are clearly high-grading activity in the Fayetteville.

Southwestern's high-grading efforts are evident when looking at specific activities of recent months, with nearly 70% of all forward-looking activity focused on developing highly productive assets. In absolute terms, Southwestern can continue to drill its prime acreage for many years, and wait for gas prices to increase the attractiveness of the lower quality areas. XOM and BHP also have a number of high-quality wells to drill. However, their inventory lacks the depth and overall average quality of Southwestern's. OGFJ

About the author

Hanwen Chang is a senior analyst at IHS. He holds a bachelor's degree from Northeastern University and a master's degree from Texas A&M University. Hanwen is a CFA charter holder and a member of the CFA Institute and CFA Society of Houston.